Hello

It’s simple why crypto made everything public.

If everyone can see everything, no one can get away with lying. Public ledgers mean exchanges can’t fake reserves, Decentralised Autonomous Organisations (DAOs) can’t quietly pull money out the back, and whales can’t pretend they never sold.

These were the pain points in traditional markets that crypto set out to fix. And it did fix some of them. But like Blockworks’ Byron Gilliam quoted Kevin Kelly this week: “Most of the problems we have today are created by the solutions we had in the past.” Crypto’s solution was radical transparency, but in markets built on pseudonymous addresses, that can seldom be a clean fix.

It works when we are talking about institutions whose transactions are standardised and audited. It works less well when you realise the same design turns every retail user’s financial life into a permanent public feed.

Crypto collapsed all of our financial contexts, including receiving, trading, donations, and experiments, into one glass wallet.

The past few months has made that tension impossible to ignore, as courts and regulators continued their crackdown on privacy infrastructure. On Wednesday, November 19, a US district judge sentenced the co-founders of Samourai Wallet, a bitcoin wallet with built-in mixing tools, to 5 and 4 years in prison, respectively. They were found guilty of running an unlicensed money-transmitting business and handling more than $237 million in criminal proceeds.

In August, a US jury deadlocked on money-laundering and sanctions charges against Roman Storm, founder of Tornado Cash, another crypto mixer. But it convicted him of conspiring to operate an unlicensed money-transmitting business and imposed a maximum sentence of five years.

In Europe, the new Anti-Money Laundering Regulation will ban privacy coins like Monero and Zcash from EU-regulated platforms starting July 1, 2027. The message is that anonymous money is not welcome.

Yet inside the market, users are doing the opposite.

In today’s deep dive, I will explain why this is more than a “privacy coin pump” and a sign that crypto is trying to fix the bug in its transparency.

Onto the story now,

Prathik

AI Agents that Trade, Predict, and Evolve, On-chain

DeAgentAI has built the largest AI Agent infra across Sui, BSC & BTC, solving what every AI dev struggles with, Identity, Continuity, and Consensus, the holy trinity for making AI actually autonomous.

Their flagship products?

AlphaX → A crypto prediction engine that hits 9/10 signals.

CorrAI → A no-code quant playground for designing and deploying DeFi trading strategies.

Truesights (launching soon) → InfoFi network that rewards real alpha, not just noise.

Backed by top-tier VCs, and a team from Carnegie Mellon, UC Berkeley, and HKUST, they’re scaling what’s basically the “ByteDance of Web3.”

Except instead of serving you TikToks, their algorithms are training autonomous AI Agents.

Public blockchains were built on the assumption that if transparency helps catch fraud, more transparency must be better for everyone.

Under this design, each wallet address removes walls between your financial personalities. On blockchain, your remuneration, your ‘degen’ self betting on random memecoins, long-term investments and random experiments, all sit in one ledger and are visible to anyone who can link that address to your real-world identity.

Anthropology professor Michael Wesch calls this ‘context collapse’ when it happens on social media, where family, colleagues, strangers, close friends and acquaintances are all getting flattened into one single audience. We all have gone through that moment when a holiday selfie that was posted for a select dozen people to see ended up on your boss’ feed, haven’t we? Just that on blockchain, the consequences can be significant financial losses.

Once your address is doxxed, there are no separate rooms. Your entire crypto asset details, activity log and risk-taking could be permanently searchable on a block explorer.

Don’t bother wondering how one could get doxxed. You don’t have to be a genius to figure that out. Once a blockchain user interacts with a platform or dApp subject to KYC regulations, the user’s pseudonymity may be linked to the KYCed account. The breadcrumbs won’t be too difficult to track.

Recent legal developments have made users wary of eroding privacy, driving them to bet more on protocols that could address transparency issues in crypto’s code.

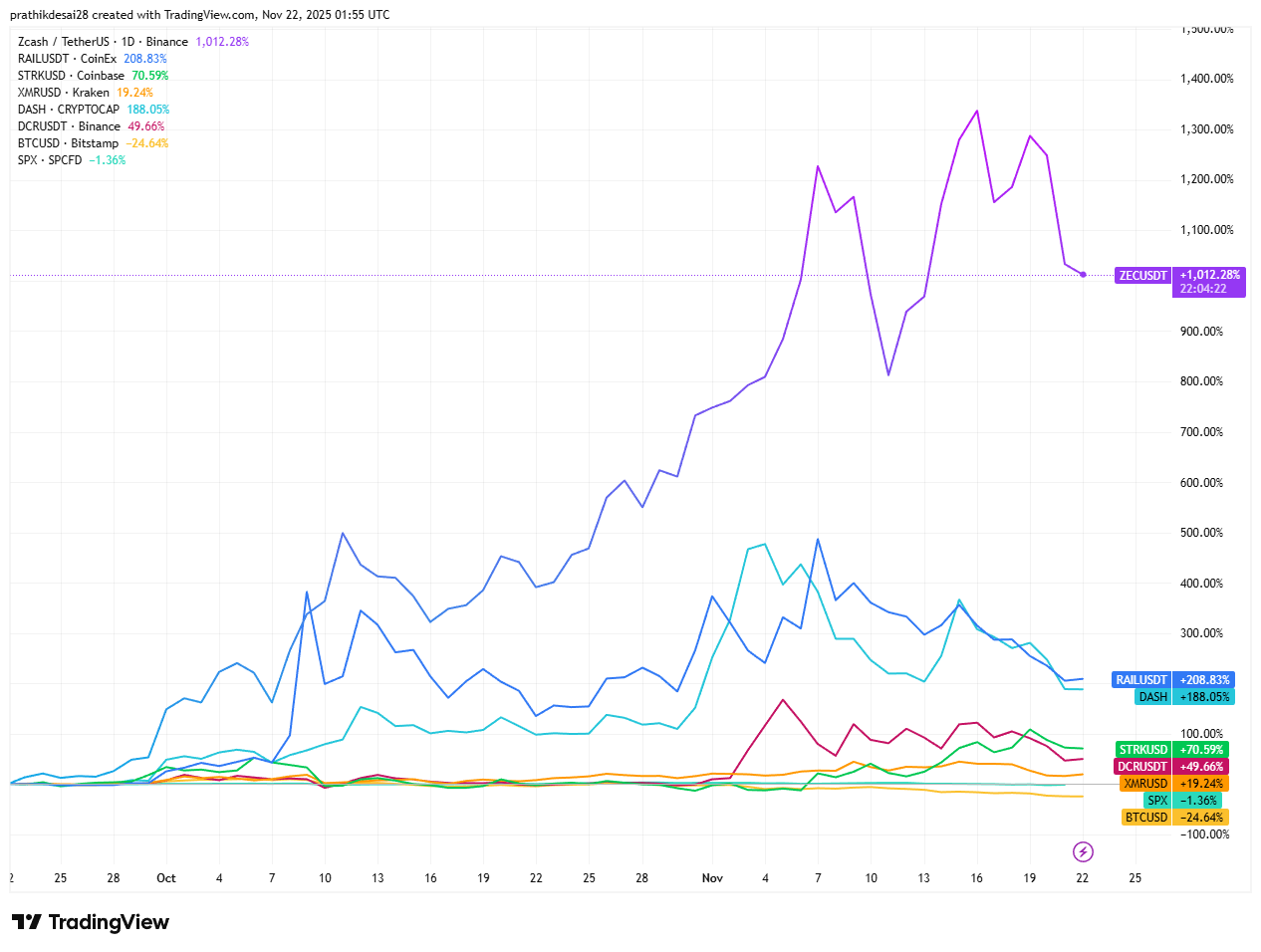

The recent performance of privacy protocols proves that users are putting money where their mouth is. While prices bleed across Wall Street and crypto markets, capital and usage are flowing into privacy rails, including Zcash’s growing shielded pool, private DeFi sets on Railgun, and Starknet’s Ztarknet experiment.

It is most evident in Zcash’s rebirth.

For over seven years, Zcash was commercially forgotten despite its academically rich whitepaper. Its approach was solid: to shield transactions by hiding the sender, receiver, and amount, while still allowing the network to verify that no coins are being created out of thin air.

It uses zero-knowledge (ZK) proofs, in which one party (the prover) can prove to another (the verifier) that a statement (in this case, a transaction) is valid without revealing any information beyond its validity.

Not many took it seriously then.

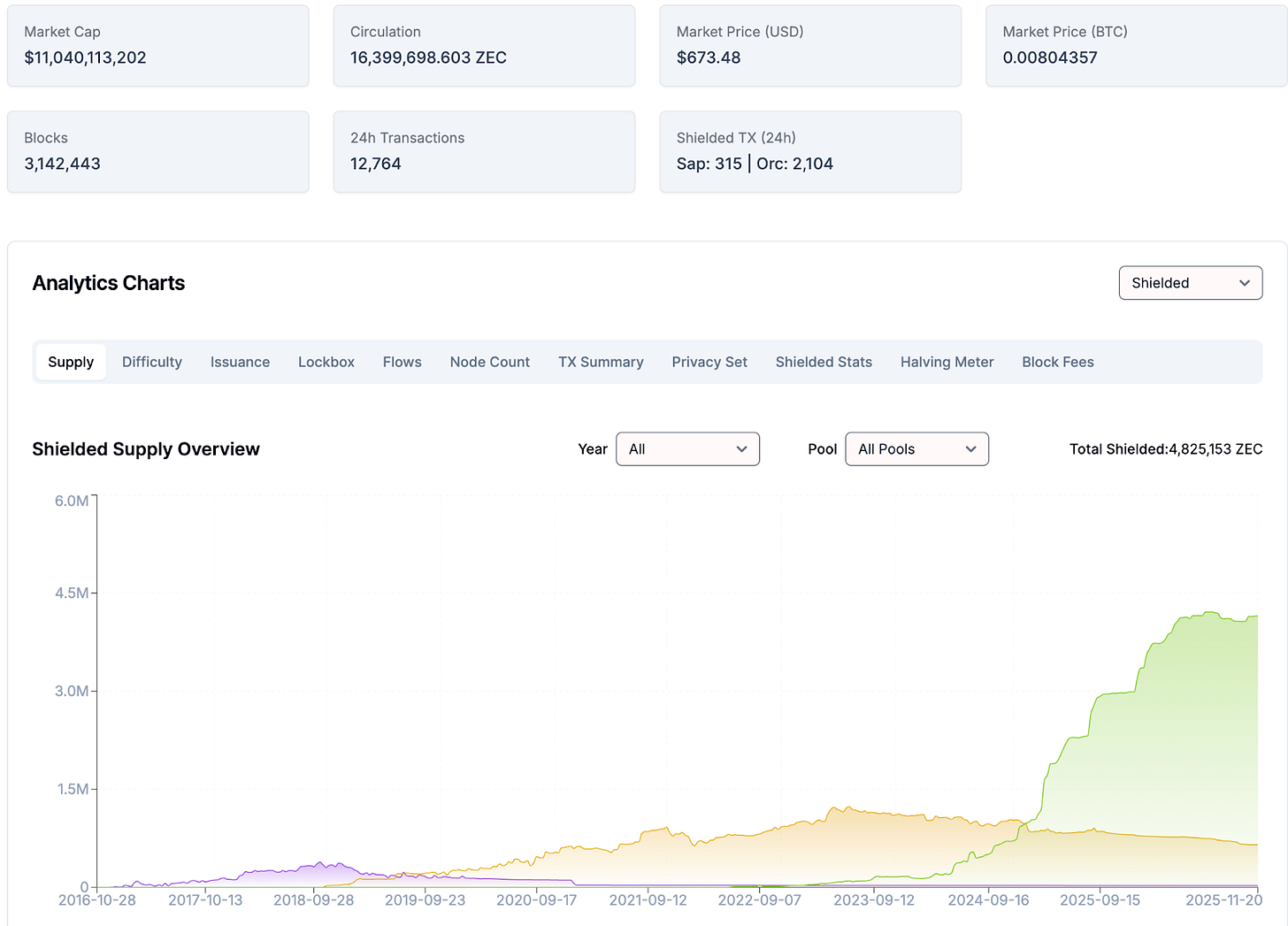

Today, the numbers have jumped. In just the last two months, the price of Zcash, ZEC’s native token, jumped 10x to trade at levels last seen over seven years ago. About 4.9 million ZEC, roughly 30% of the circulating supply, sat in encrypted pools, an all-time high and a sharp jump from earlier in the year.

What’s changed? Abstraction.

Back in early 2018, not many found the interface friendly. Now, the Zashi wallet has bridged that gap. Zashi wraps ZEC in a mobile app with unified addresses and offers one-tap shielding. It also ensures your ZEC isn’t locked up in one place. Through its integration with NEAR’s Intents system, Zashi lets you treat shielded ZEC as a kind of private savings account across multiple chains.

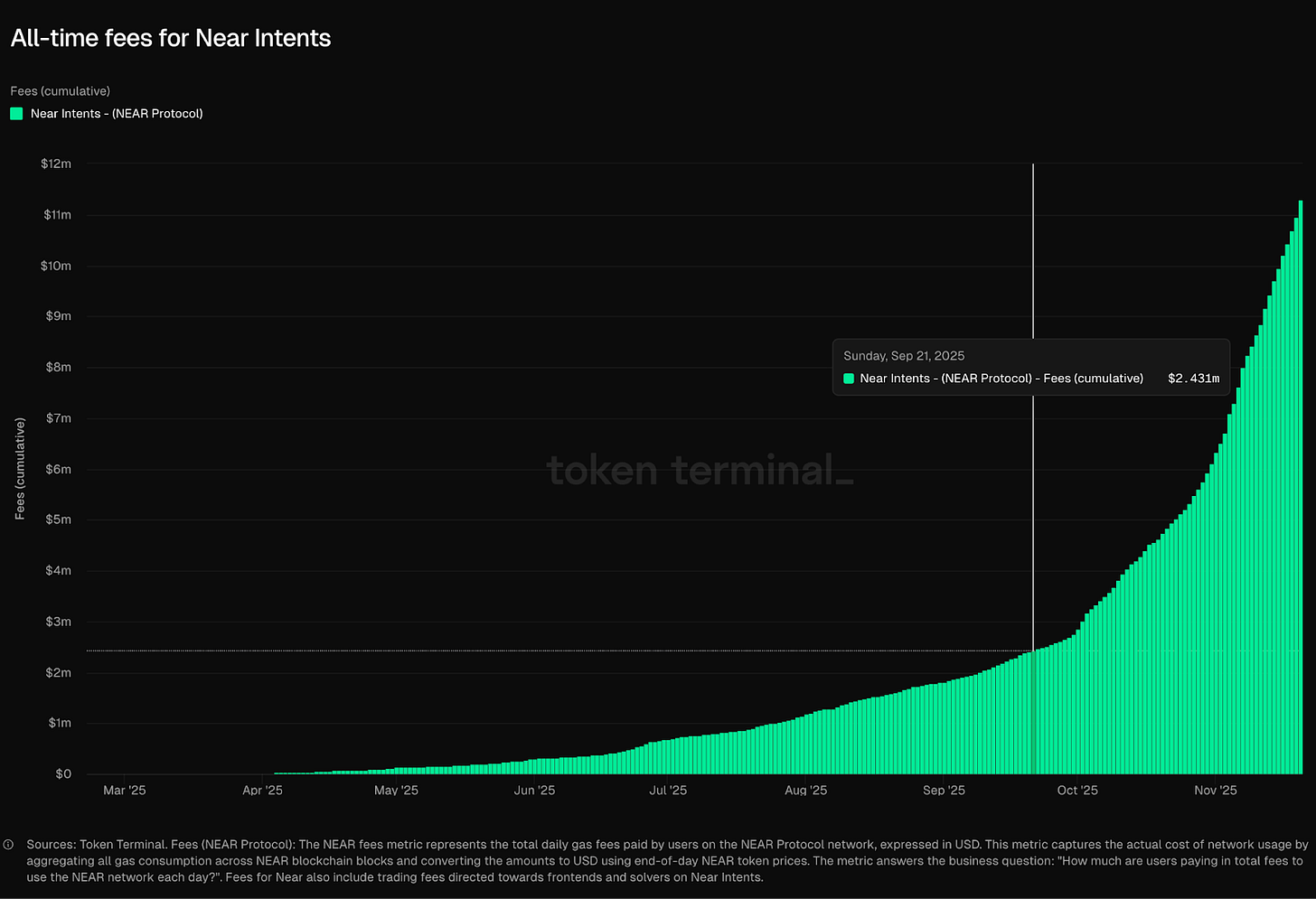

NEAR Intents, a cross-chain router, simplifies the movement of your token. It changes the user’s question from “how do I get from here to there?” to “this is what I want, you figure it out”. Rather than figuring out a route through bridges and DEXes, users can specify an outcome, and NEAR’s network of solvers will then search across liquidity venues and return the best path to execute the user’s request.

Since its launch in late 2024, NEAR Intents has handled around $6.2 billion in cumulative volume, with almost $9 million out of its cumulative $11 million in fees coming in just the last two months.

When Zashi sits on top of that, your principal balance can stay in Zcash’s shielded pool while NEAR Intents handles the messy multichain infrastructure. The only thing a destination chain sees is the final transfer. The rest of your context, including your historical transaction log, other holdings and activity, never leaves the private room.

While Zcash creates a private base layer, Railgun carves private sets into Ethereum itself.

Railgun’s smart-contract system uses a type of ZK proof to conceal balances and transaction routes while preserving composability. Users can deposit into Railgun’s shielded pool, interact privately with DeFi protocols within it by swapping, lending, or providing liquidity, and only reveal deposits and withdrawals.

By October, Railgun had processed about $4 billion in private transactions since its 2021 launch, with roughly $1.6 billion of that volume coming in 2025 alone.

Railgun pulls off for DAOs and desks what Zashi achieved for individuals. It found a way to take institutional DeFi strategy out of the public eye without leaving Ethereum.

Starknet pushes this pattern further up the stack.

It has experimented with Ztarknet, where Starknet’s ZK proofs meet Zcash’s vault.

Last month, a proposal on the Zcash community forum outlined a Starknet-style L2 that could execute programmes off-chain while providing on-chain proof.

Think of a scenario where all the complex activity occurs off-chain, Starknet generates a proof that everything was done correctly, and Zcash only verifies that proof and updates balances.

ZEC remains as the money, Zcash maintains its strong privacy, while Starknet adds speed and programmability on top.

All these projects — Zashi and NEAR Intents, Railgun, Starknet and Ztarknet — carry the same intent. Meeting the market’s demand for a world where activity and identity are separated, with no breadcrumbs left behind.

None of these if free from trade-offs.

There is a technical risk. Every extra layer of intents, rollups and shielded sets is more code that can fail. A bug in a router or a proving system could leak information you thought was hidden or trap assets in a circuit no one can safely unwind.

There is also a social and UX risk. Crypto has spent years gamifying on-chain activity to reward users through airdrops, points, loyalty schemes, and “prove you used X” campaigns. If more user activity moves into private rooms, the social engagement layer becomes incomplete.

What does a regular user do amid all these developments?

Start by asking where context collapse actually hurts, and then decide which contexts deserve walls. For some, that might be investments; for others, it could be the right to make bad trades without them becoming a permanent part of their online identity.

A Zcash wallet with view keys, an intent-based router, a private set on Ethereum, or a rollup that hides positions rather than markets — each of these fixes a different slice of the problem and comes with its own mix of risk.

Crypto fixed the issue of centralised information gatekeeping in traditional markets by making ledgers public. It made it harder to lie about reserves and easier to catch fraud. It also collapsed all financial contexts into one global, searchable feed. The rise of these protocols is an attempt to correct it.

If they keep gaining momentum, they’ll prove that privacy and accountability don’t have to be enemies, and you can add doors without demolishing the house.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.