On Friday, July 18th, the chiefs of the world’s two largest stablecoin issuers, Paolo Ardoino of Tether and Jeremy Allaire of Circle, sat in the same row as part of the East Room audience at the White House. In front of them, US President Donald Trump had just signed the GENIUS Act into law, marking the first time the United States had enacted federal rules for stablecoins.

A few years ago, this moment would’ve been unthinkable.

Because once upon a time, Tether was the problem child of crypto. Loved by traders, loathed by regulators, and dogged by investigations. It had paid fines, avoided audits, and rarely engaged with US oversight. But on this July afternoon, its CEO was being publicly acknowledged by the POTUS.

It was a signal that the outlaw stablecoin was ready to become a citizen.

Build the Skillset Crypto Teams Are Hiring For

Safary Certification is a 4‑week bootcamp taught by the very people behind growth at Kraken, Stargate, EigenLayer, and others.

In this bootcamp, you’ll learn:

How to position a crypto brand using narrative-first frameworks.

Funnel-building from acquisition to retention using onchain data.

Partnership strategies & token launch playbooks.

Building a personal brand that gets you hired in web3 growth.

Cohort 1 had 170 students. Cohort 2 kicks off August 1 with only 100 seats.

The GENIUS Act is the US’ long-awaited attempt at taming stablecoins. It requires dollar-for-dollar reserves, monthly audits, redemption guarantees, and a licensing regime for issuers known as Permitted Payment Stablecoin Issuers (PPSI). To qualify, an issuer must maintain highly liquid reserves, mostly in US Treasuries, undergo regular attestations by qualified accounting firms, and submit to US anti-money laundering (AML) and compliance controls.

Foreign issuers like Tether can participate as long as they meet equivalent standards and submit to oversight by the Office of the Comptroller of the Currency (OCC). The law offers a generous, but finite, three-year grace period to meet these thresholds. This transition window is key. It gives Tether time to retool its structure, adjust reserves, and bring both its flagship USDT and a new US-compliant token into the fold.

For El Salvador-based Tether, the public commitment marks no small shift. After years of dodging regulators and operating from offshore jurisdictions, the company is finally stepping into the world’s most scrutinised market. Though not from a position of desperation, but dominance.

Despite being shut out of the highly regulated US market, Tether has always played the global game better. Its token, USDT, dominates trading pairs, is used in emerging markets for real-world payments, and moves across 12+ blockchains with unmatched liquidity. At over $160 billion in circulation and $13 billion in net profit just last year, along with being the biggest stablecoin, Tether is also one of the most profitable financial entities in the world.

That’s precisely why its entry into the US matters.

Paolo Ardoino made it clear: Tether will comply. It plans to adjust its reserves, pursue a Big Four audit, and work with the OCC to become a licensed foreign issuer under the new law. In parallel, Tether will launch a second, US-only version of USDT, built for institutions that care about efficiency. This is a strategy aimed at owning both ends of the market: global crypto liquidity and regulated institutional rails in what is arguably the world’s largest economy.

This new American chapter of finance is focused on big money — fund issuers, banks, fintechs, and hedge funds. For Tether, entering this market isn’t a matter of survival. It’s a question of who gets to lead the next wave of global financial rails.

If Tether can prove to the industry that it can afford to play by the rules without killing its margins, it will reinforce its position as an indispensable, dominant leader in the stablecoin industry.

That said, the cost of compliance is the elephant in the room.

Monthly audits by major firms can cost tens of millions of dollars annually. AML systems require dedicated staff and technology. Reporting obligations under US law will expose the company to greater scrutiny and, possibly, to political risks down the line. There’s also the opportunity cost: riskier investments and higher-yield instruments may need to be trimmed from its reserves to meet liquidity and transparency requirements. But Tether, with its scale and profits, can afford to stomach that cost.

For Tether, the transition will bring both cultural and operational challenges. The company has long positioned itself as the anti-establishment option, particularly in markets where distrust towards traditional institutions runs high. Committing to US oversight risks alienating that base. In the past, Tether has already invited criticism in the past by freezing funds. Will users in Nigeria or Argentina trust a Tether that also begins responding to the US subpoenas? And if so, what replaces the perception of freedom that USDT once offered?

Also, compliance may not eliminate criticism.

Transparency advocates and financial watchdogs still question Tether’s historical record. Its previous refusal to produce full audits, its opaque ownership structure, and alleged involvement in shadow banking remain topics of concern. Regulatory compliance may appease institutions, but it won't instantly rebuild trust in the sceptical corners of the public.

Meanwhile, it risks ceding more ground to Circle, its closest competitor.

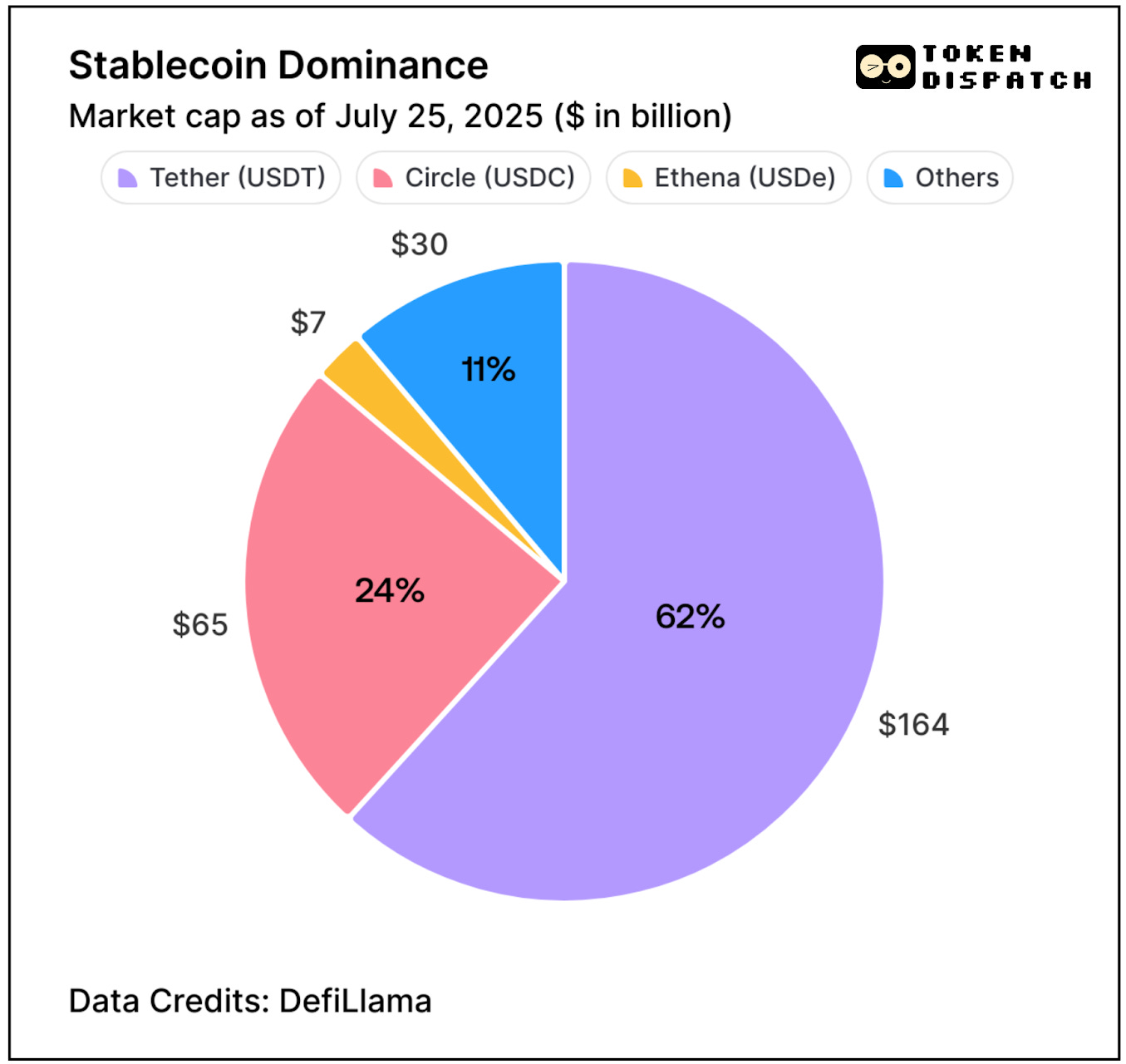

As of July 25, Tether’s dominance in the stablecoin industry has already dropped to 61.76%, down eight points from 69.69% since November 2024. Over the same period, Circle has gained four points, commanding 24.44% of market share.

The US-based issuer of USDC also enjoys a head start on compliance. It has long been audited, maintains full regulatory coverage across 48 US states, and recently had a blockbuster debut on Wall Street. CEO Jeremy Allaire framed the GENIUS Act as a green light, noting that it essentially formalises the model Circle has followed for years. Despite the recent gains Circle made in the market share, there’s still a lot more to catch up for the recent Wall Street debutant.

In 2024, Tether posted $13 billion in profit. It ended the year with $113 billion in US Treasuries, a $7 billion reserve buffer, and over $20 billion in equity. Tether held $98 billion in US Treasuries as of March 31, 2025. At a conservative yield of 4.4%, it’s already making over $4 billion in revenue. Even if compliance trims yields by 10–15%, the business model survives.

Compliance could also mean forward revenue. A compliant Tether is a credible Tether, which may then bring in more business. And for the institutions that have so far stayed away, that might be all the incentive they need.

For years, USDC had the trust advantage. It was transparent, regulated, audited. But its market cap stalled. Meanwhile, Tether thrived in the shadows — growing faster, expanding across geographies, and becoming essential in markets that US firms didn’t want to touch.

Support in the White House

With political support from Commerce Secretary Howard Lutnick (formerly of Cantor Fitzgerald, now Tether’s reserve manager), the company has cover in Washington.

Then, there’s the Bitcoin treasury firm connection. Lutnick’s son runs Cantor Equity Partners (CEP), the SPAC that merged with Twenty One Capital — a Bitcoin-native company backed by Tether, SoftBank, and Cantor. This deal further entwines Tether’s interests with US capital markets and policy circles.

Read: SPAC to the Future

With a law that gives Tether three years to transition, it has time. And with global volume on its side, it certainly has leverage.

The US play hinges on scale. If Tether can nail the cost-benefit equation, it may secure an unassailable lead, one that even Circle would struggle to match, let alone other trailing stablecoin issuers or new entrants.

But it’s a double-edged sword. The US has just handed stablecoins a playbook. If Tether plays it well, it gets to keep leading from the front. If it stumbles on compliance, disclosures and oversight, it may discover that legitimacy can be revoked just as quickly as it is granted.

For all of crypto’s history, Tether was the stablecoin a majority of the users used, even if they didn’t trust it.

Now, it’s asking to be the one they trust.

That’s it for this week’s deep dive. See you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.