The Game Behind The Game ⚽️

The billion-dollar market you’ve never seen behind every football season

Hello,

Last week, we looked at how prediction markets changed the way we engage with sports. How a game was no longer something people just watched, it became something that could be priced. Every news item, every piece of information that came in shifted the odds, reflecting how thousands of people reassessed an outcome in real time.

Today, we take this story a step further.

Prediction markets are no longer just something fans trade on: now, teams themselves will begin using them.

Consider a simple example: a basketball franchise promises its head coach a $20 million bonus if the team makes it to the playoffs. It’s a straightforward incentive. If the team wins enough games and reaches the postseason, the bonus is paid.

But from a financial perspective, that promise is a big liability. If the team makes the playoffs, the $20 million has to be paid. It does not matter whether revenues were higher or lower than expected, or how the team’s finances look for the year.

To manage that risk, teams typically buy insurance. Here, a broker helps structure the policy and finds an insurer willing to cover the bonus. That insurer may then pass part of the risk to a reinsurer, so it is not carrying the full exposure alone. The final price of that coverage is agreed upon privately between these firms. Inside that premium is an implied view of the team’s playoff chances, but the number itself is never shown. It exists only within the quote the team receives.

Now, there’s another way to think about the same risk.

The team’s playoff chances are already being priced in elsewhere. In prediction markets, that probability trades every day. It is visible to anyone who wants to see it, and it changes as expectations evolve.

Instead of relying solely on a private insurance quote, a team could look at the public probability and use it to hedge part of the bonus exposure.

In this piece, we will explore how sports bonus insurance works today, why private reinsurance can imply very different probabilities than open markets, and what it means when teams begin to treat prediction markets as financial tools.

How Sports Insurance Works

To understand how this system operates at scale, we’ll first need to look at what has changed inside sports over the past two decades.

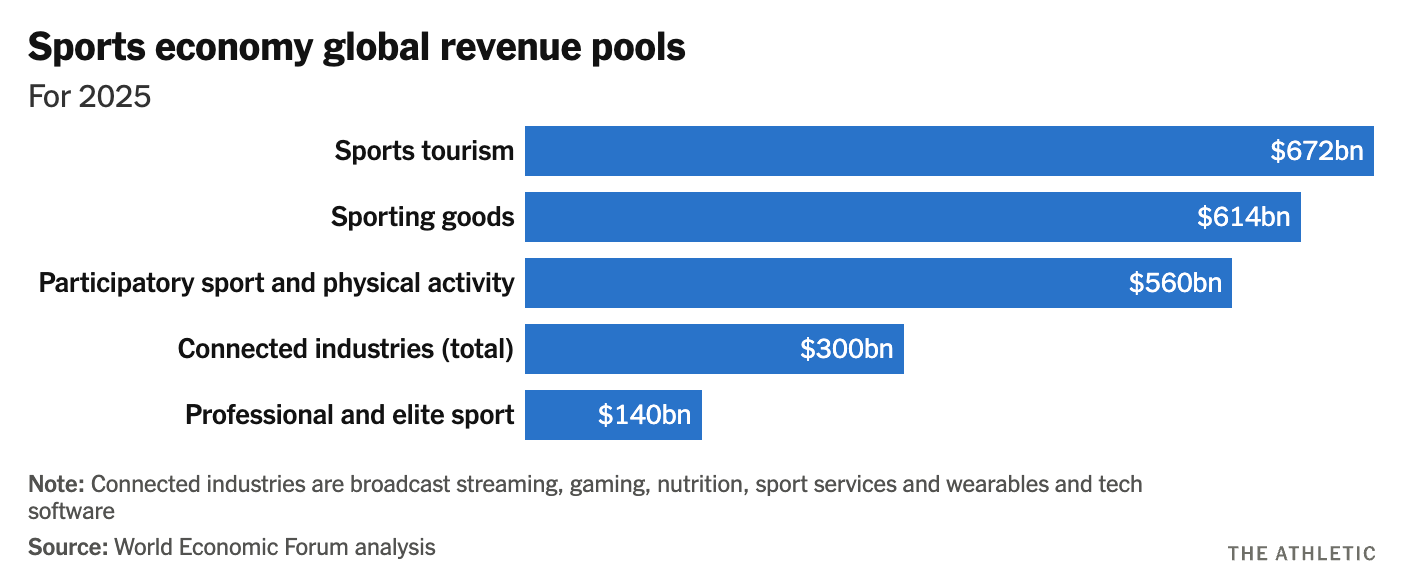

Today, professional sports generate nearly $560 billion in annual revenue, growing at roughly 7% annually. This revenue primarily comes from media rights, sponsorships, licensing, streaming platforms, and global commercial partnerships.

As revenue streams expanded, so did the contracts tied to them.

Team compensation today is no longer just a base salary paid over the season. There are also numerous performance-linked clauses layered on top, tied to specific milestones. A head coach might earn an extra $5 million if the team reaches the conference finals. A player could unlock extra compensation for hitting 1,000 rushing yards, scoring 25 goals, or appearing in a minimum number of games. Some contracts even escalate further if the team advances deeper into the postseason. These clauses are written into the contract as automatic triggers and require payment when the conditions are met.

Now, teams try to manage this exposure through insurance. They do not simply absorb the risk and hope that incentives do not cluster in the same year. Instead, they work with specialist brokers who approach insurers willing to underwrite that performance payout. Those insurers often pass part of the exposure to reinsurers, spreading the risk across larger capital pools. A single bonus clause in a contract turns into a financial chain behind the scenes.

To measure the scale of this exposure, insurers use a concept called “insurable value”, which is basically the amount of future income that depends on continued performance. It includes salary, incentive payments, and endorsement income that would be affected if a player were no longer able to compete.

If you look at the numbers, you can see how dramatically this exposure has grown. For example, during the 2014 FIFA World Cup, the total insurable value of all participating squads was estimated at approximately $7.3 billion. But in the 2022 tournament, that figure rose to around $25 billion. In less than a decade, the financial value tied directly to performance had more than tripled.

When so much income depends on performance, uncertainty cannot be left to chance. It has to be managed. So much so that an entire industry now exists for that purpose. The global sports insurance and reinsurance market is estimated at roughly $9 billion today, and it is expected to double by 2030. And it covers everything from event cancellations and player disability to sponsorship guarantees and performance bonuses.

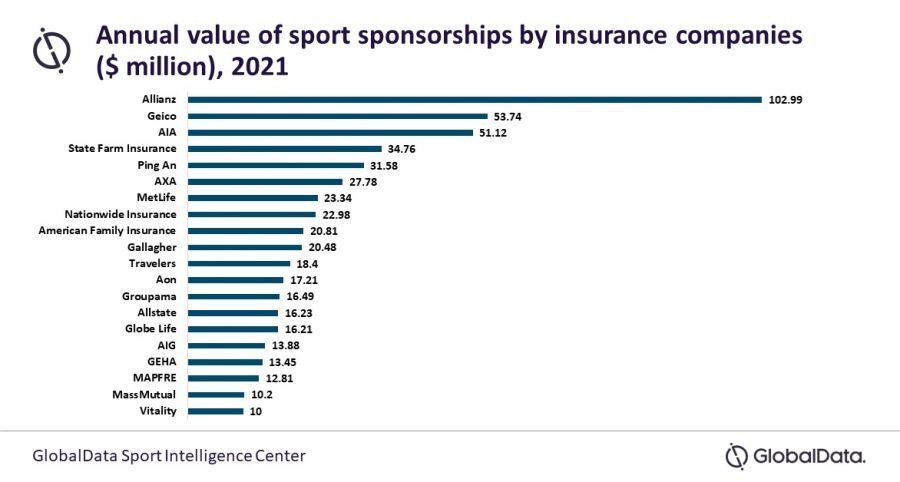

There are specialist brokers, such as Game Point Capital, that place hundreds of millions of dollars in sports insurance each year. On the other side are underwriters like Lloyd’s of London, which writes more than £150 million (~$200 million) in sport-related accident and health premiums, alongside large reinsurers that also insure hurricanes, aviation accidents, and other major disasters. That’s because a playoff bonus is priced and sits in the same risk bucket as storms, earthquakes, and other large events.

As a result, pricing is handled carefully and privately. Brokers speak to insurers, insurers speak to reinsurers, and each side uses its own model to estimate the likelihood of achieving the milestone, and that estimate is folded into the premium. The team sees the cost, but it does not see the probability behind it.

Why are Private Reinsurance Prices Higher

The price of sports insurance is not determined solely by how likely a team is to achieve a particular milestone, but also by significant external risks, taking into account factors that influence them. For example, in a simple world, if a team has a 10% chance of hitting a milestone, the premium would roughly reflect a 10% risk plus a modest margin. But reinsurance does not operate in a simple world.

Reinsurers manage a finite amount of capital, and so every dollar that they allocate to a playoff bonus is a dollar they can’t allocate to hurricane coverage, aviation insurance, or other catastrophe bonds, etc. They have to constantly balance their portfolios across geographies and risk types. So when they evaluate a sports exposure, they do so in terms of probability, capital they hold, and the volatility of the outcome, all in correlation with the risks they already hold.

Another constraint here is that the sports reinsurance market is concentrated. A relatively small number of global firms account for the majority of capacity. And so relationships for access and sometimes availability also depend on the broader portfolio conditions of the reinsurer.

All of these factors compound, and by the time a premium reaches the team, it reflects not just the raw likelihood of the milestone but also many other factors not visible to the team.

When Probability Leaves the Room

Up until this point, the probability of the outcome has existed at every step. When reissuers model it, or brokers discuss it, or when premiums are finalised. But the number itself is never made publicly available.

Now consider what happens when that probability is priced in a public market. Prediction markets enable this in a very interesting way.

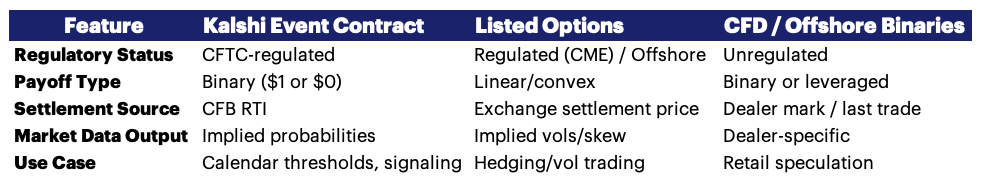

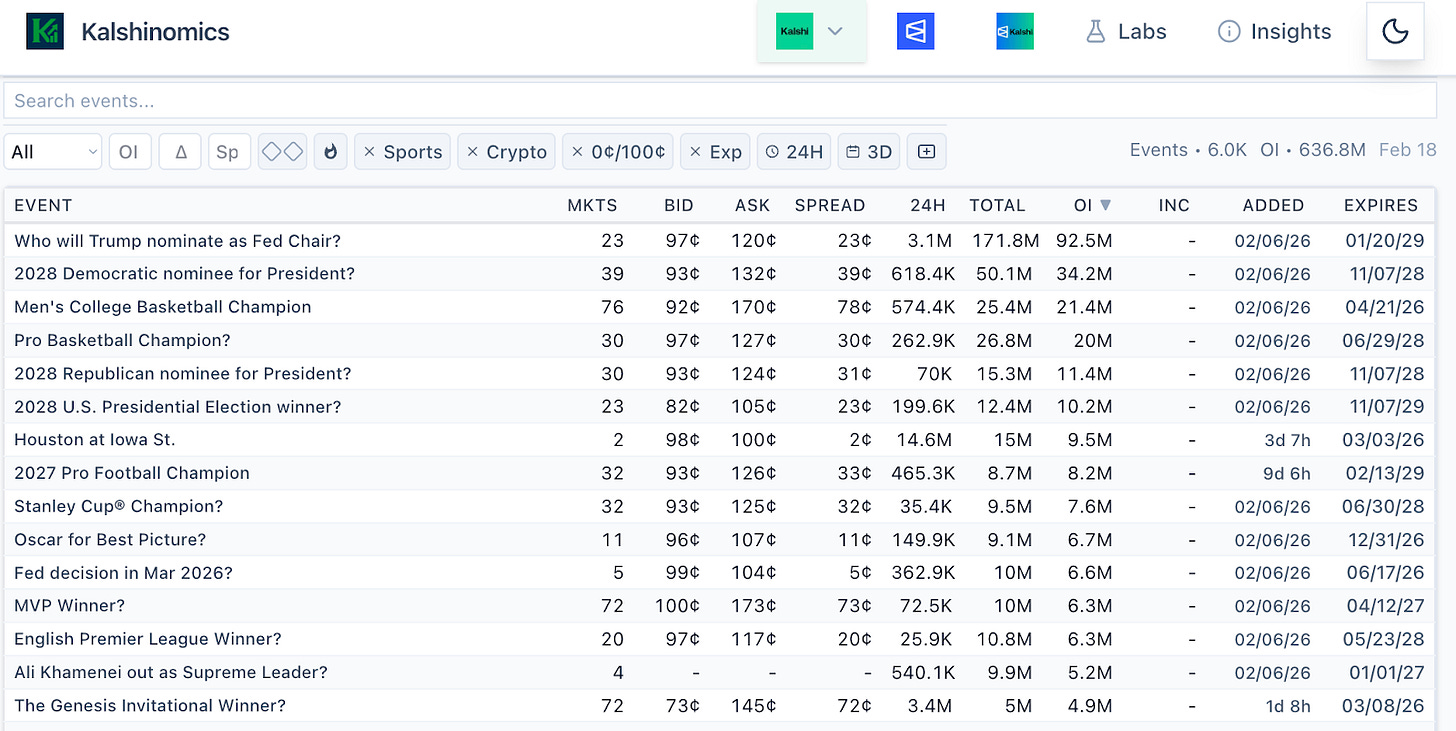

Kalshi now lists contracts on discrete real-world events, and one of those categories now includes sports outcomes. So a contract might ask a simple question: Will Team X make it to the playoffs? And each contract will settle at either $1 or $0, depending on the outcome. If, for example, it trades at $0.06, the market is implying roughly a 6% probability.

And that number is not assigned by an underwriting committee. It is discovered through trading by real buyers and sellers who put their capital at risk based on their own assessments of the probability and price, with adjustments made in real time.

This mechanism is already being used in practice. Game Point Capital used Kalshi’s market to hedge performance-linked bonuses tied to basketball outcomes. In one case, a playoff-related contract traded around 6% on the exchange, while OTC quotes implied roughly 12-13%. In another instance, a second-round advancement contract traded near 2% on the exchange, compared to 7-8% in private reinsurance markets.

This is more than just a marginal difference. On a $20 million exposure, the gap between 6% and 12% implied probability can translate into millions of dollars in premium cost.

You might wonder: If this number is just from traders clicking buttons, why should anyone treat it seriously? Why should you trust it more than an insurer’s model?

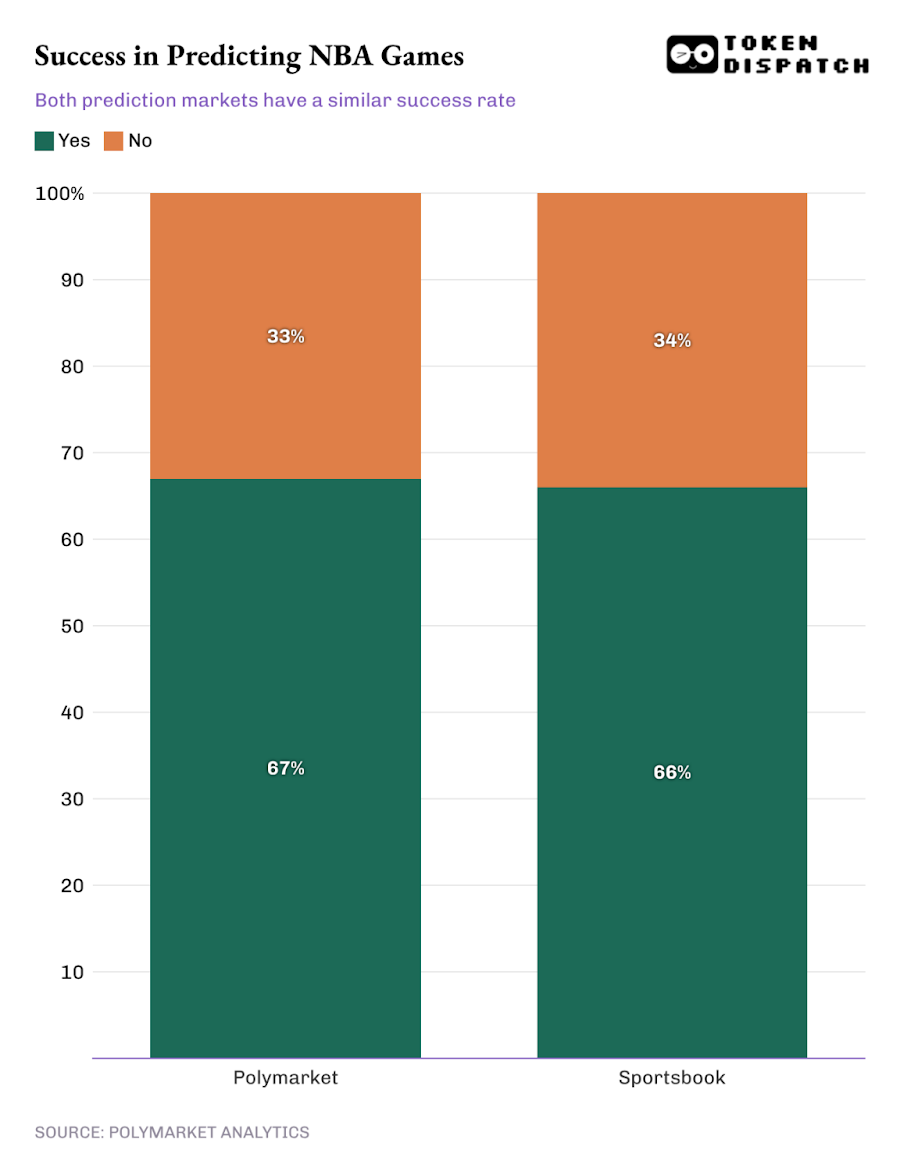

But extensive research shows that market-based odds are strong predictors of real-world outcomes. Academic studies on sports betting markets dating back decades show that bookmaker odds are highly efficient predictors of game outcomes. More recently, prediction markets have been compared directly to sportsbooks. In a study of roughly 1,000 NBA games from the 2024–25 season, both Polymarket and Sportsbook saw similar success in predicting the winners.

Statistically, there was no meaningful difference. In games where markets implied probabilities above 95%, both were correct more than 90% of the time.

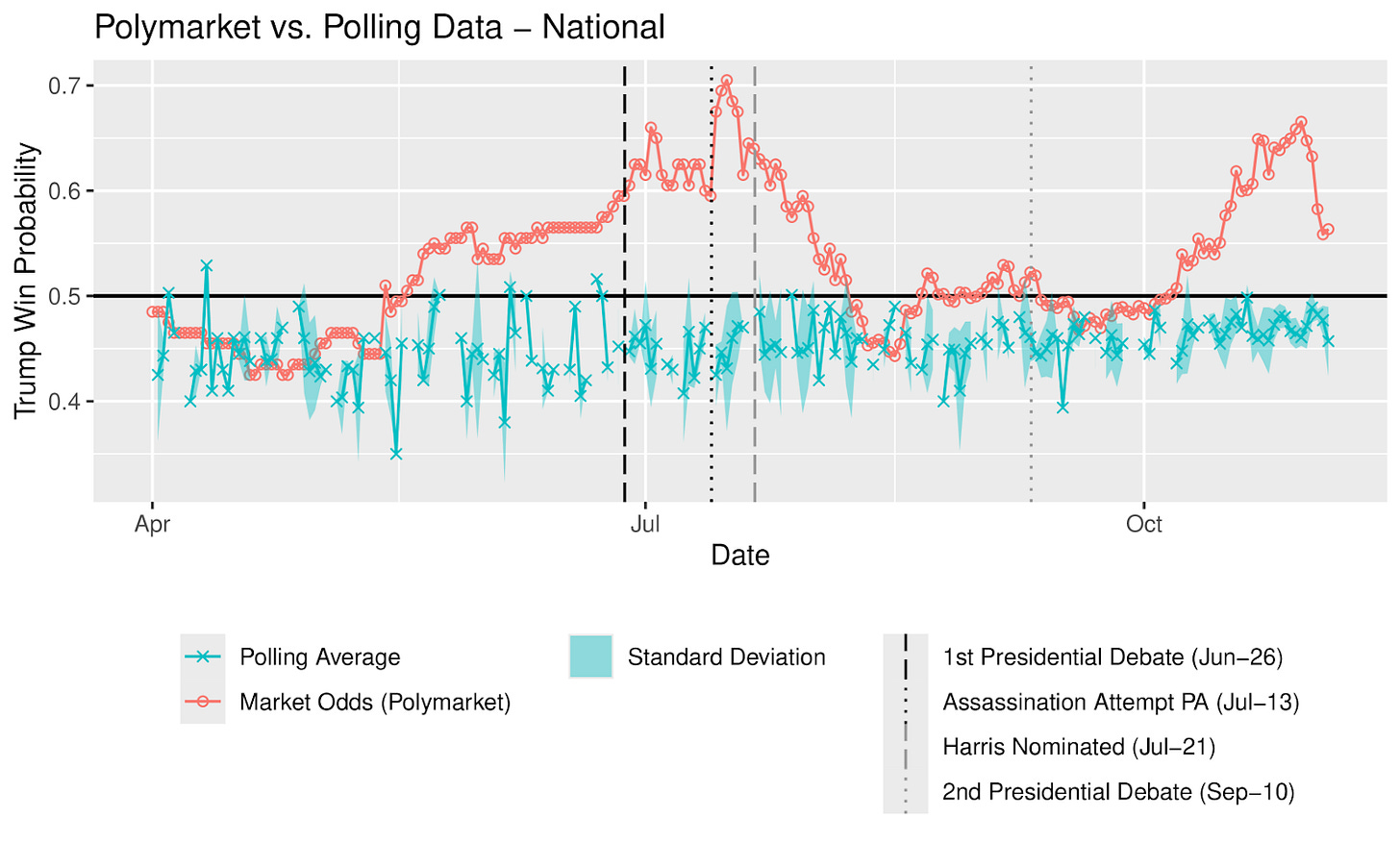

The same conclusion is even clearer in elections. A recent study comparing Polymarket with traditional polling during the 2024 U.S. presidential race found that Polymarket was more accurate in predicting the final result, particularly in swing states. In several key races where polls were off, market prices ended up closer to the actual results.

When thousands of people continuously update their expectations in a live market, the collective probability often tracks reality surprisingly well.

Prediction markets have enabled continuous price discovery. Any new information that enters the system is continuously updated and priced. There is no need to wait for an underwriting committee’s next review window. For this to matter in practice, though, the marker has to handle size. In recent major events, such as the Super Bowl, Kalshi processed trades worth around $22 million without materially moving market prices. This suggests that there is real depth on both sides of the trade, allowing substantial hedging without breaking the price.

And as these markets grow, they have also given rise to entirely new, permissionless financial tools built around prediction markets.

One example is Kalshinomics, which analyses event contracts the way analysts analyse stocks or bonds, tracking how probabilities move over time, how liquidity behaves around big events, and where prices may be misaligned with fundamentals.

There are also platforms like PredictionIndex that track and rank prediction markets in one place. You can check total trade volumes, contract types, chains, and trading mechanisms. It brings the entire space into one place, making it easier to see scale and understand how large these markets have become.

When the probability of an outcome can be priced and updated in real time, and capital is also meaningfully absorbed, it becomes something institutions can actually use. A team can now hedge a performance bonus directly against a publicly traded probability. A sponsor can hedge exposure tied to viewership targets. A studio can hedge a box office milestone. Any payout that depends on a clear and verifiable outcome can, in principle, be turned into a tradable contract.

Instead of negotiating a custom insurance contract, the outcome itself can now be traded publicly.

There is one more piece that makes this structure usable for institutions: Identity. Traditional insurance works because counterparties are verified, contracts are enforceable, and exposure can be audited. Public markets have always lacked that layer.

Companies like Dflow are working to tie real-world identity to trading activity. That means participants in these markets can be known, screened, and linked to real-world entities, rather than remaining purely anonymous. This also enables settling contracts, managing exposure, and integrating these positions into existing compliance frameworks.

In practical terms, it begins to look less like a trading venue and more like a functioning insurance layer built directly on top of publicly discovered probabilities.

That’s all for today. See you next weekend.

Until then, stay curious!

Vaidik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.