Trump vs Powell Battle Puts Bitcoin To Test

As the US President clashes with the Federal Reserve Chair, cryptocurrency stands a chance to gain from the institutional chaos.

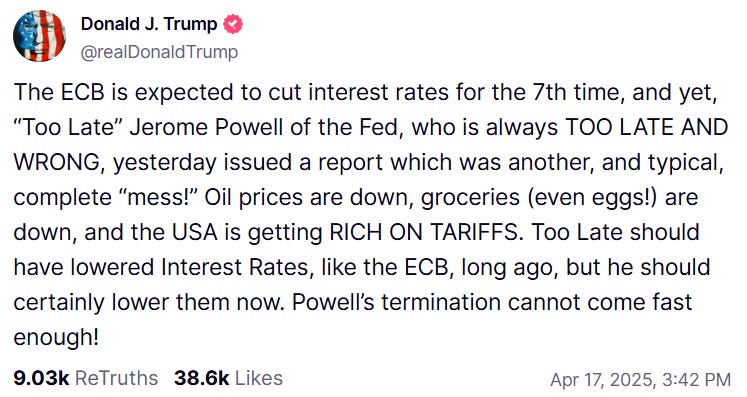

US President Donald Trump has escalated his feud with Jerome Powell, declaring on social media that the Fed Chair’s "termination cannot come fast enough."

Powell's speech at the Economic Club of Chicago this week triggered Trump's fury.

The Fed chair warned that Trump's proposed tariffs would cause "higher inflation and slower growth" — a direct challenge to the administration's economic narrative.

"Tariffs are highly likely to generate at least a temporary rise in inflation," Powell told the audience, maintaining the Fed's cautious approach to interest rates despite Trump's demands for immediate cuts.

The public disagreement raises profound questions about Fed’s independence. The Federal Reserve Act allows governors to be removed only "for cause" — traditionally interpreted as serious misconduct, not policy disagreements.

"The president can nominate me, but cannot fire me," Powell previously stated, though a pending Supreme Court case could potentially reconsider this precedent.

Senator Rick Scott (R-Fla.) has joined Trump's criticism, calling Powell "a failure" who oversees a "wildly unaccountable" institution.

As this power struggle unfolds, US banking regulators are already pivoting toward a more crypto-friendly stance:

The Office of the Comptroller of the Currency has rescinded restrictive guidance, allowing national banks to engage in crypto custody

The FDIC now permits state nonmember banks to conduct crypto business without prior notification

The SEC has removed requirements for banking organisations to recognise crypto-assets on their balance sheets.

Only the Federal Reserve — Powell's domain — maintains a more cautious approach.

The administration has already established a Strategic Bitcoin Reserve through executive order, signalling its embrace of digital assets and creating strange bedfellows between Trump and crypto advocates.

The conflict represents what crypto idealists have long warned about: centralised powers battling for control while markets suffer the consequences. With inflation at 2.4% and interest rates between 4.25% and 4.5%, the stage is set for a potential economic turning point.

If Trump successfully influences Powell or replaces him before his term expires in May 2026, monetary policy could shift. Such a scenario would test whether Bitcoin truly functions as an inflation hedge or merely amplifies market volatility.

For cryptocurrency markets, the stakes couldn't be higher: This institutional conflict could either validate their founding philosophy or expose fundamental contradictions in the "digital gold" narrative.

"The greatest irony would be if Bitcoin — created as a response to the 2008 financial crisis and centralised control — ends up becoming a political football in the very institutional battles it was designed to transcend." Financial historian Niall Ferguson recently noted.