The Financialisation of Having Opinions 🔮

Someone has to decide what counts as truth and they might have money riding on the answer.

I know exactly when I became a degenerate gambler.

It wasn't at a casino or a sportsbook. It was standing in front of two elevators in my office building, convinced I could predict which one would arrive first based on the floor indicator lights. Left elevator on floor 8, going down. That's five floors to travel. Right elevator on floor 3, going up. Only two floors, but it might stop to pick up passengers. I'd commit to positioning myself in front of one, then immediately start second-guessing when I saw the other elevator's numbers change. I developed elaborate theories about elevator algorithms, peak usage patterns, and the psychological profiles of people who press elevator buttons. When the elevator I didn't choose arrived first, I'd feel genuinely defeated. When I picked correctly, I felt like I'd cracked some fundamental code of urban transportation. The dopamine hit was immediate and addictive. I wasn't even betting real money, just standing there obsessing over which machine would save me thirty seconds.

That's when I realised something obvious that everyone pretends isn't true. Humans are fundamentally wired for gambling. The infrastructure just needed to catch up to our psychology.

Now it has.

I've said this before and I'll say it again: humans love gambling. It's addictive at a neurochemical level. And what we're seeing with the explosion of prediction markets isn't some noble quest for truth or better information aggregation. It's the systematic gamification of literally everything because someone finally figured out how to make it work at scale.

Everyone from Wall Street to Silicon Valley suddenly realised that prediction markets could be the ultimate gateway drug for getting normal people addicted to financial speculation. And unlike crypto trading or options, you don't need to understand anything complicated. Just pick yes or no.

Hiring a Wall Street Quant Team… Without the Wall Street Salary.

That’s what Almanak delivers.

It’s like having your own army of digital quants, AI agents that analyze markets, build strategies, and execute them 24/7.

Almanak removes the guesswork and makes sophisticated DeFi strategy accessible to anyone, reducing the strategy deployment time from months to minutes.

The vision is bold and the community recognises it. Almanak’s Round on Legion got oversubscribed in 45’ and is currently still open..

DeFi isn’t waiting. Neither should you.

Here's who's building the casino. Polymarket spent two years in regulatory purgatory after getting slapped by the CFTC (Commodity Futures Trading Commission) in 2022 and paying a $1.4 million fine. Now they're back with a vengeance, having acquired QCX for $112 million to get a proper US license. They hit $7.5 billion in volume this year and became X's official prediction market partner.

The prodigal son returns, but this time with proper paperwork.

Robinhood partnered with Kalshi to offer football prediction markets directly in their app. Twenty million retail investors can now bet on NFL games alongside their stock portfolio. They're not calling it "sports betting". Instead, it's "trading event outcomes."

The language matters for regulatory reasons, but the dopamine hits the same.

When Nevada and New Jersey gaming regulators tried to shut them down, Robinhood sued, arguing that CFTC-regulated event contracts preempted state gambling laws. The federal judges agreed, creating a regulatory framework where you can bet on sports through a brokerage app but not through traditional sportsbooks in those same states.

CME Group, the world's largest derivatives exchange, announced a partnership with FanDuel to launch event contracts on everything from the S&P 500 to oil prices to crypto. For as little as $1. They're bringing prediction markets to FanDuel's millions of existing sports bettors, complete with CFTC regulatory approval and the institutional credibility of the world's largest derivatives exchange.

Coinbase already has plans for an "everything exchange" that includes prediction markets alongside tokenised stocks and derivatives. When the largest US crypto exchange decides prediction markets belong in their core product, that's infrastructure itself.

Is this crypto people building weird DeFi experiments or mainstream financial infrastructure absorbing prediction markets as a standard feature? You know the answer.

But, what makes this wave different from previous attempts is the focus on three specific elements: high frequency, high leverage, and high outcome value.

High frequency means daily and intraday markets on everything. Not just "will Trump win the election" but "will Trump tweet about crypto today" and "will the Fed cut rates at 2 PM." The time horizons keep shrinking because faster resolution means faster dopamine cycles. High leverage means parlays, same-game parlays, and complex combinations. The leverage comes from the binary options structure. Pay $0.30 for a contract that becomes worth $1.00 if you're right, giving you 3x exposure on every bet.You can bet on the Chiefs winning AND the over hitting AND Mahomes throwing for 300 yards. DraftKings reports that parlays now generate over 70% of their gross gaming revenue despite being a smaller percentage of total bets. The math is terrible for players, which is exactly why operators love them.

High outcome value means markets on actual economic indicators — CPI data, Fed decisions, GDP numbers. These are markets with genuine price discovery value. Kalshi offers contracts on whether inflation will be above 2.6% in August, and people are trading real volume on it. What all these have in common is that they turn every piece of information into a tradeable asset. Your opinion on tonight's game, tomorrow's economic data, or next week's corporate earnings can all become positions with real money behind them.

The breakthrough will come when they get embedded.

X named Polymarket as its official prediction market partner, integrating odds and betting directly into the social feed. You see a tweet about the latest political drama, and there's a market right there asking if it'll lead to resignations by Friday. The friction between "having an opinion" and "backing it with money" essentially disappears.

Consider where this could go.

I'm reading a New York Times article about the latest Supreme Court case, and at the bottom there's a market: "Will this decision be announced before August 15th?" Initially, readers might find it weird. Then, with some marketing, it becomes fun. Eventually, it's just a habit like checking the weather or doing a crossword puzzle, except you can win or lose money.

Forget newspapers. Think about Netflix. Imagine if they had a Polymarket bet embedded right in the app asking who dies in Stranger Things Season 5. Would you bet on it? Of course you would. What if they did this for every major release. Will the new season of Bridgerton have a wedding? Will the documentary about cryptocurrency mention Sam Bankman-Fried? This is why polls are universally popular. People love making predictions. Prediction markets are just polls with money attached, and the money makes it infinitely more engaging. In the process, crypto goes mainstream not because people want decentralised finance, but because they want to bet on whether their favourite character survives the season finale.

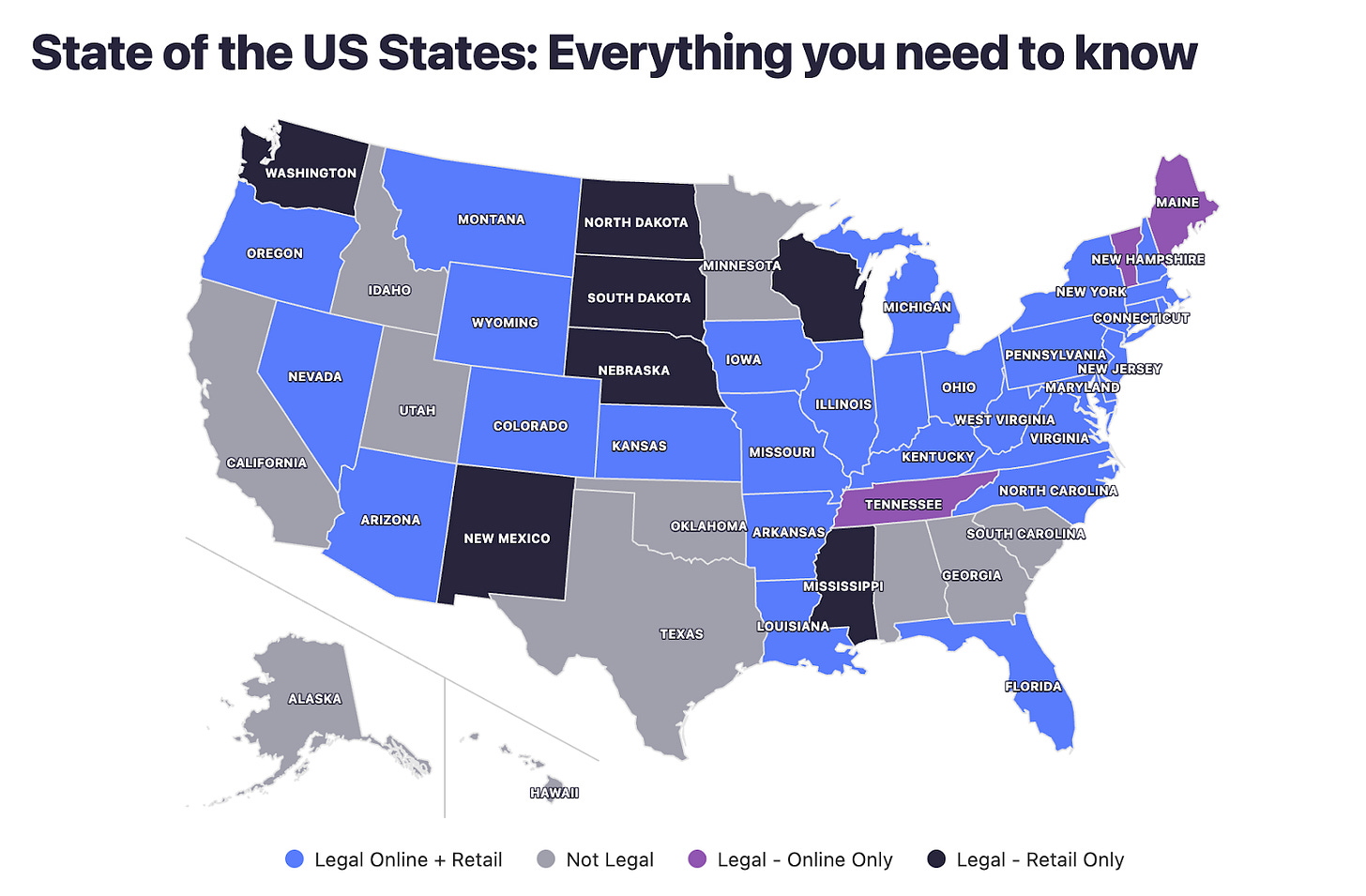

But why is everyone's focusing on sports betting? Obvious reasons. It's legal in 38 states, it generated $13.7 billion in revenue last year, and people already understand the concept. Sports betting is the training wheels for prediction markets.

Sports also have unique advantages.

Games happen constantly, outcomes are clear and quick, and there's an existing infrastructure for odds-making and risk management. ESPN already embeds betting odds in their coverage. NBA League Pass shows live betting lines during games. The cultural shift has already happened.

Sports betting teaches people the user experience patterns that prediction markets need: mobile-first interfaces, quick deposits, live updating odds, and instant settlement. Once someone is comfortable betting on football games through their Robinhood app, betting on Fed rate decisions through the same app feels like a natural progression.

What we're really witnessing is the financialisation of every human experience. Will it rain tomorrow? That's a weather derivative. Will your congressman vote yes on the infrastructure bill? That's a political future. Will the new iPhone have a better camera? That's a tech prediction market.

This isn't necessarily bad. Markets can be remarkably good at aggregating information and providing price discovery. Polymarket's election markets were more accurate than most polls in 2024. CPI prediction markets give real-time sentiment about inflation expectations. There's genuine utility here.

But let's not pretend this is about truth-seeking or better decision-making. This is about turning every aspect of human attention into a potential revenue stream. When you can bet on literally anything, you're not creating better information, instead you're creating more reasons to refresh your phone.

Don't come at me with the "skin in the game" or "wisdom of crowds" narrative. That ship sailed and broke into pieces with the Zelensky suit controversy. For those who missed it: Polymarket had a $14 million market on whether President Zelensky would wear a suit before July. When he appeared at a NATO meeting in what looked like business attire, traders erupted in disputes about whether it technically qualified as a "suit." The resolution process devolved into arguments about fabric, tailoring, and whether media consensus should override explicit market rules.

The deeper problem emerged when UMA token holders — who resolve disputed markets — appeared to vote based on their own trading positions rather than objective criteria. When your "oracle" voters can also be market participants, you have a conflict of interest. This isn't unique to crypto prediction markets. Any low-liquidity market can be manipulated, and any subjective resolution process can be gamed.

Can you generalise from one suit controversy that prediction markets don't work? Well, that depends on what you think prediction markets are supposed to do. If you think they're supposed to aggregate information and discover truth, then yes, the Zelensky suit debacle is pretty damning evidence that the system breaks down when outcomes are subjective and the referees have money on the game. But if you think prediction markets are just supposed to create liquid betting opportunities on everything, then the suit controversy is actually working perfectly. It generated $242 million in volume and endless debate, which is exactly what a gambling platform wants. The problem isn't that UMA token holders lacked skin in the game; it's that they had the wrong kind of skin in the game and what kind of game. They weren't incentivised to find the truth about whether Zelensky wore a suit. They were incentivised to vote in whatever way made their tokens more valuable. Sometimes those incentives align with truth-seeking, sometimes they don't. The suit market is what happens when they don't.

Read: When is a Suit Not a Suit?🕴

The "truth-seeking" narrative assumes good faith actors and perfect information, but real markets have whales, manipulation, and governance capture. The prediction market platforms that figure out how to avoid these structural problems through better resolution mechanisms, deeper liquidity, or different incentive designs will likely dominate the space long-term.

Here's the uncomfortable truth about liquidity. Most prediction markets are terrible at actually discovering prices. You can move markets with relatively small bets, spreads are wide, and prices often don't make mathematical sense. Polymarket's biggest markets might have decent depth during major events, but scroll down to the second tier and you'll find markets where a $1,000 bet moves prices by 10 percentage points.

The problem gets worse during off-peak hours or for niche topics. A market asking "Will Congress pass infrastructure spending before October?" might have $50,000 in total volume spread across weeks of trading. If someone drops $5,000 on "Yes," the price moves from 40% to 60% instantly, not because new information emerged, but because there's simply nobody else trading.

Traditional sportsbooks solve this with sophisticated risk management, large initial capital pools, and professional traders setting lines. They can absorb big bets without moving prices because they have depth. Prediction markets mostly rely on retail speculators trading against each other and hope for the best.

Even worse, low liquidity creates opportunities for manipulation that have nothing to do with information. If you know a particular political market has thin trading, you can move the price dramatically with strategic bets, generate media attention about the "market signal," and potentially influence the actual outcome you're betting on. It's circular reasoning with real money attached. During the 2024 election, several Polymarket markets moved significantly based on what appeared to be large coordinated bets rather than new information, raising questions about whether prices reflected genuine sentiment or just whoever had the most capital to deploy.

The regulatory landscape adds another layer of complexity. The US currently has a patchwork where event contracts can be legal under CFTC jurisdiction but illegal under state gambling laws, leading to court battles over preemption. Kalshi has successfully argued in federal court that their CFTC-regulated markets preempt state regulation, but this creates a bizarre situation where the same activity might be legal on a CFTC platform and illegal on a state-licensed sportsbook. Meanwhile, the CFTC itself has proposed rules that would ban certain types of event contracts, creating uncertainty about which markets will actually be allowed long-term.

Internationally, the picture is even messier. The EU has no harmonised approach. Some countries allow prediction markets under financial regulation, others treat them as gambling, and some ban them entirely. Even in jurisdictions where they're legal, app store policies can restrict distribution, and payment processing remains complicated.

This regulatory uncertainty means that prediction markets exist in a gray zone where rapid scaling could trigger crackdowns. Politicians already worry that election betting undermines democratic legitimacy, and regulators are concerned about consumer protection when gambling is packaged as financial products. The faster prediction markets go mainstream, the more likely they are to face the kind of regulatory backlash that killed online poker in the US

Some new approaches might address these problems. Opportunity markets, proposed by crypto researchers, hide trading prices from participants. Instead of seeing that "Event X" trades at 60% probability, you just see the event description and decide whether to bet yes or no. This eliminates some of the gaming around price movements and focuses attention on actual outcomes rather than market dynamics.

Distribution markets take a different approach: rather than binary yes/no markets, these pay based on how close your prediction is to the actual outcome. If you predict CPI will be 2.8% and it comes in at 2.7%, you get paid more than someone who predicted 3.2%. This rewards accuracy over lucky binary guesses and provides more nuanced information than simple binary markets.

Both approaches acknowledge that current prediction market designs have fundamental flaws while preserving the core insight that people will pay money to express their opinions. But gambling is still gambling. When prediction markets scale to mainstream adoption, we're not talking about sophisticated traders making informed bets. We're talking about regular people getting addicted to clicking buttons that might pay out. The social integration makes this worse (I know I gave Netflix the idea).

There's always a market asking whether you want to back up your opinion with money.

My prediction about prediction markets

They succeed not because they're good at predicting things, but because they're good at creating engagement and extracting money from human psychology. The sports betting wedge works because it leverages existing legal frameworks and user behaviour. The mainstream finance adoption works because it plugs into existing brokerage accounts and investment apps.

What you end up with is a world where every opinion becomes a potential financial position, every news event becomes a trading opportunity, and every entertainment experience includes a side bet. No, not the wisdom of crowds, but the financialisation of attention itself. Whether that's good or bad depends on your perspective. If you think markets make everything more efficient, this is progress. If you think gambling addiction is already a serious problem, this is concerning.

If you think crypto needs mainstream adoption through any means necessary, this is perfect.

The one thing I'm confident about: it's happening whether we think it's a good idea or not. The infrastructure exists, the regulatory barriers are falling, and the user psychology is already proven.

That’s it for now. Will come to you with another thought next week.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.