The Great Launchpad Takeover 🤼

When dominant platforms face existential threats, their response reveals everything about the nature of digital empires.

"The king is dead. Long live the king."

The cry echoed through the halls of Versailles on May 10, 1774. Louis XV had breathed his last. Within moments, courtiers who had once bowed before him turned their backs. They rushed toward his successor.

This wasn't cruelty. It was survival.

The French understood something profound about power. It never truly belongs to anyone. It flows like water, always seeking the next vessel. The proclamation wasn't mourning the dead king. It was acknowledging the living one.

Yesterday's sovereign becomes today's footnote. The transition is swift. Brutal. Inevitable.

Power demands this indifference. Empires rise on the bones of their predecessors. New rulers inherit old thrones. The cycle continues.

The memecoin launchpad kingdom of Solana, is witnessing its version of this ancient ritual.

Why Just Stake, When You Can Stake And Spend?

ETH staking doesn’t have to lock you out of DeFi.

With Kelp, you can restake ETH — earning both validator rewards and staking yields — while still spending or earning on that position using rsETH.

Staking + liquidity = ✅

Access to 40+ DeFi protocols

Built on EigenLayer and fully non-custodial

Multiply your ETH utility, don’t just stake.

Pump.fun, the undisputed monarch that once commanded 88% of all token launches just a month ago, now clings to a mere 13% market share while its upstart rival Let'sBONK has seized 86% of the territory.

The story here goes deeper than crypto's notorious volatility. It shows how digital empires crumble when they forget that attention, not just innovation, is the ultimate moat.

The Pump Empire

To understand Pump.fun's spectacular decline, you first need to appreciate the scale of what they built. Launched in January 2024 by three twentysomething entrepreneurs, the platform revolutionised memecoin creation with an elegantly simple proposition.

Let me remind you. You go to their website, upload a picture of literally anything. Your dog, a random meme, a photo of your breakfast, give it a name and boom, you've created a cryptocurrency. For under $2. No coding required.

That’s nothing you’ve seen before. But everything you wanted to see before.

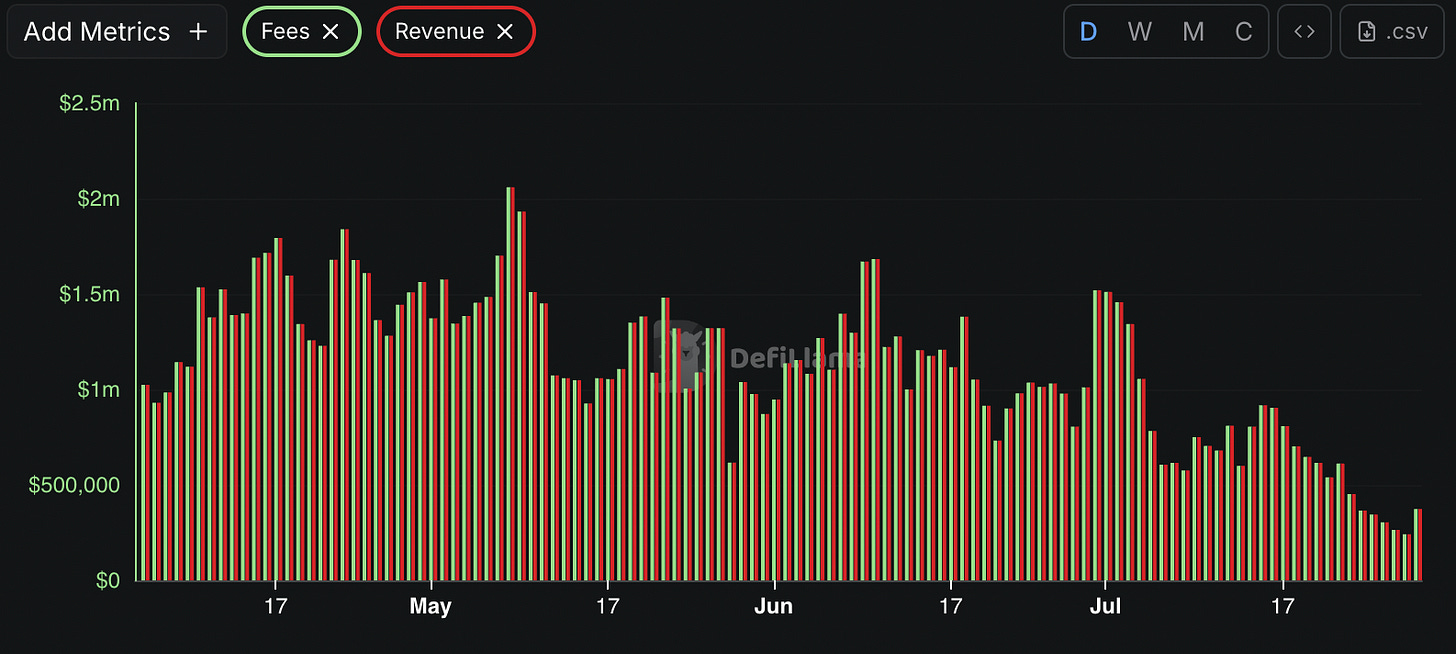

By January 2025, Pump.fun had generated over $458 million in cumulative revenue and facilitated hundreds of thousands of token launches. At their peak, daily revenue exceeded $7 million.

More importantly, they had captured something precious in the attention economy: mindshare. Pump.fun became synonymous with memecoin culture on Solana. When CT (Crypto Twitter) talked about launching the next Dogecoin killer, they thought Pump.fun.

They figured out how to monetise the human desire to create something out of nothing and then convince other humans that this nothing is worth something. Pump.fun's dominance seemed unassailable because it controlled both the infrastructure and the cultural narrative.

Empires that grow fat on their own success often develop the very weaknesses that competitors exploit.

Pump.fun's troubles began, ironically, with their most innovative feature: livestreaming. Launched as a way for memecoin creators to promote their tokens through live video, it quickly became the platform's most dangerous liability.

This went about as well as you'd expect. November 2024, people started doing increasingly crazy things on camera to get attention for their tokens. The platform became what users charitably called "a pipeline of felonies." Suicide threats, animal abuse, and eventually a child appearing on stream threatening family members with a shotgun to pump their token's price.

Read: When Pump.fun Is No Longer Fun 🥵

Pump.fun paused the feature indefinitely, but the damage was profound. Weekly revenue dropped 66% immediately. The controversy shattered the platform's reputation and gave competitors an opening they wouldn't waste.

Facing declining revenue and mounting competition, Pump.fun's team made a move that looked brilliant on paper but disastrous in execution: they launched their own token.

The ICO was technically successful — $500 million raised in 12 minutes from over 10,000 wallets. Combined with a $700 million private sale.

Dig deeper and the usual suspects emerged: over 200 wallets hitting the $1 million maximum, with the top 340 buyers hoovering up 60% of the allocation. All sale tokens were fully unlocked (no vesting), but there was a 48-72 hour transfer lockup.

Nearly half the participants had wallets funded within 24 hours - a pattern that could suggest either coordinated purchasing strategies or simply massive retail interest in the sale.

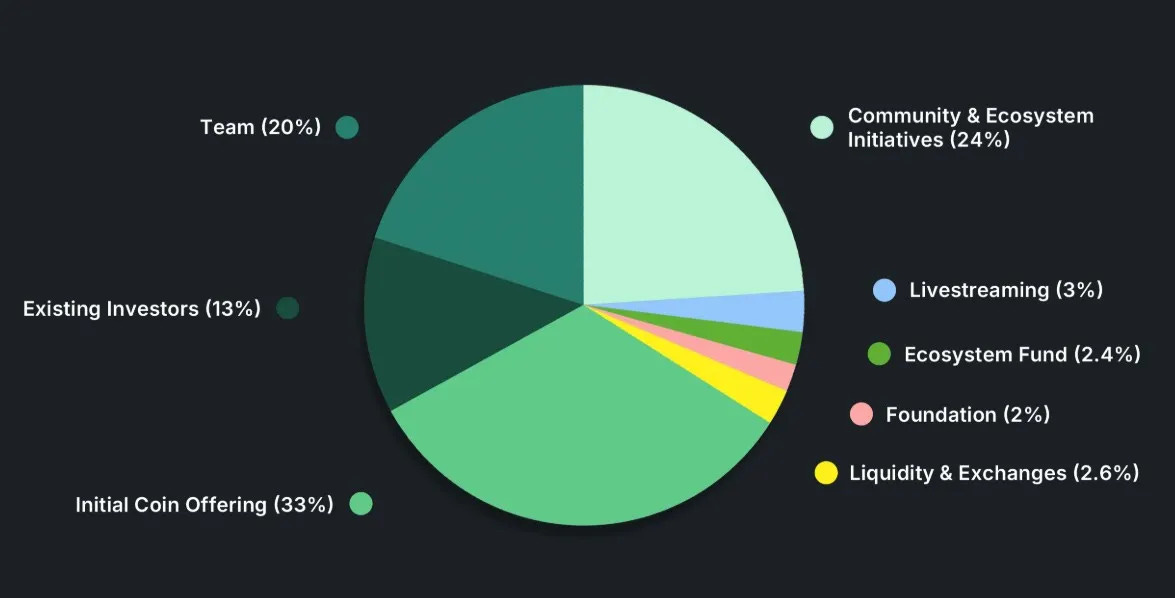

After an initial 75% surge to $0.007, the euphoria quickly soured. Down 60% within weeks, hitting frequent lower lows, classic death spiral stuff. The tokenomics were brutal with only 33% going to public and private sales, while 67% remained under project control with unclear distribution timelines. Of the 33%, 18% is designated for institutional buyers through a private sale.

No immediate community rewards despite users generating three-quarters of a billion in platform revenue, and private investors dumping $160 million worth of tokens onto exchanges, which created massive sell pressure.

The coup de grâce came when co-founder Alon Cohen publicly announced that the long-promised airdrop would "not be taking place in the immediate future."

Months of hints about rewards being "more lucrative than anyone else in the space" had built massive expectations. Then, right when community trust was most fragile, they delivered the no airdrop news. The token crashed 15% within 24 hours not because airdrops are inherently good, but because broken promises are inherently toxic.

The Bonk Rebellion

While Pump.fun was stepping on rakes, Let'sBONK was quietly building everything their rival wasn't - transparency, community focus, and clear communication.

Let'sBONK now generates $1.3 million in daily revenue compared to Pump.fun's $254,000—a 5x difference. Their 1 month annualised revenue has hit $434.92 million versus Pump.fun's $267.25 million.

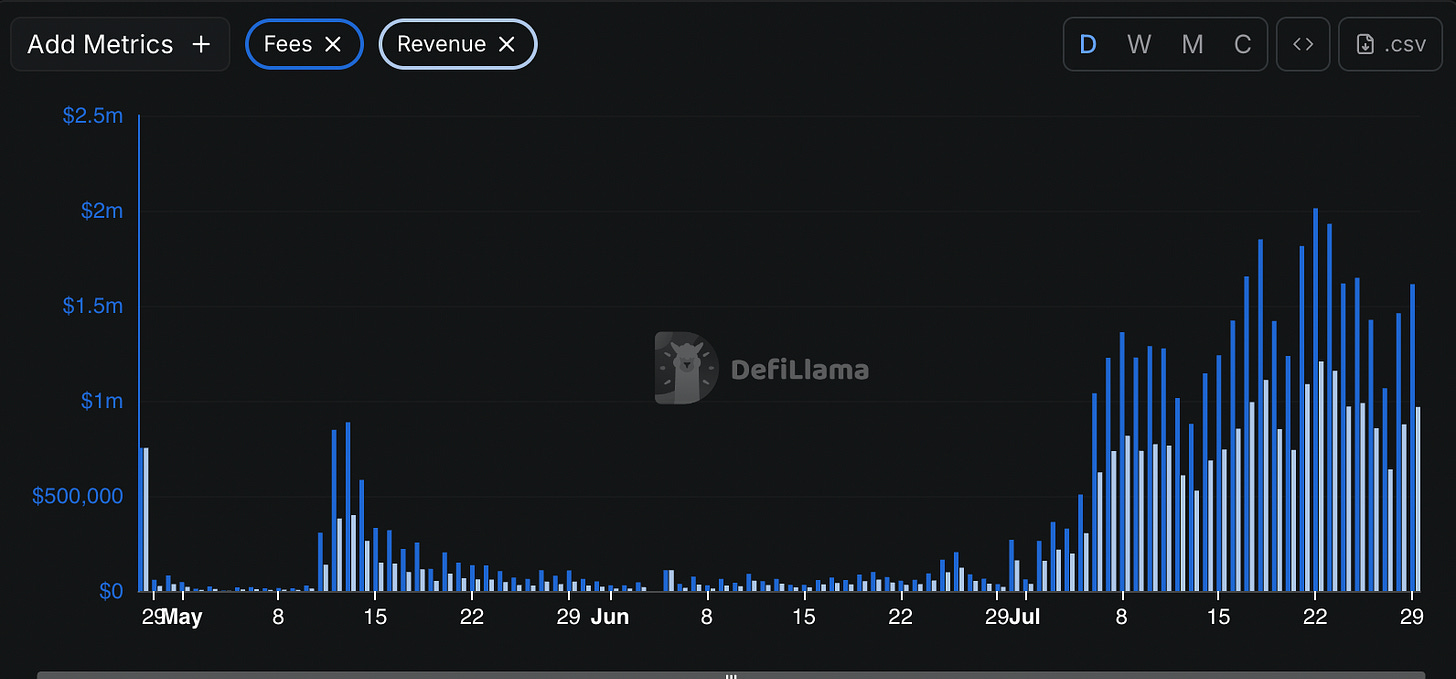

Let'sBONK's revenue climbed steadily from near-zero in May to consistent $1M+ daily figures by July. Meanwhile, Pump.fun's revenue has cratered from January peaks above $7 million to levels not seen since September 2024.

While PUMP has shed 60% of its value post-ICO, BONK has maintained relative stability with a $2.1 billion market cap.

Let'sBONK allocates 1% of weekly revenue to BONK buybacks, supporting the established ecosystem token that predates their platform by years.

The Attention Economics

Pump.fun's early dominance was built on network effects. Developers launched there because traders were there. Traders were there because the best memecoins launched there. The flywheel spun faster and faster until it seemed unstoppable.

Attention is fragile. Unlike traditional business moats — economies of scale, switching costs, regulatory protection — mindshare can evaporate almost overnight when trust breaks down.

The livestream gave users cover to try alternatives. Let'sBONK became the "clean" alternative, the platform without the baggage.

Think about how Myspace lost to Facebook. Myspace had features and scale. They lost because they lost the cultural narrative. Facebook became the platform for "real people" while Myspace became associated with spam, clutter, and declining relevance. Recognising the existential threat, Pump.fun has launched what can only be described as a desperate counter-offensive.

First, they increased their token buyback program from 25% to 100% of daily revenue. While this means roughly $254K in daily buybacks compared to Let'sBONK's modest $13K, (1% of the daily revenue) it also means Pump.fun is burning through 100% of incoming cash rather than investing in growth.

Second, they've launched a 30-day incentive program offering PUMP token rewards tied to trading activity. Early reports suggest limited impact on reversing the competitive dynamics.

The problem is strategic, not tactical. No amount of buybacks or incentive programs can restore lost trust or recapture attention once the community has moved on.

While Pump.fun offers basic trading volume rewards, Let'sBONK has built an ecosystem-driven rewards system that actually aligns user and platform interests.

The BONK Rewards program lets users lock tokens for 6-12 months, earning a share of ecosystem revenue from BonkBot, BonkSwap, and other products. Longer lockups get higher multipliers. Rewards grow with product performance. It's the difference between paying people to trade and paying them to build.

Users, including creators, earn "Bonk Points" through activities such as trading, buying, or launching tokens on Let’sBONK. These points are expected to be redeemable in the future, further incentivising active participation. Gamified growth makes users feel part of something bigger.

As Pump.fun was fumbling with its ICO and breaking airdrop promises, Let'sBONK was delivering structured rewards to committed participants. Mercenary capital in crypto will always follow the better incentive structure.

The Bigger Picture

In traditional industries, market leaders often maintain their position for decades. General Motors dominated automaking for half a century. IBM controlled enterprise computing for nearly as long. In digital markets where switching costs approach zero, dominance can evaporate in months.

Investigative reporting revealed that Pump.fun co-founder Dylan Kerler had previously launched pump-and-dump schemes in 2017—exactly the behaviour Pump.fun claimed to prevent. In an industry built on trust and memes, credibility gaps become existential vulnerabilities.

Let'sBONK didn't succeed because they built a fundamentally better product. They succeeded because they launched at the exact moment when Pump.fun's reputation was most vulnerable. In attention economies, timing matters more than technology.

The winner-take-all nature of network effects. Once users began migrating to Let'sBONK, the flywheel that built Pump.fun's dominance began working in reverse. Developers followed traders, traders followed the best launches, and the cycle accelerated the incumbent's decline.

Can Pump.fun stage a comeback? The platform isn't down for the count, despite the dramatic market share collapse.

The advantages are real. $1.2 billion in raised capital buys time to experiment and outlast competitors. Their infrastructure handled hundreds of thousands of launches without breaking. That matters when newer platforms buckle under pressure. And despite losing market share, they're still pulling in over $250K daily in fees, that's nearly $100 million annually in operating revenue on top of their massive war chest.

They invented the category. Turning memecoin creation from coding to clicking created lasting brand recognition. First-mover advantage doesn't disappear overnight.

Recent moves show fight. Pump.fun 2.0 added real-time updates and one-click trading. They increased buybacks to 100% of revenue. Launched user incentives. These aren't surrender tactics.

The most realistic scenario is market fragmentation rather than total defeat. Crypto rarely produces permanent monopolies. More likely, we see Let'sBONK capturing the majority of launches and revenue while Pump.fun carves out a sustainable niche with loyal users who prefer their interface, features, or ecosystem.

For a true recovery, Pump.fun needs to do more than fix technical issues or throw money at retention. They need to rebuild trust and recapture cultural relevance. That means transparent communication, community-first tokenomics, and probably a complete leadership refresh to distance themselves from past controversies.

The French courtiers understood this instinctively. When a king lost legitimacy, no amount of gold or grand gestures could restore it. Only a new ruler could command the old respect.

Sometimes the crown must pass to new hands for the kingdom to survive.

That’s enough deep-dive for the week. See you next week with another one.

Until then… Stay curious!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.