Tokenisation Is Moving Into the Core of Financial Markets

How regulators are letting tokenised assets into collateral and settlement systems

Hello,

This week, two decisions by US regulators changed where tokenised assets can be used in financial markets.

The Commodity Futures Trading Commission (CFTC) said that Bitcoin, Ethereum, and USDC can now be used as collateral in regulated derivatives markets. Around the same time, the Securities and Exchange Commission (SEC) allowed the Depository Trust & Clearing Corporation (DTCC) to test tokenised settlement systems without taking enforcement action.

These decisions are not about promoting crypto or making it easier for retail users to trade. They are more concerned with whether tokenised assets are reliable enough to be used in parts of the financial system that manage risk.

Collateral and settlement are core functions. Collateral is what traders post to cover losses if markets move against them. Settlement is the process by which trades are completed, and money actually changes hands. If an asset is allowed in these areas, it means regulators are comfortable with how it behaves during stress.

Until now, tokenised assets mostly operated outside these core systems. They could be issued and traded, but they were not trusted inside margin systems or settlement workflows. That limited how far tokenisation could realistically go.

What changed this week is that regulators are starting to allow tokenised assets into these central layers. This article explains why they started with collateral and settlement, what these approvals actually allow, and what kind of tokenisation is now taking shape as a result.

Polymarket: where your predictions carry weight.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions are integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Why Collateral Is the First Place Regulators Allow Tokenisation

To understand why the CFTC decision matters, you first need to understand how collateral actually functions inside derivatives markets.

In derivatives markets, collateral does one very specific job: it limits losses before they spread.

When a trader opens a leveraged position, the clearinghouse does not care about the trade’s thesis. It cares about whether the posted collateral can be sold fast enough, at a known price, to cover losses if the position moves against the trader. If that sale fails, the loss does not stay with the trader. It moves to the clearing member, then to the clearinghouse, and eventually to the broader market.

This is why collateral rules exist. They are designed to prevent forced liquidations from turning into systemic shortfalls.

For an asset to qualify as collateral, clearinghouses evaluate four things in practice:

Liquidity: Can it be sold in large size without freezing the market?

Price reliability: Is there a continuous, globally referenced price?

Custody risk: Can the asset be held without operational failure?

Operational integration: Can it plug into margin systems without manual intervention?

Most tokenised assets failed this test for years, even if they traded actively on exchanges. Because trading volume alone is not enough. A clearinghouse margin account is a controlled environment with strict custody, reporting, and liquidation rules. Assets that cannot meet those standards simply cannot be used there, regardless of demand.

The CFTC decision matters because it changes what clearing members are legally allowed to accept as margin in regulated derivatives markets. In these markets, collateral is not a flexible input. Clearing members operate under strict rules around what assets they can hold on behalf of clients, how those assets are valued, and how they are treated under capital requirements. Even if an asset is liquid and actively traded, it cannot be accepted as margin unless regulators explicitly permit it. Until this decision, that restriction applied to crypto assets.

With the CFTC’s guidance, Bitcoin, Ethereum, and USDC can now be used within existing margin frameworks, subject to defined risk controls. It removes a regulatory constraint that previously prevented institutions from integrating these assets into their derivatives operations, regardless of demand or market depth.

Margin systems depend on continuous pricing, predictable liquidation, and operational reliability during stress. Assets that cannot be valued intraday, require discretionary handling, or settle slowly create risk that clearinghouses are designed to avoid.

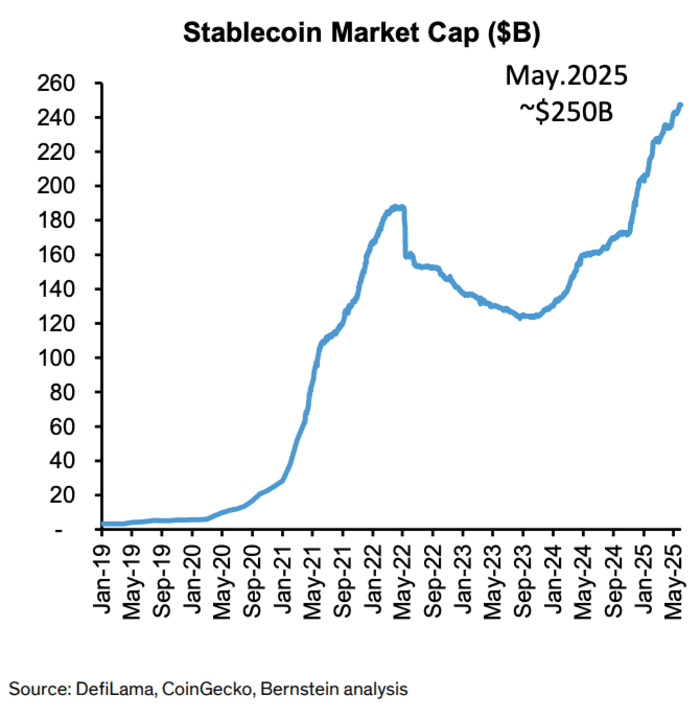

USDC qualifies under these criteria because it already supports large, repeated transactional flows. Stablecoin supply has increased from roughly $27 billion in 2021 to over $200 billion today, and on-chain transfer volumes now exceed $2 trillion per month. These volumes reflect routine movement of funds across exchanges, trading desks, and treasury operations. From the perspective of a margin system, this matters because USDC can be transferred at any time, settles quickly, and does not depend on bank operating hours or correspondent networks. That makes it usable for margin calls and collateral adjustments without modifying existing processes.

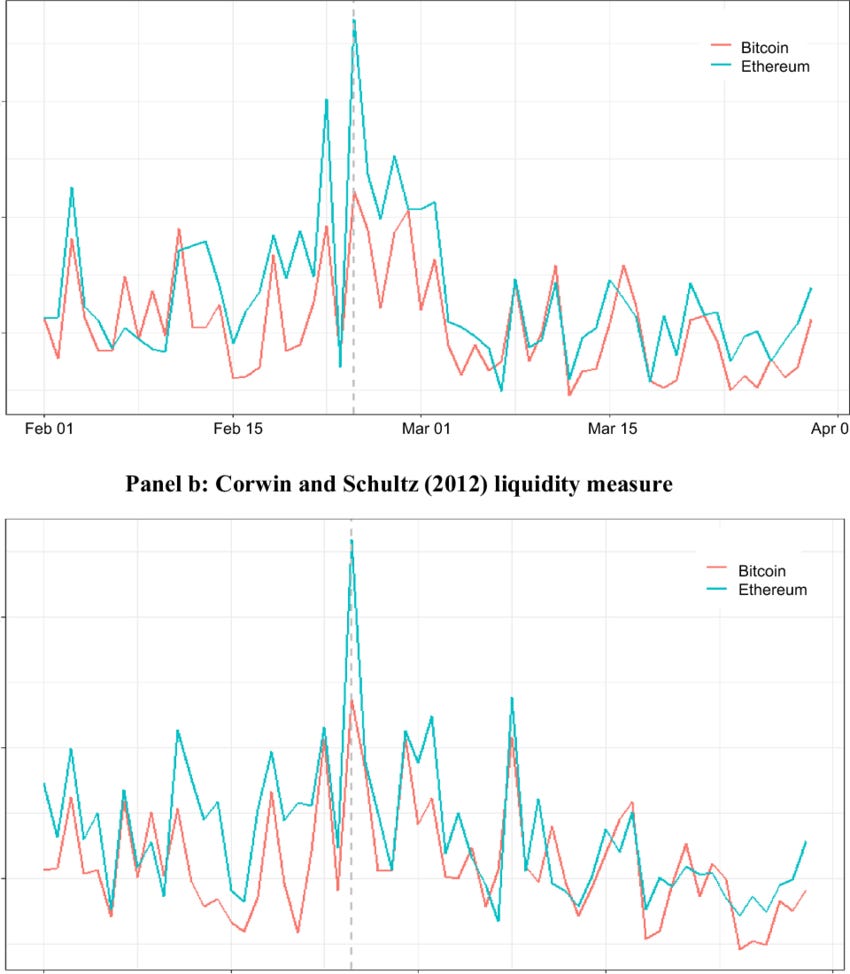

Bitcoin and Ethereum meet a different set of requirements. Both assets are volatile, but volatility itself is not disqualifying in derivatives markets. What matters is whether price risk can be managed mechanically. Bitcoin and Ethereum trade continuously across multiple venues, have deep liquidity, and reference prices that are broadly consistent. This allows clearinghouses to apply haircuts, calculate margin requirements, and execute liquidations using established models. Most tokens do not meet these conditions.

This also explains why regulators did not begin with tokenised equities, private credit, or real estate. Those assets introduce legal complexity, fragmented pricing, and slow liquidation timelines. In margin systems, delayed liquidation increases the likelihood that losses move beyond the original counterparty. For that reason, collateral frameworks always start with assets that can be priced and sold quickly under stress.

The outcome of the CFTC decision is therefore narrow but meaningful. A limited set of tokenised assets can now be used directly to absorb losses in leveraged markets. Once assets are permitted to play that role, they become part of how leverage is extended and constrained across the system. At that point, the main limitation is no longer whether these assets are eligible, but how efficiently they can be moved and settled when margin needs to be adjusted.

The CFTC’s guidance changes that constraint for a narrow set of assets. Bitcoin, Ethereum, and USDC can now be used within existing margin frameworks, subject to standard risk controls like haircuts and margin buffers. This does not create a new system, but it allows these assets to plug into one that already exists.

Margin systems are built around three requirements: continuous pricing, predictable liquidation, and operational reliability during stress. Assets that cannot be valued intraday, require manual intervention, or settle slowly introduce risk precisely when systems are under pressure. That is why most tokenised assets remain excluded.

USDC meets these requirements because it already operates at transactional scale. Stablecoin supply has grown from roughly $27 billion in 2021 to over $200 billion today, and on-chain transfer volumes now exceed $2 trillion per month. These are not one-off speculative movements. They reflect repeated fund transfers across exchanges, trading desks, and treasury operations. For margin systems, this matters because USDC can be moved at any time, settles quickly, and does not depend on bank operating hours. That makes it usable for margin calls and collateral adjustments without altering existing workflows.

Bitcoin and Ethereum qualify under a different logic. Volatility is not a disqualifier in derivatives markets. What matters is whether price risk can be managed mechanically. Both assets trade continuously across venues, have deep liquidity, and reference prices that are broadly consistent. This allows clearinghouses to apply haircuts, calculate margin requirements, and execute liquidations using established models. Most other tokens cannot meet these conditions.

This also explains why regulators did not begin with tokenised equities, private credit, or real estate. Those assets introduce legal complexity, fragmented pricing, and slow liquidation timelines. In a margin system, slow liquidation increases the chance that losses move beyond the original counterparty. Collateral frameworks, therefore, always start with assets that can be priced and sold quickly under stress.

The result of the CFTC decision is narrow but important. A small set of tokenised assets can now be used directly to support leveraged positions in regulated markets.

Settlement Is Where Capital Actually Gets Trapped

Collateral decides whether leverage can exist. The settlement decides how long capital stays locked once it does.

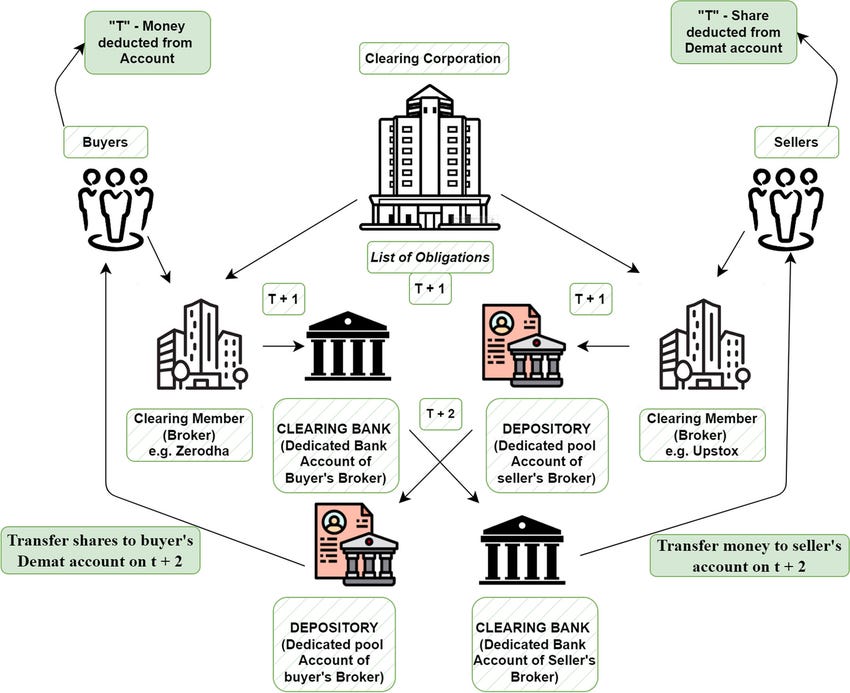

In most financial markets today, trades do not complete instantly. After a trade is agreed, there is a delay before ownership changes and cash is delivered. During this period, both sides have exposure to each other, and both sides must hold extra capital to cover that risk. This is why settlement speed matters. The longer the settlement takes, the more capital stays idle as protection rather than being reused.

This is the problem that tokenisation is trying to solve at the infrastructure level.

The Depository Trust & Clearing Corporation (DTCC) sits at the centre of this process for US securities markets. It is responsible for clearing and settlement across equities, bonds, and funds. If DTCC cannot process a transaction, the market effectively cannot move forward. That is why changes at this layer matter more than changes at trading venues or applications.

The Securities and Exchange Commission (SEC) no-action letter allows DTCC to test tokenised settlement systems without triggering enforcement action. This is not a green light for crypto trading. It is permission to experiment with how trades are settled, recorded, and reconciled, using tokenised representations instead of traditional ledgers.

The key issue DTCC is addressing is balance-sheet efficiency.

Under current settlement models, capital is tied up during the settlement window to protect against counterparty failure. That capital cannot be reused, pledged, or deployed elsewhere. Tokenised settlement shortens or removes that window by allowing near-immediate transfer of ownership and cash. When settlement happens faster, less capital needs to sit idle as insurance.

This is why settlement is a much bigger constraint than most people realise. Faster settlement does not just reduce operational overhead. It directly affects how much leverage the system can support and how efficiently capital circulates.

This is also why regulators are comfortable starting here. Tokenised settlement does not change what is being traded or who is allowed to trade it. It changes how obligations are fulfilled after the trade is done. That makes it easier to test inside existing legal frameworks without redefining securities law.

Importantly, this approach keeps control where regulators want it. Settlement remains permissioned. Participants are known. Compliance checks still apply. Tokenisation is used to compress time and reduce reconciliation, not to remove oversight.

When you connect this back to collateral, the sequence becomes clear. Assets can now be posted as margin, and regulators are testing systems that allow those assets to move and settle faster once positions change. Together, these steps reduce the amount of capital that needs to sit idle in the system.

At this stage, tokenisation is making existing markets consume less capital to do the same amount of work.

What Kind of Tokenisation Is Actually Being Allowed

At this point, it becomes clear that regulators are not deciding whether tokenisation should exist. They are deciding where it is allowed to sit in the financial stack.

The answer so far is consistent. It is being accepted where it reduces operational friction without changing legal ownership, counterparty structure, or control. Wherever tokenisation tries to replace those things, it slows down or stops.

You can see this clearly in where real volume has accumulated.

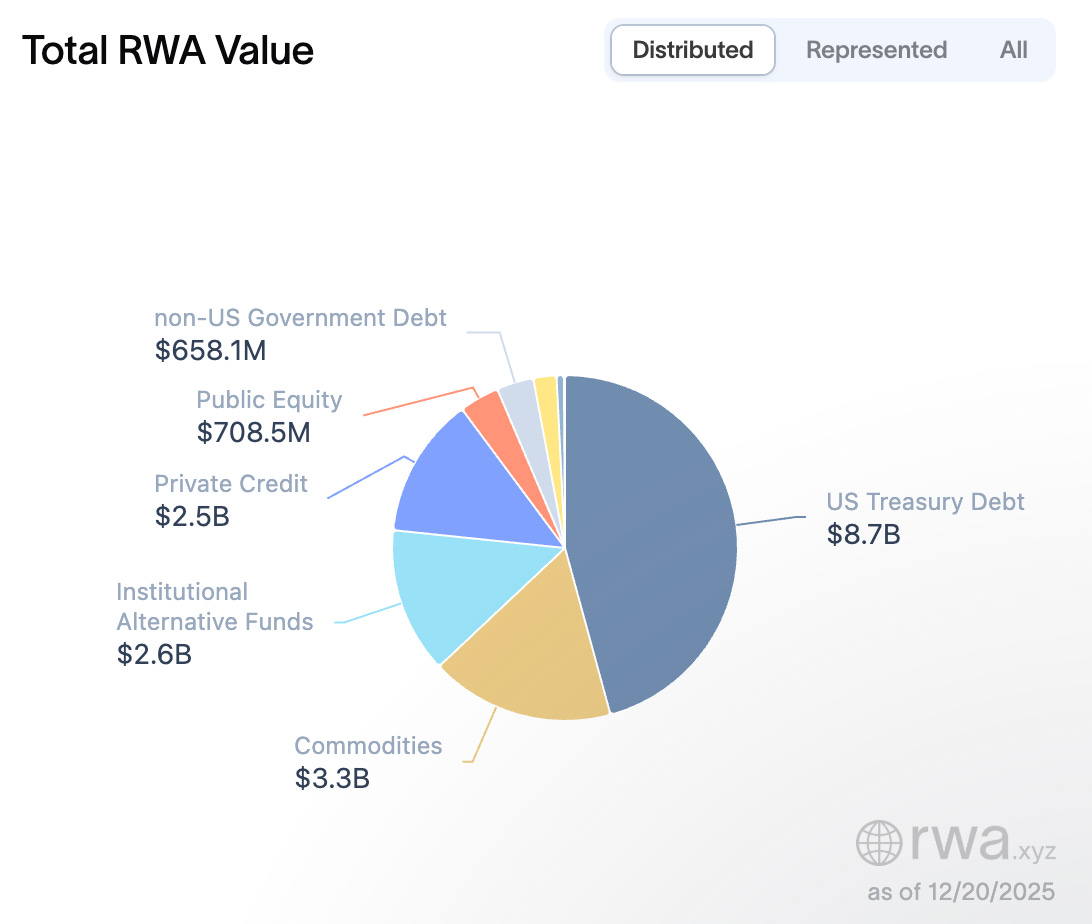

Outside of stablecoins, the largest tokenised asset category today is tokenised US Treasuries. The total value is still small relative to traditional markets, but the growth pattern is important. These products are issued by regulated entities, backed by familiar assets, and redeemed at net asset value. They do not introduce new market structure. They compress existing ones.

The same pattern shows up across other tokenised products that have survived contact with regulators. They share a few common characteristics. Issuance is permissioned. Holders are known. Custody is handled by regulated intermediaries. Transfers are restricted. Redemption is clearly defined. These constraints are what allow tokenisation to exist inside regulated markets without breaking existing rules.

This is also why many early attempts at permissionless real-world asset tokenisation stalled. When tokens represent claims on off-chain assets, regulators care less about the token and more about the legal enforceability of that claim. If ownership, priority, or liquidation rights are unclear, the token cannot be used in any system that manages risk at scale.

In contrast, the tokenised products that are scaling today look intentionally boring. They mirror traditional instruments closely and use blockchains primarily for settlement efficiency, transparency, and programmability at the infrastructure layer. The token is a wrapper, not a reinvention of the asset.

This framing also explains why the regulatory moves around collateral and settlement came before broader tokenised markets. Allowing tokenisation at the infrastructure layer lets regulators test the benefits without reopening questions about securities law, investor protection, or market structure. It is a controlled way to adopt new technology without redesigning the system.

When you connect all, Tokenised assets are being allowed into the system from the bottom up. First collateral. Then settlement. Only after those layers are proven does it make sense to expand into more complex instruments. . It also suggests that the version of tokenisation likely to scale is not open, permissionless finance replacing existing markets. But It is more regulated finance using tokenisation to move faster, lock up less capital, and reduce operational drag.

That was all for today. See you next Sunday.

Until then, stay Curious!

Vaidik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.