Hello

For years, Coinbase has been called many things: the poster child of US crypto regulation, the on-ramp for retail and the crypto stock with a dream run. When I dug into its quarterly results for the period ending September 30, 2025, I found its most significant advantage not in what it does with its trades, but in the ecosystem it has built and the flow of value it enables through that ecosystem.

About 13 years after it first launched to make buying and selling Bitcoin easier, the company has turned its customer base, custody assets and compliance muscle into distribution power. Even as activity in crypto shifted from retail to institutions over the last two years, Coinbase has expanded its total addressable market (TAM) through new products spanning spot, derivatives, custody, and The Base App.

The company calls this vision the ‘Everything Exchange’. In today’s analysis, I look at how Coinbase’s diversified businesses come together to deliver toward its vision.

On to the story now,

Prathik

Your Shortcut To Crypto’s Inner Circle

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

From Exchange to Ecosystem

Crypto trading revenues, which often die with bear markets, have instead become one layer of a growing, multi-product Coinbase.

In Q325, its net revenue reached $1.79 billion, nearly 60% higher year-on-year (YoY). During the same period, transaction revenue jumped over 80% YoY due to renewed trading activity, while the recurring subscription and services revenue rose by about a third.

Yet what interests me here is not how much money Coinbase made but how it made it.

The firm earns across every layer of the market it connects to in the overall crypto ecosystem, whether through custody fees on institutional assets, yield on USDC balances, or by clearing derivatives spreads. Trading, which used to be Coinbase’s defining characteristic, has now become a front door to an expanding range of services, including custody, stablecoins, payments, and derivatives.

The company called this new architecture the ‘Everything Exchange’ on its earnings call. When I first heard it, it sounded like a marketing buzzword. But the simple idea that stood out behind it was that distribution is the new moat Coinbase is betting on.

Never was this bet clearer than it was in August, when Coinbase completed its $1.2 billion acquisition of Deribit, the world’s largest crypto-options platform.

The all-stock deal gives the US largest crypto exchange a bridge into global derivatives, a market that had long lived outside US jurisdiction. For the first time, a US-listed firm can clear spot and derivative trades under one roof.

The deal has boosted Coinbase’s institutional business. The Dutch entity added $52 million to Coinbase’s quarterly revenue in just six weeks after the takeover. That’s about 40% of the institutional transactions revenue, which has more than doubled to $135 million from $55 million in the same period last year.

The Stable Game

While Deribit expanded instrument coverage by adding options and futures, USDC brought stable cash coverage.

As USDC circulation reached an all-time high of $74 billion, Coinbase also held a record-high $15 billion in USDC on its platforms. Stablecoin revenue rose 44% YoY to $354 million, making it the single biggest line in the Subscriptions & Services category.

Through Base and its new payment APIs, Coinbase enables businesses to embed USDC deposits, payouts, and treasury flows directly into their apps.

This entire stablecoin infrastructure, along with the flow of money through it, has turned Coinbase into an on-chain clearing bank. The return for all this is highly rewarding: stablecoins generate yield from balances, expand their networks through usage, and retain users through the convenience they offer. In contrast to the volatility of trading, USDC’s income compounds as adoption grows. Every new developer using Base or a merchant integrating USDC adds to Coinbase’s float.

The Trust Factor

Trust is the hardest asset to scale, yet Coinbase has replicated the success of other businesses in its custody business.

Last quarter, its assets under custody (AUC) hit $300 billion, up 60% from last year, driven by strong ETF flows and corporates rushing to stack up their Digital Asset Treasuries (DATs). Coinbase now provides custody for more than 80% of all BTC and ETH held in US spot ETFs. When institutions, including BlackRock, Fidelity, and ARK Invest, create or redeem shares, the underlying assets flow through Coinbase’s vaults, and the fees for these services are reflected in Coinbase’s revenue streams.

Custodial revenue contributes less than 8% of Coinbase’s total revenue, but its strategic value is significant. Custody begets trust, and trust multiplies distribution and retains users.

The same custody clients are also more likely to trial Coinbase’s new product stack, including derivatives and USDC payments. Coinbase’s latest acquisition, Echo, will be the newest to benefit from the trust factor, as its clients will now be able to issue, trade, and store tokens within the same compliance perimeter.

Custody brings stickiness. I see it as that one invisible layer that makes the ‘Everything Exchange’ vision possible.

The Earnings Evolution

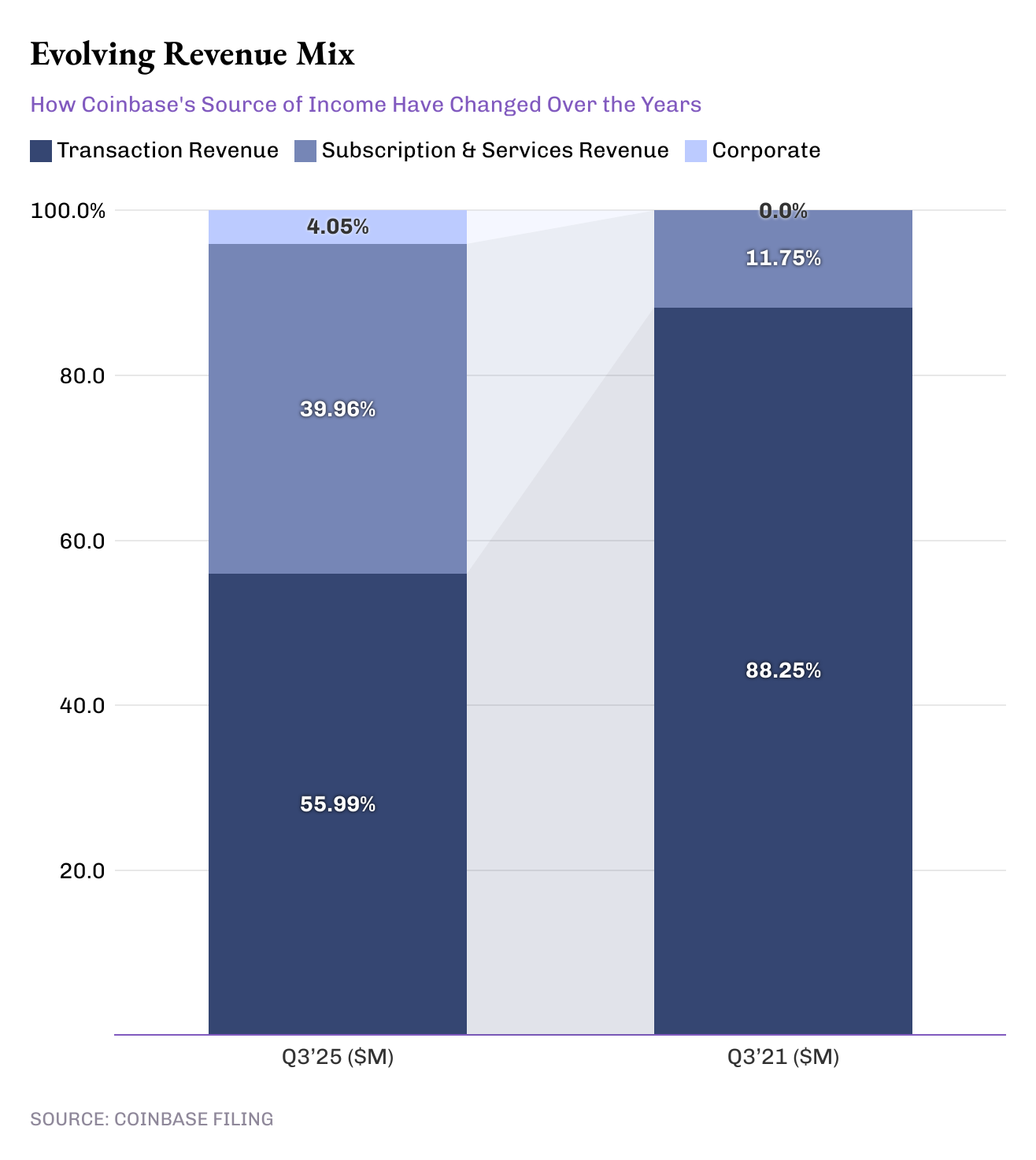

Coinbase’s trajectory toward its ‘Everything Exchange’ vision is even more convincing when you zoom out and look at how its revenue mix has changed quantitatively and qualitatively.

In 2021, almost 9 in 10 dollars Coinbase made came from trading spreads. Today, nearly 40% comes from recurring sources such as custody fees, stablecoin yield, and blockchain rewards. Although its revenue is still heavily dependent on market cycles, those cycles no longer dictate its survival.

Each recent Coinbase product launch has generated incremental revenue. This is what leveraging distribution can do for an organisation’s new business lines.

I like the ‘Everything Exchange’ vision because it doesn’t claim to build a random assortment of products; that would have been easier. I find it interesting because it sees crypto as a space where people come and like to stay, if you give them an ecosystem of products that naturally connect or flow value into one another.

Custody and stablecoins brought institutions and developers, while Base brought the creator economy on-chain. Deribit offered leveraged markets. Together, they resemble an infrastructure network more than a trading floor, where Coinbase makes money across different domains of crypto’s capital stack.

The ubiquity of Coinbase’s vast network of products has helped it become the distribution backbone of the entire crypto industry.

Looking ahead, Coinbase has signalled its intent to extend the ‘Everything Exchange’ architecture beyond current assets.

During the earnings call on Thursday, CEO Brian Armstrong admitted the company’s vision was central to the “next pieces” it was building, including prediction markets and bringing assets on-chain. We would have to wait until Coinbase’s December product showcase event, where it will provide more information on this.

I see an exciting potential for Coinbase here. If it can run prediction markets on Base, outcomes could be tokenised, settled in USDC, and custodied within Coinbase’s infrastructure, all of which fall under the same reliable regulatory umbrella.

If this is executed well, it could help Coinbase evolve from a venue that once traded assets to one that trades information, which will be another testimony to its distribution prowess.

What concerns Coinbase is that much of its revenue rests on a few volatile pillars. About 20% of its total revenue this quarter came from USDC yield, income that tracks short-term Treasury rates. A one-point cut in this rate could shave about $70 million from quarterly stablecoin revenue.

Coinbase calls its architecture diversified by design, but the next few quarters will show whether that diversification benefits even when its key businesses don’t deliver promising results.

That’s all for this week. I will see you in the next one.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.