Hello

Over the past week, I have been reading about the evolution of a stock trading platform. It all began with pixels. There was a time when opening the app felt like winning something. A flick of green, a burst of confetti, and a dopamine hit with each tap of the buy button.

It worked well for users because it offered a cheap, addictive, and fun way to access finance, minus the jargon and complicated broker statements. The good ol’ days saw the retail army engaging with the app as if they were playing in a casino.

But it all came to a halt one January morning in 2021. The trading screens jammed, and the great gamification of investing screeched to a stop. This moment is known as the GameStop short squeeze. That hangover lasted for over a year.

Some hangovers help people grow. In this post-hangover evolution, the screens dimmed, the spreads narrowed, and the company that once gamified investing evolved into something few could have imagined.

In today’s earnings analysis, I dive into Robinhood’s journey to understand how a meme-stock casino transformed into a full-stack financial engine and what its future holds.

On to the story now,

Prathik

Play, Earn, Own. That’s Klink Finance.

With Klink Finance you don’t just watch crypto, you act. Complete tasks, social quests, and partner offers to earn in crypto or cash. Build reputation, unlock rewards, and gain access to special drops.

Earn for gaming, app trials, surveys and more.

Flexible withdrawals: crypto or fiat, your choice.

Backed by a global user-base and trusted integration partners.

If you’re ready to turn your time into value, join the earning revolution with Klink.

Post-Hangover Rebuild

Robinhood’s post-GameStop rebuild in 2022 came at a difficult time. Volumes had dropped, and regulators were circling like vultures. The company’s revenue for 2022 dropped over 25% from the 2021 peak, and the dopamine loop had lost its steam.

Since then, CEO Vlad Tenev has repositioned Robinhood, replacing confetti and chaos with order and discipline.

Last week’s Q3 earnings are proof that the app, once pulled up by regulators for gamifying investing, has now institutionalised retail chaos. The meme-stock casino now earns the old-fashioned way: through interest, deposits, and fees.

Three years after the rebuild, the repositioning is paying dividends.

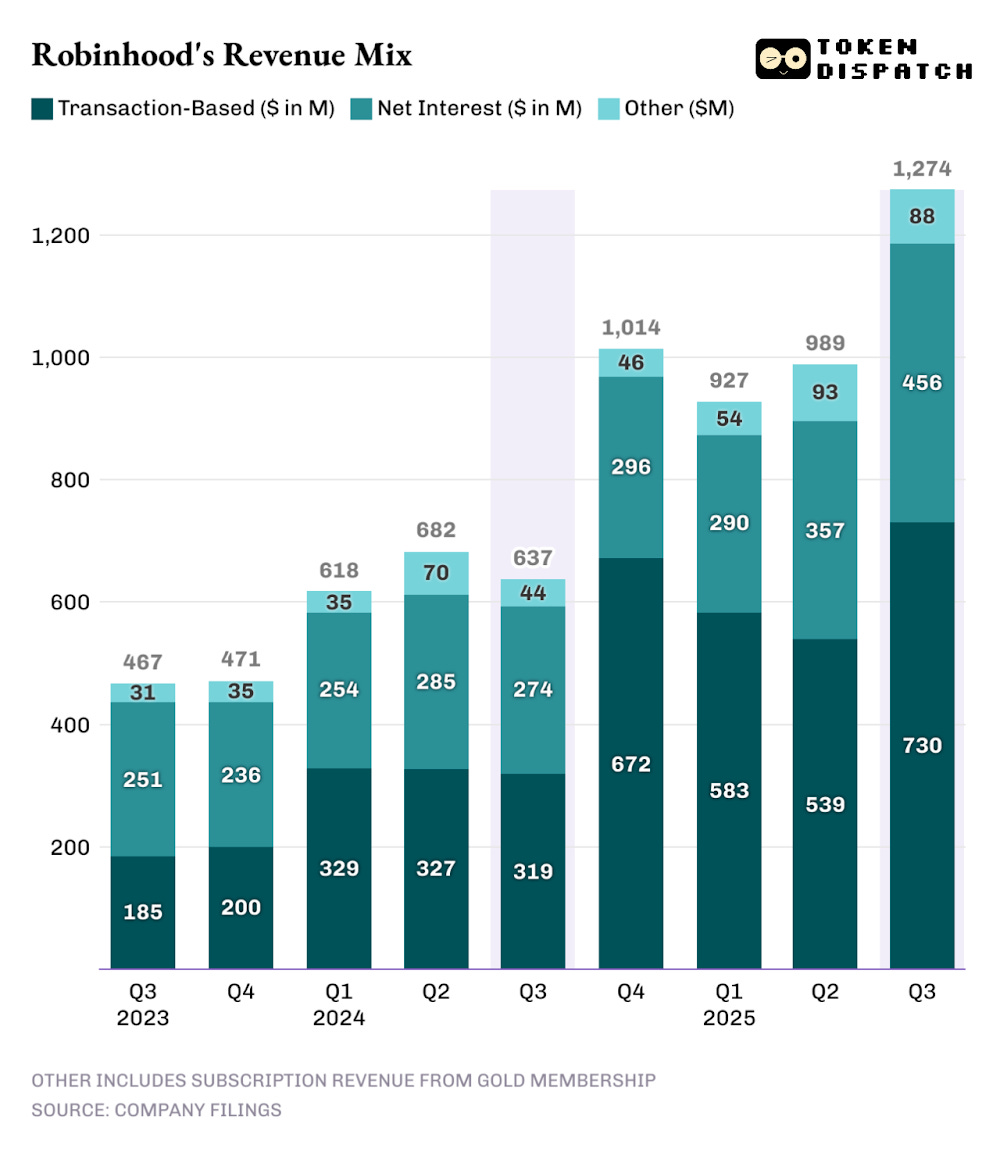

Robinhood’s revenue for the quarter ending September 30, 2025, doubled year-on-year (YoY) to $1.27 billion. Its net income nearly quadrupled to $556 million, helped by just a 35% rise in its adjusted operating expenses.

That’s a 44% net margin, the kind of profitability that Wall Street veterans spend decades chasing. Only NVIDIA out of the Magnificent Seven stocks achieved a higher net margin (54%) in Q3 2025.

While trading-related transaction revenue continues to dominate, about 35% of Robinhood’s revenue now comes from users simply parking idle cash in their accounts. Robinhood sweeps that cash into partner banks or short-term Treasuries, earning interest on it. A share of that yield is returned to select customers through Robinhood Gold, while the rest is retained as income for the firm.

In Q3, this “sleeping cash” generated $456 million through interest on liquidity and option-sweep balances, margin loans, and securities lending, one of the most unglamorous but dependable engines in Robinhood’s business.

Monetising Conviction

Robinhood is also witnessing a shift in customer behaviour.

Although the number of funded users only increased 10% YoY, the old guard is getting stronger. With Robinhood’s expanded product line, the same customer now generates more revenue. Its Average Revenue Per User (ARPU) has jumped 82% YoY to $191/year.

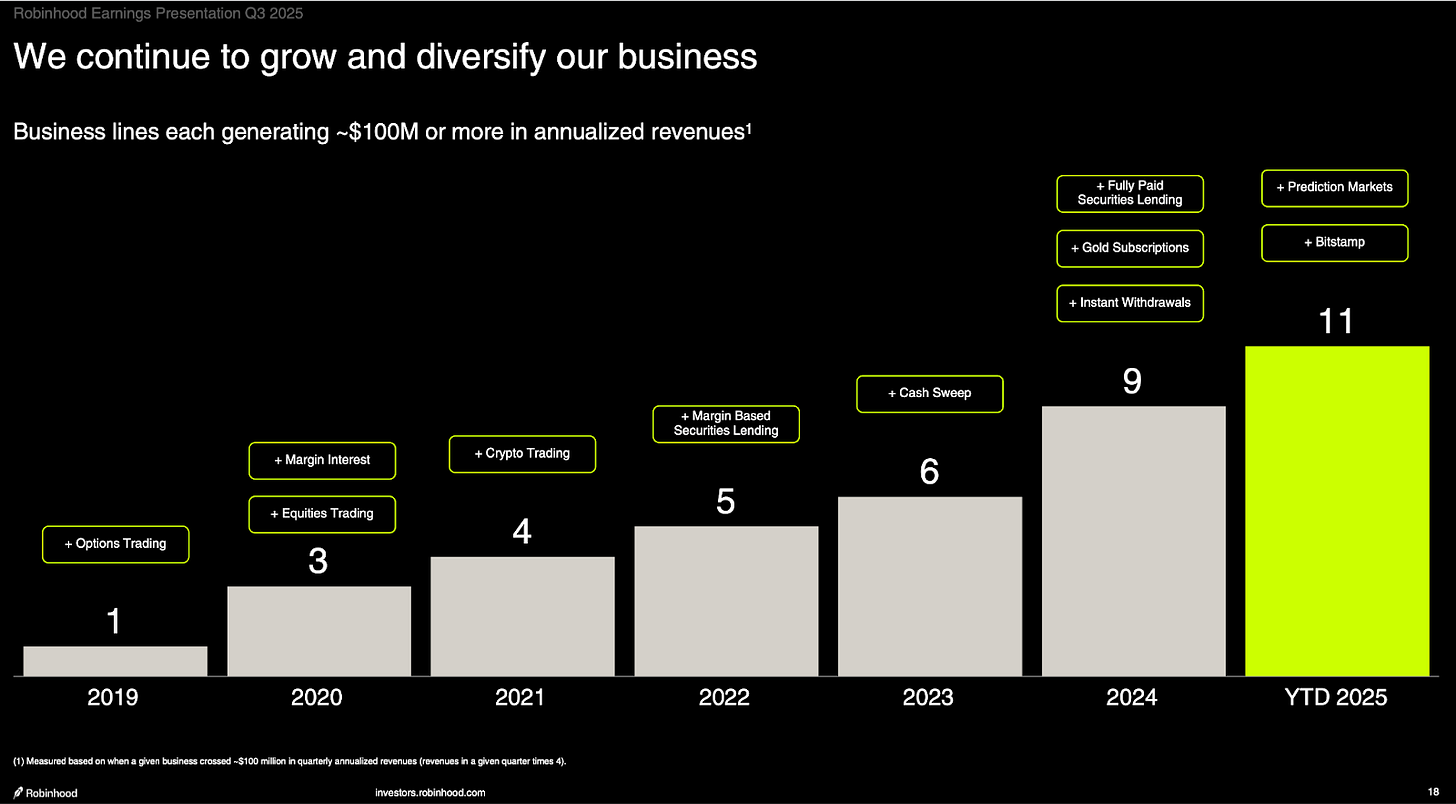

The number of Robinhood Gold Subscribers has gone up from 2.19 million in Q3 2024 to 3.88 million in Q3 2025. More customers now pay to access research tools, higher yields and better support. The behaviour is atypical of what one sees in the compounding phase of businesses, where vast distribution leads to rapid incremental income across new business lines, albeit at a slower pace per individual business.

Its newest business line, an embedded prediction market, is a testimony to this.

In August, Robinhood launched pro and college football prediction markets directly within its app, allowing its young customer base to directly trade on the outcomes of one of the most popular sports in the US. It became an instant success. In under two months, Robinhood users traded 2.3 billion prediction-market event contracts and generated $115 million in annualised revenue.

With speculation reborn in this form, life has come a full circle for Robinhood, which started its early years living off the very thing. In its current bundled form, though, they gain more prominence as Robinhood can leverage its distribution to cross-sell products across its 11 business units, each of which exceeds $100 million in annualised revenue.

Crypto’s Rise

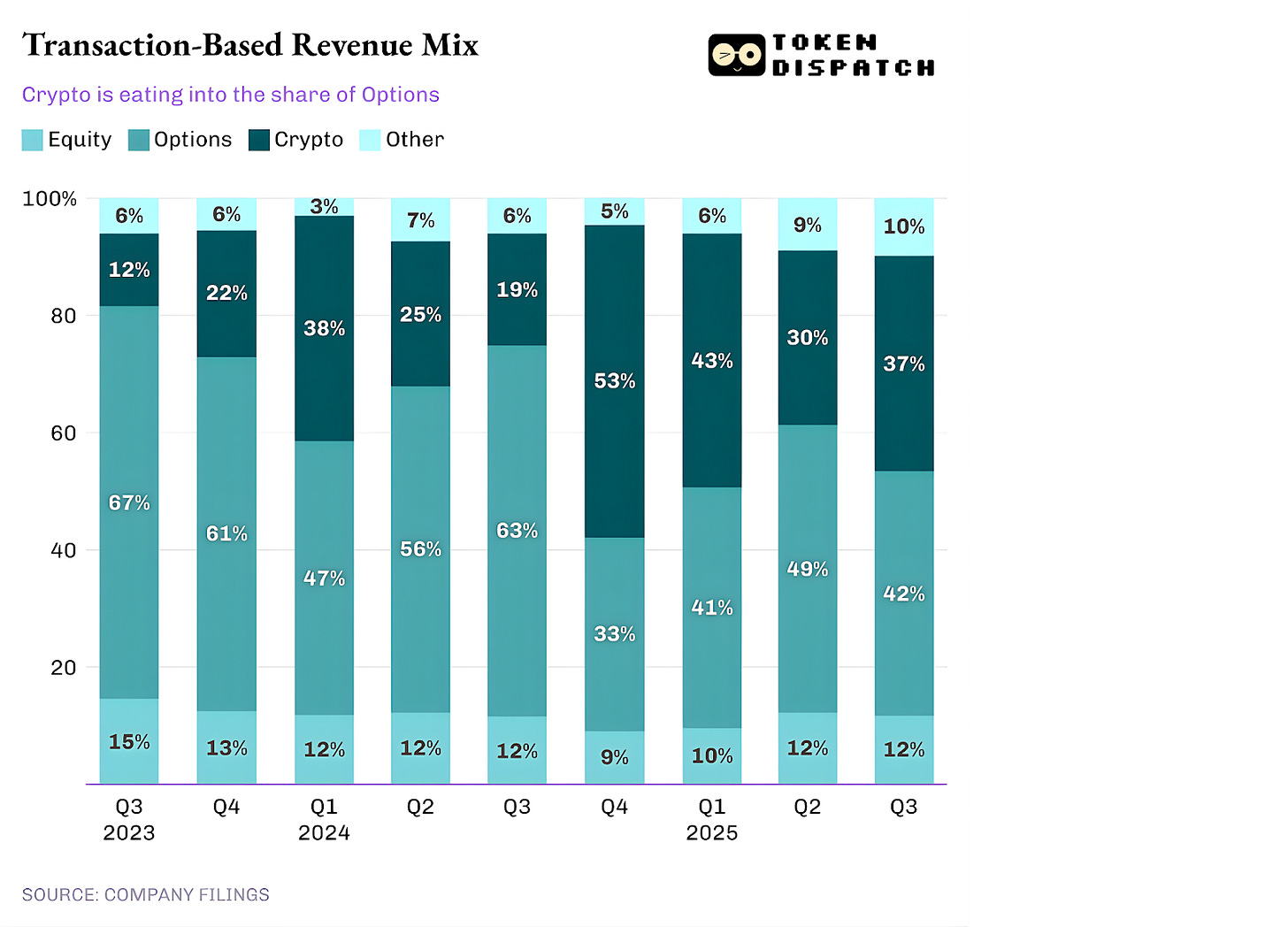

Although trading activities remain Robinhood’s core revenue driver, the mix within that category is changing.

An app that began its journey in trading equities and options on traditional markets is witnessing a shift in momentum toward crypto.

Crypto’s share has stayed above 30% for the last four quarters, accounting for $268 million out of $730 million in transaction-based revenue during Q3 2025. It shows that although equity options still dominate the revenue, crypto has become the gateway for new deposits.

This growth coincides with Robinhood’s push into on-chain infrastructure through a self-custody wallet launched last year.

What Could Go Wrong

Despite its reinvention, Robinhood still walks a tightrope, with more than a third of its revenue coming from interest income, which is rate-sensitive.

As interest rates fall, income from idle cash diminishes. With $64 billion in interest-earning assets, the cost of earning from fluctuating interest rates could be significant. Even a half-percentage-point cut in Fed rates could erase roughly $160 million in annual net interest income, assuming Robinhood retains only 50% of that yield after distributing the rest to Robinhood Gold customers.

To offset this, the company has turned to fee-based products, such as the Robinhood Gold subscription, but it still accounts for only a small portion of overall revenue. In Q3, this figure stood at $47 million, up 68% YoY, and accounted for 3.7% of the total revenue.

From its new prediction markets to global crypto expansion through Bitstamp acquisition, Robinhood is venturing into areas where compliance complexities are still being ironed out. One bad precedent could undo months of progress.

Finally, there is the looming risk of a market cooldown. Something crypto cycles are not new to, and one that the trader community is staring at as we write this. Robinhood generates most of its revenue from trades it facilitates for its customers.

The Shape of the New Robinhood

The challenge for Robinhood will be to align its new businesses into a coherent financial ecosystem, rather than appearing like a trading app with side projects. Its roadmap makes it resemble a vertically integrated retail finance platform where saving, speculating, spending and investing live together.

While Robinhood Ventures gives retail users access to private markets before they go public, Robinhood Retirement has already made long-term investing an indispensable part of its in-app journey. Robinhood Banking, which connects debit cards, direct deposits, and savings accounts to that same identity layer, is already being rolled out to its Gold Subscribers.

Robinhood must ensure that each business line feeds into the others: the banking arm supplying deposits, the trading desk and prediction markets, and the wallet anchoring crypto flows. The Ventures and Retirement arms must recycle liquidity back into long-term positions.

Only then will the consolidated entity function less like a broker and more like a financial one-stop shop for retail users, where every dollar, idle or active, can earn money.

When I look at Robinhood’s journey, it mirrors that of its users. It began with rebellion, flirted with excess, stumbled through a hangover, and is now learning the slow craft of compounding.

The confetti is gone, but so is the chaos. In its place, Vlad and his team aspire to build a company that can earn like a bank, trade like a broker, and build products like a fintech. How it manages to create a cohesive brand across a dozen different business lines will determine how well it completes its redemption arc.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

👀