The year of ETH? 🫶

Ethereum to outperform Bitcoin? Holds strong above $2,500 amid Ether ETF speculations. ETF scores big. Jamie Dimon remains skeptical. A new meme coin surges. Wormhole's TVL rebounds.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

2023 was the year of Bitcoin’s comeback!

Almost hit $50K with the Spot Bitcoin ETF approval. Yet to reach the $66k mark tho.

Read this: Why Bitcoin ETFs a big deal? 🤔🤷♀️

This year Ethereum is expecting the same or more and rightfully so.

Ethereum spot ETFs are on its way.

Multiple filings for spot Ether ETFs were made by Ark Invest, 21Shares, VanEck, Grayscale Investments, and BlackRock.

All of them big names who brought back Bitcoin’s optimism.

Read this: Ethereum's Deja Vu? ✊✌️

What’s happening to the price? Ethereum (ETH) is casually hanging out above the $2,500 mark.

Despite the crypto market being a bit moody recently.

Now, is Ethereum going to outperform Bitcoin?

Few things to note here

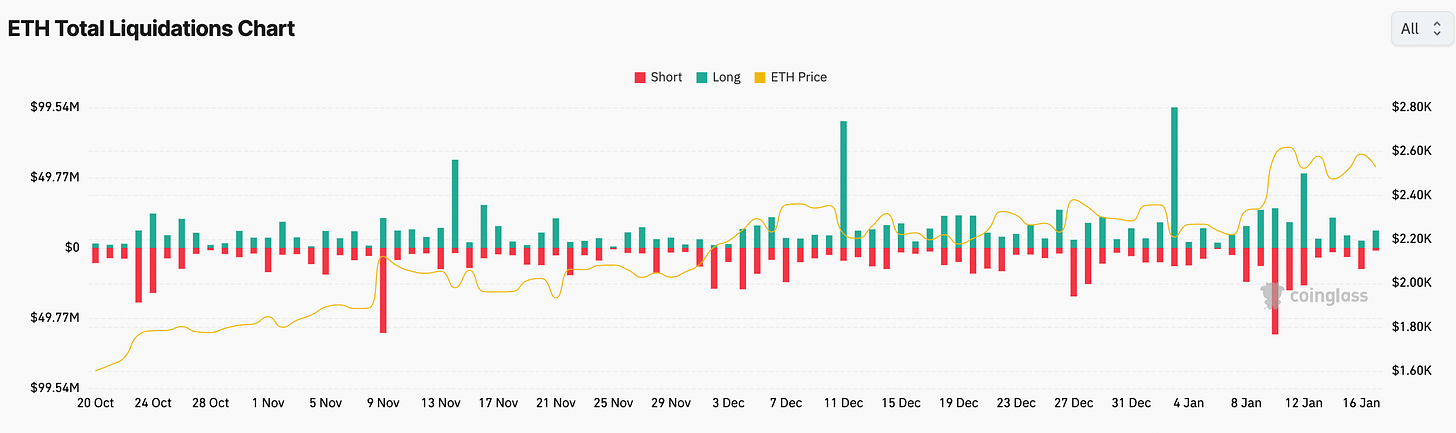

Liquidation Data: On Jan. 16, $15.03 million of ETH shorts were liquidated compared to $5.3 million in long liquidations, coinciding with ETH/USD reaching $2,614.

Increasing Open Interest in Ethereum: A report by 10xResearch notes Ethereum's growing share of open interest in perpetual futures, from 21.8% to 26.5%. Bitcoin's open interest share remained flat.

Bitcoin Dominance Decline: Bitcoin's dominance indicator dropped below 50%, often seen as a sign of stronger altcoin performance, with ETH's dominance reaching over 18%.

QCP Predicts So

QCP Capital's Market Update report suggests Ether (ETH) might continue its recent trend of outperforming Bitcoin (BTC).

Following the SEC's approval of multiple spot Bitcoin ETFs, Ether rallied over 5%, while Bitcoin saw a decline of over 6%.

On-Chain Metrics Favour Ethereum

Ethereum's price dominance surged against Bitcoin, with a +22.4% increase in the past week.

The creation of new Ethereum addresses is on the rise.

Ethereum's supply on exchanges is nearing an all-time low = self-custody and staking.

The percentage of Ether's circulating supply in profit hit a multi-year high of 91.8%, outpacing Bitcoin's 86.2%.

These are all good signs that ETH > BTC is not impossible.

James Seyffart from Bloomberg Intelligence is more optimistic

"I think the same thing is going to happen for Ethereum."

BlackRock CEO's Larry Fink hinted at the value of a spot Ether ETF in the US, boosting market sentiment.

Cathy Wood, CEO of ARK Invest, predicts a flip. Wood sees Ethereum as poised to outperform Bitcoin long-term.

Is ETH Security?

Still in question.

The SEC hasn't clearly stated whether Ether is a commodity or a security.

BlackRock's filing acknowledges the ambiguity in digital asset classification and the possibility of Ether being deemed a security.

Potential Approval Timeline: The deadline for VanEck's Ethereum ETF is May 23, followed by Ark Invest and 21Shares' proposal on May 24.

Upgrades Are Happening

The Ethereum network's latest upgrade, "Cancun-Deneb" or "Dencun," has been deployed on the Goerli testnet.

This upgrade, featuring EIP-4844, aims to reduce transaction costs on Ethereum layer 2 solutions and introduces new features.

Further testing is scheduled on the Sepolia and Holesky testnets, with mainnet implementation yet to be announced.

Dencun Upgrade Live on Testnet

Ethereum's latest upgrade, "Cancun-Deneb" or "Dencun," is now operational on the Goerli testnet, with a minor delay.

A bug in the Prysm implementation caused a delay of about four hours before the network could function correctly.

Once on the mainnet, Dencun aims to significantly reduce transaction costs on Ethereum layer 2 solutions and introduce new features.

Shortly after the fork, the network experienced a chain split due to a lack of finalisation.

The Prysm bug was identified and patched, leading to the network's smooth operation post-fix.

The upgrade is scheduled for implementation on the Sepolia testnet on Jan. 30 and the Holesky testnet on Feb. 7, with the mainnet date yet to be announced.

TTD Numbers 🔢

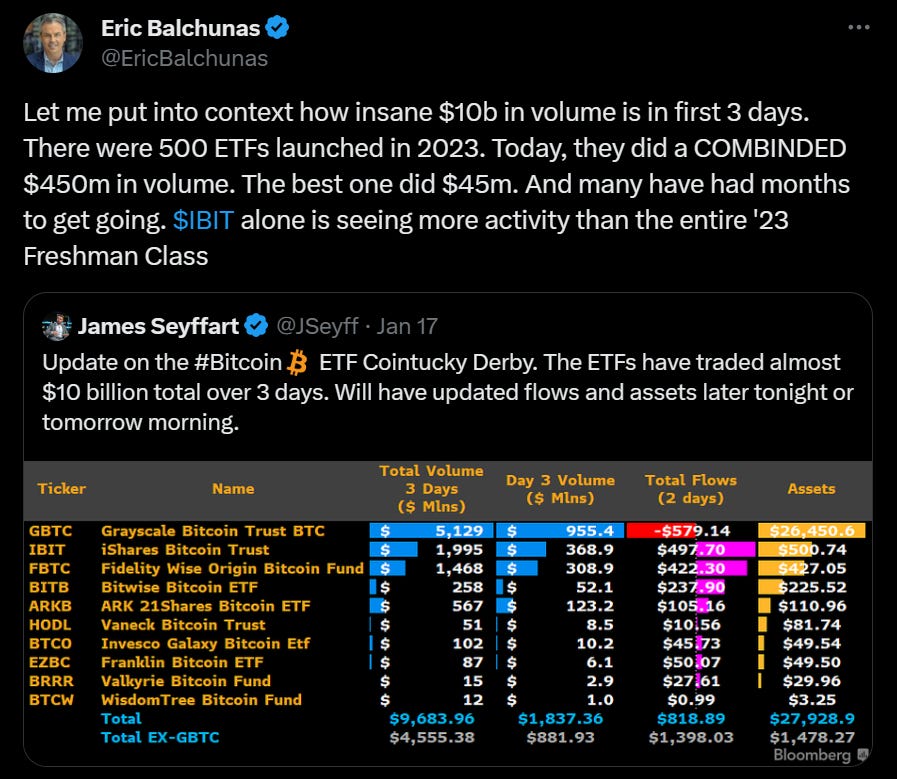

$10 billion

That's the trading volume of the spot Bitcoin ETFs in the first three days.

Why is this a big deal? Spot Bitcoin ETF's are bossing the trading volume by a huge margin.

What’s interesting? The volume is significantly higher compared to other ETFs launched in 2023, the normies.

What are the other numbers? Inflow and outflows

Net gains for BlackRock’s iShares Bitcoin Trust (IBIT), increases by $700 million.

Grayscale Bitcoin Trust (GBTC) faced over $1.1 billion in net outflows.

Read this: Who's got what?❓

James Van Straten of CryptoSlate views the inflow pace as encouraging.

CEO Samson Mow expects a recalibration period post-ETF launch.

Despite the ETF excitement, Bitcoin’s price is expected to stay within the existing trading range established since December 2023.

US Dominance

Bitcoin ETPs globally currently hold 864,719 BTC.

The US now holds 80% of the total market share in Bitcoin held in ETFs, according to K33 Research.

Following US ETF approvals, similar products in Europe and Canada saw a decrease of about $380 million in holdings, while markets in Hong Kong, Australia, and Brazil remained relatively stable.

Read this: First day blockbuster 👊🏼💥🔥

TTD Blockquote🎙️

JP Morgan Chase CEO Jamie Dimon.

"I call it the pet rock"

Jamie Dimon is still dismissive of Bitcoin.

When asked about BlackRock CEO Larry Fink's views on of bitcoin. He minced no words— "I don’t care. So just please stop talking about this shit."

BlackRock is the most valued asset manager in the world. CEO Fink reckons Bitcoin is an asset class that protects you.

Dimon lashed out his Bitcoin stance in an interview at the World Economic Forum in Davos, Switzerland.

Last month he said that : 'If I was the government, I'd close it down.'

Where’s ETF?🚨

ProShares, a major ETF issuer in the US, has filed for five Bitcoin ETFs with indirect exposure to the crypto.

TTD Memecoin 🪙

A trader capitalized on a meme coin surge inspired by Tesla CEO Elon Musk.

The trader converted 4.3 ETH into $1 million following Musk's little profile update.

Musk's change of his bio to "Chief Troll Officer (CTO)" sparked interest in the TROLL token.

TROLL saw a significant surge following Musk's bio change, over 150,000% in three days.

Transaction Details

The trader converted 4.3 Ether (approximately $10,000) into 19 trillion TROLL tokens.

Sold half to recoup the initial investment, with the remaining tokens peaking at $1.34 million.

In just 10 days, the value of these coins surged to $1.03 million.

Following Musk’s influence, TROLL's market cap reached $120 million, with a daily trading volume of about $38 million.

Similar market impacts were seen with Dogecoin and a non-affiliated Grok (GROK) memecoin, the latter reaching nearly $200 million in market cap.

The price of TROLL is $0.079254 today -15.03% decline in the last 24 hours.

TTD Wormhole 🕳️

Wormhole, a cross-chain protocol, has seen its total value locked (TVL) rebound to $1.02 billion, nearly two years after the crypto market downturn in May 2022.

The TVL is primarily comprised of Ether at $675 million, Fantom at $174 million, and Solana's SOL at $96 million.

The protocol's TVL has surged over 300% since dropping to $234 million at the start of the year.

Previous Peak: Wormhole reached its peak TVL of $3.8 billion 16 months before the Terra ecosystem collapse and subsequent crypto winter.

Market Recovery and Capital Infusion: The resurgence aligns with the overall market recovery and a significant $225-million capital infusion at a $2.5 billion valuation in November 2023.

History of Hacking Incident

In February 2022, Wormhole experienced a major hack, resulting in a loss of over $321 million due to an infinite minting glitch on its Ethereum–Solana bridge.

Jump Crypto and other entities executed a counter-exploit against the Wormhole hacker in February 2023, recovering $225 million in user assets.

TTD Surfer 🏄

Crypto custodian Qredo has experienced a wave of departures as it focuses on enhancing the value of its equity business and building utility for its token.

Cryptocurrency exchange Gemini has been approved to operate in France as a digital asset services provider.

Decentralised exchange dYdX has surpassed Uniswap as the largest DEX by daily trading volume.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋