Thunder Dragon's $1B Bitcoin Stack 🇧🇹

In the shadow of the Himalayas, a Buddhist kingdom has been quietly building one of the world's most successful national crypto operations. And almost nobody noticed - until now.

Hello, y'all. Happy Sunday 🍻 We’re looking looking forward to the BTC $100K day, today? tomorrow? day after that? Bhutan is waiting to know too.

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 160,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Many companies, people and countries have been on the headlines for buying Bitcoin.

We love Michael Saylor, we love El Salvador, we love Tesla.

Well, turns out another country was quietly stacking sats all along.

Not China. Not the US. Not even Dubai.

But Bhutan - a tiny Buddhist kingdom in the Himalayas.

And they didn't just buy Bitcoin. They mined it.

A lot of it.

Bitcoin is hovering around $100K.

Breaking out of the $50-$70k range that it was stuck in for months.

Total Bitcoin market cap is closing in on $2 trillion.

The total crypto market cap is around $3.4 trillion.

Bitcoin's market dominance and trading volumes are shooting up.

Read: Bitcoin: Inches Away From History 💯

Bhutan's holdings have swelled to 12,218 BTC – more than twice El Salvador's stash.

Holdings now worth $1.2 billion, representing 34% of GDP.

Ranked fourth globally in government Bitcoin holdings.

A diverse portfolio including 656 ETH worth $2.24M.

And that's just the beginning of their success story.

They mined most of it themselves, without ever sending a single tweet about it - that’s very tough eh?

The art of quiet accumulation

If you're old enough to remember when Facebook was still called The Facebook, you might recall the scene in The Social Network where Sean Parker advises Mark Zuckerberg: "A million dollars isn't cool. You know what's cool? A billion dollars."

Bhutan seems to have taken a different lesson: You know what's really cool? Nobody knowing you're about to have a billion dollars.

2019 - While everyone was recovering from crypto winter, the country's sovereign wealth fund, Druk Holdings, started its secret mining operations.

Bitcoin price then? Around $5,000.

Their first Bitcoin transaction was modest – just 0.0267 BTC ($1,770) received from AntPool.

Their secret weapon? The same thing that makes Bhutan one of the world's only carbon-negative countries: abundant hydroelectric power.

With 23,760 MW of technically feasible hydropower potential – enough to power New York City twice over – Bhutan found itself in an enviable position.

Instead of exporting excess power at bargain prices, they decided to transform it into Bitcoin. Elegant solution. Innit?

The current operation is impressive by any standard.

55-75 BTC ($3.6-4.9 million) mined weekly

Partnerships with major mining pools including AntPool, Braiins and Foundry

Total mined: 27,727 BTC in just three and a half years

Plus, 92.53 ETH before the Merge.

2021-2022 activity

$817M in crypto moved

Platforms used

BlockFi

Celsius

Hodlnaut

Yes, all three went bankrupt. But Bhutan kept stacking.

In 2023, they partnered with Bitdeer

$500M green mining fund

Plans to reach 600MW capacity

Current facility: 100MW in Gedu

The strategy is working: Bhutan's bitcoin reserves now account for over 26.9% of its $2.9 billion national GDP. For perspective, that would be like the U.S. holding $7 trillion in Bitcoin.

From Education City to Mining Haven

Remember the failed Education City project?

Bhutan turned that ghost town into their largest mining facility.

The receipts

2020: $1.1M in computer chips

2021: $51M in computer chips

2022: $142M in computer chips

That's 10% of their total imports.

But it's not just about mining.

Bhutan's approach to managing their Bitcoin wealth shows surprising sophistication.

They regularly cycle portions of their holdings through major exchanges

Since June, they've deposited 1,358.64 BTC ($90 million) to exchanges

They maintain a diverse crypto portfolio including ETH, BNB, and MATIC

Their treasury operations rival those of major institutional investors

Strategic timing of sales and professional portfolio management

The success of Bhutan's Bitcoin strategy isn't just theoretical.

It's having tangible effects.

Funded 50% salary increase for public servants

Contributed to foreign currency reserves

Created new high-tech employment opportunities

Positioned Bhutan as a leader in sustainable mining

Don’t Miss Out on Our Weekly Features

Connecting dots to bridge the narrative that's shaping the crypto world. Saturday analysis written by Prathik Desai 👇

Crypto world can be a maze. Lot of information, not much context. Lot of noise, not much insight. Sunday explainers written by Thejaswini M A👇

A Tale of Two Approaches

The contrast couldn't be more striking.

One nation is buying, and the other mining.

One shouting from the rooftops, and other, working in near-total secrecy.

Both strategies are working spectacularly. El Salvador's President Bukele's Bitcoin strategy has been all about publicity: Twitter announcements for every purchase, renderings of a futuristic Bitcoin City, and regular appearances at crypto conferences. It's flashy, it's bold, and now, it's paying off big time.

Read: El Salvador votes pro-Bitcoin 📝🗳

El Salvador's holdings have surged to a staggering $558.6 million, generating over $300 million in unrealised profits. For a country that was widely criticised for its Bitcoin adoption in 2021, that's quite the vindication.

And they're not stopping there. El Salvador is now pioneering the first regulated tokenised US Treasury offering in the country, aiming to raise at least $30 million. The small nation is transforming from a Bitcoin adopter to a full-fledged crypto innovation hub.

Meanwhile, Bhutan's strategy was so discreet that their holdings weren't discovered until blockchain intelligence firm Arkham pieced together the puzzle this September. The kingdom was content to quietly stack sats while others stacked headlines.

Despite having only 12% of El Salvador's population, Bhutan has accumulated more than double the Bitcoin holdings.

While El Salvador's Bitcoin purchases have been a roller coaster of paper gains and losses, Bhutan's mining operation generates steady returns regardless of market conditions. When you're producing the Bitcoin yourself with some of the world's cheapest renewable energy, the economics look very different.

The kingdom's approach also solves one of the main criticisms of national Bitcoin adoption: volatility risk. By mining rather than buying, Bhutan creates a natural hedge — when prices are high, they earn more per Bitcoin mined; when prices are low, they can accumulate more for their energy expenditure.

The Global Bitcoin Mining Landscape

When Michael Saylor took the stage at Bitcoin 2024 in Nashville, he proposed something that Bhutan had already figured out: Bitcoin mining could be a solution for indebted nations.

His suggestion? Countries should reallocate their treasury reserves from traditional assets like gold and bonds to Bitcoin.

But Bhutan went one step further. Instead of just buying Bitcoin, they're creating it.

The numbers are staggering. According to recent World Bank data, Bhutan's crypto reserves now account for over 26.9% of its $2.9 billion GDP. For a developing nation with a gross national income per capita below $14,005, this is nothing short of revolutionary.

In a world where nations are drowning in debt and struggling with rising borrowing costs, Bhutan's approach offers a compelling alternative. Rather than relying on external loans or traditional exports, they've turned their abundant hydroelectric power into a digital export that requires no shipping containers or trade agreements.

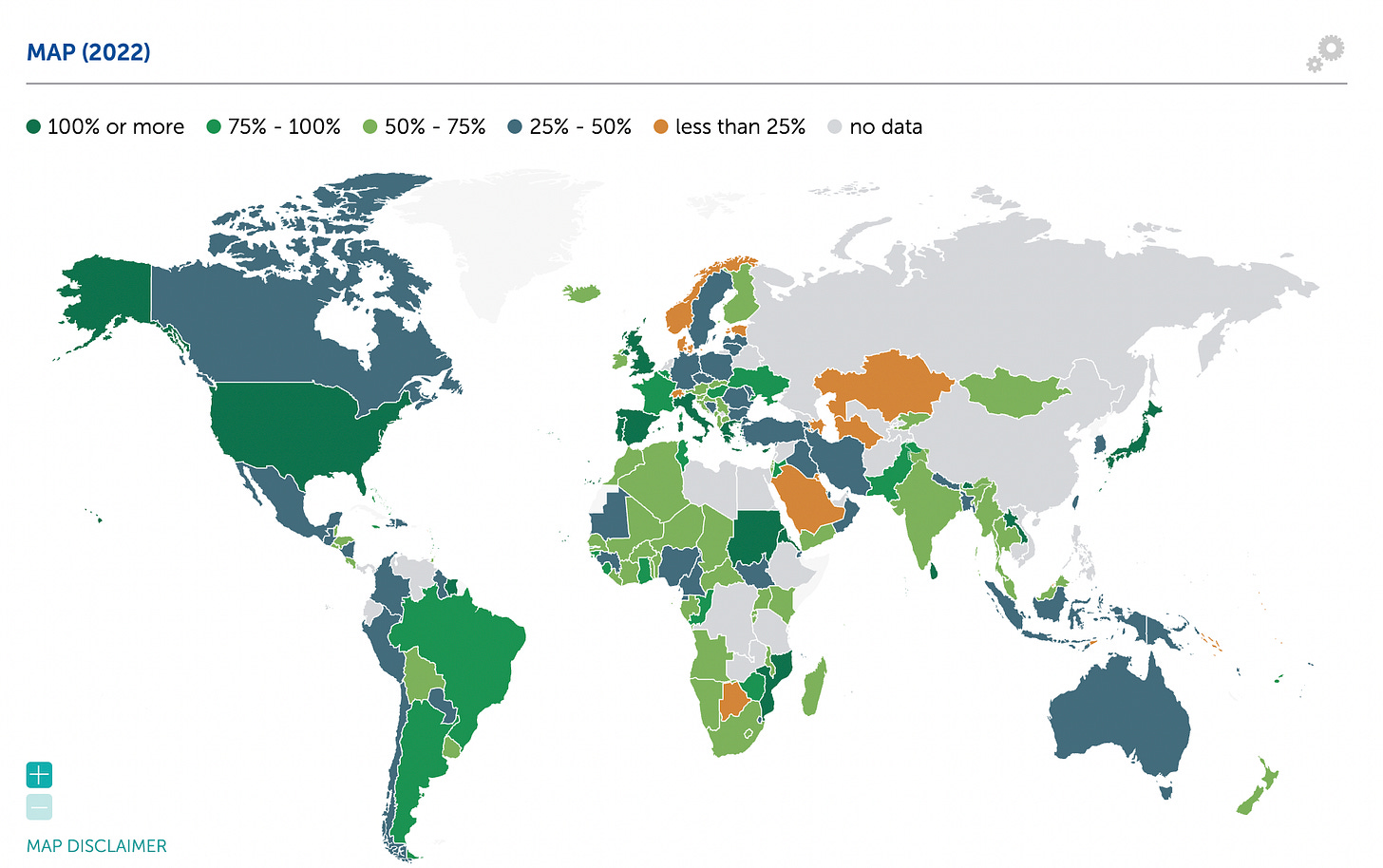

Other developing nations are taking notice, each with their own unique circumstances.

Paraguay: The Sleeping Giant

99% hydroelectric energy generation

Largest power exporter in South America

Currently sells surplus energy to neighbours at low prices

Political resistance has prevented Bitcoin mining adoption

Single party rule for 70 years has stifled innovation

Venezuela: A Cautionary Tale

Abundant energy resources but crumbling infrastructure

Frequent power outages hamper mining operations

Government has banned crypto mining

High crypto adoption among citizens despite restrictions

Ranks in top 20 for global crypto adoption

Kenya: The New Frontier

Partnership with Marathon Digital shows promise

Plans for 100% renewable energy by 2030

Moving from crypto skepticism to embrace

Potential to replicate Bhutan's success

Government actively studying mining policies

Argentina: The Wild Card

Pro-Bitcoin president but limited concrete action

Rich in renewable energy resources

High crypto adoption due to inflation

Significant private mining investment

Lacks coordinated national strategy

Token Dispatch View 🔍

Bhutan's Bitcoin story isn't just about making money - it's about reimagining what's possible for small nations in the digital age.

While others made noise about adopting Bitcoin, Bhutan quietly built an empire. They turned their natural resources into digital gold, and did it without compromising their values or stability.

This isn't just another country buying Bitcoin - it's a masterclass in national crypto strategy. No flashy announcements, no Twitter spaces with the king, just steady execution and remarkable results.

What's most fascinating is how they balanced tradition with innovation. A Buddhist kingdom, known for measuring Gross National Happiness, is now one of the biggest Bitcoin miners in the world.

The implications are profound. Small nations don't need to depend on tourism or traditional exports anymore. With the right resources and strategy, they can participate in the digital economy at the highest level.

This transformation is particularly significant given the global context. As nations worldwide grapple with mounting debt levels and rising borrowing costs, Bhutan's model suggests a potential escape route. Instead of accumulating more debt or depleting natural resources, they're creating value from what would otherwise be wasted energy capacity.

A Blueprint for National Debt Relief Bhutan's success raises an intriguing possibility: could Bitcoin mining serve as a debt relief mechanism for developing nations?

The evidence suggests it might.

Revenue Generation: Bhutan's mining operations have created a new revenue stream without increasing national debt

Asset Accumulation: Their Bitcoin holdings serve as a growing treasury reserve

Economic Diversification: Mining operations have created new high-tech jobs and industries

Sustainable Development: By using renewable energy, they've maintained their environmental commitments

This approach could be particularly relevant for the 80+ countries currently classified as developing nations by the World Bank. Many of these countries share Bhutan's initial challenges: limited economic capacity, reliance on external loans, and untapped natural resources.

Bhutan has shown that you don't need to be a tech hub or financial centre to succeed in crypto. You just need patience, discretion, and a clear vision.

Week That Was 📆

Thursday: The Cardano Underdog Is Awake 😳

Wednesday: What’s wrong with ETH? 🤔

Tuesday: Corporates Opt Debt To Buy Bitcoin 🛒

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋