Hello

Crypto’s user base looks massive on paper. Ownership has hit an all-time high, with over 700 million people globally now holding some form of digital asset. If it were a country, it would rank as the third-largest, next only to India and China.

The adoption has risen 7x in under five years. At first glance, the progress seems fast and big, and gives an impression of how much crypto adoption has scaled. Yet, a closer look at other numbers shows that the story here is much more nuanced.

In this week’s quantitative analysis, I bring more numbers and charts to add colour and help you better understand the difference between crypto ownership and usage.

It might be that crypto is not really waiting to onboard the next 100 million users, but rather for a couple of hundred million users, who are already here, to become more active.

Now, onto the story,

Prathik

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

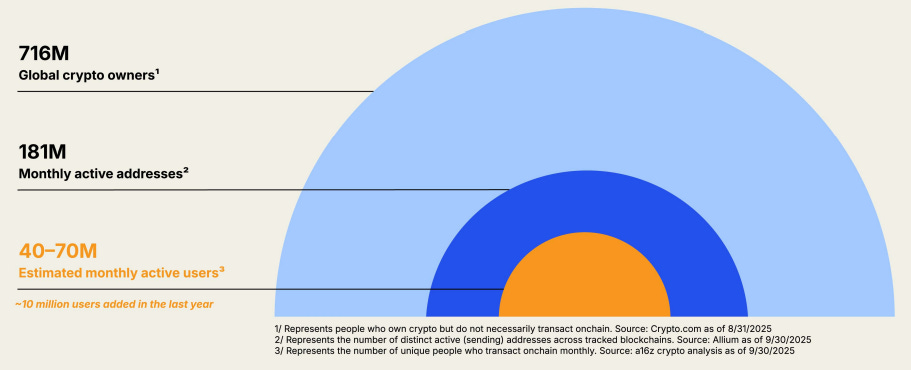

As of August 31, 2025, the number of crypto owners holding any digital asset stands at 716 million, according to a16zcrypto’s ‘State of Crypto 2025’ report. When you compare this number with those from other reports in the past, it has risen 7x from 100 million in 2021.

It makes for a great headline. But it also hides something that raises questions when you look at the portion of these owners who actively use or transact with their digital assets.

The chart shows that less than 10% of the 716 million crypto owners transact with crypto as monthly active users (MAUs). This number throws up multiple possibilities.

Some owners may have bought crypto for experimentation in the past16 years and might have forgotten about it. Some others could be using off-chain, centralised platforms to transact with their crypto. Others could have opted for traditional routes, such as exchange-traded funds or buying shares of Digital Asset Treasuries (DATs), to get crypto exposure.

All these and more scenarios can make interpreting these numbers challenging.

Despite this, an undeniable sign of adoption is that at least 10 million of the 40-70 million monthly active on-chain users were added in just the last year.

On-chain, you see clear signs of a high dormancy rate among those who own wallets.

Of the 350 million wallet addresses created on Ethereum since its genesis, less than 1% are currently active addresses.

While the 30-day simple moving average (SMA) of active addresses on ETH went up from 400,000 in April 2024 to 460,000 in August 2025, the SMA has since dropped below 420,000 active wallet addresses.

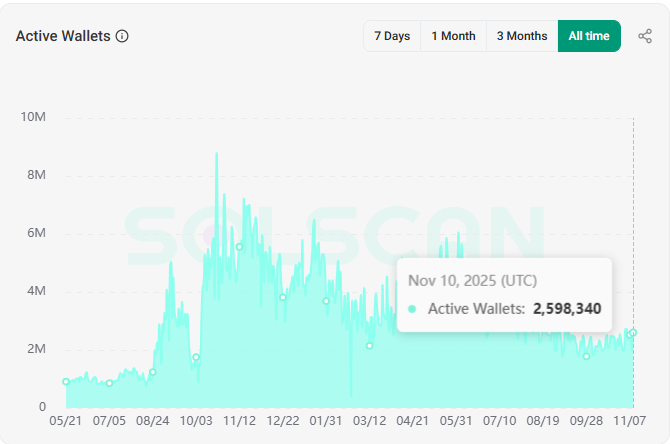

Solana’s story is worse.

The real-time active wallets on Solana, which are those with at least one signature in the last year, have come down to 2.6 million as of November 10, down from an average of over 5 million in October-December 2024.

This behavioural drop-off isn’t only visible on-chain. It plays out at the user level on the wallet layer, too, the apps that most users actually interface with.

MetaMask, the most popular self-custody wallet in crypto, has over 143 million installs. But only about 30 million people open the app monthly. That’s a 21% activation rate.

Trust Wallet is worse: with over 200 million installs, only 17 million are monthly active users. That’s 8.5%.

Only Solana-based Phantom enjoys a superior ratio. The relatively sticky wallet sees over 15 million MAUs on a base of ~24 million downloads.

Even after considering Phantom’s numbers, that’s 85% user inactivity across the three top wallets.

When you benchmark these numbers against mainstream fintech, you see how far most crypto apps and chains need to go. Venmo activates 35–40% of its user base every month. PayPal sees similar retention, even with 2024 demographics.

You can attribute the contrast with crypto to ‘early-stage behaviour’. But when the install base is in the hundreds of millions and your active user pool is in the tens, it could hint at a product problem rather than a growth problem.

So, what’s driving this gap between ownership and usage?

Crypto is filled with complexities, from bridging to seed phrases to paying gas fees. These complexities make crypto easy to buy, but hard to use, and even harder to come back to if the user snaps once due to friction.

That’s where the solution to fixing adoption could lie. Crypto doesn’t have to become Venmo overnight. But it can look ahead to the opportunity. The next 100 million users are already within the system, not outside. They just need a reason to restart their activity.

Crypto builders need to give them a reason to return.

The answer probably lies beyond dashboards or token trackers, in building products that can embed wallets as invisible primitives. There are case studies across crypto to learn from.

On Farcaster, users mint NFTs and vote in social feeds using Frames, without separate wallet pop-ups or decentralised applications (dApps). Many Telegram bots let people swap tokens, send tips, and earn yield directly in chat. On-chain Summer on Base brought gasless onboarding to millions through simple mint pages.

Another example is OpenAI’s ChatGPT. The AI product, which now has over 800 million weekly active users, is activating more users weekly than most crypto wallets or chains do monthly. It’s doing so with fewer steps, less friction and no speculation loop.

If crypto builders mimic this, especially when solving for mass adoption, the headline number of 716 million wallets might start translating into something more meaningful.

That’s it for this week’s quants story. I’ll see you next week.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.