Hello,

Money has a fascinating way of telling stories. It reveals what it thinks of the world by how it moves through global markets.

In a confident market, money behaves like a talent scout. It takes chances, experimenting with a pitch deck, a prototype, or a vision of the future that might seem outlandish today. It shows its belief through the signed cheque for funding.

In a nervous market, however, money acts more like a cautious auditor. It gravitates toward things that are already proven. Think of businesses with healthy cashflows, a user base, distribution or a strong team.

Then, there’s a third scenario, somewhere in between. Here, money starts recycling existing ideas and jumps between hands. We see this happen when business ownership changes through mergers, acquisitions, realignments of business arms, and so on. All these scenarios show money moving, but that doesn’t create new liquidity.

This is why anyone reading into the capital flows and funding numbers should approach them with caution. A large funding number might signal fresh risk-taking, or it could just mean money is changing hands among existing businesses.

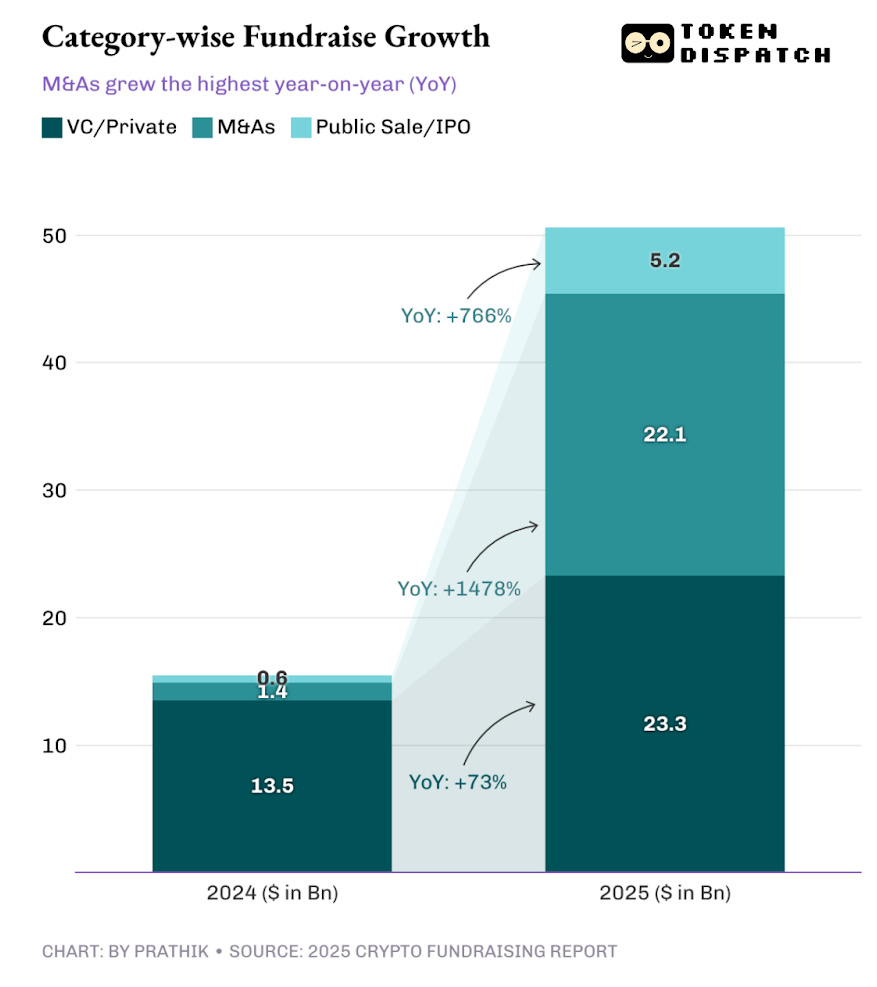

The Crypto Fundraising Report 2025 reveals one such figure: $50.6 billion raised across 1,409 rounds in 2025, more than 200% higher than the $15.5 billion raised in 2024. It sounds like a party, but only the breakdown of this figure shows the true picture.

In today’s analysis, I will dive into these numbers and explain what last year’s movement of money tells us about the trajectory of the crypto market.

On to the story,

Prathik

A significant portion of “capital raised” isn’t necessarily new money flowing into the crypto market. The fundraising report breaks total raised into categories: Venture Capital (VC)/Private, Mergers & Acquisitions (M&As), and Public Sales/IPOs.

Over 40% of the capital raised last year came from M&As, compared to only 9% in 2024. Although the total funds raised more than tripled from the previous year, 2025 was more of a year of consolidation for crypto.

The report interprets these numbers as “moderate growth” in VC activity and “explosion” in M&A. However, I believe there’s more to these figures than meets the eye.

Consolidation of businesses in a relatively new industry, such as crypto, could mean maturity and progress. But when paired with capital flight from other routes, it could tell a different story.

In 2025, money was not merely rerouted from funding new projects to acquiring existing ones. While the total funds raised rose by $35 billion year-on-year, M&As and Public Sale/IPOs accounted for $27 billion of that growth.

VC activity still grew by more than 70% year-on-year (YoY) last year, albeit at a declining share in the overall fundraising categories.

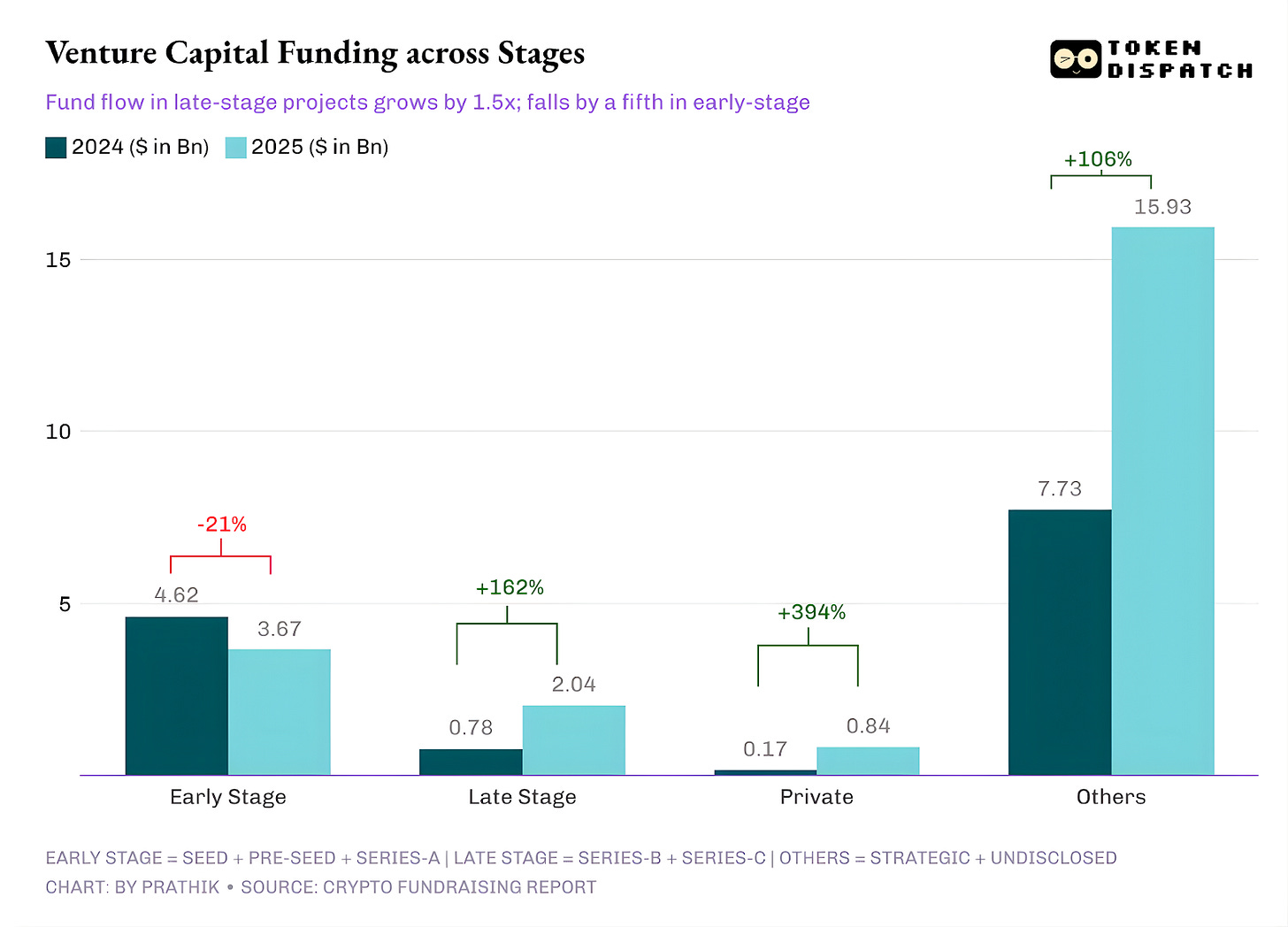

While VCs accounted for over 85% of the total fundraising in 2024, that share slipped to 46% in 2025. This, along with how VCs allocated capital across different stages of crypto projects last year, is what concerns new crypto builders and founders. VCs signed far fewer but larger cheques in 2025 to fund existing projects at a later stage in their life cycle than to fund newer, early-stage projects.

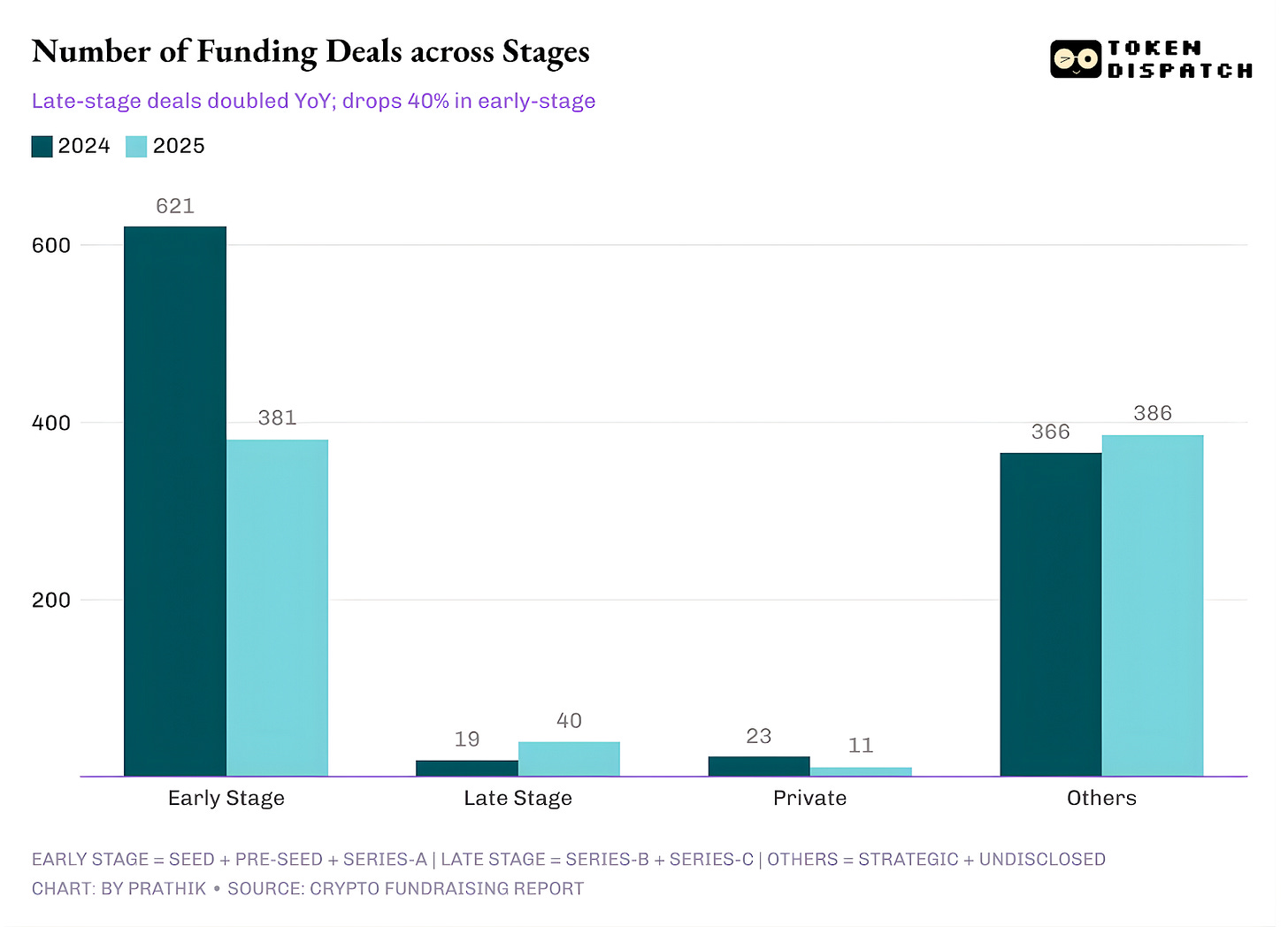

The breakdown shows that Pre-Seed, Seed, and Series A funding fell year-on-year, while Series B and Series C funding more than doubled in 2025.

The behaviour is mirrored even when you look at the number of cheques signed across all funding stages.

Both the above charts collectively tell us that “Yes, capital rose. But it rose where uncertainty is lower, and the founder’s pitch is not more about ‘future of money’ but about ‘here are some proven metrics to bet on’.

While this signals tough competition ahead for early-stage founders, it could mark a value-investing opportunity for investors looking to infuse capital into Series A and Series B projects, according to the State of Venture Economy report by Equal Ventures.

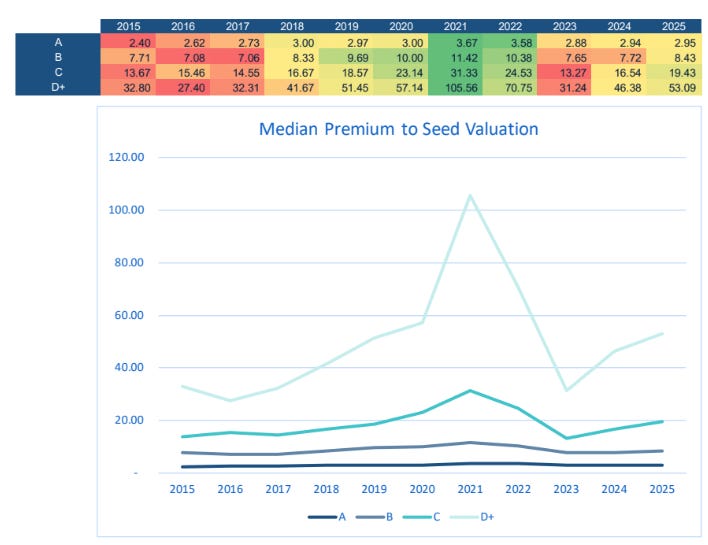

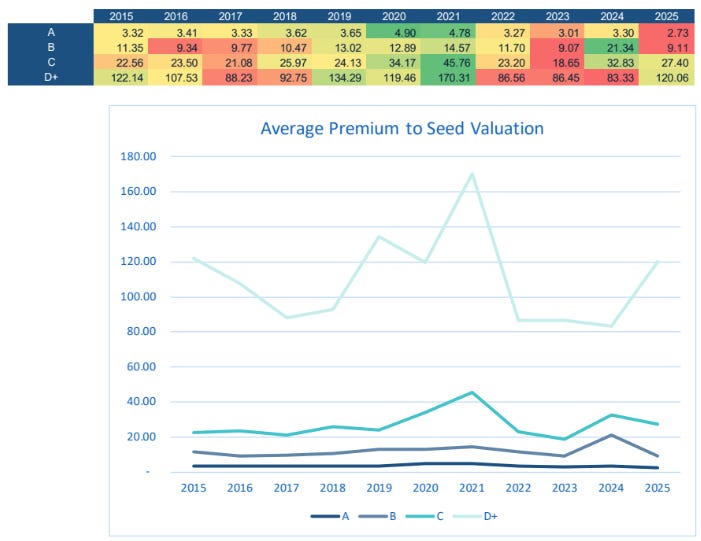

That’s because intense competition to raise funds at the Seed and Pre-Seed stages has driven up valuation premiums.

Higher valuation premiums could mean paying for a growth-stage multiple with the risk profile of a Seed-stage project.

This shift prompts rational capital allocators to reallocate their funding to lower-risk opportunities, such as Series A and Series B projects, which demand lower valuation premiums than Seed, Pre-Seed, Series C, and Series D+ projects.

This, along with the explosion of M&As, shows how the risk appetite is shifting across stages. On the one hand, M&As account for over 40% of all “capital raised”, which is not really “new money” in the same way as fresh capital is infused via VC rounds. On the other hand, later-stage funding is being rewarded because it appears risk-free to underwrite, offering greater certainty and a higher potential for better ROI.

When capital concentrates in select avenues, two things happen.

First, decision-making becomes focused. Founders begin preparing to pitch to a smaller audience that tracks similar metrics and shares notes.

Second, the idea of “quality” becomes standardised. In crypto, this could mean wide distribution, regulatory robustness, enterprise readiness, and a business model that doesn’t rely on bull- and bear-market narratives.

This is why I am sceptical about reading the 2025 Crypto Fundraising report’s numbers being purely bullish. Although funding is up, it is important to understand what’s driving the M&A explosion. Although crypto is a relatively new market, the stack has become crowded, making it difficult to scale distribution.

In such times, it becomes a no-brainer for incumbents to buy and scale what’s already working rather than convincing users to adopt a new one. This is evident in the deals that we saw last year.

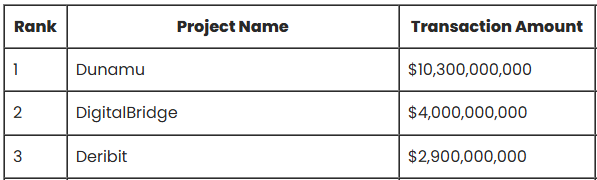

Let’s take the top three M&A deals listed in the report: Dunamu, DigitalBridge, and Deribit. They total to $17.2 billion, ~81% of the report’s total M&A value.

Coinbase bought Deribit not because it was betting on innovation or experimenting with it. It was a move to capitalise on a flywheel that Deribit had already put in place. Deribit offered a venue with existing liquidity, client habits and an Options and Derivatives product that can double down as a default casino for sophisticated traders once markets mature.

Coinbase read the signs and prepared in advance.

South Korean internet giant Naver had a similar strategy on its mind when it decided to acquire Dunamu, an operator of the country’s largest cryptocurrency exchange, Upbit, in an all-stock deal valued at $10.3 billion.

The deal married a massive consumer distribution platform (an internet-based fintech giant) with a regulated, high-frequency financial product (an exchange).

What does all this mean for 2026?

I expect the capital concentration to persist until we get a clear exit pathway. My only reservation about the consolidation idea that the report lays out is that maturity doesn’t have to mean the death of innovation. If too much capital is invested in rearranging ownership or doubling down on existing ideas, it could lead to stagnation and fewer breakthrough innovations.

If we don’t see successful IPOs and large liquid listings reopening, expect late-stage investors to continue behaving like strict underwriters, while early-stage founders face attention scarcity.

But I don’t believe the Seed stage is dead in crypto.

2025 provides valuable lessons and clarity for early-stage founders. In 2026, they will need to refine their pitch decks to focus on the metrics that matter most to the market. Like how they have a distribution wedge, how they can ship quickly while staying within regulatory compliance, and why their product can survive without relying on bull markets.

That’s it for this week’s quantitative analysis. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.