The Token Apocalypse: 1.8 Mn Gone

As new tokens flood the market, many failed projects vanished without a trace, causing financial chaos.

The cryptocurrency world is experiencing "Great Token Extinction", a brutal market correction that has seen a mind-boggling 1.8 million digital tokens collapse in just the first quarter of 2025.

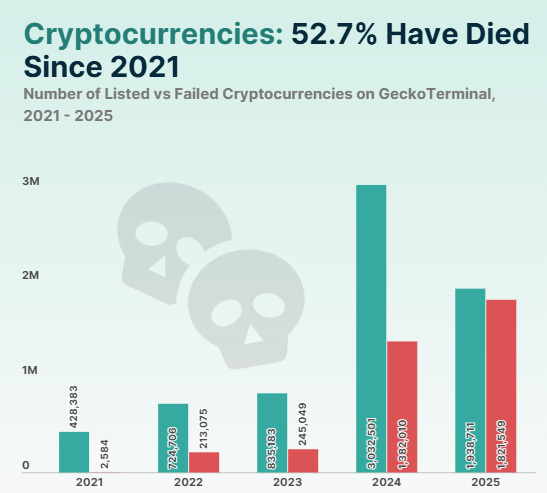

CoinGecko's latest research reveals that Q1 2025 accounted for nearly half (49.7%) of all crypto failures since 2021. Of the 7 million tokens tracked since 2021, 52.7% have now ceased trading entirely.

What changed? Accessibility.

When Solana-based platform Pump.fun launched in January 2024, it democratised token creation to an unprecedented degree. Anyone with a few SOL and a clever meme could launch their digital asset in minutes. No coding required.

The result was predictable: an explosion of low-effort tokens with zero utility beyond speculation. Over 3 million new tokens flooded the market in 2024 alone, most named after celebrities, memes, or random objects.

The survival rate? Abysmal.

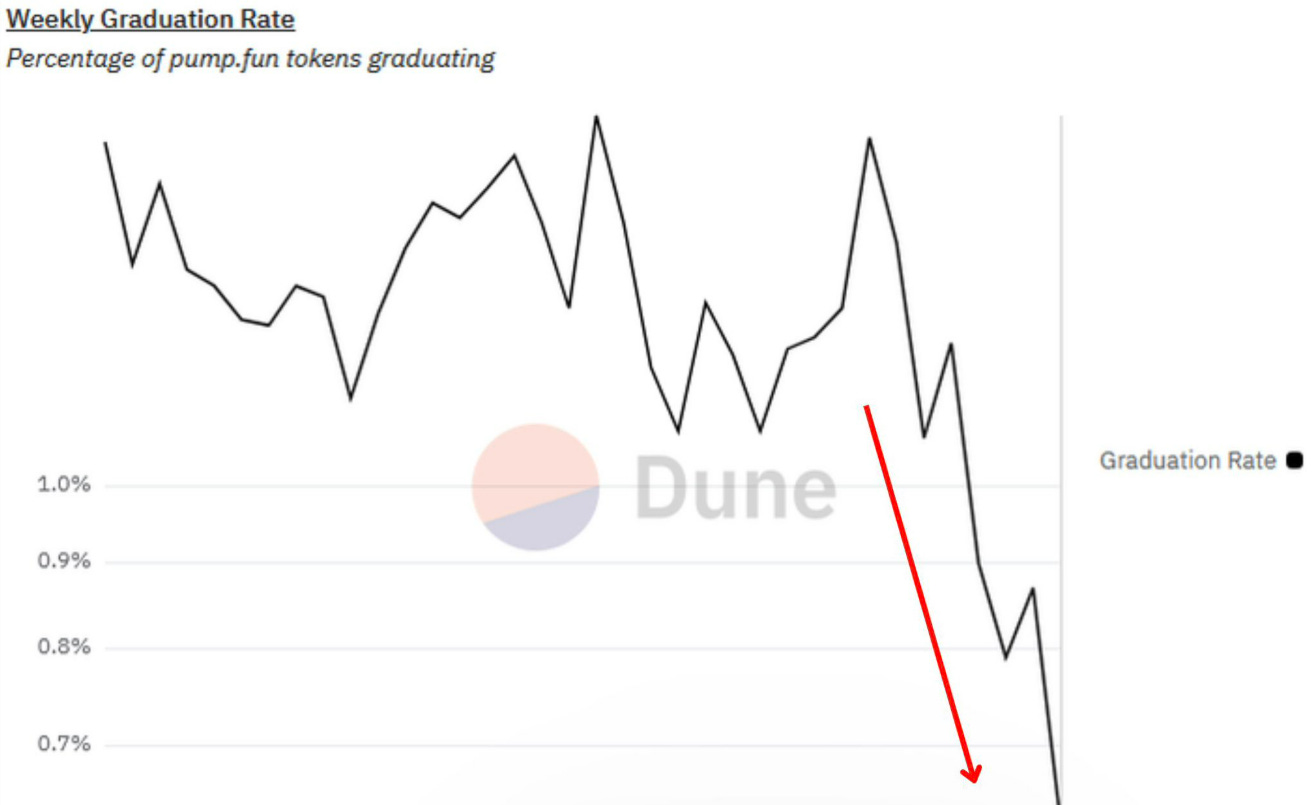

A jaw-dropping 98% of Pump.fun tokens fail to graduate to open markets. Even during the platform's best week in November 2024, only 1.67% of tokens made it to meaningful trading.

"Before the launch of Pump.fun in 2024, cryptocurrency failures numbered in the low six digits, project failures between 2021 and 2023 made up just 12.6% of all cryptocurrency failures over the past five years," explains Shaun Paul Lee, research analyst at CoinGecko.

It's the crypto equivalent of industrial farming — mass production leading to mass extinction.

The timing of this token apocalypse aligns perfectly with the market turbulence following Donald Trump's January inauguration. After Bitcoin hit $95,109, the US president’s silence on crypto during key economic addresses sent markets spiralling.

"The crypto community expected Trump to mention digital assets or announce pro-crypto policies. When he omitted any reference to cryptocurrencies or Bitcoin, traders saw this as government indifference," reported Cryptonews on April 29.

The subsequent tariff threats and market uncertainty only accelerated the token purging already underway.

Amidst the token chaos, some crypto sectors have carved out their shelter.

Stablecoins have emerged as the resilient foundation of the crypto ecosystem, steadily building about $240 billion market cap with projections pointing to a $2 trillion valuation by 2030.

The memecoin massacre has claimed some high-profile victims.

Trump-adjacent token $MELANIA collapsed over 95% from its February peak. Libra token traders collectively lost $251 million according to on-chain analytics firm Nansen.

Even tokens that launched with fanfare and celebrity endorsements have proven no match for market reality. For every survivor like DOGE or SHIB, thousands of imitators have disappeared without a trace.

When 98% of new tokens fail to graduate to meaningful markets, that's not a bug — it's a feature of a maturing ecosystem learning to distinguish between value and noise.