The Yield Is The Virus 💸

When money becomes programmable, everyone wants to control the code

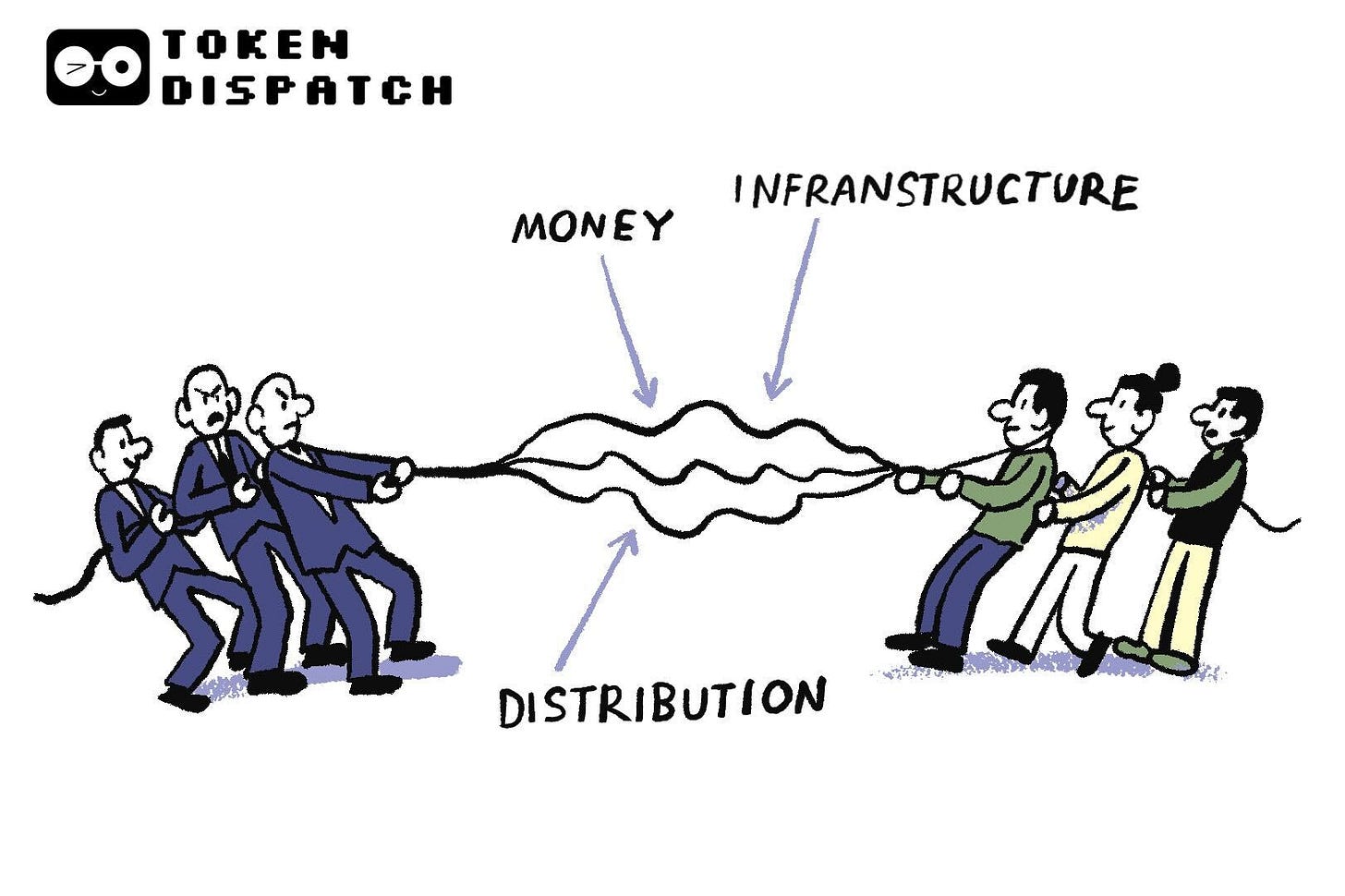

I’ve been reflecting on how we structure the world into distinct layers. We like to believe that money is one thing, infrastructure another, and distribution something entirely separate. It’s a cleaner narrative that simplifies things. The dollar is the dollar, the bank is the bank, and the payment network is the payment network. But none of this is actually true. Money has always been inseparable from the system that moves it, and the system that moves it has always been tied to who controls access to it. And every time money moves through that system, whoever controls it skims a little something off the top. We just pretended otherwise because the illusion was convenient. What’s happening now isn’t that crypto is blurring these lines. It’s that the lines were never real to begin with, and everyone just figured it out at the same time.

For me, the illusion is finally crumbling, and it’s happening due to something seemingly mundane: interest rates. Your bank savings account offers a meagre 0.4% while stablecoins backed by the same treasury bills offer 4% to 5%. This is due to some form of market inefficiency. It’s clear evidence that what we call “money” and what we call “infrastructure” were never separate. The bank isn’t paying you less because banking is expensive. It’s paying you less because it can, because it controls both the money and the pipes, and it decided to keep the spread.

Issuers created the money. Blockchains moved it. Platforms distributed it. For a brief moment, we could see each layer clearly and price it independently. And the moment people could see the layers, they realised that whoever controls just one layer is leaving money on the table. The rational move is to control all of them.

Now everyone is racing to rebuild the stack before someone else does.

AI Agents that trade, predict, and evolve, on-chain

DeAgentAI has built the largest AI Agent infra across Sui, BSC & BTC, solving what every AI dev struggles with, Identity, Continuity, and Consensus, the holy trinity for making AI actually autonomous.

Their flagship products?

AlphaX → A crypto prediction engine that hits 9/10 signals.

CorrAI → A no-code quant playground for designing and deploying DeFi trading strategies.

Truesights (launching soon) → InfoFi network that rewards real alpha, not just noise.

Backed by top-tier VCs, and a team from Carnegie Mellon, UC Berkeley, and HKUST, they’re scaling what’s basically the “ByteDance of Web3.”

Except instead of serving you TikToks, their algorithms are training autonomous AI Agents.

For years, stablecoins were simple. Tether and Circle dominated the market with USDT and USDC, operating what looked like an unshakeable duopoly. Together, they controlled 90% of the stablecoin market. Their business model was beautiful in its simplicity. Hold customer dollars in treasury bills earning 4% to 5%, pay customers nothing, keep the difference. In 2024, Tether made $13 billion in profit, and Circle pulled in $1.7 billion in revenue. Not bad for a business that essentially functions as a money market fund that does not share its returns.

But then came the question: What if we paid holders?

Yield-bearing stablecoins have tripled their market share since late 2024, surpassing past $14 billion and now representing over 6% of the total stablecoin market. JPMorgan analysts project that, if they maintain this trajectory, yield-bearing stablecoins could claim as much as half of the market.

If Tether holds treasury bills earning 5% and you hold USDT earning 0%, someone is capturing $5 for every $100 of value you technically hold. Scale that across hundreds of billions of dollars, and it represents one of the most significant wealth transfers of the digital age, flowing quietly from holders to issuers.

Banks Realise They Have Competition

The banking lobby looked at yield-bearing stablecoins and saw an existential threat. Senator Kirsten Gillibrand made the concern explicit during the DC Blockchain Summit.

“Do you want a stablecoin issuer to be able to issue interest? Probably not, because if they are issuing interest, there is no reason to put your money in a local bank.”

The Treasury Department ran the numbers and came up with a figure. Allowing interest-bearing stablecoins could pull $6.6 trillion from bank deposits. Standard Chartered went further, estimating that $1 trillion could leave emerging market banks alone in the next three years. In countries running double-digit inflation, stablecoins are not speculation. They are a survival mechanism, a way to hold dollars when local currency is evaporating.

So, banks did what any rational incumbent would do. They lobbied for the GENIUS Act, which passed in July 2025 with explicit language prohibiting stablecoin issuers from paying yield or interest to holders. Problem solved, right?

Not quite.

The GENIUS Act banned issuers from paying interest. It said nothing about intermediaries. Circle figured this out immediately. Instead of paying USDC holders directly, Circle shares reserve income with Coinbase through a commercial partnership. Coinbase then uses that money to pay USDC rewards to its customers. Economically, holders receive at least a part of yield. Legally, Coinbase is making the payment, not Circle.

The arrangement is not even subtle. Circle and Coinbase publicly describe it as a revenue-share model, and in 2024, it collectively generated $1.7 billion in revenue. Other platforms quickly adopted this approach. PayPal offers balance rewards on PYUSD through a similar partnership with issuer Paxos. The yield is not coming from thin air. It is coming from the same treasury bills that have always backed these stablecoins, just routed through an extra step.

The Bank Policy Institute, understandably upset, urged Congress to close what they call the “payment-of-interest workaround” by banning indirect payments through affiliates and agents. Whether regulators will act depends on how final rules interpret “paying interest” and whether intermediaries get lumped in with issuers. For now, the loophole is still open and the traffic is heavy.

For Tether and Circle, the solution has always been liquidity and ubiquity. USDT and USDC are accepted everywhere, integrated into every major exchange, and embedded in every DeFi protocol. Their network effects have been their moat.

But that moat is beginning to crack.

While banks and regulators argue about semantics, something more fundamental is happening. Tether and Circle’s combined market share peaked at 91.6% in March 2024. By late 2025, it had slipped to 86% and it continues to fall. The reason is not just yield-bearing stablecoins. It is that issuing a stablecoin has become radically cheaper and easier.

A few years ago, launching a white-label stablecoin meant calling Paxos and absorbing high fixed costs. Today you can choose from Anchorage, Brale, M0, Agora, or Bridge, which Stripe acquired. Companies in Galaxy Digital’s portfolio have already launched stablecoins at the seed stage using Bridge’s infrastructure. The barriers to entry have collapsed.

Exchanges, wallets, and DeFi protocols are realising they no longer need to rely on USDC or USDT. They can issue their own stablecoins, internalise the yield, and pass some of it back to users.

Bridge co-founder, Zach Abrams laid out the case clearly: “If you’re using an off-the-shelf stablecoin to build a neobank, you can’t fully access the rewards necessary to create the best possible savings account. Your reserve mix cannot be customised. And you’d have to pay a 10bps redemption fee to withdraw your own money.”

So they’re not using off-the-shelf stablecoins anymore.

Phantom, a popular Solana wallet, recently launched Phantom Cash, a Bridge-issued stablecoin with built-in yield and debit card functionality. Hyperliquid ran a public bidding process for its own stablecoin, specifically aiming to reduce its reliance on USDC and capture reserve yield for the protocol. Ethena has been particularly successful in selling its yield-sharing model to exchanges.

MetaMask, the leading self-custodial Ethereum wallet, has stepped into the stablecoin game too. Rolling out MetaMask USD (mUSD) in partnership with Bridge and M0, directly integrated into its wallet for onchain use, swaps, and upcoming debit card payments. MetaMask users can now earn passive yield not only on mUSD, but on major stablecoins like USDC, USDT, and DAI, thanks to its in-wallet ‘Stablecoin Earn’ integration with Aave pools.

Other exchanges are banding together to create consortia. The Global Dollar Network, backed by Paxos, includes major players like Robinhood, Kraken, Anchorage, Galaxy, and Bullish, among others.

Every $1 billion in USDT sitting on your platform generates roughly $50 million annually in treasury income for Tether. You provided the trading infrastructure, the custody, the liquidity, the regulatory compliance, and the customer support. Tether provided the token. Guess who keeps the $50 million?

Chains Want Stablecoins, Stablecoin Issuers Want Chains

The convergence is happening from both directions.

Hyperliquid holds around $6 billion in USDC. If that activity ran on USDH, Hyperliquid’s native stablecoin, both the yield on reserves and transaction fees would loop back into the ecosystem for buybacks and growth. That’s a recurring revenue stream that Circle currently captures.

After USDH’s success, other Layer 1s are following the same playbook. Ethena and others are offering stablecoin-as-a-service models, enabling ecosystems to deploy compliant, yield-bearing coins without heavy technical or regulatory burdens.

Stablecoin issuers are now launching their own chains. Why? Operating on external chains creates dependencies: performance issues, throughput bottlenecks, gas fees, wallets, and third-party bridges. Each touchpoint introduces friction and, more importantly, value leakage. By launching their own chains, stablecoin issuers can vertically integrate both the monetary layer and the settlement layer, keeping both value and user experience under one roof.

Circle’s Arc is the clearest example. Circle built Arc to run USDC with zero fees and instant settlement, and then created CCTP as the official bridge to burn and mint native USDC across chains, rather than wrapping it. Circle now controls both the chain and every cross-chain flow.

Tether followed with Plasma, a new Layer 1 blockchain purpose-built for stablecoin payments and anchored by USDT, but not limited to just USDT. Plasma’s design focuses on ultra-fast, zero-fee transfers for stablecoins, stripping out unnecessary features found on general-purpose chains. Its bridge, USDT0, now moves $8 billion in volume, more than CCTP or Wormhole combined. What started as infrastructure to move tokens has evolved into a way to control liquidity flows and eliminate middlemen capturing value between chains.

Institutions are building the whole stack, and Stripe provides a clear example of where this is headed.

Stripe processes $1.05 trillion annually. Instead of building on Ethereum or Solana, it launched Tempo, its own payments-optimised chain. Why? At that scale, Stripe can’t inherit someone else’s congestion or governance risks. Tempo integrates Bridge for stablecoin issuance and Privy for wallets - offering the full stack: chain, coin, and custody.

What strikes me most is that this does not look like disruption - it looks more like revelation. The technology didn’t change the rules. It revealed what the rules had always been. Control over money is control over infrastructure is control over access.

These were never three distinct things. They were one thing, simply wearing three different masks.

The optimistic view is that once everyone understands this, competition improves the system. Maybe having a dozen vertically integrated stacks competing will lead to better outcomes than having just one. Maybe regulatory clarity around stablecoins will prevent the worst abuses. Perhaps the cost of building and maintaining a full stack will naturally limit how extractive any single player can be.

The pessimistic view, however, is that we’re just witnessing the same consolidation game play out faster and more visibly. The winners won’t be the ones with better technology or fairer economics. They’ll be the ones who moved fastest to rebuild the monopoly before anyone else could.

Either way, the illusion is gone. We’ll spend the next decade figuring out whether that matters.

See you next week with another deep dive.

Until then … stay extremely curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.