Hello!

Crypto raised $23B in VC funding in 2022. Last year? $6B. The party's over, but that's not necessarily bad news.

Check out yesterday’s edition to know more about why crypto VC needed this reality check.

Welcome to Mempool - your weekly market and news insights on Bitcoin.

We're looking at Week 23 of 2025 (Jun 02-Jun 08)

Bitcoin records a sharp reversal from Trump-Musk feud

Bitcoin ETFs see second straight week of outflows

Half of corporate Bitcoin treasuries face liquidation risk

Circle's Wall Street debut inspires more IPO filings

The Week That Was

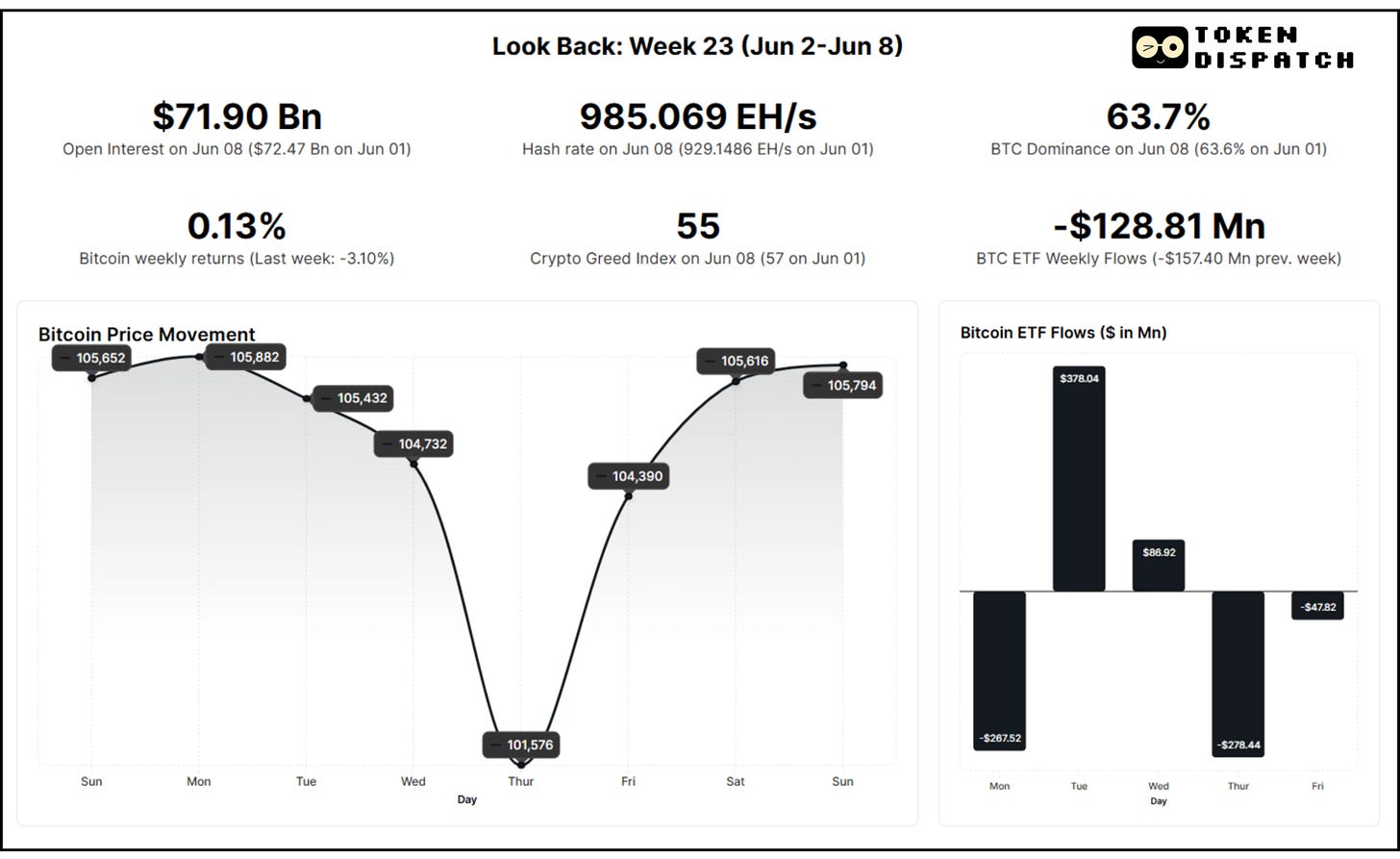

Bitcoin closed the week at around $106,000 with a deceptively modest 0.13% weekly gain that masks one of the most dramatic intraweek fall-and-rise episodes in recent memory.

The cryptocurrency weathered a storm of political chaos as the public feud between US President Donald Trump and Tesla CEO Elon Musk got uglier with each passing day hour.

The drama escalated throughout the week, with Trump threatening "serious consequences" for Musk if he financially backed Democratic candidates, while firmly dismissing any possibility of mending their relationship.

Musk fired back by claiming Trump's plan for sweeping global tariffs "will cause a recession in the second half of this year" and threatening (in a tweet which he later deleted) to decommission SpaceX's Dragon spacecraft — the only US-made option for sending astronauts to space.

The break-up even triggered a 17% drop in Tesla’s stock price in two trading sessions.

The weekend brought additional drama as Trump authorised the deployment of 2,000 National Guard troops to Los Angeles amid immigration-related unrest.

Yet these events couldn’t stop Bitcoin from bouncing back. The cryptocurrency showed a V-shaped recovery within a day on the back of Friday’s better-than-expected May jobs report.

Open Interest declined marginally. Bitcoin dominance increased one basis point, reinforcing its status as the preferred safe haven within the crypto ecosystem.

The Crypto Greed Index retreated two points and stayed within "neutral" territory throughout the week despite the political theatrics.

ETF flows turned negative for the week at -$128.81 million.

Price Chart Analysis

Anybody who didn’t track the events of the week could be excused for believing that Bitcoin price moved just 0.13% in the entire week.

Behind the marginal weekly gain is hidden a more-than-4% slide from $105,000 to $100,500 that was triggered in just a few hours, courtesy the spat between the world’s most powerful president and its richest.

The drop also saw Bitcoin falling below the $103,000 support level it had not breached in more than two weeks. It also threatened falling below $100,000, a level last seen a month ago.

But the June 6 jobs data by the Labor Department put Bitcoin back on a quick reversal to $105,000 which it managed to hold through the weekend.

What remained as a resistance level, $107,000, for more than 10 days, was finally breached in the early hours of Monday (June 9).

Key Technical Levels

Support level: $100,500 (Thursday low)

Critical Range: $103,000-$105,000 (where most of the week's drama unfolded)

The week's price action ultimately demonstrated that while political theatre can create short-term chaos, economic data and fundamental market forces continue to drive Bitcoin's longer-term trajectory.

The fact that Bitcoin closed the week near its highs despite experiencing one of its most dramatic political stress tests to date speaks to the cryptocurrency's evolving institutional acceptance.

Circle Debuts Big as ETF Flows Persist in Red

The USDC issuer’s explosive NYSE debut stole the crypto spotlight this week, with shares continuing to surge into Friday.

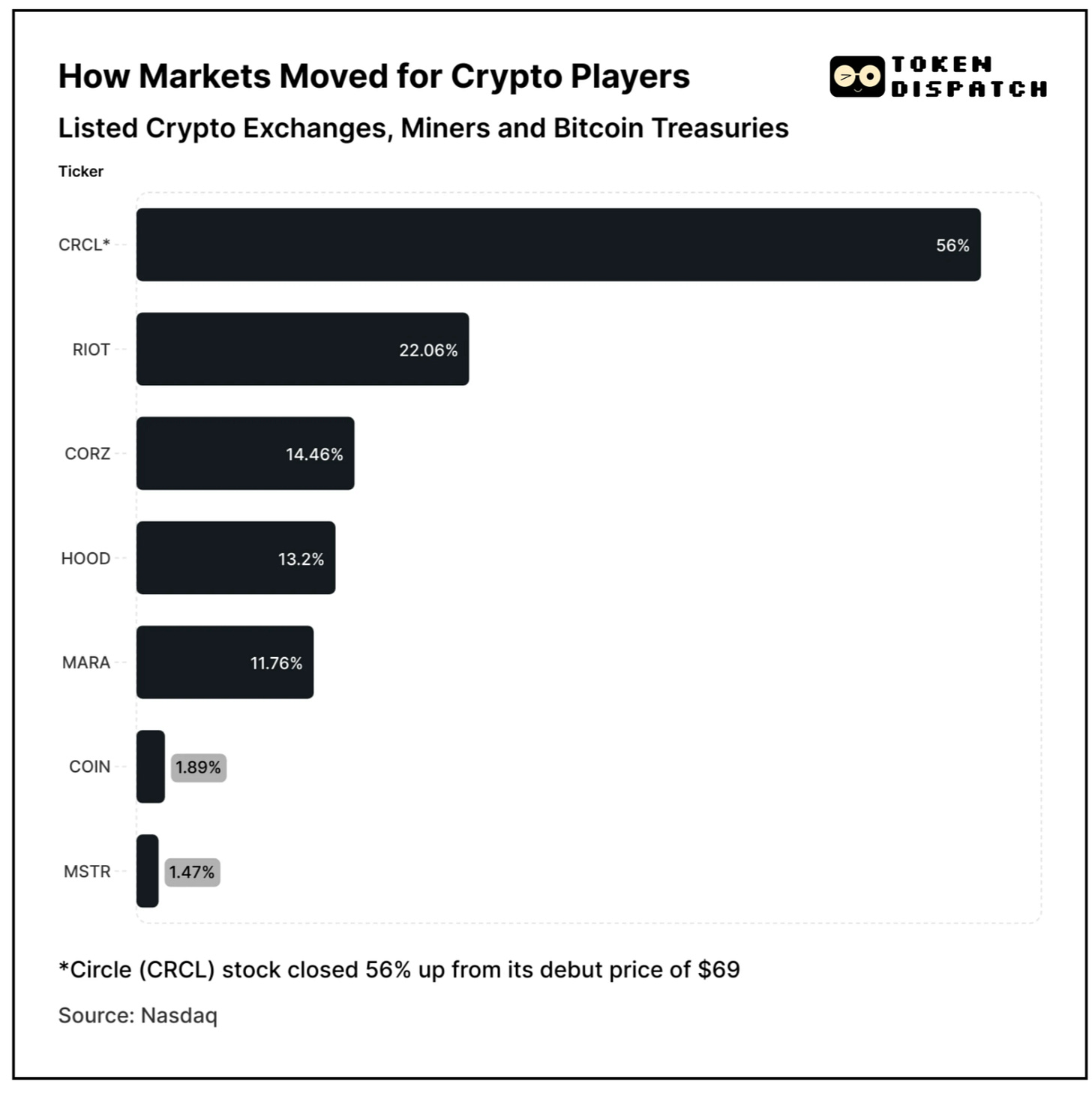

The stablecoin giant opened at $69 and touched a high of $123.49, nearly quadrupling its $31 IPO price and creating a market cap exceeding $32 billion. CRCL dominated crypto equities with a 56% weekly gain from its open price.

The IPO euphoria spread across crypto stocks, with Riot Platforms, Core Scientific, Robinhood and Marathon Digital recording double-digit gains.

Coinbase and Strategy managed marginal gains.

Circle's success encouraged Gemini announcing its own IPO filing just 24 hours later, signalling a potential reopening of the crypto IPO window.

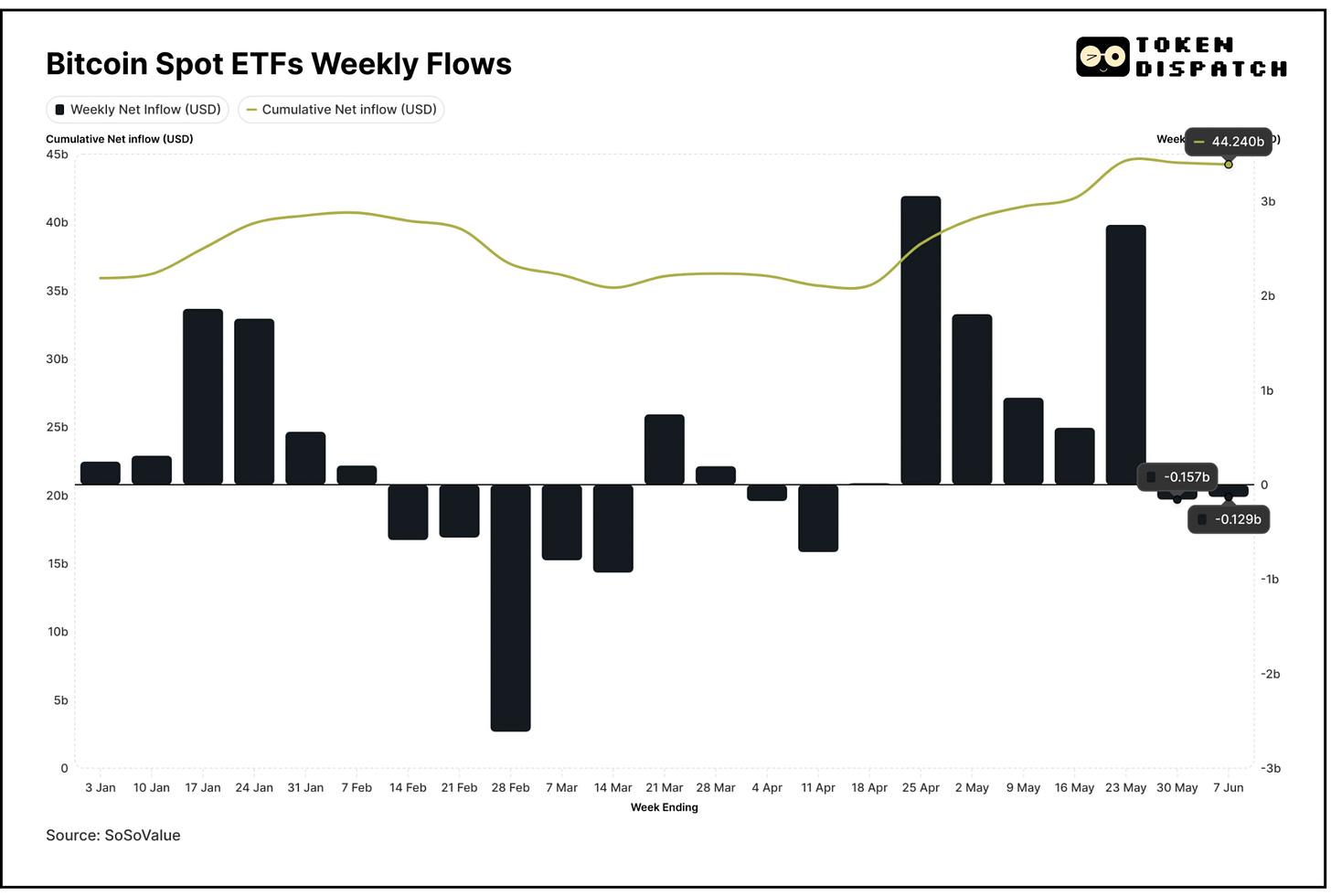

Meanwhile, Bitcoin ETFs recorded second consecutive week of outflows. Cumulative ETF inflows since launch now hover around $44.24 billion, well below February peaks.

The BTC Treasury Trap

While 61 publicly traded companies have jumped on the Bitcoin treasury bandwagon, doubling their holdings to nearly 100,000 BTC in just two months, Standard Chartered analyst Geoffrey Kendrick warns they've walked into a potential trap.

These Strategy "imitators" have set their average purchase prices much higher than Michael Saylor's pioneering company, with roughly half of all non-crypto public company Bitcoin treasuries now sitting at average cost bases above $90,000.

Compare it with Saylor’s Strategy whose average BTC acquisition cost is $70,023, more than 34% below current price.

This means if Bitcoin falls below $90,000 — just ~15% from current prices — about half of these corporate treasuries would be underwater.

The irony: while these companies adopted Bitcoin treasury strategies to hedge against traditional financial risks, they may have created new ones. Kendrick notes that "Bitcoin price volatility in and of itself may drive the BTC price below the average purchase prices of many new treasuries," potentially forcing liquidations at precisely the wrong time.

Kendrick remains bullish on Bitcoin's long-term prospects though. He predicts it could reach $500,000 by the end of Trump's second term.

Surfer 🏄

A solo Bitcoin miner operating under the Solo CK pool mined block 899,826, earning a $330,386 reward despite record network difficulty of 126.98 trillion, likely using a rented hashrate of 259 PH/s to secure the win. With increasing difficulty, solo wins are expected to get rarer.

Bitcoin’s supply on exchanges has dropped below 11% for the first time since 2018, driven by institutional withdrawals and growing long-term holding, signalling a potential supply shock. This trend reduces available BTC for trading and could fuel price volatility and upward momentum.

The Bitcoin network’s seven-day average transactions recently dropped to around 317,000, the lowest since October 2023, despite BTC trading near all-time highs. Bitcoin Core developers urged miners to continue relaying low-fee transactions to preserve network censorship resistance amid declining transaction demand.

Token Dispatch View 🔍

Bitcoin's performance last week revealed how political theatre and fundamental economics converged to test the asset's evolving institutional identity. The fact that BTC emerged largely unscathed from one of the most dramatic political feuds in recent memory signals a maturation in its asset quality seen never before.

The immigration-related unrest was an additional stress test for Bitcoin's "digital gold" narrative amid uncertainty. Bitcoin’s swift recovery despite all these events showed its resilience despite the political noise.

Circle's IPO debut highlighted a key market dynamic: Wall Street's appetite for crypto infrastructure vastly exceeds demand for direct Bitcoin exposure.

While ETFs saw their second consecutive week of outflows, Circle's near-quadrupling of its IPO price validated the thesis that regulated stablecoin infrastructure could be key to mainstream adoption.

What This Means for Investors

Watch the $103,000 support level closely: This has become a critical threshold for Bitcoin and a fall below this could accelerate further sell-off toward the $100,000-mark.

Track Circle's performance: CRCL's sustained success could unlock the IPO window for other crypto firms like it did for Gemini.

Bitcoin's ability to maintain six-figure pricing while navigating political chaos, treasury accumulation risks, and shifting institutional could mark its evolution from speculative asset to a much more robust financial infrastructure.

That's it for this week's Mempool edition.

See ya, next Monday.

Until then … stay sharp,

Prathik

P.S. Forward this dispatch to fellow investors who need edge in their crypto portfolio. They'll thank you when our next call plays out.

Don't forget to whitelist thetokendispatch+mempool@substack.com to ensure you’ve got me each week in your primary inbox.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.