Two Michaels One Bitcoin 🛒

Michael Dell’s Bitcoin post leads BTC purchase speculations. Spot Ethereum ETF issuers post disclosures. Solana ETF in Canada? $2T RWA tokenisation market - McKinsey. Why Do Kwon fled to Montenegro?

Hello, y'all. Two to tango 👐

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Michael Dell posts about Bitcoin.

CEO of Dell Technologies.

Worth $120+ billion.

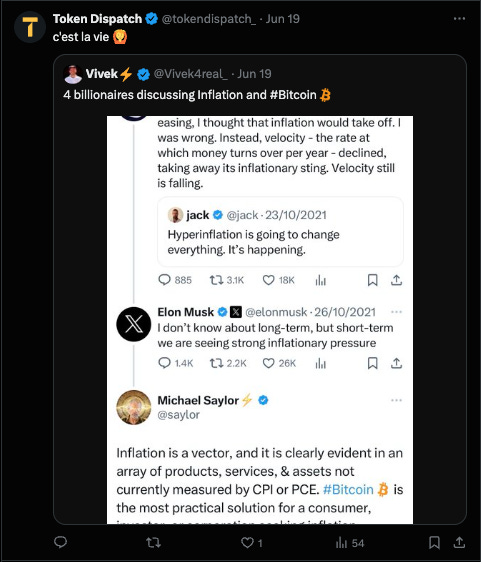

The tweet drew the attention of Michael Saylor.

The in-your-face advocate for Bitcoin as a corporate treasury asset.

Dell's $2.1 billion cash out

Dell's recent financial moves provide a strong backdrop for this potential investment into Bitcoin.

Dell Technologies’ stock has appreciated nearly fivefold since its return to the public market in December 2018.

In the past 18 months, the company’s Class C common stock has surged from $40 to $145 per share.

Quadrupling Dell’s net worth to around $120 billion, making him the 14th richest person globally.

In 2024, Dell has cashed out $2.1 billion while retaining 58% of the company's ownership.

Why? The negative impact of US dollar’s value in the future against the backdrop of rising US debt

So what? He has excess capital available to deploy into the Bitcoin market.

What if Dell Technologies' portfolio goes 1% Bitcoin?

Joe Consorti presents an interesting argument.

An analyst at the Bitcoin Layer - a global macro research firm.

Bitcoin can benefit from corporations like Dell Technologies.

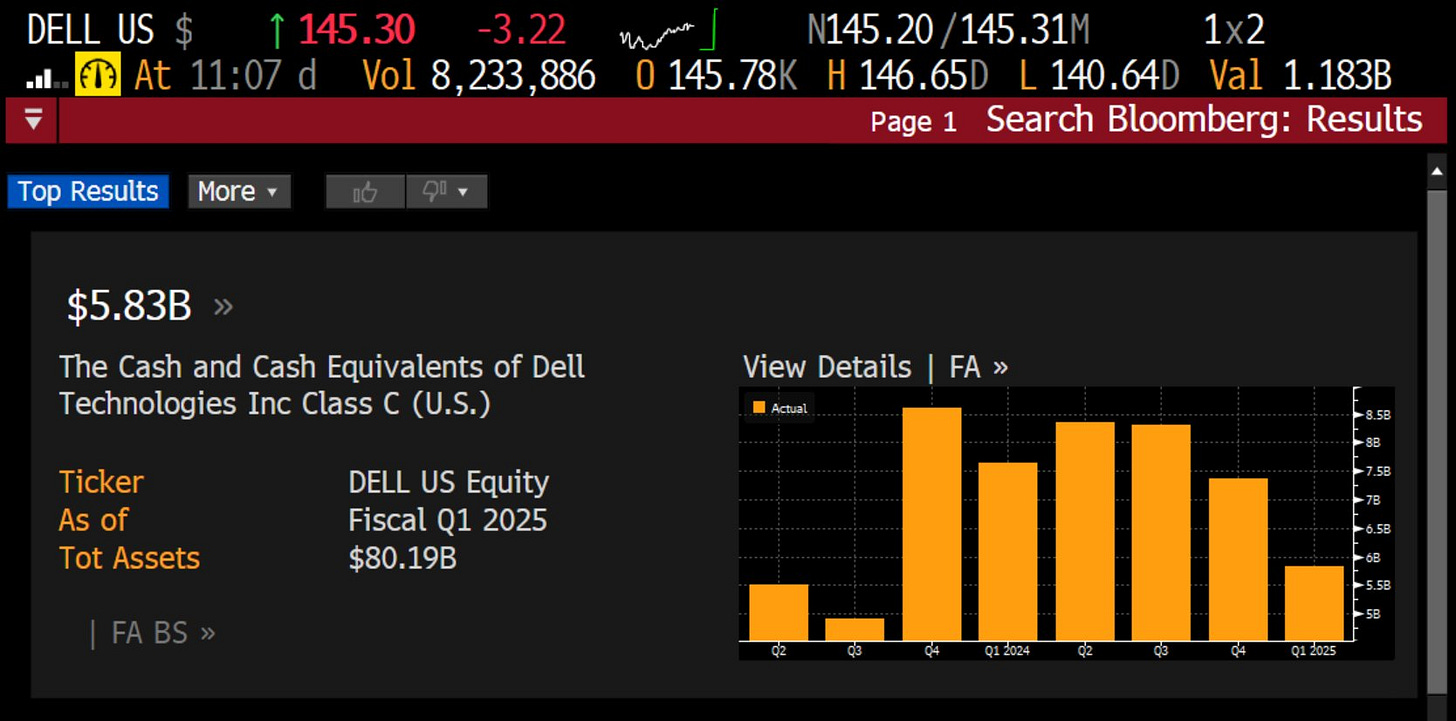

"Dell is sitting on $5.83 billion in cash to make that happen … Outsized returns on their reserves during this AI boom will provide a further buffer for capital allocation during a time when spending and scaling in computer manufacturing haven’t been this rapid or hotly contested in decades.

If Dell Technologies allocates 1% of its $5.83 billion cash reserves to Bitcoin, it amounts to $58.3 million.

Based on Bitcoin's historical annualised returns of approximately 103.5% over the past decade - the investment could potentially see this investment grow to $118.7 million in just one year

MicroStrategy Bitcoin blueprint

Corporations can benefit from Bitcoin investment.

Saylor’s MicroStrategy is a great example.

Profit of approximately $6.33 billion from its strategic Bitcoin investments.

"You're simply not working in the best interest of your shareholders if you ignore this without reason. Bitcoin is the single best asset to position yourself in for outsized risk-adjusted returns over any multi-year timeframe" - Consorti’s assessment

Read: Bitcoin Treasuries 💵 - Is Bitcoin investment a trend for listed companies?

Arthur Hayes, the former CEO of BitMEX, predicts that Bitcoin will surge due to the financial struggles of Japanese banks.

Banks' difficulties will lead to increased demand for Bitcoin, driving up its value.

Bitcoin as a safe-haven asset during times of economic uncertainty.

Increased demand will drive up the value of Bitcoin, to a new all-time high.

Bitcoin options market: Indicating a strong bias towards $100,000 calls despite the recent price weakness.

Market participants are not buying into the current price decline and are instead anticipating a significant increase in Bitcoin's value.

Demand for calls at $100K suggests traders preparing for a renewed rally into 2025, according to one trading firm.

Spot US Bitcoin ETFs continue to bleed: Outflows of around $550 million in the last trading week.

More reasons for Bitcoin decline: Nasdaq just notched its seventh straight record high — why hasn’t Bitcoin budged?

Block That Quote 🎙️

CEO of Dell Technologies, Michael Dell.

“Scarcity creates value.”

Phrase associated with Bitcoin due to its supply cap of 21 million tokens against rising demand.

An interesting exchange followed - two Michaels buying one Bitcoin.

Are billionaires finally coming for Bitcoin? All that money pouring in.

Can’t escape the irony.

Spot Ethereum ETF Issuers Post Disclosures

Documents released by Bloomberg analyst Eric Balchunas show 👇

Eight spot Ethereum ETF applicants, have submitted updated versions of their S-1 documents - Bitwise, Fidelity, VanEck, Franklin, 21Shares, Grayscale, BlackRock, and Invesco.

The show has begun?

Disclosed the fees for their upcoming products.

Franklin Templeton set its fee at 0.19% for its Ethereum ETF.

VanEck disclosed its fee would be set at 0.20%.

Balchunas thinks that low fees "add a touch of pressure on BlackRock to stay under 30bps at least." He expects Ethereum ETFs to have fees as low or even lower than Bitcoin ETFs.

Grayscale Ethereum Trust faces comparative disadvantag: Due to the lack of staking. The trust's structure does not allow for staking, which is a key feature of many other Ethereum ETFs.

Staking is a key feature of many Ethereum ETFs, allowing investors to earn passive income by holding and validating transactions on the Ethereum network.

The lack of staking in Grayscale's Ethereum Trust could make it less attractive to investors compared to other ETFs that offer this feature.

3iQ files for Solana ETF in Canada

Canadian digital asset manager 3iQ has filed a preliminary prospectus with Canadian securities regulators to launch a Solana-based exchange-traded fund (ETF). The proposed fund would provide investors with exposure to the Solana cryptocurrency.

In The Numbers 🔢

$2 trillion

Value of tokenised asset market by 2030, as per McKinsey & Company's latest report. A base case scenario, significantly lower than other predictions.

Reports from Boston Consulting Group and 21Shares forecasted over $10 trillion of tokenised assets by the end of the decade in their optimistic scenarios

What does the report say?

Broad adoption 'still far away': Citing a slower pace of adoption by financial institutions and a limited range of assets being tokenised.

Adoption is expected to happen in waves: Led by assets like mutual funds, bonds, and loans, while slower for real estate, commodities, and equities

Challenges for the growth: Need for significant blockchain integration with existing processes and standards, as well as favourable regulations and industry collaboration.

Favourable conditions required: Accommodating regulations, industry-wide collaboration, and no systemic events hindering adoption for $4 trillion bullish scenario for the tokenised asset market by 2030.

Why did Do Kwon Flee To Montenegro?

US court filings reveal Montenegro’s Prime Minister Milojko Spajic personally invested in Terraform Labs crypto holdings in 2018.

Long before the company’s algorithmic stablecoin TerraUSD and reserve asset Luna collapsed in 2022.

Wiping out tens of billions of dollars worth of market capitalisation.

Spajic's $75,000 investment: Invested $75,000 in Terraform Labs in April 2018, one of the first 16 investors in the project. At peak, the investment was worth $90 million.

Spajic's previous denials: Spajic had denied any personal involvement in the investment, claiming that a company he worked for, Das Capital SG, made the investment. SEC documents contradict this claim, listing Spajic as a direct investor.

Political fallout: Revelation has led to calls for Spajic's resignation from Montenegro's political opposition. His LinkedIn page shows he worked in Singapore's financial industry from 2014 to late 2020, during which time the investment was made.

Terraform Labs' legal troubles: Filed for Chapter 11 bankruptcy earlier this year and must pay the US Securities and Exchange Commission $4.47 billion in penalties. Do Kwon, the founder, must pay another $204 million.

The Surfer 🏄

Standard Chartered is creating a Bitcoin and Ethereum trading desk in London, making it one of the first global banks to enter spot crypto trading. The new desk will begin trading soon and will be part of the Forex trading unit, supporting institutional clients across the digital asset ecosystem.

United States presidential candidate Robert F. Kennedy Jr. has promised to pardon Silk Road founder Ross Ulbricht if elected in November. Kennedy Jr. criticised Ulbricht's two life sentences for hosting an e-commerce platform and shared a petition to demand his release from prison.

American Rapper 50 Cent's X account was hacked, leading to a fraudulent meme coin promotion. He posted a tweet about GUNIT tokens with a link to pump fun. Within half an hour of the post, the market value of GUNIT soared to more than $8 million, 8,000% surge . He quickly deleted the tweet and said on Instagram that his Twitter was hacked and the hacker released this token.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋