Hello,

Earlier this week, the New York Stock Exchange (NYSE) announced its plan to build a 24/7, blockchain-based trading venue for tokenised securities. At a glance, this may seem like just another “TradFi adopts blockchain” headline. Tokenised equities, on-chain settlement, and stablecoin funding are familiar to anyone who’s been paying attention to the crypto space over the past few years.

However, this announcement is not about testing new technology. It is about challenging parts of the market that rarely change.

Equity markets still operate on fixed trading hours and delayed settlement, primarily because this system has been effective at managing risk for decades. Trading happens during narrow windows, with clearing and settlement happening later. A significant amount of capital sits idle between these periods to absorb counterparty risk. While this system is stable, it is also slow, expensive, and increasingly out of sync with how capital moves on a global scale.

What the NYSE is proposing directly challenges that structure by reworking how markets deal with time. A venue that does not shut down, a settlement that moves closer to execution, and fewer periods where prices stop updating while exposure continues to exist all point in the same direction.

Unlike crypto markets, which were built under different constraints, the traditional equity market has the ability to pause trading or defer settlement. In contrast, crypto markets operate continuously—pricing, execution, and settlement occur in real time, reflecting risk instantaneously rather than delaying it for later. While this design has its own trade-offs, it eliminates the inefficiencies tied to time-based systems that traditional markets still rely on.

The NYSE is now attempting to incorporate elements of a continuous model into a regulated environment, while preserving the safeguards that keep equity markets stable. This article examines what the NYSE is actually building, and why it is more than just a headline.

Why This Is Not “Just Another Tokenisation Announcement”

The important detail in the NYSE’s announcement is not that equities are being tokenised. Tokenised stocks have existed for years in various forms, and most of the time, they failed. What makes this different is who is doing it and which layer they are touching.

Past attempts at tokenised equities aimed to replicate stocks outside the core market, including products like FTX’s tokenised stocks, Securitize’s tokenized equity offerings, and synthetic equity representations built on protocols such as Mirror and Synthetix. These products traded on separate venues at different times and relied on price feeds from markets that were often closed. As a result, they struggled to attract sustained liquidity and were mostly used as niche access products rather than core market instruments.

These earlier attempts existed outside the primary equity market. They did not change how shares were issued, how trades were settled, or how risk was managed within the system that actually sets the prices.

The NYSE, however, is approaching the problem from within. Rather than creating a parallel product, it is modifying how trading and settlement work within a regulated exchange. The securities remain the same, but the way they move and settle over time is being adjusted.

The most significant part of the announcement is the decision to combine continuous trading with on-chain settlement. Either of these changes could have been introduced on its own. The NYSE could have extended trading hours without blockchain. It could have experimented with tokenised issuance without touching market hours. Instead, it chose to bundle both. This suggests that the focus is not on access or user experience, but on how exposure and capital behave when markets operate continuously.

A large part of today’s market infrastructure exists to deal with what is called “time gaps”. When markets close, trading stops, but positions remain open. Risk and exposure still stay even though prices are no longer moving. To manage these time gaps, brokers and clearinghouses require collateral and safety buffers that stay locked until settlement finishes. This process is stable, but it becomes inefficient as markets speed up and global participation increases, and more activity happens outside local trading hours.

Running markets continuously and settling trades faster shortens this gap. Risk is handled closer to when it is created instead of being carried overnight or across days. That does not remove risk, but it reduces how long capital needs to sit idle just to cover timing uncertainty. This is the problem the NYSE is trying to address, too.

This is also where stablecoin-based funding fits into this model.

Today, cash and securities move through different systems and often on different schedules, causing delays and extra coordination. Using on-chain cash allows both sides of a trade to move together, without waiting for external payment systems. Coupled with continuous trading, this becomes crucial for global markets where information and investors are active around the clock. Prices can adjust in real time when news arrives, not hours later at the next market open. Whether this improves outcomes under stress is still unclear, and that is where the real implications of these changes begin.

What Changes Inside the Market

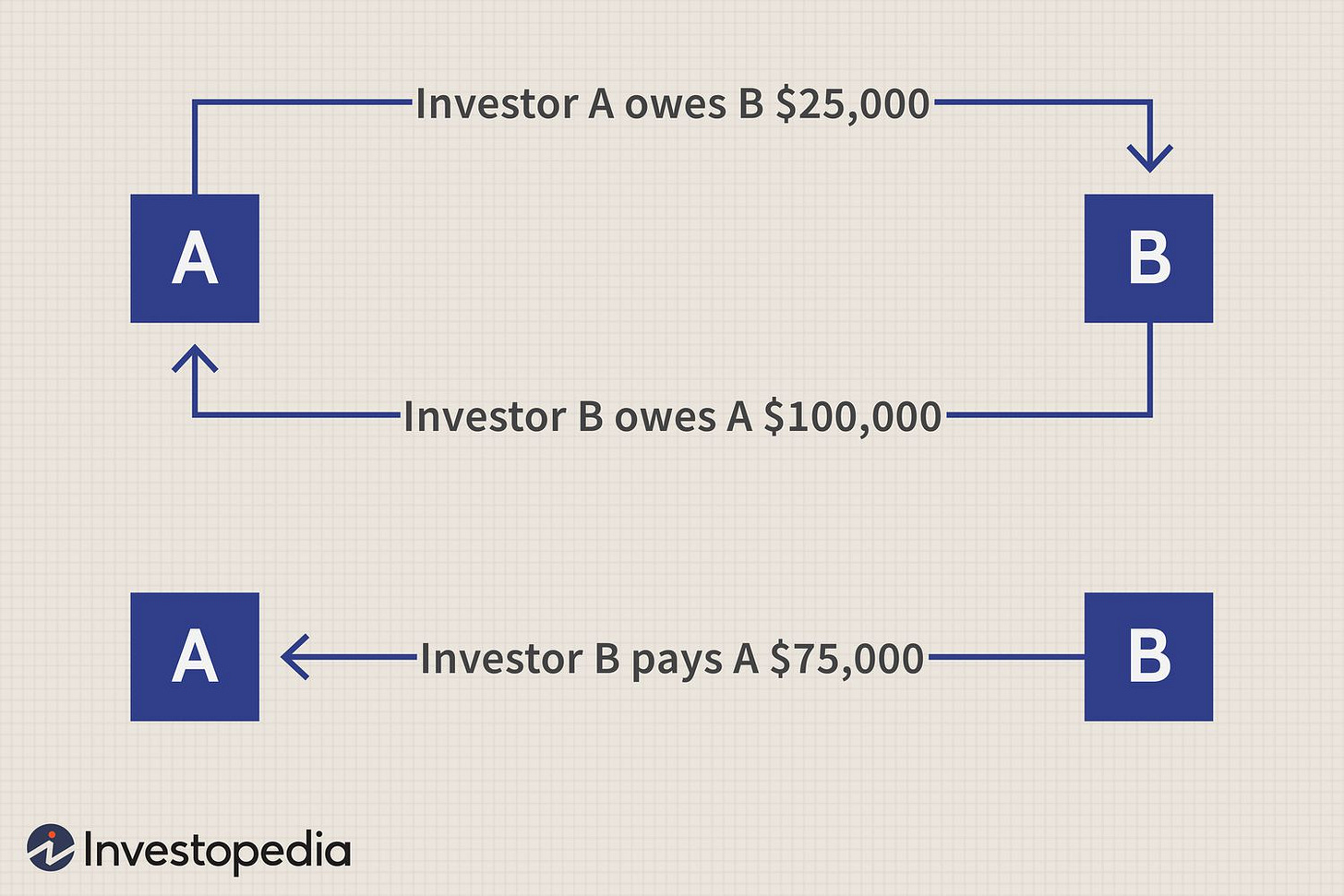

One of the simple but important consequences of what the NYSE is proposing shows up in how trades are cleared and settled behind the scenes. Today’s equity markets rely heavily on netting. Millions of trades are offset against each other before settlement, which reduces the amount of cash and collateral required to move trades. This works well in a system built around fixed trading hours and delayed settlement, but it also depends on time gaps to function efficiently.

Continuous trading and faster settlement change how trades are cleared. When trades settle sooner, there is less opportunity to offset large volumes of activity through end-of-day netting. This means some of the efficiency that comes from batching trades is reduced. As a result, brokers, clearing members, and liquidity providers need to manage funding and exposure throughout the trading day, rather than relying on overnight processes to absorb and smooth out risk.

Market makers and large intermediaries will be the first to adopt this change. In today’s setup, they can hold inventory and adjust positions around predictable settlement cycles. With faster settlement and continuous trading, positions turn over more quickly and funding needs to appear sooner. Firms that already operate with automation, real-time risk checks, and flexible liquidity can handle this more easily. Others face tighter constraints because there is less time to rebalance or rely on overnight processes.

The same pressure appears in short selling and securities lending. Today, Borrowing shares, locating the inventory, and resolving settlement issues currently happen across multiple steps and time windows. When settlement timelines tighten, those steps compress, making failed deliveries harder to roll forward and borrowing costs and availability adjusting more quickly to market conditions.

What is important here is that most of the impact is felt behind the scenes. Retail users may not notice much difference at the interface level, but the institutions that provide liquidity and fund positions operate under tighter timing constraints. Some sources of friction are removed, while others become harder to ignore. Time no longer absorbs mistakes in the same way, and systems have to stay in sync throughout the trading day instead of catching up later.

The Second-Order Effects That Follow

Once markets stop relying on time as a buffer, a different set of constraints starts to matter. One of the first places this shows up is in how capital is reused within large institutions. Today, the same balance sheet supports multiple positions across settlement cycles because obligations net out over time. As the settlement tightens, that reuse becomes harder. Capital has to be available earlier and in more precise amounts, which quietly changes internal capital allocation decisions, limits the use of leverage, and changes how liquidity is priced during volatile periods.

Another consequence is how volatility propagates. In batch-based markets, risk tends to accumulate during closed periods and then be released at predictable moments like the open or close. When trading and settlement are continuous, that cluster doesn’t work anymore. Price moves spread out across time instead of concentrating at specific windows. This does not make markets calmer, but it does make volatility harder to anticipate and manage using old playbooks that assume pauses, resets, or downtime.

This also affects how different markets are aligned. A meaningful amount of price discovery today happens outside primary equity venues through futures, ETFs, and other proxies, largely because the underlying market is closed. When the main venue stays open and settles faster, these workarounds become less important. Arbitrage shifts back toward the primary market, changing liquidity patterns across derivatives and reducing the need to hedge exposure through indirect instruments.

Finally, this changes the role of the exchange itself. The exchange becomes more entangled with risk coordination rather than simply order matching. That increases its responsibility during stress events and reduces the distance between trading infrastructure and risk management.

Taken together, these effects explain why this move matters even if it does not immediately change how markets look or feel. The impact shows up gradually, in how capital is reused, how volatility spreads through time, how arbitrage shifts back toward primary venues, and how balance sheets are managed under tighter constraints. These are not short-term improvements or surface-level upgrades. They are structural changes that reshape incentives inside the system, and once markets begin operating this way, rolling them back becomes far harder than adopting them in the first place.

In today’s market structure, delays and layers of intermediaries act as a buffer when things go wrong, allowing problems to surface later, losses to be absorbed gradually, and responsibility to be spread across time and institutions. As timelines compress, that starts to weaken. Funding and risk decisions move closer to execution. There is less room to smooth errors over or push consequences forward, so failures show up earlier and are easier to trace.

The NYSE is testing whether a large, regulated market can operate under those conditions without relying on delay to manage risk. Less time between trading and settlement means less room to reshuffle positions, stretch funding, or clear things up. This change forces problems to appear during normal operation instead of being pushed into later processes, making it clear where the market struggles.

That’s all for today!

See you next weekend, and until then, stay curious!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.