Hello

Welcome to our weekly Bitcoin macro and news analysis: Mempool.

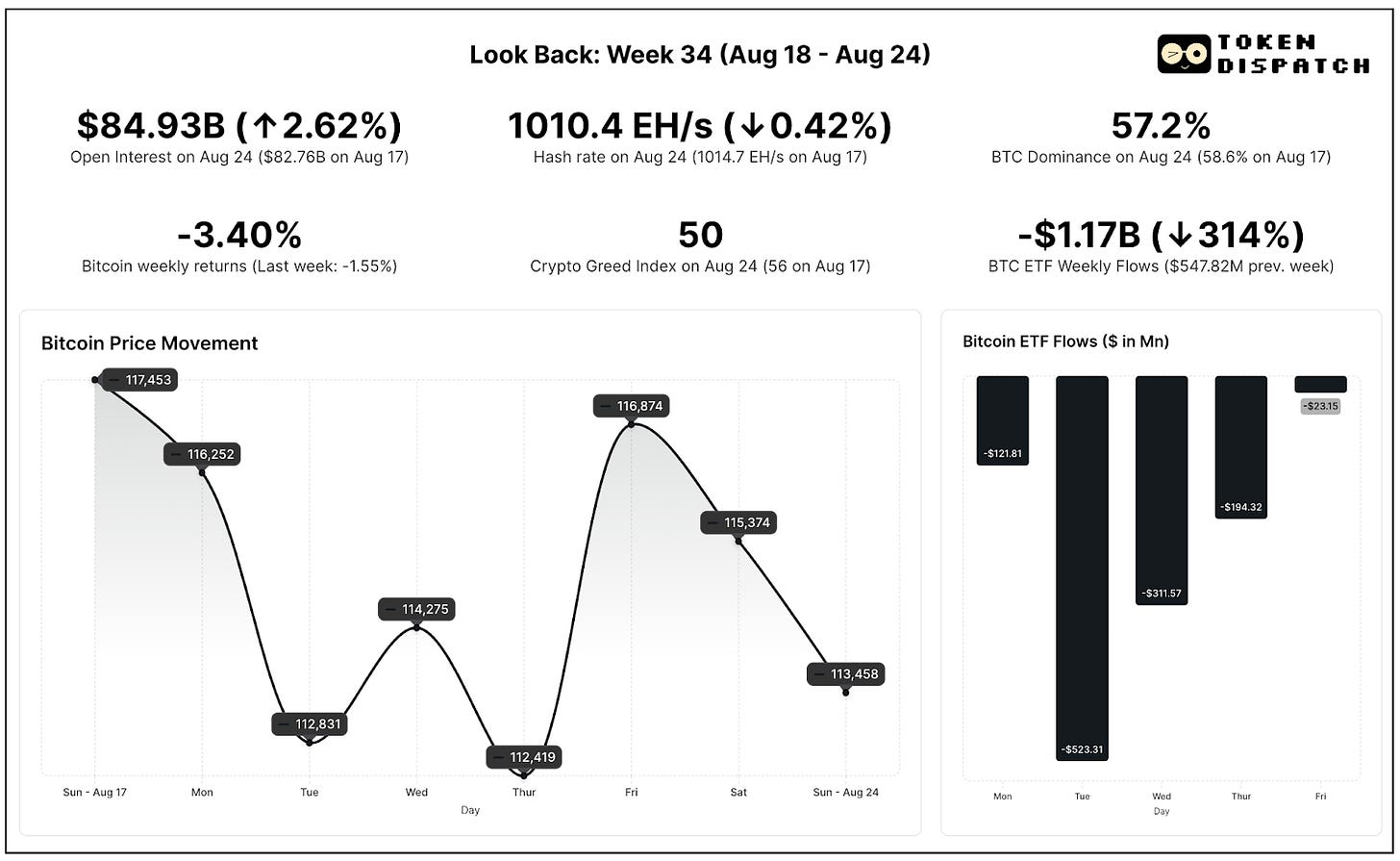

We're looking at Week 34 of 2025 (August 18-August 24):

Bitcoin ETFs bleed, record the second worst week

Fed hints at cuts but tariff-driven inflation uncertainties lurk

MVRV cools, exchange inflows rise, and sentiment flips

Riot rallies 17% while Circle loses nearly a third in two months

DeFi Won’t Stay Manual for Long

Spreadsheets, manual looping, and Twitter signals are already falling behind.

The next edge is vibecoding DeFi strategies with Almanak's AI agents that can research, optimise, and execute on-chain strategies better and faster than any human desk.

It’s the shift from human-driven DeFi to machine-accelerated DeFi. Smarter trades. Lower risk. Higher consistency.

The market’s vote of confidence? Almanak’s Round on Legion got oversubscribed in 45’ and is currently still open.

Join the wave that’s redefining how DeFi gets done.

⚡ See why

Week That Was

Bitcoin started the week on the back foot, slipping further under $117,000 to levels last seen in early July. At its lowest, the price touched $110,680 on Sunday, a level last seen on July 10. That’s an 11% pullback from the preceding week’s $124,474 peak.

Open interest climbed 2.6% to $84.9 billion even as Bitcoin lost 3.4% on the week, showing traders kept positions open rather than unwinding, a sign of hedging and cautious positioning. Hashrate barely moved, underscoring that miner commitment hasn’t wavered despite thinner rewards amid tariff uncertainties.

Bitcoin dominance also slipped to a seven-month low at 57.2% as more institutions and whales moved capital to Ethereum as the second largest cryptocurrency recorded a new all-time high. Bitcoin’s Greed Index slipped further in the neutral territory to close the week at 50.

Macro headlines dictated much of the week.

At Jackson Hole, Fed Chair Jerome Powell admitted inflation was “close to target” but stressed that the full impact of US President Donald Trump’s tariffs had yet to filter through supply chains. That caveat unsettled markets.

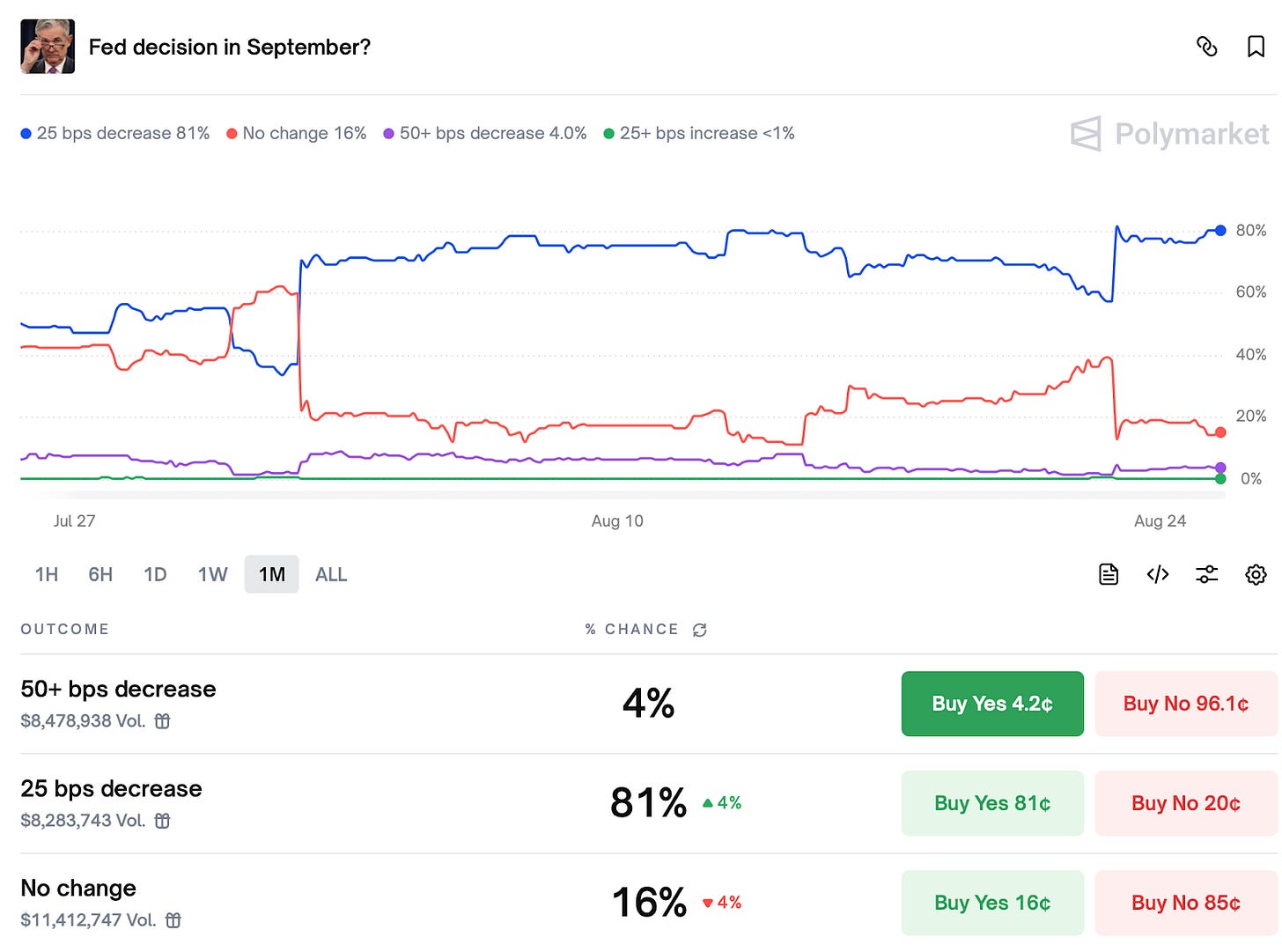

If tariff-driven inflation flares in the coming months, the Fed may have less room to ease than traders expect. Uncertainty over how sticky tariff inflation could be, left investors second-guessing risk assets. Yet, rate cut expectations for September peaked at 85% during the week on Polymarket with over $45 million riding on the trade.

Although Bitcoin made some recovery above $113,000 late Sunday, it dropped below $111,500 again in the early hours today.

On-chain data and other Bitcoin metrics showed that it is likely more than a correction.

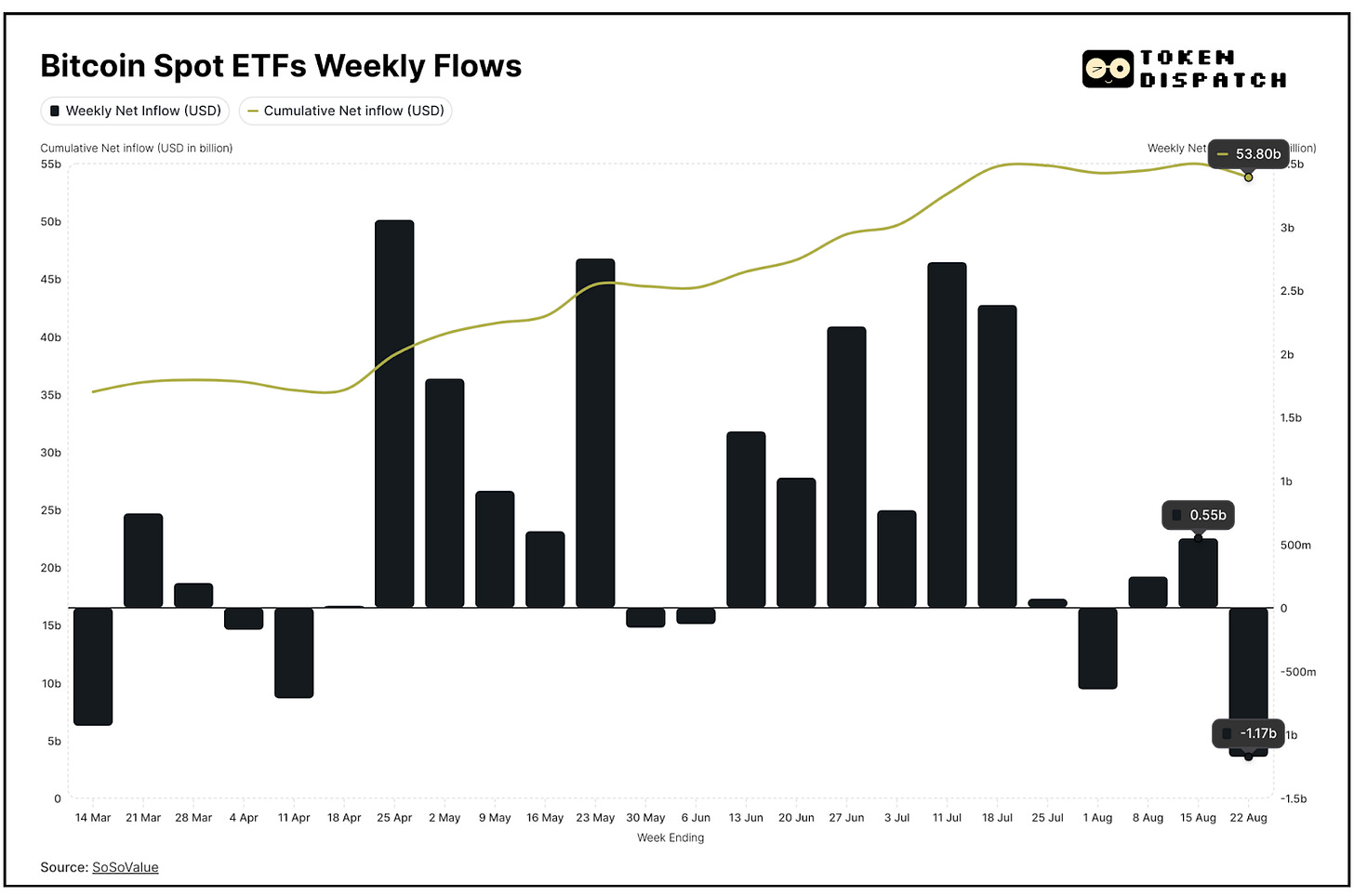

Bitcoin exchange-traded funds reflected the bearish sentiment. Spot Bitcoin funds shed $1.17 billion in outflows, their second worst week since launch.

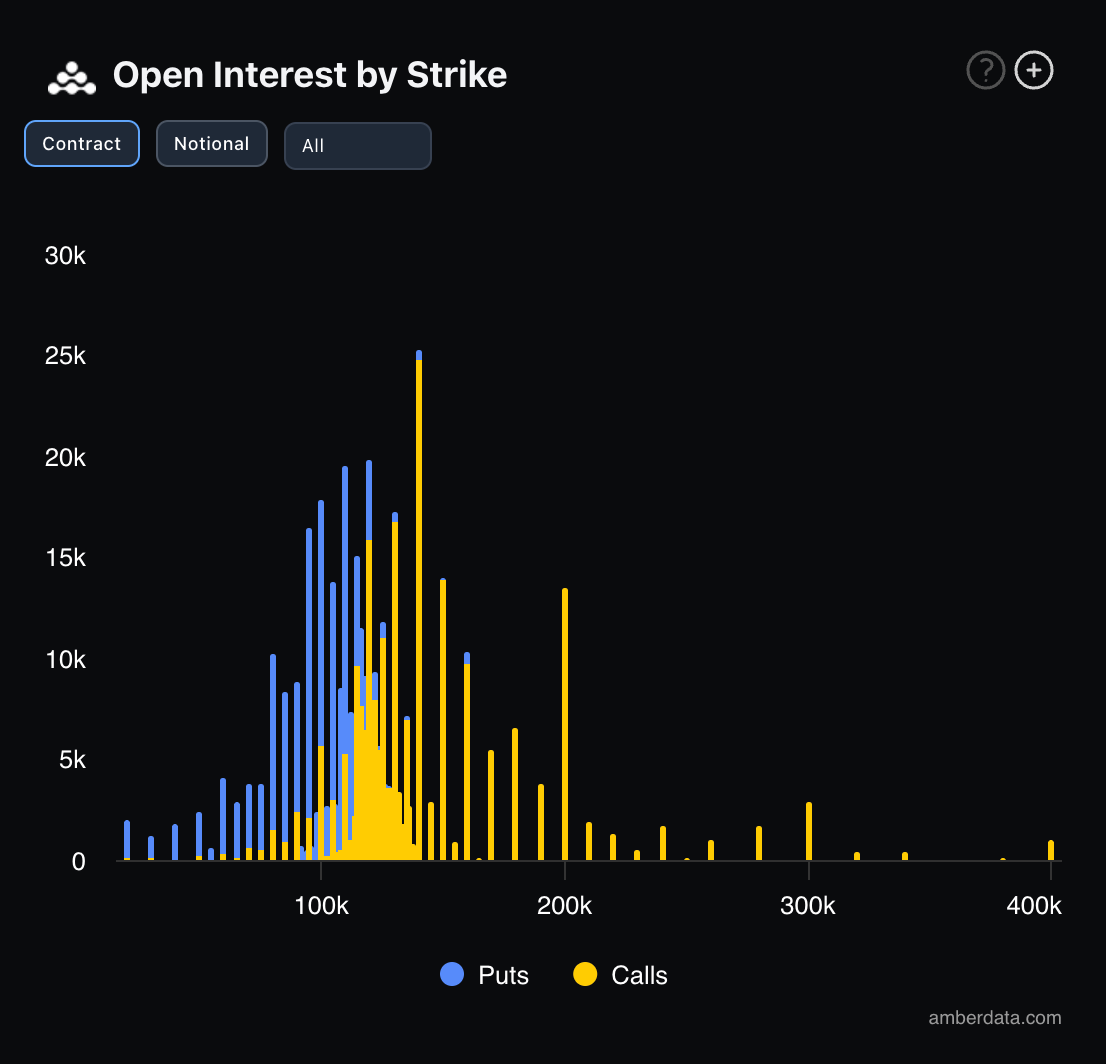

Institutional positioning is cautious on the derivatives front too.

Options data from Deribit shows open interest stacked tightly around $110K and $120K strikes, likely creating a limiting range for Bitcoin price.

Bitcoin balance in exchanges also aligned with this sentiment.

Exchange inflows saw a net addition of 14,526.62 BTC to their total balance in the last seven days, out of which half were moved just in the last 24 hours. This reflects that investors moved coins back to venues to sell.

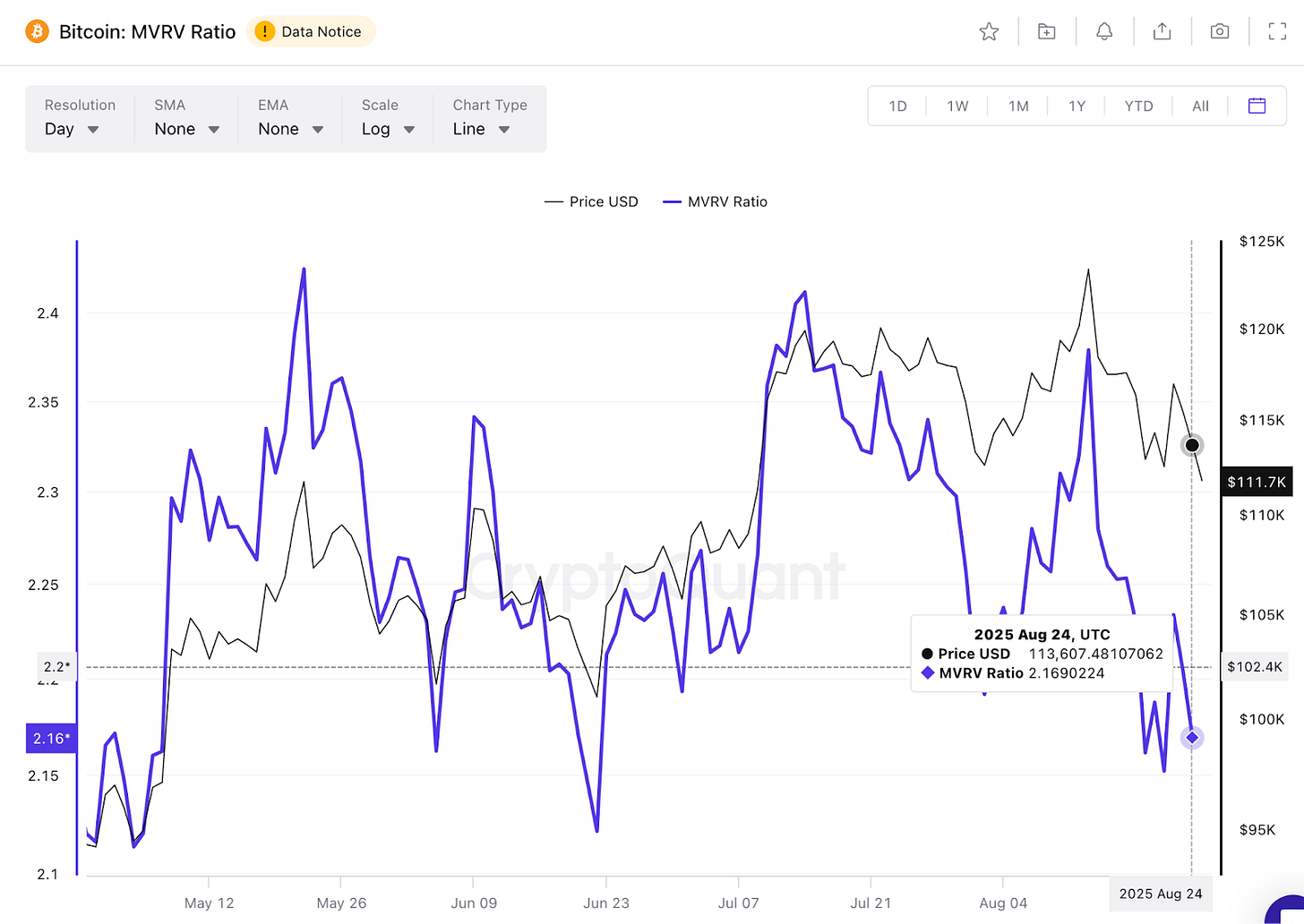

At the same time, Bitcoin’s MVRV ratio cooled from 2.37 to 2.17 in the past 10 days. That’s a relief, yet a signal that Bitcoin could likely face more sell-pressure since long-term holders are still comfortably in profit due to an elevated market value.

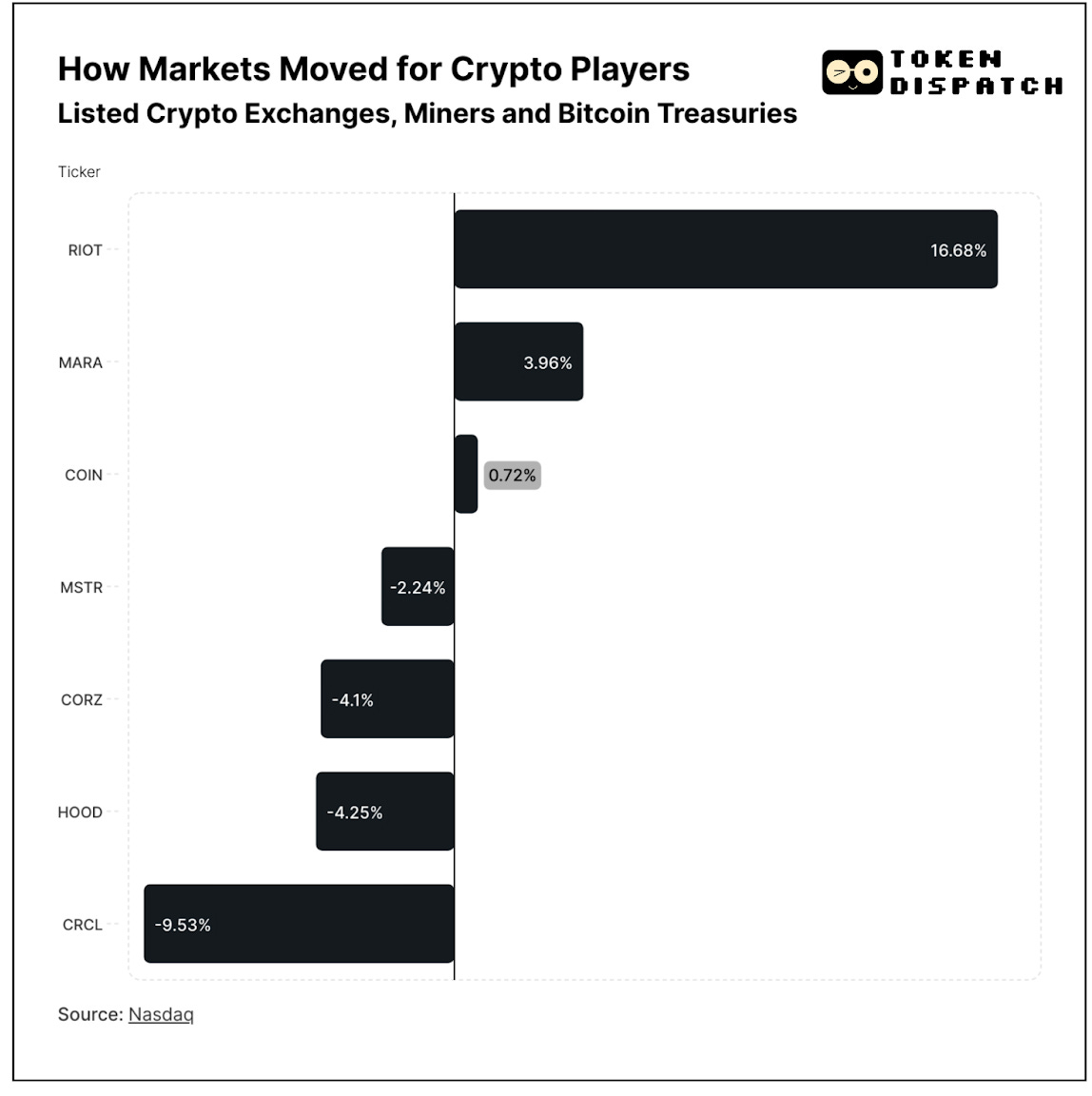

Crypto equities had a split week, reflecting the same push and pull seen in Bitcoin.

Riot Platforms surged nearly 17% and Marathon Digital gained close to 4%, catching a bid from Powell’s dovish Jackson Hole remarks that briefly boosted risk assets. Coinbase managed a small uptick, while Strategy (MSTR), Robinhood and Core Scientific slipped into the red.

The standout loser was Circle, which has now shed almost a third of its market cap in two months, down another 9.5% this week.

Where does this leave investors?

The market is leaning defensive ahead of September’s Fed meeting. Powell’s Jackson Hole speech has already dangled the carrot: a possibility of a rate cut. And if that easing indeed comes despite the unsettling inflation data, $120K could flip into a support level. If not, $110K becomes the line to defend.

Corrections like these have punctuated every bull cycle. In 2017, Bitcoin fell 36% in September before rallying to fresh highs. In 2021, a 50% dip through the year set up the final run to $69K. The data suggests we are in that window: profit-taking has slowed, fear is back, and miners are under pressure. For long-term holders, that’s often been the recipe for accumulation.

Surfer 🏄🏾♂️

An Arizona collector won nearly $115,000 in Bitcoin after buying a $13 pack of Cardsmiths trading cards at GameStop, scoring a rare 1 BTC redemption card. This marks at least the third full Bitcoin prize pulled from the series in the past year, with odds of such a win at 1 in 192 packs.

Bitcoin mining difficulty surged to a record 129.6992 trillion, up 6.4% in 90 days, even as miner revenues fell due to low fees and tougher margins. New tariffs on imported mining equipment add further cost pressures, with major US miners facing multimillion-dollar liabilities.

Metaplanet now ranks seventh globally among public Bitcoin treasuries after it purchased 103 more Bitcoin for $11.7 million, raising its total holdings to 18,991 BTC. This helped the Japanese Bitcoin treasury firm upgrade to mid-cap status on the island-nation’s FTSE index.

Crypto Asia Picks Pace

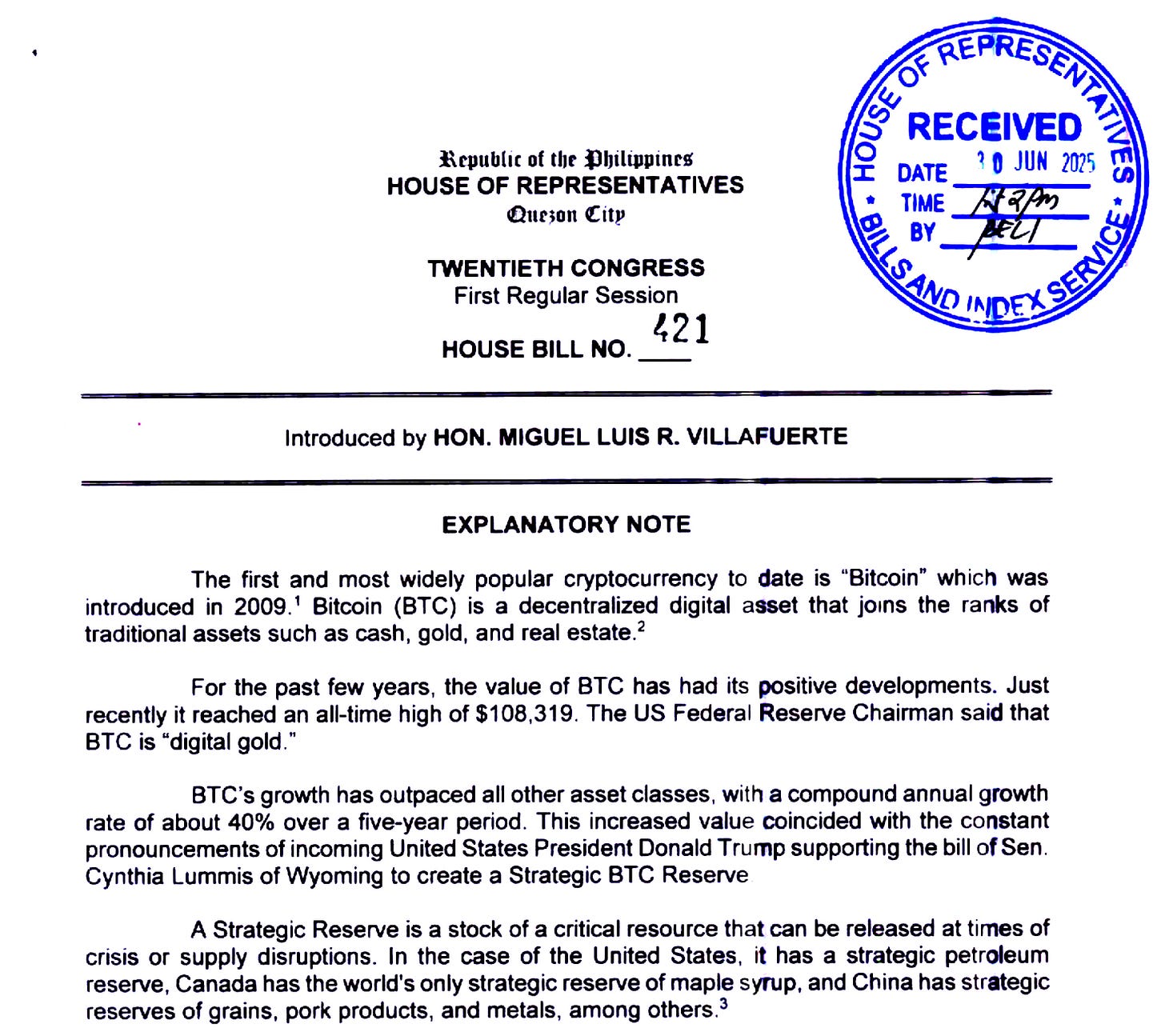

The Philippines is weighing a Strategic Bitcoin Reserve with a new bill that proposes the central bank buy 10,000 BTC over five years and lock it away for two decades. This would obligate the government to hold the Bitcoin and not sell it in any circumstance except to pay off government debt.

If passed, it would make the Philippines one of the first Asian countries to legislate a sovereign Bitcoin stockpile, with strict rules for custody, audits, and disclosure.

Unlike the US or Germany, which built their reserves through seizures, this plan requires scheduled purchases. If this bill materialises, the Philippines will be the only other nation, besides El Salvador, to buy Bitcoin by a dollar-cost averaging approach.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The rotation from BTC to ETH by major institutions signals a new phase for digital asset allocations. Subscribers recently received an in-depth technical breakdown of MVRV and on-chain signals behind these trends. For a future feature: which institutional rotation or allocation model would you most like to see investigated?