The Problem BTC & ETH Haven’t Solved ⛓️

Can imperfect tools still provide some answers?

Hello

Every Saturday, I dive into a podcast from our partners at Decentralised.co and share what stayed with me.

This week I reflect on the conversation between Saurabh Deshapande and Kyle Samani, Managing Partner and co-founder, Multicoin Capital, hosted by Decentralised.co.

🎧 Give the full back-and-forth a listen — one where he even shares why his team stopped going all-in on Ethereum in a portion of the episode that I’m leaving out in today's reflection.

I’ve spent more hours than I can count explaining to family and friends why I don’t see Bitcoin as some magic-internet-money bubble waiting to burst. Ever since I dived into crypto, they think I have been up to something illicit. I tell them it’s permissionless — no bank or government can block you from using it. I point to its fixed supply — no one can quietly inflate it away. And I remind them it isn’t centralised in a way that allows a single authority to bend it to political needs, the way the government goes about printing dollar bills when their primary goal is staying in power.

That’s the frame I carry into most conversations about Bitcoin. And it came right up from the back of my mind when I heard Kyle Samani drop his closing remark: “Bitcoin and Ethereum don’t solve a problem.” Not “don’t solve my problem” or “don’t solve it well” — just flat-out, don’t solve one at all.

It’s the kind of statement that sticks because it doesn’t care to carry nuance. And yet, nuance is exactly where I think the truth lives.

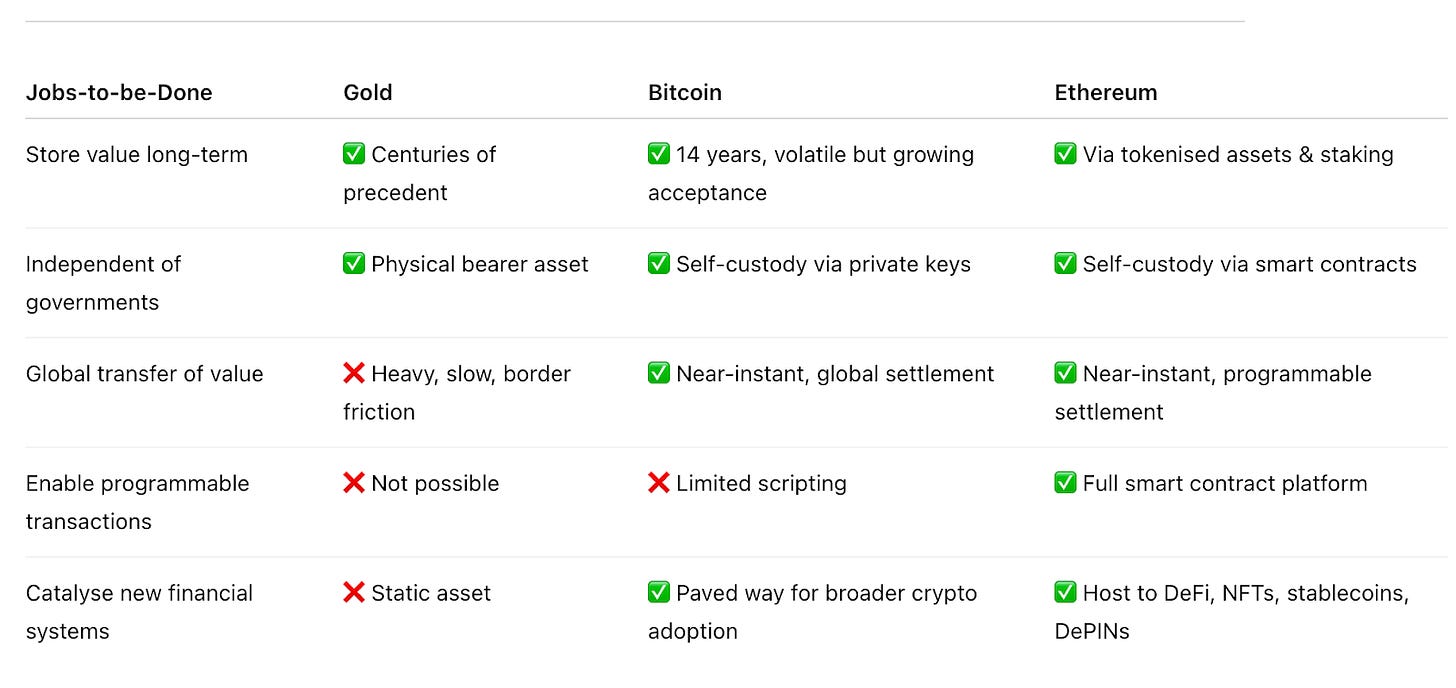

When I hear “solving a real problem,” I don’t think it means achieving some flawless end state. To me, it’s about making something possible that was previously impractical, or at least widening the set of options people have. By that measure, Bitcoin already shifts the ground. It gives you a way to store and move value that doesn’t require a bank account and is something no central authority can arbitrarily print more of to pay off its debts. Ethereum lets strangers transact and coordinate rules in code, without trusting one company to run the ledger.

I know the pushback: these are still clunky, expensive, and not yet the default for billions of people. But that doesn’t erase the fact that the possibility exists now, where it didn’t before.

The “Bitcoin as digital gold” line gets thrown around here. I’ve used it myself — scarcity, durability, freedom from government control. The analogy works up to a point, but gold’s monetary role wasn’t inevitable. It was shaped, like Kyle points out, by centuries of accidents and circumstances: wars, colonial trade patterns, central bank policy. That’s where I agree history matters.

“If you were to restart history in 2024, assuming we have the fiat money system as we have it now, gold would not be a thing. Gold is only a thing because of its historical relevance. And again, history is path dependent,” Kyle says. And this is exactly why Bitcoin has to stand on its own merits, not just borrow gold’s backstory.

Similar traits don’t guarantee similar outcomes. I see the logic in that, but I still don’t buy the “solves nothing” line. Strip away the marketing from Bitcoin and Ethereum, and they still do things many other assets can’t. Bitcoin has enabled tremendous wealth generation as an asset with $2.3 trillion in market capital. Ethereum is already powering exchanges, lending markets, games and more. It’s even the dominating rail enabling stablecoins and Decentralised Physical Infrastructure Networks (DePINs), both of which Kyle said he and his team at Multicoin Capital are most interested in.

Unlock Web3 Insights with Decentralised.co

Long-form stories trusted by the best in Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Good writing. In-depth conversations. Right in your inbox.

Subscribe to Decentralised.co

Yes, I do believe both BTC and ETH are flawed solutions. Bitcoin’s initially conceived role of payment is often eaten by faster, cheaper rails like stablecoins on Solana or Tron. Ethereum’s openness still feels like a maze for newcomers with fees spike, transactions stall, and an intimidating UX. But imperfect tools can still be useful and are exactly what drive the next wave of progress.

Ten years since its launch, Ethereum still tops every single continent as the most dominant chain in terms of developer activity.

This is what gets lost in binary verdicts. Even if neither asset fully “wins” its original job description, they’ve already widened the design space. Bitcoin’s custody headaches are precisely what’s pushing the world toward innovating simpler solutions. Ethereum’s scaling bottlenecks and governance debates have prompted developers toward building layer-twos, faster L1s, or entirely new architectures. And with that tightening competition, Ethereum has been forced to rethink and reimagine its forward trajectory, something Kyle pointed out was lacking all this while.

The internet started with screeching dial-up, static websites, and fragile email before it built Google Docs and Netflix. Those early tools didn’t perfectly solve problems either. But without them, the refinements we take for granted wouldn’t exist.

I see Bitcoin and Ethereum as similar test rigs. They’ve shown that certain jobs are worth doing, even if the execution is rough. In doing so, they’ve made it possible for someone else to do those jobs better. That “someone” might be Solana, as Kyle bets. It might be a network that hasn’t launched yet. Maybe all this will, after all, enable Ethereum and Bitcoin to bring out the best in them.

And if you want to hear how Kyle sees Solana fitting into that job, and why he’s happy to bet against the status quo, that’s in the episode. It’s worth a listen, if only to test your own mental model of what “problem solved” should look like in crypto.

That’s it for this week’s reflections.

I’ll see you next week.

Off to find a vending machine that sells crypto without crypto,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.