In 1979, Republic National Bank offered customers a choice. Deposit $1,475 for 3.5 years and walk away with a 17-inch colour television, or commit the same amount for 5.5 years and get the 25-inch model. Want an even better deal? Just $950 for 5.5 years earned you a stereo system complete with built-in disco lights.

This was how banks competed for deposits when Depression-era banking regulations banned them from paying competitive interest rates. Regulation Q, enacted in 1933 as part of the Banking Act, prohibited banks from paying interest on demand deposits and capped rates on savings accounts. While money market funds offered higher yields, banks were stuck giving away toasters and televisions instead of actual returns.

The banking industry called money market fund investors "smart money" and their own depositors "dumb money" who didn't understand they could get better yields elsewhere.

Wall Street adopted this language enthusiastically, using it to describe any investor who seemed to buy high and sell low, chase trends, and make emotional decisions.

Fifty years later, that "dumb money" is having the last laugh.

TOKEN2049 Happy Bird Ends Next Week

This October, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore. You can still save US$400 off your tickets.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Don’t miss your chance to be part of the defining crypto event of the year.

Use code TOKENDISPATCH15 for an exclusive discount.

The concept of "dumb money" has deep roots in Wall Street psychology. Professional investors, hedge fund managers, and institutional traders built their entire identity around being the "smart money" - the sophisticated players who could see through market noise and make rational decisions while retail investors panicked.

This narrative worked well when retail investors actually behaved that way. During the dot-com bubble, day traders mortgaged their houses to buy tech stocks at their peaks. During the 2008 financial crisis, individual investors fled the market just as it bottomed out, missing the entire recovery.

The pattern was: professionals bought low and sold high, while retail investors did the opposite. Academic studies confirmed this bias. Professional fund managers pointed to these patterns as evidence of their superior skill and justification for their fees.

What changed? Access, education, and tools.

The New Retail Reality

The data tells a dramatically different story today. When US President Trump announced tariffs in April 2025, triggering a $6 trillion market selloff over two trading days, professional investors dumped equities while retail traders saw a sale.

Individual investors snapped up stocks at record pace throughout the market turmoil, earning roughly 15% returns since April 8 as they poured a net $50 billion into US stocks. Bank of America's retail clients were buyers for 22 consecutive weeks through that period - the longest streak in the firm's history going back to 2008.

Meanwhile, hedge funds and systematic trading strategies positioned themselves in the bottom 12th percentile of equity exposure, missing the entire rebound.

The same pattern played out during 2024's market volatility. JPMorgan data shows retail investors drove the primary gains during late April, with individual investors controlling 36% of market share on April 28-29 - the highest level ever recorded.

Steve Quirk from Robinhood captures the shift: "We are oversubscribed in every single IPO that comes to market. The demand is always stronger than the supply. Issuers love that and want people who are fans of their companies to be recipients of an allocation."

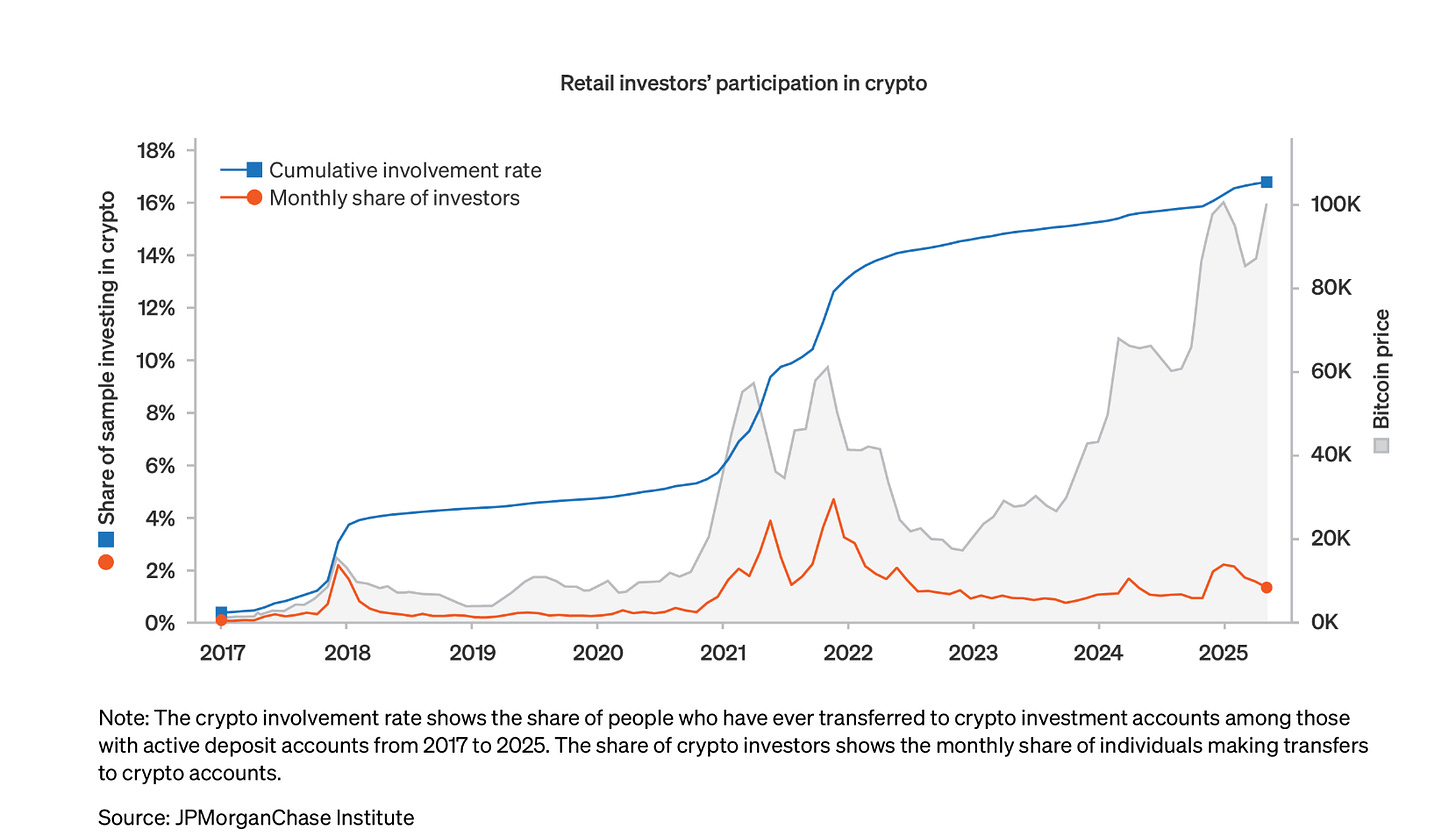

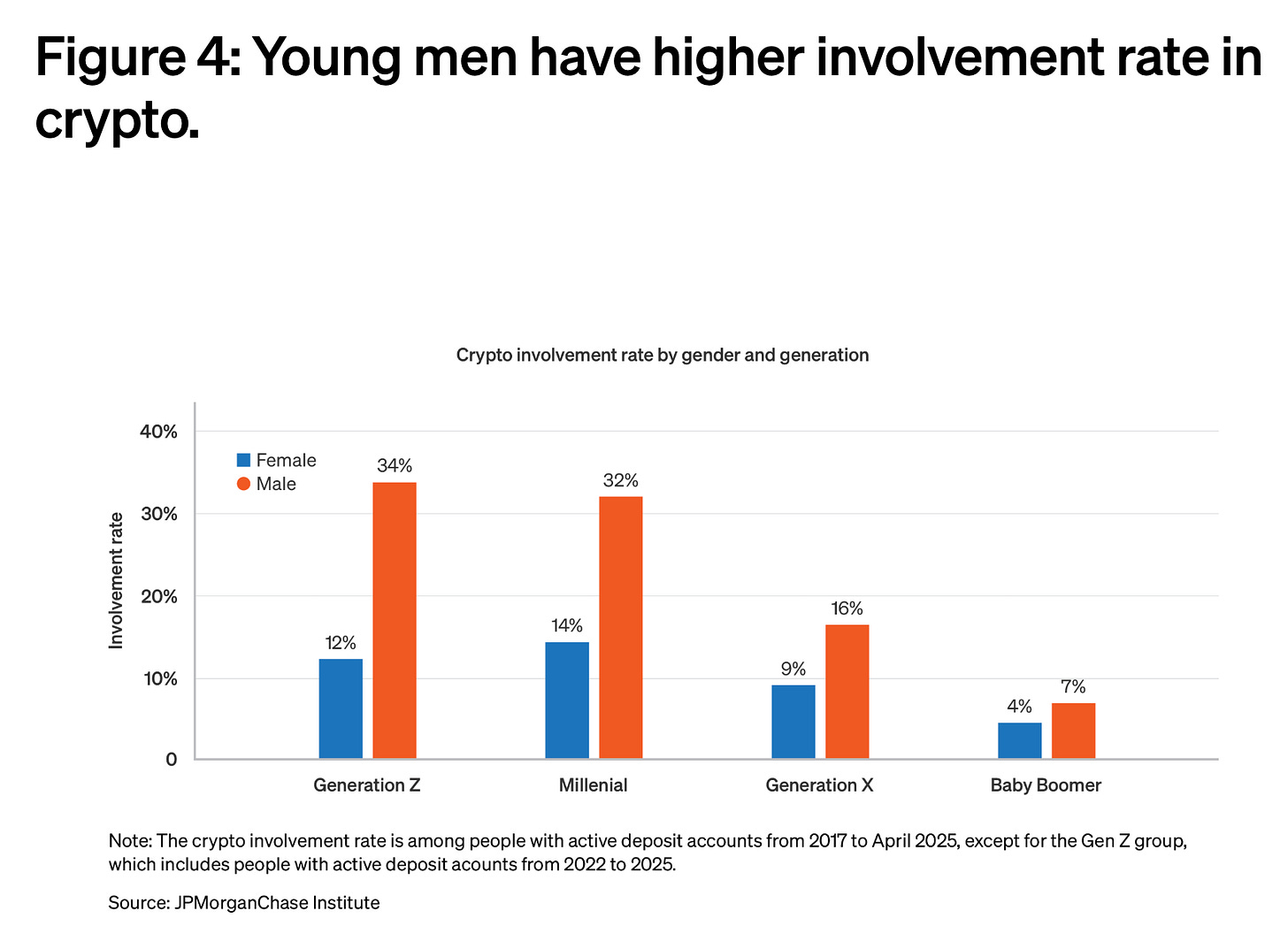

In crypto, retail behaviour has evolved from the stereotypical "buy high, sell low" pattern to sophisticated market timing. According to JPMorgan data, 17% of active checking account holders transferred funds into cryptocurrency accounts between 2017 and May 2025, with participation spiking during strategic moments rather than emotional peaks. The data reveals retail investors increasingly exhibit "dip-buying" behaviour, with significant upticks in March and November 2024 coinciding with new Bitcoin all-time highs - but notably, when Bitcoin reached even higher peaks in May 2025, retail participation remained measured rather than frenzied. This suggests learning and restraint rather than the FOMO-driven behavior traditionally associated with retail crypto investors. Median crypto investments remain modest at less than one week's worth of income, indicating prudent risk management rather than speculative excess.

Sectors like gambling, sports betting, and memecoins prove there's still a "steady supply of dumb money." The numbers suggest otherwise.

Casinos and sports betting platforms do generate billions in volume, with the online Gambling Market valued at USD 78.66 Billion in 2024, and projected to reach USD 153.57 Billion by 2030.

In crypto memecoins regularly create speculative frenzies that leave late entrants holding worthless tokens.

Yet even in these supposedly "dumb money" sectors, behaviour is becoming more sophisticated. Pump.fun, despite generating $750 million in revenue from memecoin creation, saw its market share collapse from 88% to 12% when competitors offered better communication and transparency. Retail users didn't blindly stick with the incumbent - they migrated to platforms offering better value propositions.

The memecoin phenomenon, rather than proving retail stupidity, demonstrates retail investors' rejection of VC-backed token launches that deny fair access. As one crypto analyst noted, "Memecoins give tokenholders a sense of belonging and facilitate bonding over shared values and culture" - they're social and financial statements, not just speculation.

The IPO Revolution

Nowhere is retail's growing influence more visible than in the IPO market. Companies are abandoning the traditional model of exclusively serving institutional investors and high-net-worth individuals.

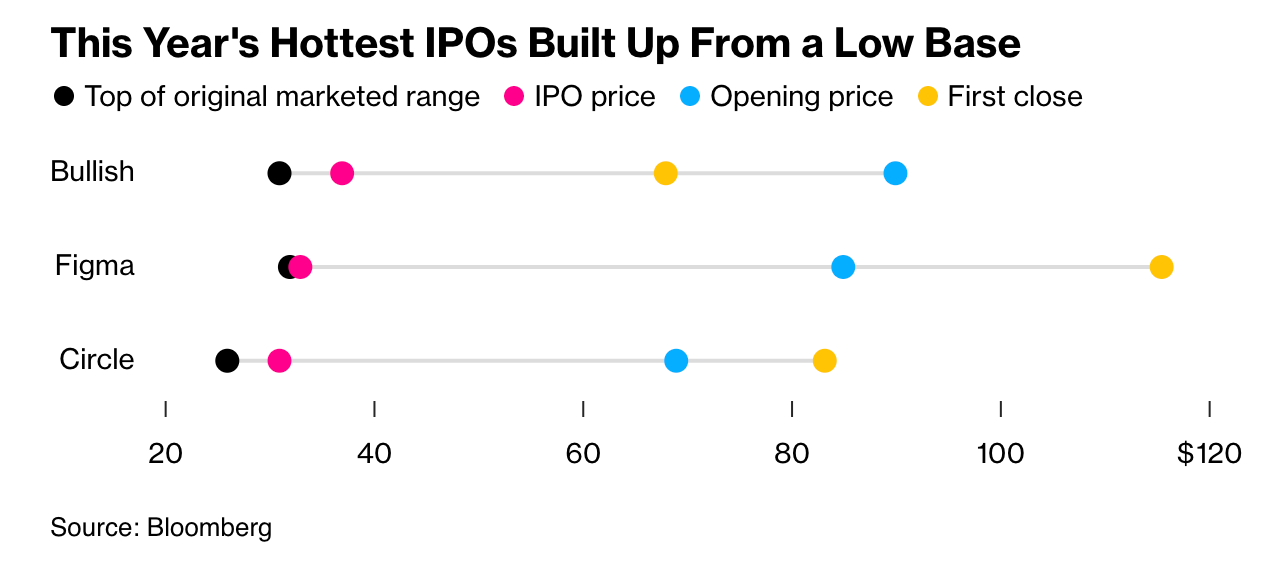

Bullish represents a watershed moment in how companies approach IPO distribution. Founded by Block.one and backed by major investors including Peter Thiel's Founders Fund, Bullish operates as both a cryptocurrency exchange and institutional trading platform. The crypto firm that went public in a $1.1 billion debut, gave retail investors direct access to the offering via platforms like Robinhood and SoFi. Retail demand was so strong that Bullish priced at $37 per share, nearly 20% above the top of their initial range. The stock then popped 143% on its first day.

Bullish sold one-fifth of its shares to individual investors - roughly $220 million worth, about four times what industry veterans consider typical. Moomoo clients alone placed orders for more than $225 million.

This wasn't an isolated event. The Winklevoss Twins' Gemini Space Station includes an explicit 10% allocation to retail investors. Figure Technology Solutions and Via Transportation have both tapped retail platforms for their IPOs.

The shift reflects a fundamental change in how companies view retail investors. As Becky Steinthal from Jefferies explains:

"Issuers have the option of retail being a bigger piece of the IPO process than they've been historically. This is all driven by technology."

Robinhood data shows IPO demand on their platform was five times higher in 2024 than 2023. The platform now has policies against flipping shares within 30 days of IPOs, creating more stable, buy-and-hold behaviour that benefits both companies and long-term shareholders.

The transformation extends beyond individual investment decisions to structural market changes. Retail investors now account for roughly 19.5% of US equity trading volume, up from 17% a year ago and well above pre-pandemic levels of around 10%.

More importantly, retail behaviour has fundamentally shifted. In 2024, just 5% of investors in Vanguard 401k plans made changes to their portfolios. There's now more than $4 trillion in target-date funds.

This means investors are trusting systematic, professionally managed investment solutions instead of frequently buying and selling. This shift supports better retirement outcomes by avoiding costly, emotion-driven trading mistakes.

eToro data shows 74% of its users were profitable in 2024, rising to 80% for premium tier members. This performance contradicts the fundamental assumption that retail investors consistently lose money to professional managers.

The demographic data supports this transformation. Younger investors are entering the market earlier - Gen Z starts investing at age 19 on average, compared to 32 for Gen X and 35 for Baby Boomers. They're armed with educational resources that didn't exist for previous generations: podcasts, newsletters, social media personalities, and zero-commission trading platforms.

Crypto adoption provides the clearest example of retail's growing sophistication. Despite institutional headlines about Bitcoin ETFs and corporate treasuries, retail investors drive the majority of actual crypto usage.

India leads global crypto adoption according to Chainalysis, followed by the United States and Pakistan. These rankings reflect grassroots usage across both centralised and decentralised services, not institutional accumulation.

The stablecoin market, dominated by retail payments and remittances, processed over $1 trillion monthly in USDT alone during 2024. USDC volumes ranged from $1.24 trillion to $3.29 trillion monthly. These aren't institutional treasury management flows - they represent millions of individual transactions for payments, savings, and cross-border transfers.

When we break crypto adoption by World Bank income brackets, high-, upper-middle-, and lower-middle-income cohorts all peak together. This suggests the current wave is broad-based rather than concentrated among wealthy early adopters.

Bitcoin remains the primary fiat on-ramp, accounting for over $4.6 trillion in exchange purchases between July 2024 and June 2025. Yet retail investors are increasingly sophisticated in their diversification, with Layer 1 tokens, stablecoins, and altcoins all seeing substantial inflows.

The irony of the "smart money" versus "dumb money" narrative becomes clearest when examining recent institutional behaviour. Professional investors consistently mistimed major market moves while retail investors demonstrated discipline and patience.

During crypto's institutional adoption phase, hedge funds and family offices made headlines for adding Bitcoin to portfolios near cycle peaks. Retail investors, meanwhile, accumulated during bear markets and held through volatility.

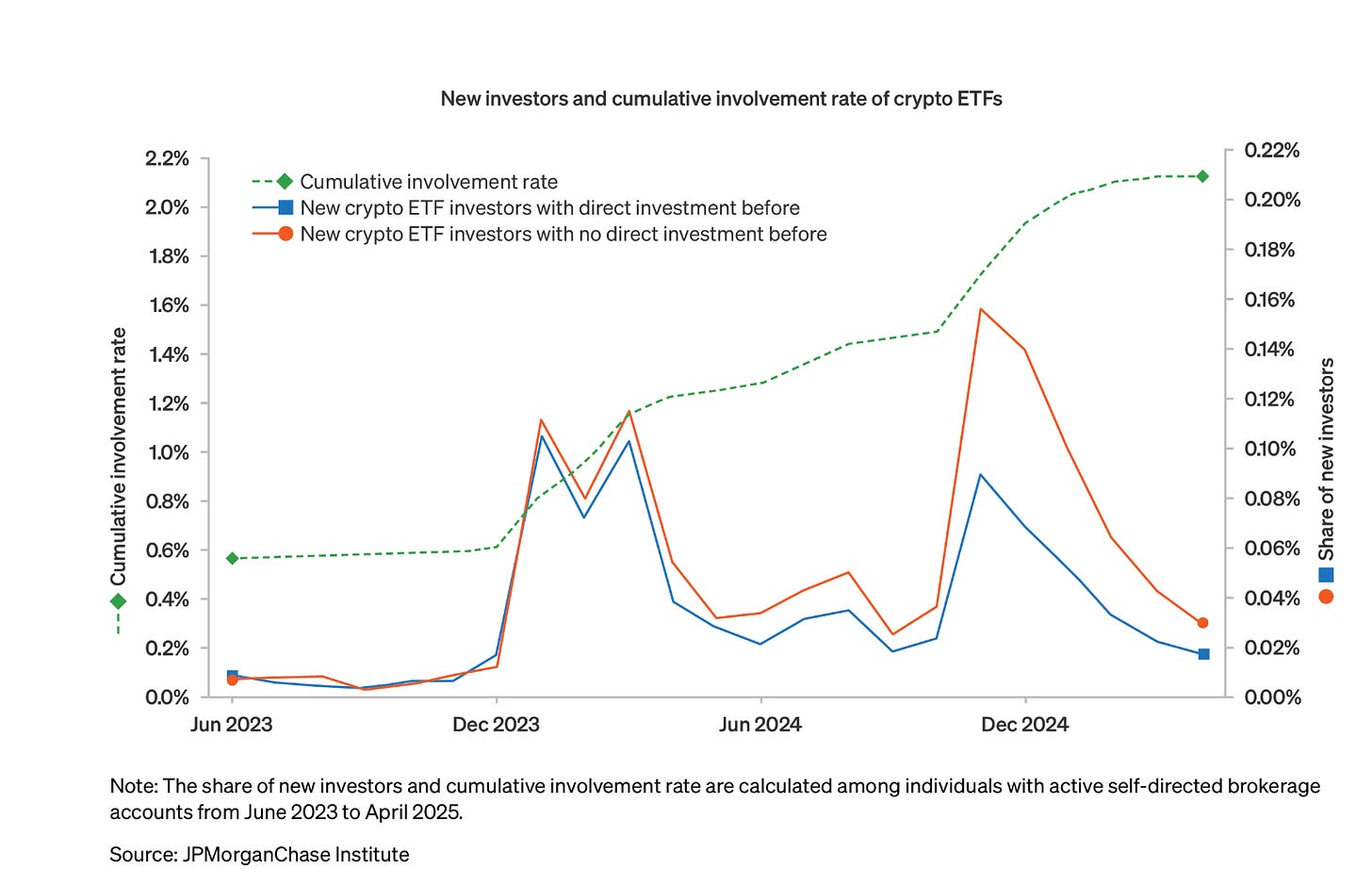

The rise of crypto ETFs illustrates this perfectly. More than half of crypto ETF investors had no prior direct crypto holdings, suggesting traditional channels are expanding rather than cannibalising the investor base. Among ETF holders, median allocations remain around 3-5% of portfolios - suggesting prudent risk management rather than speculative excess.

Professional investors' recent behaviour mirrors the classic retail mistakes they've long criticised. When markets become volatile, institutions often flee to preserve quarterly performance metrics while retail investors buy dips for long-term accounts.

Technology as the Great Equaliser

The transformation of retail investor behaviour isn't accidental. Technology has democratised access to information, tools, and markets that were previously exclusive to professionals.

Robinhood's innovations extend beyond zero-commission trading. They've launched tokenised US stocks and ETFs for European users, enabled staking for Ethereum and Solana in the US, and are building copy trading platforms where retail users can follow verified top traders.

Coinbase has expanded consumer crypto products with improved mobile wallets, prediction markets, and simplified staking. Stripe, Mastercard, and Visa have all launched stablecoin payment features, enabling crypto spending at thousands of retailers.

Wall Street's recognition of retail's influence has created a feedback loop that further empowers individual investors. When companies like Bullish succeed with retail-focused IPO strategies, others follow.

Jefferies research identifies stocks with high retail trading turnover and low institutional interest as potential opportunities, including Reddit, SoFi Technologies, Tesla, Palantir, and others. The research suggests "when retail is a bigger portion of trading, quality fails to matter" in traditional metrics - but this might reflect retail's different evaluation criteria rather than inferior decision-making.

The crypto industry's evolution toward retail accessibility demonstrates this dynamic. Major platforms now compete on user experience rather than just institutional relationships. Features like easy perpetual trading, tokenised stocks, and integrated payments all target mass retail participation.

The "dumb money" narrative persists partly because it serves professional investors' economic interests. Fund managers justify fees by claiming superior skill. Investment banks maintain pricing power by restricting access to lucrative deals.

The data suggests these advantages are eroding. Retail investors increasingly demonstrate the discipline, patience, and market timing that professionals claim as their exclusive domain. Meanwhile, institutions often exhibit the emotional, trend-following behaviour they've long attributed to retail.

This doesn't mean every retail investor makes optimal decisions. Speculation, leverage abuse, and trend-chasing remain common. The difference is that these behaviours are no longer uniquely "retail" problems - they exist across all investor types.

The transformation has structural implications. As retail investors gain influence in IPOs, they're likely to demand better terms, more transparency, and fairer access. Companies that embrace this shift will benefit from lower customer acquisition costs and more loyal shareholder bases.

In crypto, retail dominance means products and protocols must prioritise usability over institutional features. The platforms that succeed will be those that make complex financial services accessible to everyday users.

There's an uncomfortable truth underlying retail investors' recent success that deserves acknowledgment: for the past five years, almost everything has gone up. The S&P 500 delivered +18.40% in 2020, +28.71% in 2021, +26.29% in 2023, and +25.02% in 2024, with only 2022 showing a meaningful decline at -18.11%. Even 2025 has delivered +11.74% year-to-date.

Bitcoin went from around $5,000 in early 2020 to peaks near $70,000 in 2021, with continued volatility but overall upward trajectory. Even traditionally assets like Treasury bonds and real estate saw substantial gains during parts of this period. In an environment where "buy the dip" consistently works and holding almost any asset for more than a year generates positive returns, it becomes difficult to separate skill from luck.

This raises important questions about whether retail investors' apparent sophistication will survive a genuine bear market. The longest meaningful drawdown most Gen Z and millennial investors have experienced was the brief COVID crash that lasted just 33 days. The 2022 inflation scare, while painful, was followed by immediate recovery. Warren Buffett's famous observation that "you only find out who is swimming naked when the tide goes out" applies here. Retail investors may indeed be smarter, more disciplined, and better informed than previous generations. Or they may simply be beneficiaries of an unprecedented bull market across nearly all asset classes. The real test will come when easy money conditions end and investors face sustained losses across portfolios. Only then will we know whether the "dumb money" transformation is permanent or merely a product of favourable market conditions.

That’s it for today’s deep dive. See you next week with another one.

Until then.. stay awesome.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.