Hello,

Aren’t you tired of the doomposting on Crypto Twitter (CT) lately? What I find even more frustrating is how conflicted people on CT are about the future of the crypto markets. Some are writing obituaries for the great bull run we had, while others insist it’s just another blip in the market’s cyclical drama. I don’t see anything new here. As always, everyone has their own theory.

Some signs suggest that this time might be different. ETFs recorded $1 billion in net outflows for three straight days for the first time since their inception, funding rates for BTC have flipped, and ‘buy-the-dip’ sentiment has largely been relegated to memes on CT. Yet there have been past instances when BTC has corrected by 25-30% only to register new all-time highs in the following months. How does anybody know for sure which theory is playing out this time?

But there’s one group in the crypto space that doesn’t deal in vibes, astrology, and other blind theories. One group of participants that cannot be misinterpreted. The first participants in the Bitcoin chain: the miners.

They went through their share of struggles after US President Donald Trump announced the first round of reciprocal tariffs on Asian countries, including China, where most of the mining equipment comes from. Yet, their economic reality is tied mainly to simple math, including the halving condition, written in Bitcoin’s whitepaper over 15 years ago.

In this week’s quantitative analysis, I’ll show you where miners’ profitability stands as their revenue gets squeezed following BTC’s price meltdown.

Now, onto the story,

Prathik

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

👉 Explore Polymarket

The BTC miners’ financials are straightforward: they live on a fixed protocol income, with floating real-world expenses. When the market tremors, they’re the first to feel the strain on their balance sheets. Their revenue comes from selling mined BTC, while their operating costs are largely made up of electricity bills to run the heavy computing required for mining.

I spent this week tracking what the network pays them, what it costs to earn that revenue, how much of their profit survives once cash expenses are deducted, and what they take home after accountants have their say.

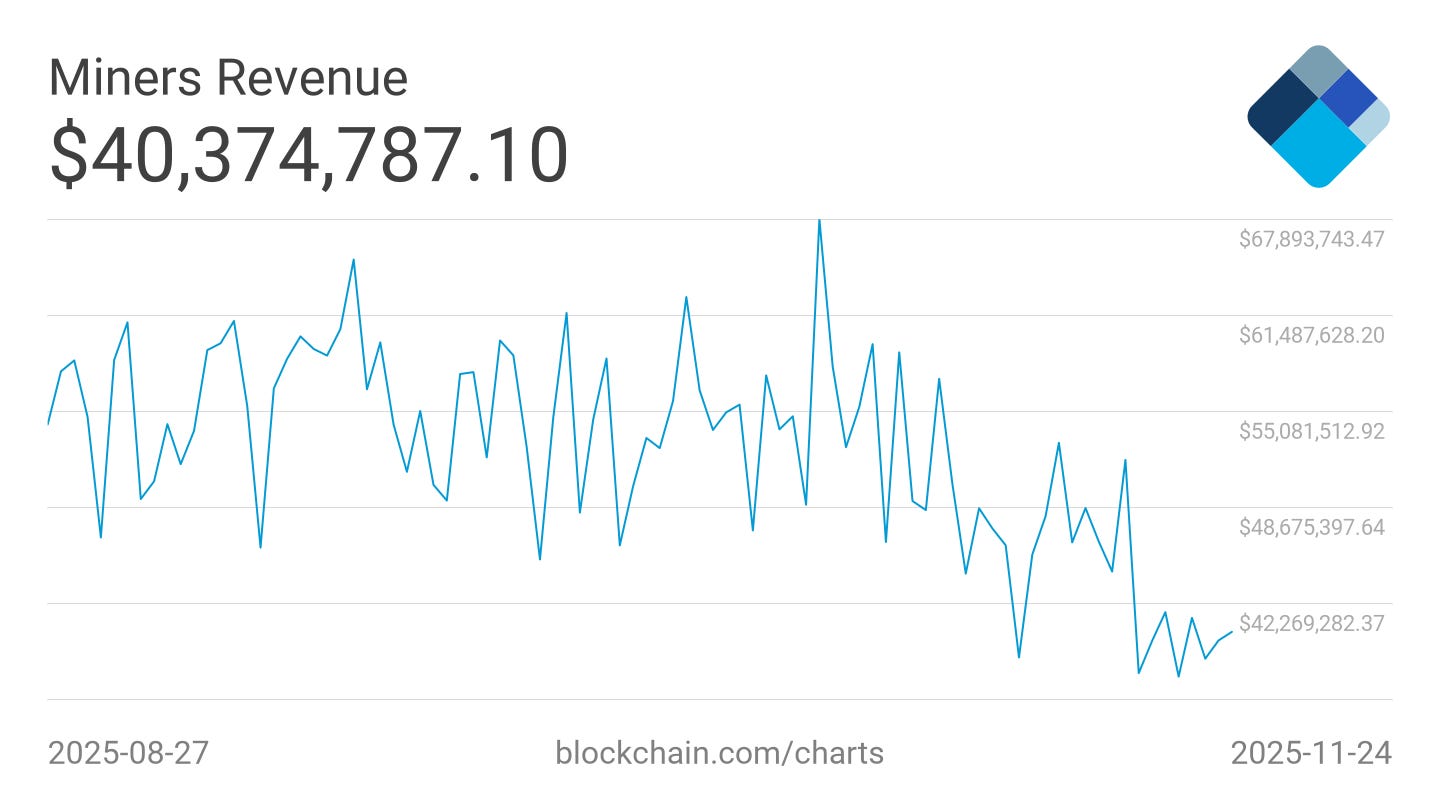

TL;DR: At current BTC trading levels below $90,000, the mining industry is cornered and far from thriving. Average 7-day miners’ revenue has dropped 35% from $60 million to $40 million over the past two months.

Let me walk you through the top.

Bitcoin’s revenue is mechanical and coded into the protocol. A mining reward of 3.125 BTC per block, combined with an average block time of 10 minutes, yields roughly 144 blocks per day. That’s about 450 BTC mined every 24 hours. Over the course of 30 days, BTC miners worldwide mine 13,500 BTC, which at the current BTC price of ~$88,000, amounts to approximately $1.2 billion. Once you divide that across a record-high hashrate of 1,078 Exahashes per second (EH/s), that billion-dollar pie dissolves into just 3.6 cents of revenue per Terahash per day. That’s the entire economic base that keeps the $1.7 trillion network secure.

On the cost side, electricity charges are the most significant variable, as they vary by location and the efficiency of the mining hardware.

If you are using modern machines, such as S21-class rigs pulling 17 joules per terahash with cheap power, you can still make cash margins. But if your fleet relies on older rigs or you’re paying higher energy rates, every hash you compute adds to your cost. At today’s hash price, which is influenced by network difficulty, Bitcoin’s price, block subsidy, and transaction fees, an S19 running on $0.06 power is barely break-even. If difficulty increases, the price drops slightly, and a heatwave spikes electricity costs, the economics will slide further into the water.

Let me help you break this down with some numbers.

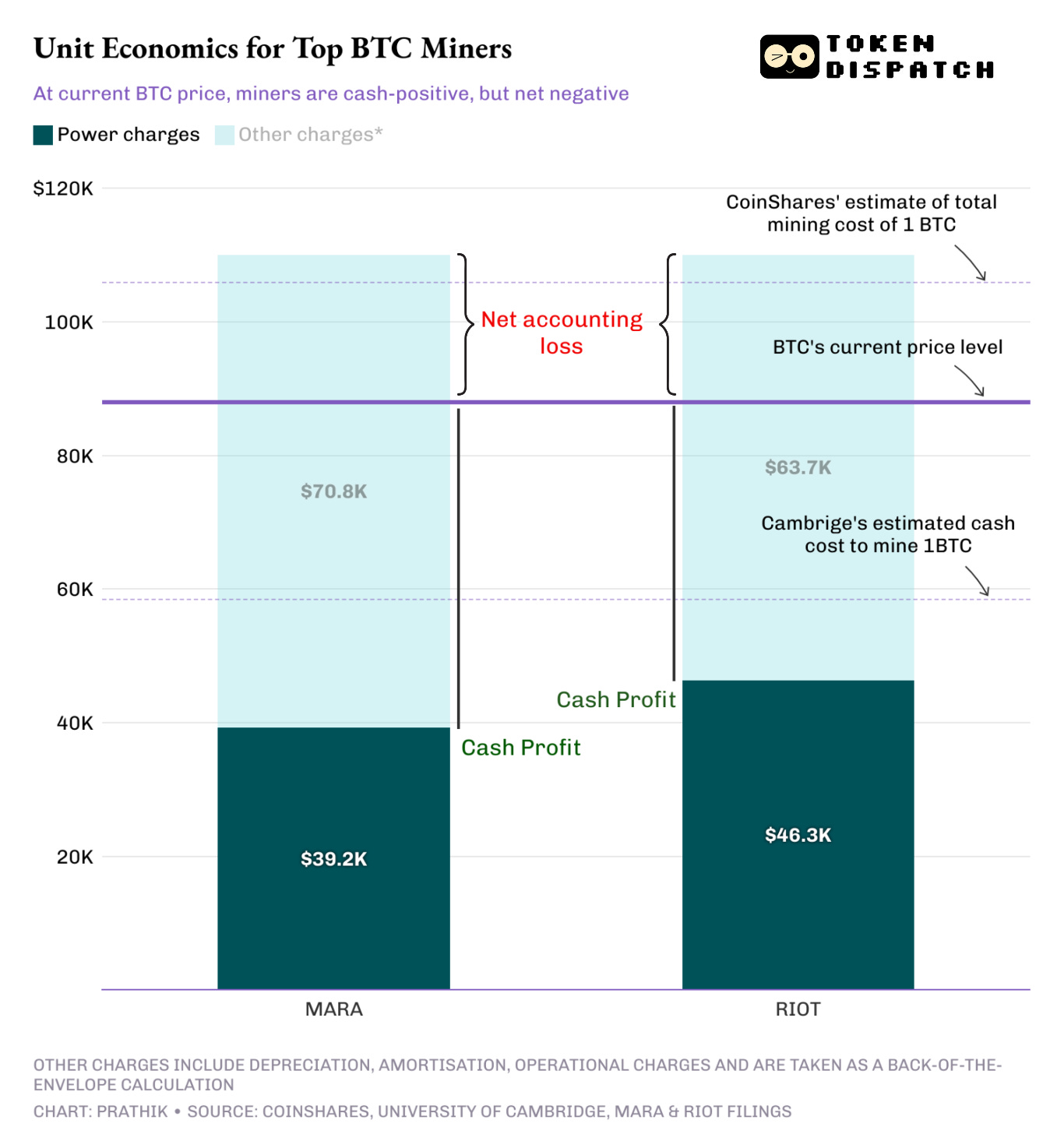

In December 2024, CoinShares estimated the cash cost of producing 1 BTC among listed miners to be ~$55,950 in Q3 2024. Today, Cambridge estimates the cost at ~$58,500. The actual cost of mining BTC can vary from miner to miner. Marathon Digital (MARA), the largest publicly listed Bitcoin miner, spent an average of $39,235 in energy costs to mine each BTC in Q3 2025. Riot Platforms (RIOT), the second-largest listed miner, paid $46,324. Despite BTC trading 30% below its peak at $86,000, these miners are still thriving. But this is not the complete picture.

Miners also have to account for non-cash items, including depreciation, impairments and stock-based compensation. These items collectively make mining a capital-intensive business. Once you factor these in, the total cost of mining one BTC can easily exceed $100,000.

MARA mines BTC using both in-house and third-party-hosted hardware. Just for using all the equipment, it has to pay for electricity, provide for depreciation, and set aside hosting charges. A back-of-the-envelope calculation puts the total mining cost above $110,000 per BTC. Even CoinShares estimated the total mining cost at ~$106,000 in December 2024.

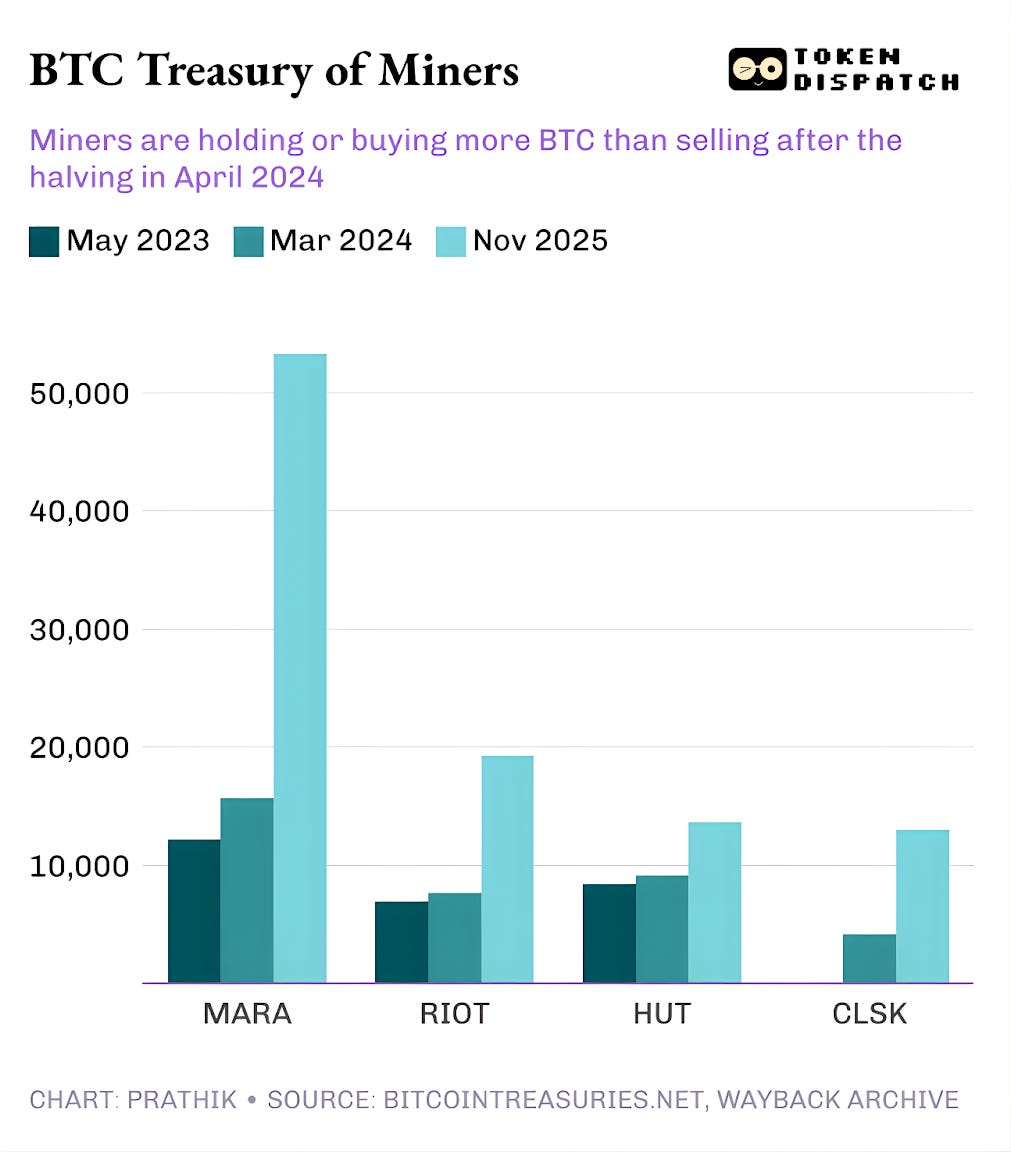

On the surface, the miners’ business looks robust with fat cash margins, a path to positive accounting profit, and enough operational scale to raise capital at will. However, when you zoom out, you start to understand why more miners are choosing to hold their mined BTC or even buy more BTC from the market instead of selling it.

Stronger miners, like MARA, can cover their costs because they have ancillary businesses and access to the capital markets. Many others, however, are just one difficulty increase away from ending up in the red.

When you put all this together, you end up with two break-even scenarios co-existing in the miners’ world.

The first is where industrial miners operate with efficient fleets, cheap power, and capital-light balance sheets. For them, the BTC price can fall from $86,000 to $50,000 before the daily cash flow turns negative. They make over $40,000 in cash profit per BTC today, but it varies from miner to miner if they can squeeze out any accounting profit at current price levels.

The second scenario is where the rest of the miners will struggle to stay above the break-even point once you account for depreciation, impairments, and stock-based expenses.

Even if you assume a conservative all-in cost of producing 1 BTC between $90,000–$110,000, it means many miners are already below their economic break-even. They can keep hashing because their cash cost hasn’t been breached, but their accounting cost has. This will likely drive more miners to hold onto their BTC rather than sell it right now.

Miners will keep mining as long as their economics stay cash-positive. At $88,000, the system looks stable, but only if the miner doesn’t sell their BTC. Once BTC drops further or miners are forced to liquidate their holdings, they start approaching their break-even lines.

So, while price meltdowns will continue to impact the retail and trading community, they are unlikely to hurt miners yet. What, though, could worsen this situation for miners is if their access to capital becomes more constrained. That’s when the flywheel will snap, and miners will need to double down on their ancillary businesses to stay afloat.

That’s it for this week’s quantitative analysis. I’ll see you next week.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.