Hello

A year ago, prediction markets were riding a wave of euphoria that seemed endless. The US 2024 Presidential election frenzy drew in both casual punters and serious quants, sending bets soaring and turning Crypto Twitter timelines into price feeds. Every headline had its own market.

Then came January 2025, and with it the hangover. As Donald Trump re-entered the White House, the “big politics” activity lost its momentum, leaving bettors wondering if the prediction space had already peaked.

Monthly volumes dropped, active users cooled down, and the world began to view prediction markets as just another seasonal fad.

But, quietly, things began to turn around. Both category leaders - Polymarket and Kalshi - raised fresh capital and have now transformed into durable multi-billion dollar businesses, a far cry from what many initially thought would be one-cycle phenomena.

In this week’s quant piece, I explore how the prediction market giants have evolved into something entirely different from where they were just a year ago.

On to the story now,

Prathik

Polymarket: Where Your Predictions Carry Weight.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

👉 Explore Polymarket

Over the past week, both platforms secured new funding: Kalshi, the US-regulated prediction market, announced over $300 million in new funding at a $5 billion valuation, led by Sequoia with a16z joining in. That’s roughly 2.5x its evaluation from three months ago.

The influx of capital coincides with a broader expansion: Kalshi now allows customers in 140 countries to place trades. Internal figures show their annualised volume is marching toward tens of billions, a significant leap from last year’s early days.

Meanwhile, crypto-native Polymarket disclosed a strategic funding round of up to $2 billion from Intercontinental Exchange (ICE), the parent company of the NYSE, at a $9 billion post-investment valuation.

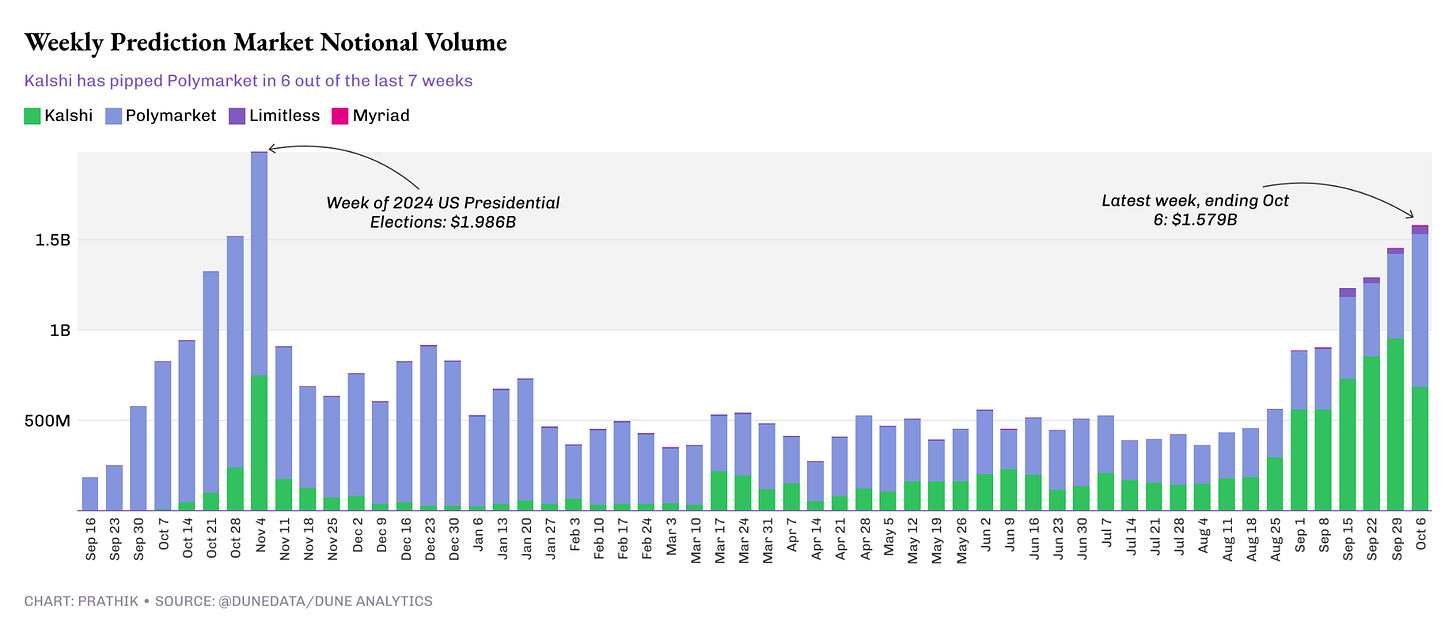

In recent months, Kalshi has overtaken Polymarket in trading volume.. Over six of the past seven weeks, Kalshi outpaced Polymarket in notional volume, reflecting the total value of all contracts on the prediction markets.

The weekly notional volume has steadily risen since September, with over $1.2 billion recorded in each of the last four weeks. Although volumes haven’t yet reached the highs we witnessed during last year’s elections, the trend is steadily climbing toward the $2 billion mark.

While Kalshi and Polymarket dominate, accounting for 96% of the total notional volume, smaller platforms like Limitless and Myriad Markets are also making strides.

In the week ending October 6, Limitless saw trades worth over $44 million, and Myriad Markets recorded $6 million - more than six times their notional volume from a month ago.

Where is the interest coming from?

After the election hangover, traders on prediction markets shifted their focus to other everyday events that people follow regularly.

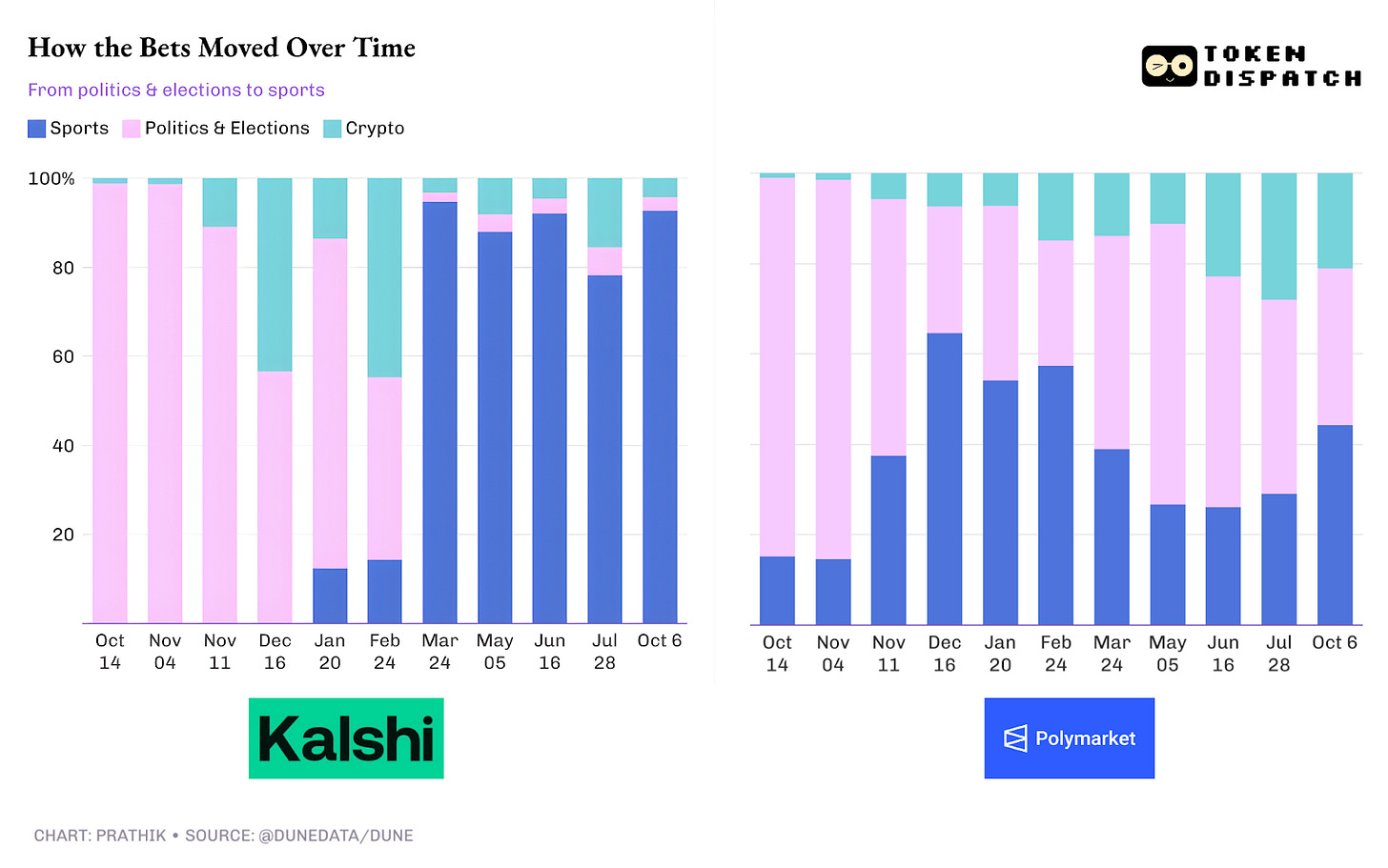

While politics and election-related markets accounted for over 95% of Kalshi’s and 83% of Polymarket’s volume in October 2024, the mix has gradually moved in favour of Sports.

Both platforms have seen sports take the lead in betting activity. This shift can be attributed to human behaviour, which tends to gravitate towards events with high frequency and short response times.

Sport presents multiple short-duration events, including win/loss outcomes, player line-ups, injuries, and individual performances - which create numerous micro-narratives.

Nowhere is this shift more pronounced than with Kalshi. The share of Sports in Kalshi’s weekly notional volume increased from less than 5% in December 2024 to 15% in February and over 90% in March. Since then, it has remained above 80% in most weeks.

On the other hand, Polymarket’s Sports category has more than doubled, increasing from around 15% to 40% in the past year.

Crypto has kept its seat at the table. Although it hasn’t commanded a significant share of prediction market volume, crypto price and ETF-timing events have provided enough opportunities for speculation, particularly on Polymarket. On Kalshi, however, the category has struggled to maintain a 15% share in most months.

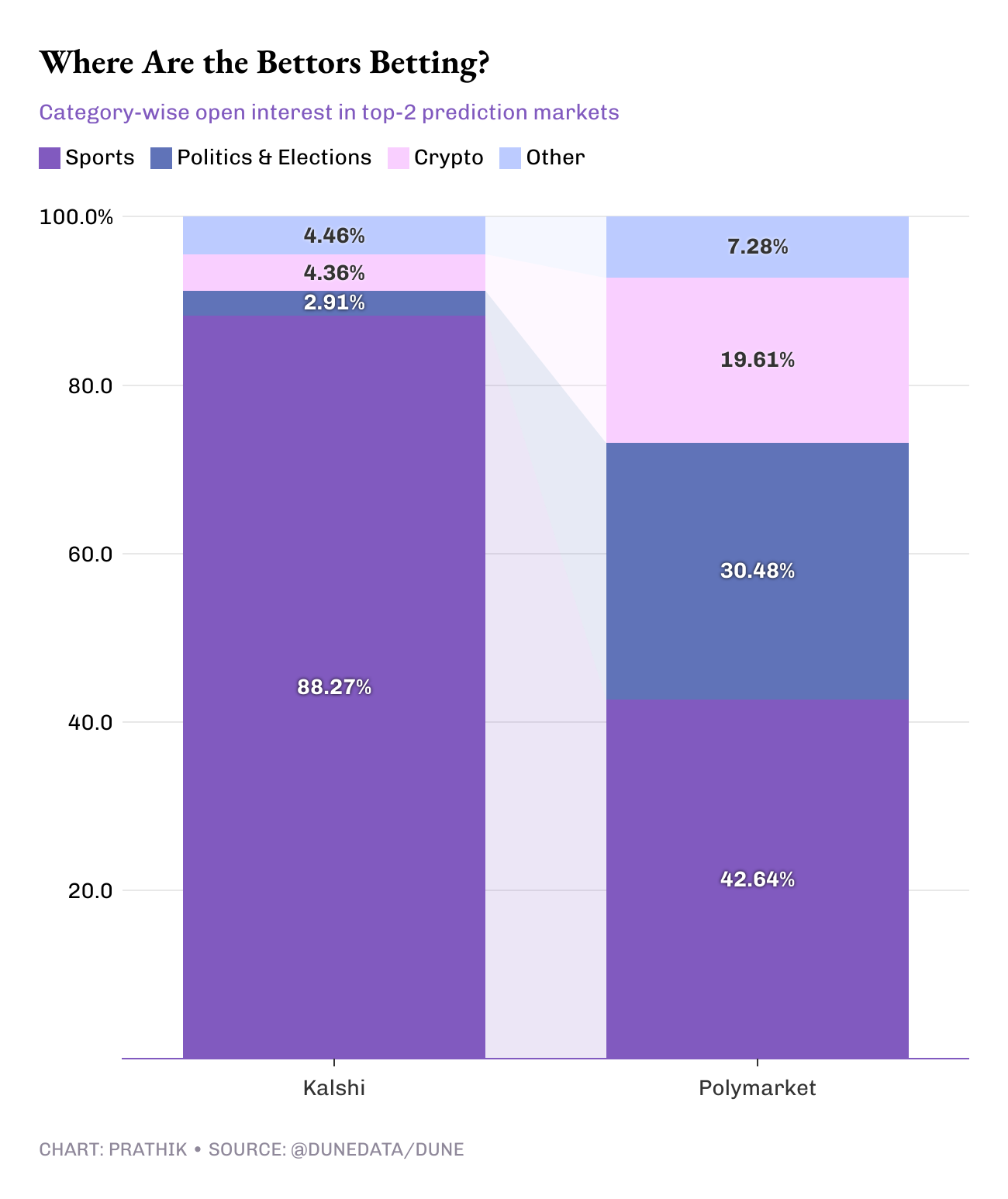

The most recent category mix between the two leading platforms — Kalshi and Polymarket — shows they are following distinct strategies.

Kalshi’s book is heavily anchored in sports, followed by politics and crypto. This reflects the intentions of a platform that seeks to bet on retail speculation habits, which require standardised, rules-driven markets. Think of weather, energy, and rate-cut events layered on top of sports, creating a consistent flow of betting opportunities week after week.

In contrast, Polymarket’s book is built around three solid pillars: sports, politics, and crypto. The mix rotates in response to current news events and developments, adapting to the prevailing narratives.

Looking at these three charts, it’s clear that liquidity didn’t disappear after the election euphoria of last year. Instead, it was redistributed across categories where traders saw value.

These categories help establish a sustainable business, maintaining activity even in the quieter weeks. However, politics is likely to remain a key category, with elections, debates, and government policies generating sudden spikes in market volume, even if they are seasonal.

Crypto, economic, and finance-related markets provide valuable fillers, with activity around price events, ETF announcements, Fed meetings, and policymaking. These events are particularly appealing to degen traders who thrive on fast moving markets, as well as macro-curious users eager to price economic narratives.

When different segments of traders coexist on speculation markets, the betting book becomes deeper and more diverse. Imagine Sunday NFL betting slates alongside weather forecasts and gas-price strips, or NBA injury odds paired with CPI ranges and campaign fundraising.

If the market can make “checking prices” as habitual as checking sports scores, it will enhance platform retention. And retention, whether in crypto or traditional markets, is key to breaking free from seasonal cycles.

If successful, this approach will shift public perception, moving prediction markets away from being seen as platforms focused solely on special events, and towards being viewed as a barometer for everyday occurrences.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.