The Oracle Who Came In From the Cold 🔗

How Chainlink’s new flywheel is an overlooked value play in crypto

The 1992 Dream Team dominated Olympic basketball so thoroughly they won games by an average of 44 points, but there’s something about that story most people don't remember.

They almost lost their first scrimmage against college players.

The problem wasn't talent. Michael Jordan, Magic Johnson, and Larry Bird on the same team should have been unstoppable from day one. The problem was that superstars don't automatically create championship teams. You need systems that turn individual excellence into collective dominance. You need someone to build the connective tissue that makes everyone else better.

Chuck Daly, the Dream Team coach, spent the first week doing something that seemed incredibly boring compared to highlight-reel dunks: he built passing lanes. He established pick-and-roll timing. He created the infrastructure that would turn a collection of hall-of-famers into an unstoppable force. By the Olympics, something magical had happened. Every pass created better shots. Every defensive rotation made the next one easier. Every player made every other player more valuable.

The genius was in creating the infrastructure that amplified everyone else's abilities.

This is basically what Chainlink has been doing in crypto.

While every other crypto project was trying to be the Michael Jordan of blockchains, Chainlink quietly became the Chuck Daly of digital finance. They built the infrastructure that makes everyone else's shots easier.

In 2019, Chainlink launched its mainnet with the modest goal of getting sports scores and weather data onto Ethereum so people could bet on football games without trusting a centralised bookmaker. Six years later, JPMorgan is using that same infrastructure to settle cross-chain Treasury transactions while the Federal Reserve nods approvingly in the background.

Last Call: Almanak's Legion Round Closes Tonight

Manual DeFi trading is already obsolete. Almanak's AI agents research, optimise, and execute on-chain strategies while you sleep.

No spreadsheets. No copy-trading. No missed opportunities. Just describe your strategy goals and let AI agents handle the Python coding, optimisation, and deployment.

Legion's investment round got oversubscribed in 45 minutes but stayed open for retail participation. Final hours remaining.

The smart money moved fast. If you believe AI agents will dominate DeFi strategy development, this window won't stay open for long.

Chainlink solves what the crypto world politely calls "the oracle problem," which is really just the problem that blockchains are digital islands that can't talk or listen to anything else. If you want your smart contract to know the price of Apple stock, or whether it rained in Kansas yesterday, or if someone actually has the dollars they claim to have in their bank account, you need something to ferry that information onto the blockchain. That something is an oracle, and Chainlink is the oracle that ate all the other oracles.

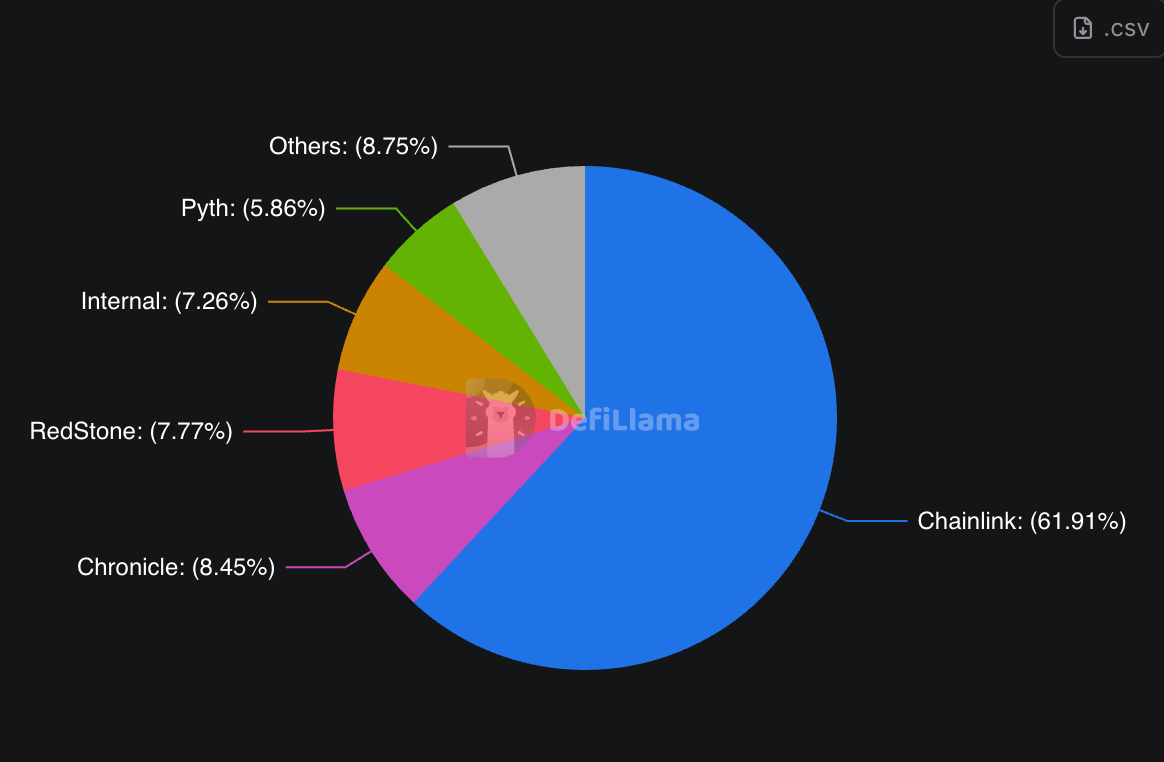

Chainlink already enables over 60% of DeFi's value, approaching 80% on Ethereum. As traditional assets migrate onchain, they'll need the same infrastructure that DeFi uses. Chainlink is first to market and they're building the standard that everyone else follows.

Let me explain the infrastructure.

Chainlink didn't set out to become the bridge between Wall Street and Web3. But somewhere along the way, traditional financial institutions realised they had a problem: if you want to tokenise a Treasury bill, you need a way to prove that the Treasury bill actually exists and is worth what you say it's worth.

Enter Chainlink's Proof of Reserve system, which sounds fancy but is really just a very sophisticated way of proving you're not running a fractional reserve scam.

Suddenly, every major stablecoin issuer needed this service, because telling people "trust us, we totally have $100 billion in Treasury bills" wasn't cutting it anymore with regulators, especially after the Terra and FTX crises.

Then came the Cross-Chain Interoperability Protocol (CCIP), which lets assets move between different blockchains. This is like building a universal translator. It helps banks communicate across blockchain barriers. The result is that JPMorgan can now send a tokenised deposit from their private Ethereum network to a public Solana network, with Chainlink acting as the trusted courier.

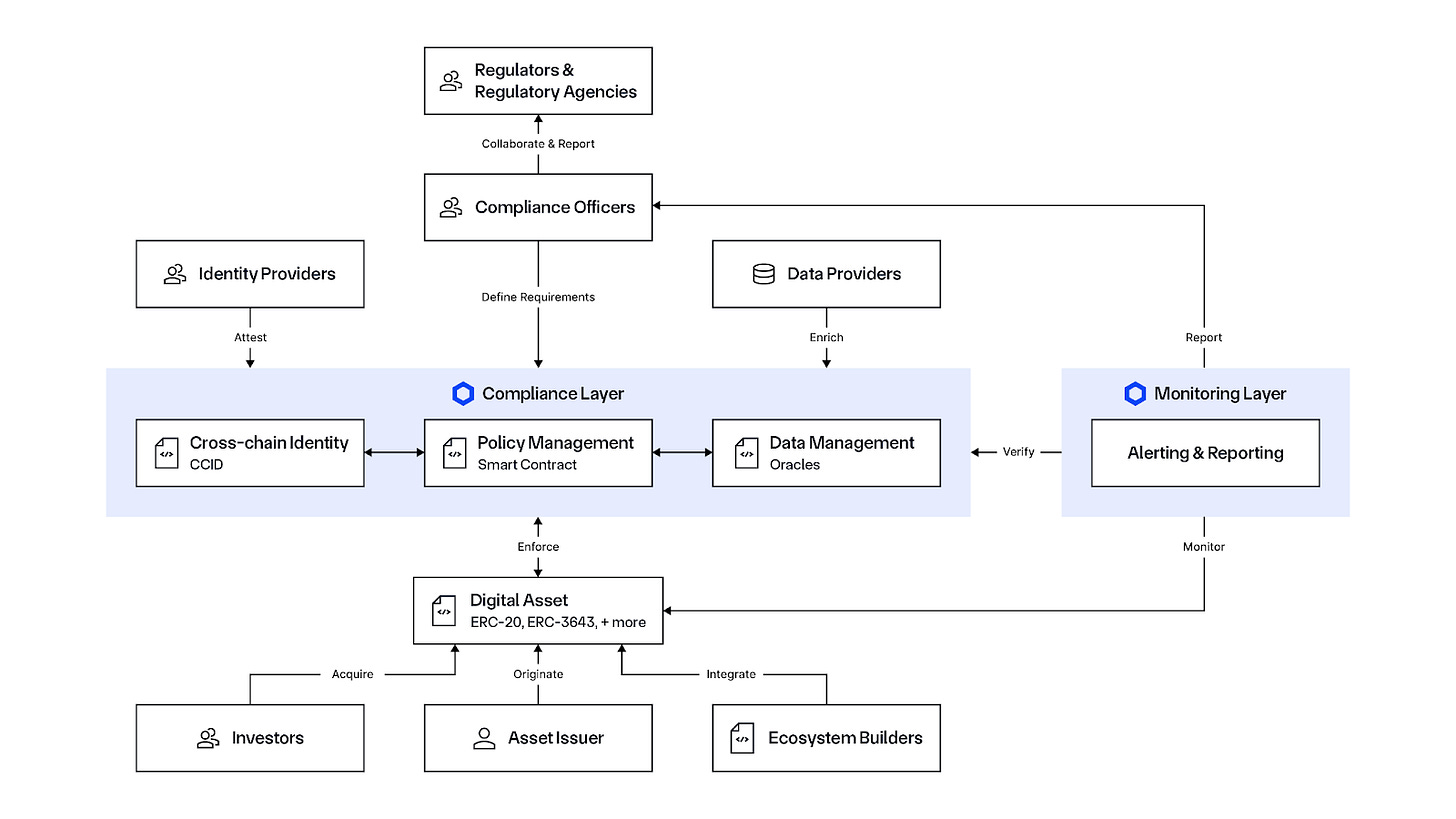

Chainlink built tools specifically designed to help institutions comply with regulations.

Their new Automated Compliance Engine (ACE) automatically handles all the regulatory paperwork that makes crypto transactions legal. Want to move tokenised assets between blockchains while maintaining AML compliance, KYC verification, and audit trails? Chainlink will handle all of that automatically, ensuring that every transaction meets whatever regulatory requirements apply in whatever jurisdiction you're operating in.

This positions them perfectly for the coming wave of tokenised finance. Every bank, asset manager, and government agency that wants to experiment with blockchain technology needs to solve the compliance problem first.

Chainlink's 2025 story is particularly interesting.

Tuttle Capital filed for the first spot Chainlink ETF (Exchange-Traded Funds) in January, with an SEC decision expected by autumn 2025. The timing aligns perfectly with the current pro-crypto regulatory environment.

JPMorgan's Kinexys used Chainlink to complete the first crosschain delivery-versus-payment settlement between traditional banking rails and public blockchains.

Intercontinental Exchange, parent company of the NYSE, integrated Chainlink Data Streams to bring foreign exchange and precious metals data onchain. When the world's largest stock exchange needs oracle infrastructure, they choose Chainlink.

Mastercard partnered with Chainlink to enable 3 billion cardholders to buy crypto directly. When a payment processor needs compliant crypto infrastructure, they choose Chainlink.

Chainlink launched Data Streams for US equities and ETFs, providing real-time price feeds for stocks like Apple, Tesla, and the S&P 500 index.

Central banks in Brazil and Hong Kong are using Chainlink for CBDC pilots and cross-chain settlement experiments. When governments need blockchain infrastructure, they choose Chainlink.

The pattern is consistent: when institutions move beyond experimentation to production deployments, they standardise on Chainlink.

The Treasury Printer Goes BRRR

In August, they announced something called the "Chainlink Reserve," which is basically Chainlink's version of a stock buyback program. The company takes the fees it earns from enterprise clients (JPMorgan, Mastercard, the New York Stock Exchange) and uses that money to buy LINK tokens on the open market.

Here's how the flywheel works:

Step 1: Enterprises pay Chainlink for data feeds, cross-chain services, and compliance solutions. Co-founder Sergey Nazarov confirmed they're already generating "hundreds of millions in revenue created" with the offchain portion being substantial.

Step 2: All payments — whether in fiat, stablecoins, or other tokens — get automatically converted to LINK through their Payment Abstraction system.

Step 3: A portion of that LINK goes into the strategic reserve, where it sits locked for years.

Step 4: As more institutions tokenise assets, demand for Chainlink's services increases, generating more revenue and more automatic LINK purchases.

The beauty of this system is that it ties LINK demand directly to real-world business adoption. Traditional crypto projects rely on speculation or token utility within their ecosystem.

Since launching the reserve, they've accumulated over 150,000 LINK tokens worth roughly $4.1 million. That might seem small, but consider the trajectory. They're moving from pilot programs to production deployments across multiple institutions simultaneously.

Chainlink is evolving from a data provider into what Sergey Nazarov calls "a system of transactions." Modern institutional transactions require more than just price data.

Data feeds for accurate pricing and valuations

Cross-chain capabilities to move assets between networks

Identity and compliance to meet regulatory requirements

Proof of Reserve to verify backing assets

Reporting and auditability for institutional oversight

Chainlink is probably the only infrastructure provider that offers all of these services in a single integration. When institutions want to tokenise assets, they can work with Chainlink exclusively rather than cobbling together solutions from multiple vendors.

This positions them uniquely for the coming tokenisation wave. As Nazarov pointed out in recent interview, less than 1% of global assets are currently tokenised. Even reaching 5% would represent a 10x expansion of the entire crypto market.

The scale of this opportunity is staggering. Traditional finance represents roughly $500 trillion in assets. Chainlink's thesis is that most of these assets will eventually migrate onchain, and they'll all need the infrastructure services that only Chainlink can provide comprehensively.

The Bitcoin vs. Tokenisation Split

Sergey Nazarov outlined a compelling thesis about crypto's future evolution. Bitcoin will likely capture safe-haven demand during periods of instability, potentially reaching multiple trillions in value. But tokenised assets will dwarf Bitcoin by several orders of magnitude.

Bitcoin serves as digital gold, appealing to investors seeking uncorrelated assets during uncertain times. Tokenised assets serve as more efficient versions of existing financial products that already represent hundreds of trillions in value.

When sovereign wealth funds and pension funds allocate to crypto, they're not going 50% Bitcoin. They're maintaining diversified portfolios that include equities, commodities, bonds, and real estate — just in tokenised form. The total addressable market for tokenised assets is the entire traditional financial system.

This shift will fundamentally change what we call "crypto." Instead of being defined by cryptocurrencies like Bitcoin and Ethereum, the space will be defined by tokenised versions of traditional assets. Chainlink is positioning to be essential infrastructure for this transition.

The Supply Dynamics

LINK's circulating supply has grown from 470 million tokens in 2021 to 680 million today, which is a 44% increase that looks alarming until you understand what funded it.

That 210 million token dilution funded the most aggressive infrastructure buildout in crypto history.

The supply expansion was essentially Chainlink's Series A, B, and C funding rounds, except instead of giving equity to VCs, they sold tokens to fund development. Critics called it dilutive. Supporters called it a necessary investment.

According to Tokenomist data, 41% of LINK's total supply (411.90 million tokens) remains locked with no immediate unlock events scheduled. This suggests the major dilution phase may be behind us, with most historical unlocks occurring during the 2018-2022 development period.

The August 2025 strategic reserve launch fundamentally changes this dynamic.

Large portion (41%) remains locked with no scheduled unlocks

Strategic reserve creates sustained buying pressure

Net effect depends on enterprise revenue growth vs. any future unlock decisions

Early accumulation data shows reserve growing consistently

The timing creates an interesting inflection point. Supply growth funded the infrastructure that's now generating hundreds of millions in enterprise revenue. That revenue feeds the strategic reserve, which removes tokens from circulation just as institutional adoption accelerates.

The dilution that looked bearish in previous years becomes the foundation for sustained demand in 2025 and beyond. Investors who focused on supply expansion missed the infrastructure being built. Investors who focus only on current buyback volumes might miss the revenue trajectory that determines future accumulation rates.

All of this raises a question.

What happens when the infrastructure layer becomes more valuable than the applications running on top of it?

In 2025, Chainlink’s Total Value Secured (TVS) has surged to over $93 billion across decentralised finance protocols, tokenised assets, and cross-chain infrastructure. They provide data feeds to thousands of DeFi protocols. They're the bridge technology that lets traditional banks experiment with public blockchains. They're building the compliance tools that will determine which crypto applications are legal and which aren't.

That $93 billion isn't infrastructure value - it's application value that depends entirely on Chainlink's infrastructure. The infrastructure is Chainlink's oracle networks, data feeds, and cross-chain messaging systems.

But if Chainlink disappeared tomorrow, how much of that $93 billion would become worthless? How many DeFi protocols would stop functioning? How many tokenised assets would lose their price feeds?

The answer is: most of it. Which suggests the infrastructure might already be more valuable than the applications, even if the market hasn't recognised it yet.

They've become systemically important to crypto in a way that very few protocols have achieved. The network effect is obvious: the more institutions use Chainlink, the more other institutions want to use Chainlink, because everyone else is already using Chainlink.

In crypto, this happens when everyone needs the same underlying service and the network effects become self-reinforcing. The more institutions use Chainlink, the more other institutions want to use Chainlink, because everyone else is already using Chainlink. The revenue is sticky because the infrastructure gets paid regardless of which applications succeed or fail. So while individual DeFi protocols come and go, the data layer that enables all of them keeps collecting fees. The apps are commodities. The infrastructure is a monopoly. And monopolies, as we know, tend to capture most of the value in any ecosystem.

The Cracks in the Foundation

But let's be honest about what could go wrong here, because the Chainlink bull case assumes a lot of things that might not stay true forever.

The first problem is that oracle networks are technically difficult to build. But hard part isn't the software. It's getting everyone to agree to use your version. Chainlink's moat is network effects and first-mover advantage, not some insurmountable technical barrier. Google and Amazon have the infrastructure to build competing oracle services tomorrow if they wanted to. So does Microsoft. So does any major cloud provider with a decent engineering team.

The second problem is regulatory capture risk. Chainlink has become so systemically important that if it fails, huge chunks of the tokenised finance system fail with it. That's exactly the kind of "too big to fail" situation that makes regulators nervous. What happens when some senator realises that a private company with no government oversight controls the data feeds for trillions in tokenised assets? Suddenly Chainlink might find itself facing the kind of regulatory attention that turns profitable businesses into compliance nightmares.

The third problem is the tokenisation assumption. Chainlink's entire value proposition depends on traditional finance actually moving on-chain at massive scale. But what if it doesn't? What if banks decide they like their private blockchains just fine and don't need to interact with public chains? What if the regulatory environment shifts and makes tokenisation harder instead of easier? Chainlink has built infrastructure for a future that might not happen.

The fourth problem is competition from the people they're helping. JPMorgan is using Chainlink now, but JPMorgan also has thousands of engineers and billions in R&D budget. How long before they decide to build their own oracle system rather than paying fees to Chainlink forever? Same question applies to every major bank and asset manager experimenting with tokenisation.

And finally, there's the fundamental question of whether any middleware company can maintain pricing power long-term. History suggests that infrastructure layers tend to get commoditised over time. The internet started with expensive dial-up services and ended up with commodity broadband. Cloud computing started with Amazon charging premium prices and ended up with multiple providers competing on cost. Why should oracle networks be different?

Chainlink's bet is that they can maintain their network effects and switching costs forever. That's possible, but it's also the kind of bet that tends to work until suddenly it doesn't.

But right now this success story looks nothing like the decentralised, disintermediated financial system that crypto was supposed to create. Instead, it looks like the old system with better APIs. The banks are still the banks, the regulators are still the regulators, and the money still flows through institutions that governments can control.

Chainlink didn't replace the traditional financial system. They built the translation layer that lets the traditional financial system speak blockchain. And now, as that translation layer becomes indispensable, whether crypto is decentralising finance or just giving centralised finance better tools remains unclear.

That’s it for now. Will come to you with another thought next week.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Wow, this is probably the most comprehensive breakdown of Chainlink I've read. The comparison to Chuck Daly and the Dream Team realy nails how infrastructure works in crypto. The part about the Chainlink Reserve creating a sustained buyback mechanisim through enterprise fees is honestly brilliant. I'm curious tho if the dilution phase is truly over or if we'll see more strategic unlocks down the line to fund further expansion. Either way, the positioning for tokenized assets seems spot on.

This is the exact evolution in blockchain utility my "Beyond The Coin" subscribers expect: Chainlink moving from data feeds to powering institutional-grade asset transfers. JPMorgan’s adoption proves how ‘boring’ foundational tech often wins in regulated markets. How do you see other oracle protocols extending their value beyond price feeds—are there real estate or logistics examples you’d nominate for deeper analysis? Ping me for an exclusive protocol breakdown if you’d like!