Titanic submarine's decentralised truth 🔍

Controversy surrounding Polymarket's bet on finding a missing submarine. US still 'centre of gravity' for crypto, K33 research. Andy Murray’s Wimbledon NFT Artwork. Solana's AI tool to pick NFTs.

Hello, y'all. Our friends at Asset have been at it tryna build cool shit. You can collect a digital collectible. For free. Every week. Why not claim yours - here?

Give your books a »» Muzify «« spin? This is The Token Dispatch, you can hit us on telegram 🤟

Crypto-based betting platform Polymarket faced controversy and negative press when it offered a $2 million wager on whether a missing submarine would be found by a specific date.

The bet sparked debate over the definition of "finding" something and led to a separate dispute resolution process involving UMA, a decentralised truth machine.

The bet and dispute

Polymarket asked users to bet on whether the missing submarine would be found by a certain date.

The US Coast Guard discovered pieces of the submersible on the ocean floor, confirming its demise.

Users who bet "yes" won, but those who bet "no" argued that the fine print of the bet was in their favour.

The dispute was handed over to UMA, a decentralised dispute resolution partner of Polymarket.

UMA's role and voting process

UMA token holders vote on settling questions of fact to determine the outcome of disputes.

The voting process aims to leverage collective wisdom to arrive at the truth.

Critics raised concerns about the trustworthiness of UMA's process, while the founder, Hart Lambur, defended it against accusations of collusion.

Polymarket's controversial bets

Polymarket gains attention by creating betting markets tied to current events, even if they have a limited timeframe or lack a clear resolution.

This flexibility may be due to Polymarket operating in a regulatory grey area.

The platform had previously faced a $1.4 million fine from the CFTC for allowing unregistered betting, leading to the blocking of US citizens' access.

The fine print and definition of "found"

The fine print of the bet specified that the submarine didn't need to be physically recovered for it to be considered "found."

However, locating only pieces of the submersible without finding the cabin with the passengers wouldn't suffice for a "yes" outcome.

Bettors purchase shares reflecting the odds at the time of purchase, and the market value of shares fluctuates based on the outcome.

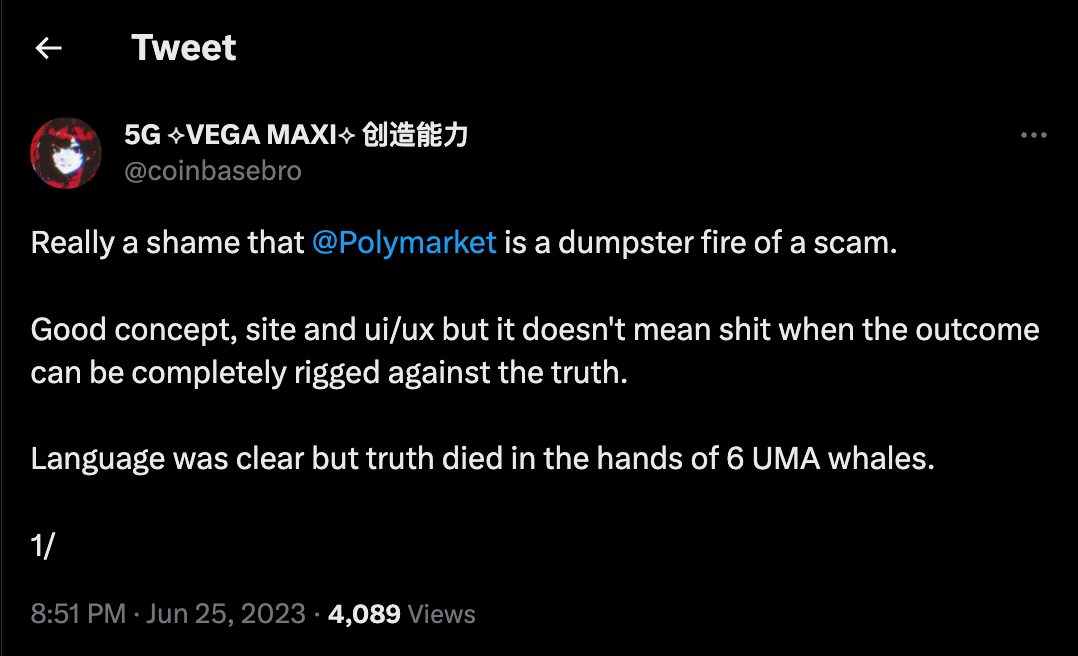

Allegations of whale influence

Critics of UMA's vote alleged that a few token holders with significant holdings, known as whales, influenced the outcome.

Some suggested collusion among whales who had bet "yes" despite their better judgement.

Lambur dismissed these claims, emphasizing that collusion would undermine the value of UMA's token.

Game theory and voting incentives

UMA's protocol employs game theory to discourage collusion and incentivise credible, unbiased voting.

Votes are cast anonymously and revealed only after voting concludes.

Token holders voting against the majority face penalties to discourage voting for obvious falsehoods.

Evaluating decentralisation

UMA's voting process involved approximately 100 token holders with an uneven distribution of tokens.

Questions arose regarding whether this can be considered a decentralised outcome.

Lambur acknowledged the challenge of achieving widespread, equal distribution of tokens but emphasized ongoing improvements.

The controversy surrounding Polymarket's bet on finding a missing submarine highlights the challenges of defining "finding" and the complexities of decentralised dispute resolution. While criticisms were raised about the voting process, UMA defended its protocol and aims to refine its system to attract more voters and achieve greater decentralisation.

TTD Research 🏢

According to a report by K33 Research, 30% of the global crypto workforce resides in the United States.

The report states that the industry comprises 10,000 companies, employing 190,000 people, with a valuation of $190 billion.

Exchanges and brokerages employ the majority of workers, followed by financial services, blockchain analytics and mining firms, and NFTs and gaming.

The report highlights the significant presence of smaller crypto companies. India leads the job market in Asia, surpassing China.

Despite regulatory challenges, the U.S. remains the country with the highest number of crypto workers.

Other regions, such as Africa, Europe, and Latin America, also have a share in the industry. The report predicts that the industry will follow the path of demand.

TTD Tennis 🎾

Wimbledon, the historic tennis tournament, has collaborated with former champion Andy Murray and digital artist Refik Anadol to launch an official art NFT on the Ethereum blockchain.

The project, called "The Exposition," combines 18 years of Murray's Wimbledon data, including his two Grand Slam victories, with motion-capture sessions to create a data-driven digital artwork.

The NFTs were sold on manifold.xyz during Murray's second-round match at Wimbledon 2023 and will be available until July 16, priced at $147 each.

The artwork visually represents the drama and triumphs of Murray's Wimbledon career using a unique algorithm that incorporates statistics, motion, audio, and visual data.

Holders of The Exposition NFTs will have exclusive access to future opportunities, including the chance to purchase a physical print edition of the artwork.

More collaborations between Murray, Wimbledon, and Anadol are planned for the future, with Murray's latest Wimbledon run providing data for upcoming projects.

Refik Anadol, known for his algorithmic art, will serve as an advisor for the inaugural Wimbledon NFT collection and continue to collaborate on future phases.

Murray was previously involved in Wimbledon-themed NFTs in 2021, created by WENEW, which featured video displays of his tournament wins and sold for high prices, including one NFT selling for almost $178,000.

TTD Tool 🔧

Solana Labs is developing an AI tool to assist newcomers in navigating the NFT market.

The tool aims to

Simplify the process of selecting suitable NFTs by analyzing various data points.

Help users identify trending collections and find communities that align with their preferences.

While NFTs on Solana are generally less valuable than those on Ethereum, Solana has been making progress in expanding its ecosystem.

In May and June, Solana added millions of new digital wallet addresses, demonstrating growth comparable to Ethereum.

Solana Labs' CEO Anatoly Yakovenko has previously highlighted the potential of AI in enhancing user experience and understanding in the crypto space.

TTD Recovery 🤑

Bitfinex, a crypto exchange, has recovered stolen funds from a 2016 hack with the help of the United States Department of Homeland Security.

The recovered assets include $312,219 in cash and 6.9 Bitcoin Cash, valued at $1,951 today.

Bitfinex is collaborating with law enforcement to retrieve more assets and return them to affected customers. The hack resulted in the loss of approximately 120,900 BTC, worth $3.6 billion currently.

The Department of Justice seized most of the stolen assets and arrested two individuals for conspiring to launder the stolen cryptocurrency.

Bitfinex aims to recover as much stolen Bitcoin as possible and distribute it to token holders issued in response to the hack.

The recovered assets will be given to holders of Bitfinex's Recovery Right Tokens, which were issued to users who suffered losses in the hack.

The thieves attempted to move the stolen crypto through various exchanges with fewer regulatory protocols but were eventually tracked down by U.S. law enforcement in the largest cryptocurrency seizure to date, uncovering a sophisticated money laundering technique.

TTD Surfer 🏄

Cross-chain bridge Multichain has reportedly lost crypto assets worth $126 million after being locked since May. The bridge has $1.25 billion in total liquidity for facilitating cross-chain transfers, per DeFiLlama.

Ryan Wyatt, president of Polygon Labs, has announced he will be stepping down from his position at the end of the month. He will be replaced by the project’s Chief Legal Officer, Marc Boiron.

MicroStrategy’s chief revenue officer Kevin Adkisson has quit after working for the company for nearly seven years. The company’s CEO Phong Le has assumed Adkisson’s responsibilities.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋

If the process is too good to be true, it’s probably a phony crypto recovery expert. I have been scammed by so many recovery companies, and I can tell, it’s almost not possible to recover stolen or crypto sent to the wrong address. It’s rare to find a legit recovery company without getting scammed believe it or not. I’m saying from experience and I can tell you freddictine At consultant com is reliable,not 100% but will never leave you stranded