A pizza that cost 10,000 Bitcoins and last week’s PumpFun raise have a common element between them: a card that ports capital from Hyperliquid to your favorite barista.

In today’s product deep dive, we take a look at what BasedApp is offering crypto-natives.

Over the weekend, close to half a billion dollars were raised in PumpFun’s Initial Coin Offering (ICO). Unlike token listings of previous years, the price discovery for the asset happened on Hyperliquid. The token had a pre-sales market with sufficient volume long before the token went live. In fact, it did more in volume than conventional exchanges like Coinbase and Binance. If this is indeed the case, then the bridges between Hyperliquid and the traditional world—the one where people spend real money—would increasingly matter.

BasedApp is a team from Singapore that has been building towards the payments layer in crypto. It allows you to have a card that can be loaded with stablecoins. In a world where freelancers, merchants, and community members choose to be paid in stablecoins, tooling like that of BasedApp allows the off-ramping problem to be solved. You no longer need to remit money to a bank account or deal with a shady peer-to-peer exchange to get a payment done. You simply load your BasedApp card and use it for payments. In regions where Apple Pay is the norm, one barely waits for the card to be delivered. You can add it to your mobile device in a matter of minutes.

But how did the product come along? And what does it tell us about the future of crypto? To understand that, we probably need to go to the past. In particular, we may need to understand the motives and backgrounds of the individual behind Based, Edison Lim.

Over the weekend, he was kind enough to spend an hour explaining the product, its direction, and where it is headed. This article is what came of it. Let’s dig in.

In 2018, fresh out of Carnegie Mellon with a master's degree in distributed systems, Edison joined Zilliqa as one of the early engineers during the ICO boom. The timing was both perfect and terrible. While Zilliqa raised $20 million and successfully launched their mainnet in 2019, the crypto winter that followed was brutal.

"I don't think many people who came in after 2021 faced a similar bad market at that scale," Edison recalls.

Despite building what he describes as a "Lamborghini" of blockchains, capable of high throughput and fast transactions, Zilliqa's utilisation remained disappointingly low.

"Most of the time we were basically driving the Lamborghini in a car park," he says.

The technical capabilities meant nothing without real applications and users.

When DeFi summer arrived in 2020 with projects like Uniswap and Synthetix, Edison saw the validation of his thesis: applications, not just infrastructure, were what would make crypto relevant to everyday people. He teamed up with his friend Zac to start building what would eventually become BasedApp, with a simple goal - make crypto feel natural and easy for regular people to use.

Between 2019 and 2022, an entire cycle for stablecoins would play out. It would go from a nascent industry with about $10 billion dollars flowing to one where $40 billion in value would vanish due to the Terra Luna incident. Between those years, a few things would become apparent:

That stablecoins are crypto’s killer use case and they are here to stay

That regulations around stablecoins may front-run regulations for more speculative aspects of the market

Given the lack of volatility and reduction in costs of transfer, stablecoins were simply a better way to move money

If the three were real factors, the best place to build a payments product would be atop stablecoins. So that is what Edison and his co-founder set out to do.

The Payment Gateway That Wasn't

Like many crypto entrepreneurs of that era, Edison's first instinct was to build infrastructure. BasedApp started as a payment gateway, essentially trying to create a crypto version of Stripe.

The idea? Let merchants accept USDT and USDC payments through simple API integrations. They even built plugins for Shopify and developed standards for recurring crypto payments.

The technical execution was solid, but the business part was harsh. Merchants weren't ready. Beyond the obvious volatility concerns with crypto payments, there were practical problems that couldn't be coded away. Different countries had different rules about what counted as legal tender for tax purposes. Accounting departments didn't know how to handle crypto revenues. Even when merchants integrated the payment gateway, they rarely promoted it to customers because the demand wasn't there yet.

When Edison cold-called merchants, the conversations always ended the same way.

"How many people are using crypto today?" they'd ask.

"How many customers can you bring to our business?"

And when the numbers were too low, when the accounting got complicated, when the regulatory questions piled up, the merchants politely declined.

Since transfers in Web3 are often done with a user signature, subscription products are hard to make atop stablecoin payment rails. A user would have to consciously make a purchase decision and do manual transfers if a vendor chose to accept stablecoins. This was a real problem—and still is. It is partly why stablecoins have not been used in subscription products yet. But there were two key problems:

Firstly, accepting stablecoins meant merchants getting up to speed on how accounting for these digital representations of the dollar would look. It was more work, for limited revenue.

Secondly, there was a monetisation challenge. If the number of customers coming via stablecoins were not large enough, vendors would not bother paying additional fees to simply accept stablecoins.

As with all companies running on limited resources, Edison and crew had to figure out a new way to approach the problem.

After a year of trying to make the merchant-facing approach work, Edison had a realisation at a conference in Denver in 2023. Instead of asking merchants to change their systems, why not give consumers a way to spend their crypto anywhere? The answer was a Visa card connected directly to a crypto wallet.

The Card That Changed Everything

The pivot from merchant-facing payments to consumer spending proved to be exactly what the market needed. By late 2023, BasedApp launched their Visa debit card linked to smart contract wallets.

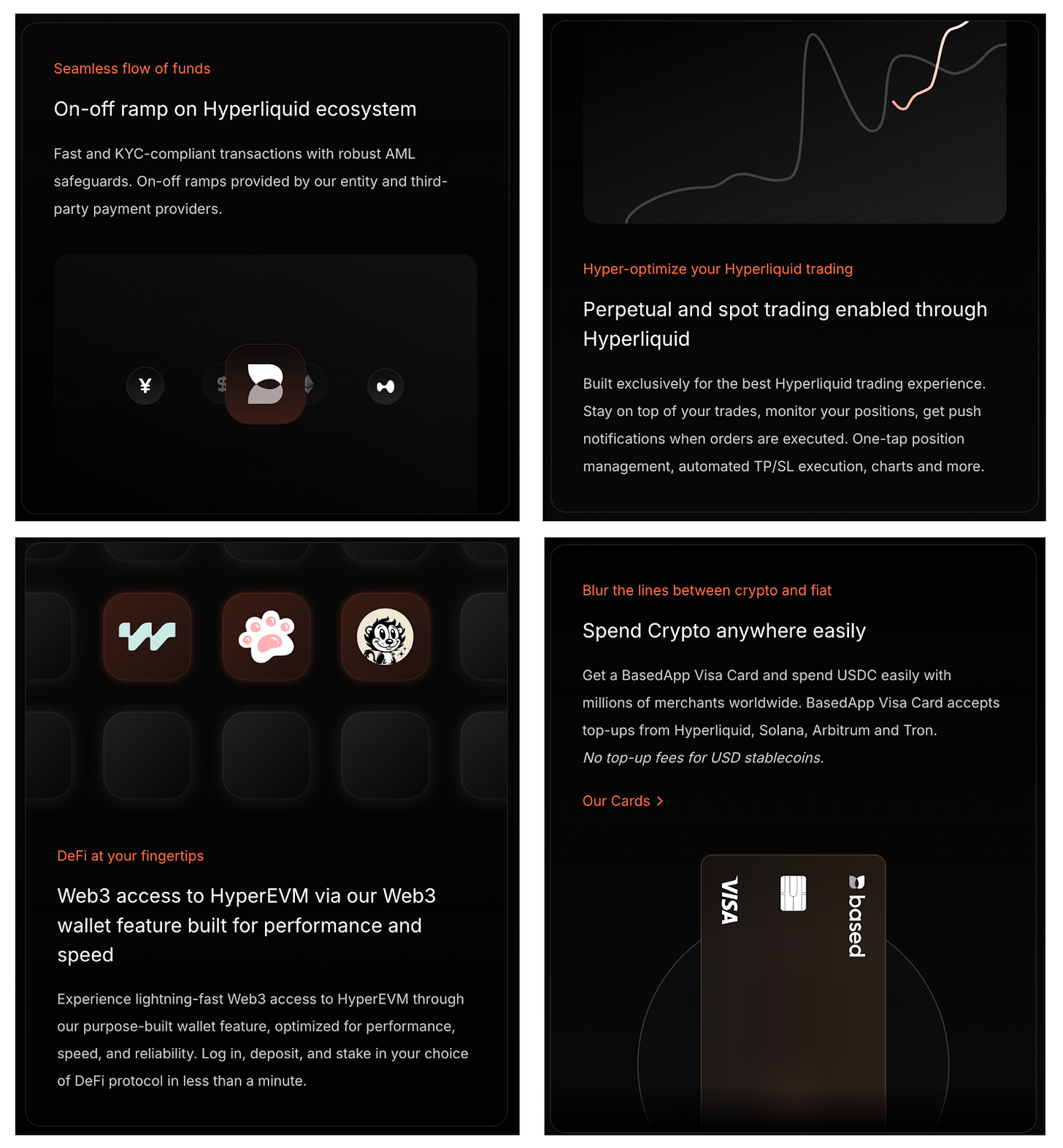

The way it worked: a user could simply transfer money to a Polygon address and begin spending it at any retail outlet. BasedApp would abstract the behind-the-scenes payment side of it. Cards usually make money on interchange fees, but that fee also needs to account for costs incurred in fraud detection, user rewards, and compliance, making margins tight even when profitable.

However, at the time, they were one of the few offering such a product. Users were able to use their crypto-native sources of capital right away without undergoing scrutiny from banks or dealing with third-party off-ramps. The value proposition was clear, and it onboarded users.

But as with most startups, PMF is not enough. There is always the pursuit of more. Edison began exploring what his power users were doing, why they were spending money on BasedApp, and what the sources of capital were. He quickly realised that most crypto-native users followed a pattern. The stablecoins were coming from exchanges. And in the age of Hyperliquid, these dollars were coming from the perps exchange Hyperliquid offered. It made sense. Much of the new forms of capital in crypto were coming from traders booking profits.

He quickly realised that most crypto-native users followed a pattern: stablecoins were coming from exchanges, with traders booking profits and looking for seamless ways to spend them. Recognising this trend, Edison decided to leverage Hyperliquid's openness and build a wallet focused on trading

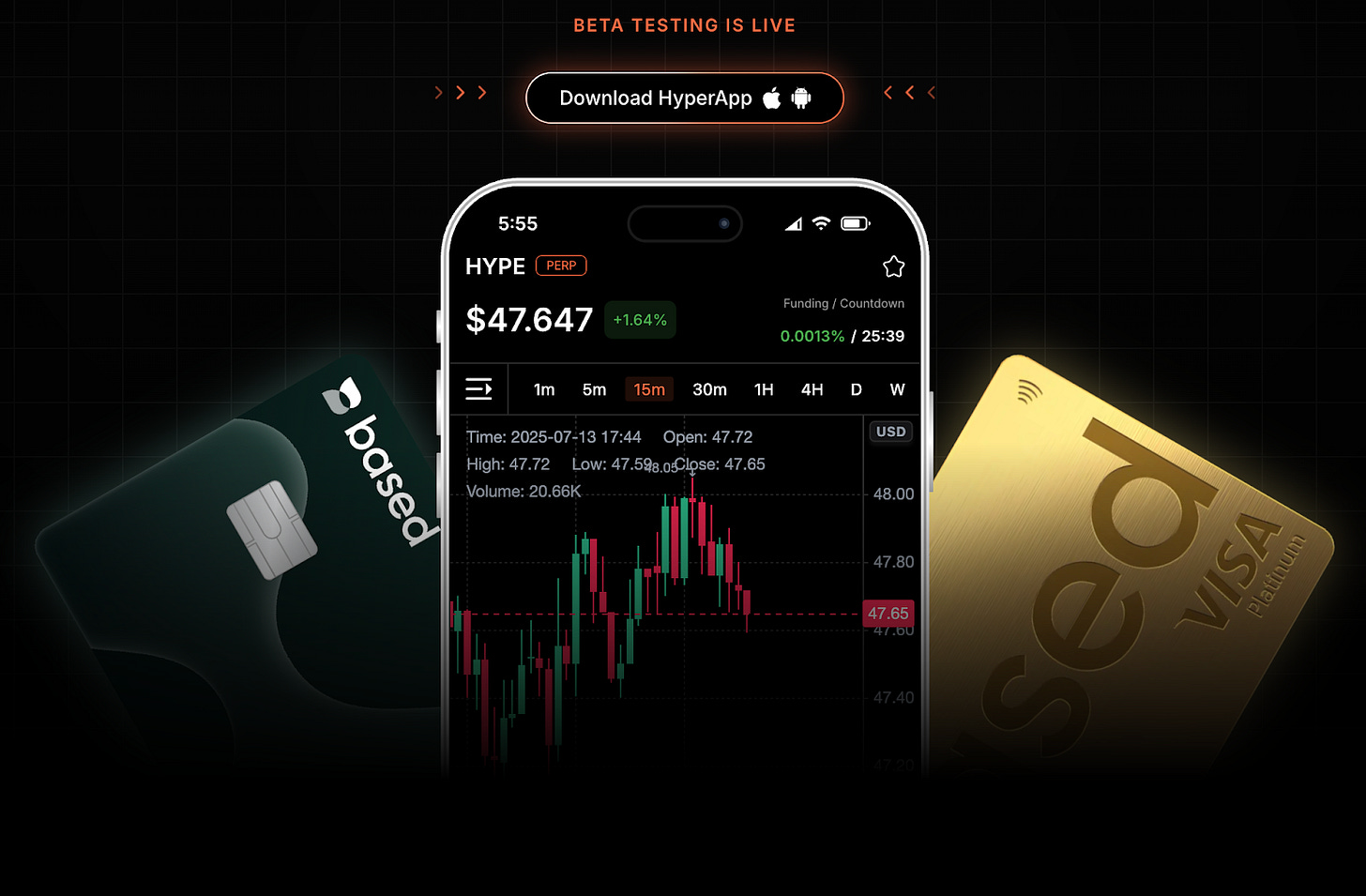

So over the last few months, they released a new product that allows users to go from trading perps to spending the profits in real time. The idea is that if you focus on the core subset of power users who bring in most of the volume, the rest of the business will be fine on its own. But there is perhaps a separate line of thinking here. Much of the revenue that is generated in crypto today comes from trading apps. By allowing the trading to happen in a third-party product, BasedApp might be losing out on revenue. Bringing the whole experience into a single product allows them to capture a higher share of revenue while allowing users to benefit from their off-ramping functionality.

The HyperApp Evolution

This user feedback led to BasedApp's latest transformation into what they call the "HyperApp". A mobile-first platform that combines trading, holding, and spending crypto in a single interface. The choice to build on Hyperliquid, a decentralised exchange focused on performance, wasn't accidental.

Hyperliquid offers the speed and user experience that approaches centralised exchanges while maintaining decentralisation. For BasedApp's trader-heavy user base, this meant they could get the performance they expected without giving up custody of their assets. The integration allows users to trade perpetuals and spot tokens, manage their portfolios, and immediately spend profits through their Visa card.

The approach solves specific pain points: creating simple UX for easy trading, enabling trading on-the-go, and allowing instant transfers to their Visa card for real-world spending.

The business model makes sense from multiple angles. On the trading side, BasedApp charges a builder fee on top of Hyperliquid's native fees, which remains competitive with centralised exchanges. This revenue funds operations and enables them to offer affiliate commissions that rival major exchanges, something Hyperliquid's native referral program couldn't match due to its lower referral percentages compared to centralised exchanges

The card business, while less lucrative per transaction, provides stable revenue and serves as a unique differentiator.

BasedApp is able to do this because of Hyperliquid’s builder code functionality. It turns any app with sufficient distribution into an interface that allows trading to settle on Hyperliquid. You do not need the liquidity, market-makers, or custody of the assets. All of it is abstracted away.

All of it is abstracted away. BasedApp charges a builder fee on top of Hyperliquid's rates, but gives most of it back to users as affiliate rewards. The goal is getting more people to use both BasedApp and Hyperliquid, and the affiliate program is so rewarding that it matches what some of the bigger centralised exchanges offer. Last week, Phantom enabled support for Hyperliquid’s perpetual product within the wallet. We are slowly but steadily seeing an increasing number of apps build on Hyperliquid. Except, each of them takes a different approach to it.

In BasedApp's case, the long-tail ambition is to become the super app that allows users to do everything: from sending money to spending it, from trading crypto to simply holding it. BasedApp has plans of releasing a web app in the near future. Which means they can function closely to what a bank does - a simple product that allows users to receive, trade, and spend money. What we are seeing is the blurring of lines between what is considered crypto and traditional finance. We are also witnessing how an increasing number of apps will rely on trading products to enable non-speculatory use cases.

A common question to ask here is: are trading products all that there is to crypto? One way to think of it is that trading (or speculation) enables sufficient revenue to deploy into forward-leaning utility like payments. Early adopters may spend more and thereby subsidise future users. These functions have happened repeatedly in the past. For now, here is what is evident:

BasedApp is slowly but definitely becoming the interface between on-chain activity and real-life spends.

Edison’s vision of being a full-stack super app is still playing out, and there is a lot to do towards that vision. But in the interim, we are simply glad to be spending stables via Apple Pay.

I will comeback next Sunday with another cool project.

Until then … DYOR and HODL tight,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

the article wasnt bad but the app was not that great based on the overwhelming good things about what was talked about in the article