Happy Thursday, Dispatchers! Welcome to this week's News Rollups.

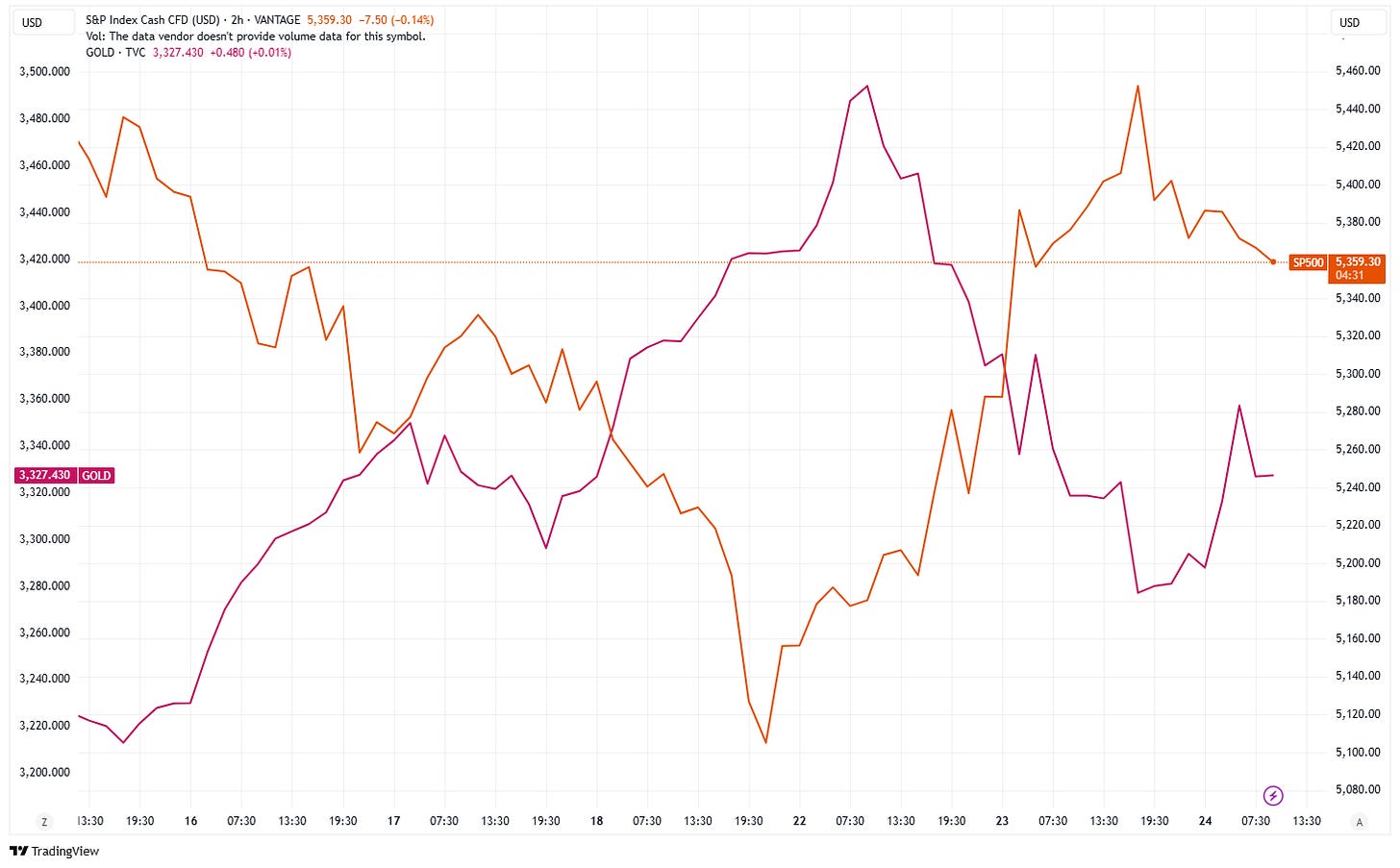

Broader and crypto markets swung in the last seven days as US President Donald Trump publicly attacked Federal Reserve Chair Jerome Powell, calling him a "major loser" and saying his "termination cannot come fast enough!" before suddenly backing down on Tuesday this week, stating he had no intentions of firing Powell.

In today's News Rollups edition, we look at:

Why Trump backed down from firing Fed Chair Powell after threatening him

The constitutional debate over whether a president can legally remove Powell

Why Oregon is suing Coinbase even after the SEC dropped its charges

Why Kraken is cutting jobs despite doing stable business

Emerging of public companies building Solana treasuries

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in our weekly News Rollups.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Q: Why Trump won’t fire Powell? Legally, can he? What if he does?

President Trump’s U-turn of not intending to ask the Fed Chair to leave didn’t come out of nowhere. In meetings with top retail CEOs and advisers, the industry stakeholders painted a dire picture of empty store shelves and financial turmoil if the trade war with China and attacks on Fed independence continued.

Can a president legally fire the Fed chair, though?

The Federal Reserve Act states board members can only be removed "for cause" (meaning serious misconduct or violations), not policy disagreements. This is backed by a 1930s Supreme Court ruling commonly called Humphrey's Executor.

All good, then? Nah, Trump's Justice Department is still actively seeking to overturn this precedent as part of a broader legal fight regarding independent agencies. While Powell believes the Fed might receive special treatment from the courts, the uncertainty has kept markets on edge.

Why does Fed independence matter?

The historical record is clear: When presidents successfully pressure the Fed to lower rates for political gain, inflation rises "strongly and persistently." One study found that presidential pressure at half the level Nixon applied to Fed Chair Arthur Burns in the 1970s raised prices by 8% over a decade.

What if Trump actually fired Powell?

Traditional assets like bonds and the dollar would plummet

US equity markets would crash on fears of political meddling

Alternative assets like gold and Bitcoin could surge as safe havens

This is why both Wall Street and White House advisers reportedly persuaded Trump to back off.

Get 17% discount on our annual plans and access our weekly premium features (Game On, News Rollups, HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Q: Why is Oregon state suing Coinbase?

Oregon Attorney General Dan Rayfield filed a securities enforcement action against Coinbase last week, just months after the US Securities and Exchange Commission dropped similar charges against the exchange.

The lawsuit claims Coinbase "encouraged and helped the sale of unregistered cryptocurrencies to people in Oregon," listing XRP and 30 other tokens as unregistered securities.

Why counter SEC’s position?

"States must fill enforcement vacuum being left by federal regulators who are abandoning these cases under Trump administration," said Rayfield, positioning state authorities as a counterbalance to the SEC's dramatically shifted approach to crypto regulation post Trump’s relection.

Coinbase Chief Legal Officer Paul Grewal blasted the action as "Oregon's holdout campaign" and "obstruction for the sake of obstruction," arguing it "takes us a giant leap backwards from hard-won progress."

Legal experts note that even if Oregon wins, the ruling wouldn't create binding precedent beyond the state. However, it could provide ammunition for other state regulators or potential plaintiffs seeking to build similar cases.

Q: What's up with Kraken's layoffs?

The crypto exchange platform was reported to have trimmed hundreds of job ahead of a potential IPO, after it confirmed it's making "the difficult decision to eliminate certain roles and consolidate teams where redundancies exist."

This follows a previous 15% reduction (about 400 employees) in October 2024 when Silicon Valley investor Arjun Sethi joined as co-CEO alongside David Ripley.

Despite the cuts, Kraken maintains its "business is thriving" with strong revenue growth. The exchange currently handles more than $1 billion in daily trading volume.

If successful, Kraken would join Coinbase as only the second publicly traded US crypto exchange.

The Crypto Comic 🎭

$TRUMP, marketed as the official token of president Donald Trump, rallied about 70% on Wednesday as the official website posted an invitation to a dinner event with the US President for top 220 token holders.

Watch: Why Bitcoin's Moment Is Finally Here

Dispatch Decoder 👨🏽🏫

What's the Fed's "Dual Mandate"?

The Federal Reserve operates under what's called a "dual mandate" from Congress: maintain maximum employment while keeping prices stable (targeting 2% inflation).

This creates a dilemma when facing economic pressures like Trump's tariffs, which simultaneously threaten to:

Slow economic growth (pushing the Fed toward rate cuts)

Increase inflation (pushing the Fed toward higher rates)

This "stagflation" scenario puts the Fed's dual mandates in direct conflict, forcing what Powell recently described as a "difficult judgment" between competing goals.

The situation explains why the Fed is hesitant to cut rates despite Trump's demands. With inflation still at 2.4% in March (above the 2% target) and tariffs threatening to push prices higher, rate cuts could worsen inflation while only temporarily boosting growth.

Under the Radar 🔎

Companies race to build Solana treasuries

A wave of public companies rushed to stack Solana in the past week, mimicking Strategy's (formerly MicroStrategy) Bitcoin accumulation playbook.

DeFi Development Corp added $9.9 million worth of SOL on Wednesday, bringing its holdings to 317,273 tokens ($48 million). The former real estate data company, which was earlier known as Janover until its rebranding exercise last week, acquired discounted locked SOL through BitGo's OTC desk.

Canadian firm SOL Strategies, which has been a pioneer in building Solana treasury, secured a $500 million convertible note facility to accelerate its Solana purchases.

Nasdaq-listed Upexi saw its stock surge 335% in a single day after announcing a $100 million raise with 95% dedicated to establishing a Solana treasury.

These small-cap stocks (both Upexi and DeFi Development Corp with market caps under $7 million each before their crypto pivots) have found new life by offering investors regulated exposure to Solana.

Only time will tell if this will help them taste the kind of success that Saylor’s Strategy is enjoying.

That’s it for this week’s News Rollups.

Until next Thursday, stay curious.

PS: Got some questions about the world of crypto from this week? Fill this form here and get a chance to have your question featured and answered by our experts in the next edition.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Find it kind of funny that in the era of $TRUMP the crypto community suddenly ceased to have a strong narrative of decentralization and opposing state oligarch grift, as if it was never a legitimate concern in the first place.