Two Roads, One Destination 🛣️

How Coinbase and Robinhood want to win the future of finance

Hello,

Last week, two of new-age finance’s most closely watched companies reported earnings within 48 hours of each other. Both missed revenue expectations. And both were immediately slotted into the same narrative: crypto markets are down, trading volumes are soft, so the good times are behind them.

But this perspective misses the point entirely.

Coinbase and Robinhood’s stocks might move closely in line with Bitcoin’s (BTC) price, but their future trajectories will not be determined by BTC’s performance in Q4. They are soon becoming companies that transcend the narrow categorisation of a company whose fortunes are tied to crypto cycles.

Both companies are undergoing significant transformations — visible in their numbers if you know where to look — which one could entirely miss if they looked at the noisy numbers of the last quarter.

It’s not that hazy, though. Not when you look at the numbers over the past few quarters and compare them with the series of product announcements from both companies in the past 12 months.

The long-term trends of both companies tell us where each is going, what bets they are making on the future of finance, and, crucially, where their paths begin to cross.

In today’s analysis, I will break down each of their stories separately before explaining where they converge and what it reveals about the broader space in which they compete.

Part 1: Coinbase - The Infrastructure Bet

Coinbase’s $667 million net loss in Q4 2025 could make you walk away thinking it had a bad quarter. But numbers need a narrative to be accurately represented. That quarter also saw $718 million in unrealised losses on its crypto holdings and $395 million in markdowns on its Circle investment. Once you adjust for these non-cash, on-paper losses, Coinbase maintains 12 consecutive quarters of adjusted profitability.

It reports $178 million in adjusted earnings and $566 million in adjusted EBITDA (Earnings before interest, taxes, depreciation and amortisation).

While this could be reassuring, there’s something else I find more compelling.

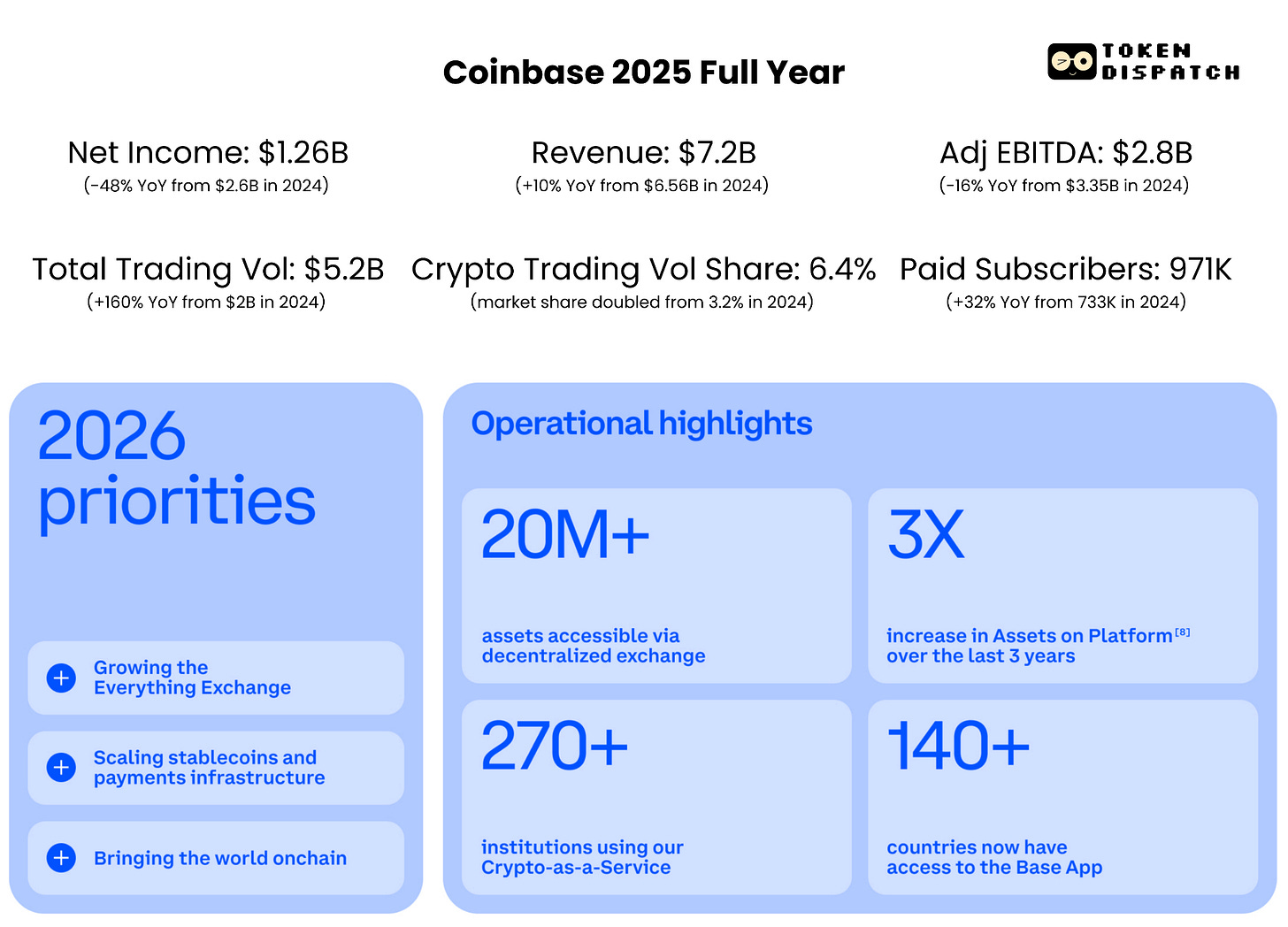

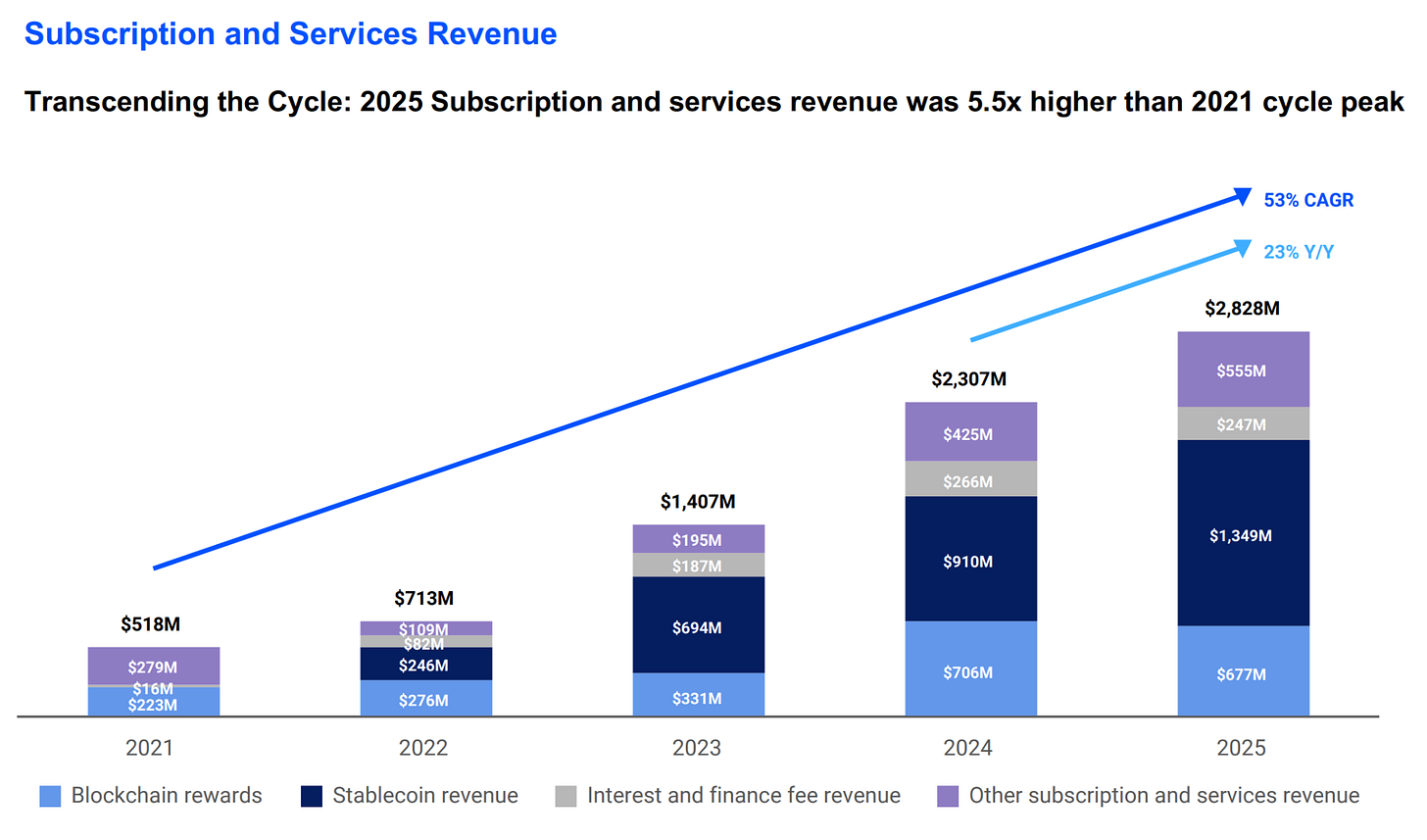

Coinbase’s Subscription and Services (S&S) revenue in 2025 reached $2.8 billion, up 5.5x from the peak of the 2021 cycle and double that of 2023. This shows a broadening revenue base across stablecoins, custody, and blockchain rewards. The USDC held in Coinbase products hit an all-time high of $17.8 billion in Q4, up 18% quarter-on-quarter (QoQ). Coinbase now holds more crypto than any other company in the world, accounting for 12% of global crypto holdings.

However, this revenue is highly sensitive to interest rate changes. Stablecoin yield, staking rewards, and interest income on custodial balances compress when interest rates and crypto prices fall. This is evident from the company’s Q1 2026 guidance, which expects S&S revenue to drop to $550-630 million, down from Q4’s $727 million.

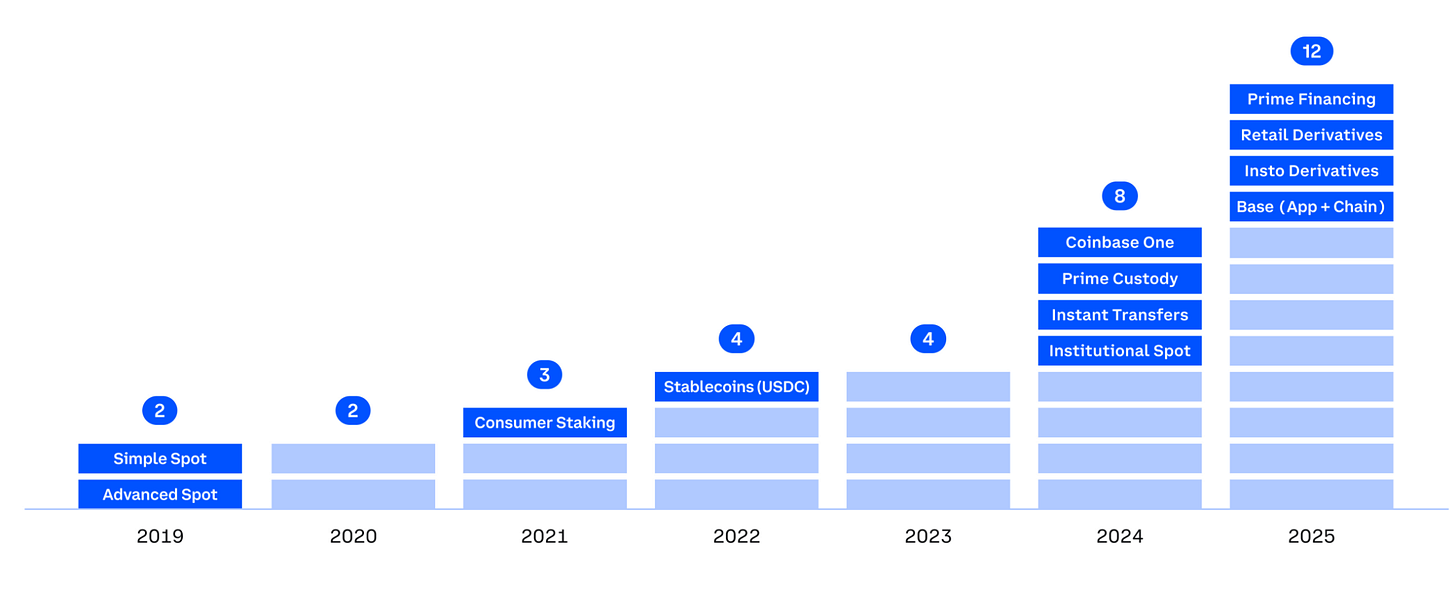

What should give investors confidence is Coinbase’s systematic diversification across multiple business segments, reducing its reliance on crypto cycles. It now has 12 business lines generating over $100 million in annualised revenue, with six over $250 million and two over $1 billion.

Coinbase’s acquisition of Deribit, the largest crypto deal ever, positions the company to capture high-volume derivatives trading, particularly when spot markets are volatile.

Its Everything Exchange vision is starting to show up in places beyond the app in the traditional finance world. Earlier this week, Armstrong tweeted about how five of the world’s largest Global Systemically Important Banks (G-SIBs) are working with Coinbase.

JPMorgan has already signed an agreement that lets customers link their bank accounts directly to Coinbase. BlackRock’s Bitcoin ETF custody runs through Coinbase infrastructure. These experiments are signs that Coinbase’s long-term bet is to become the settlement layer that large institutions can plug into as finance moves on-chain.

Coinbase’s recent launch of prediction markets follows the same pattern for retail customers. Launched two weeks ago, prediction markets extend the Everything Exchange vision by tapping into event-based trading. That’s a whole new asset class, offering Coinbase a new revenue stream and another reason for a customer to keep their assets on Coinbase rather than moving them elsewhere.

Although the near-term numbers for this new business line may be small, the strategic intent is clear. How do I know this? Nowhere else is this clearer than in how prediction markets have become the fastest-growing business line for Robinhood.

Onto that side then…

Part II: Robinhood - The Consumer Depth Play

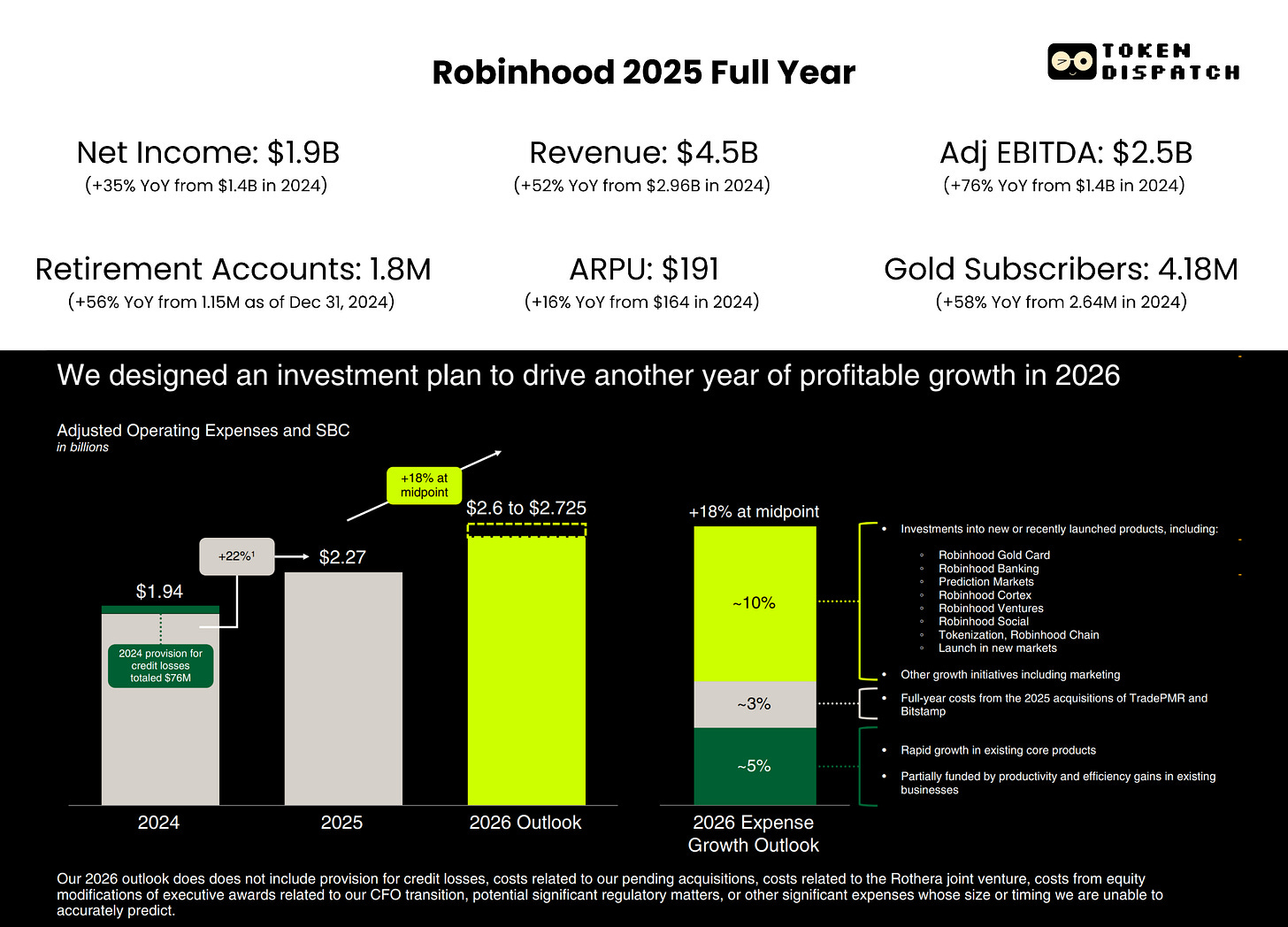

Robinhood’s Q4 was also a good quarter, but it got penalised for the wrong reasons. It missed revenue expectations on the back of lower crypto volumes and the end of the football season, but none of that is the big story for me.

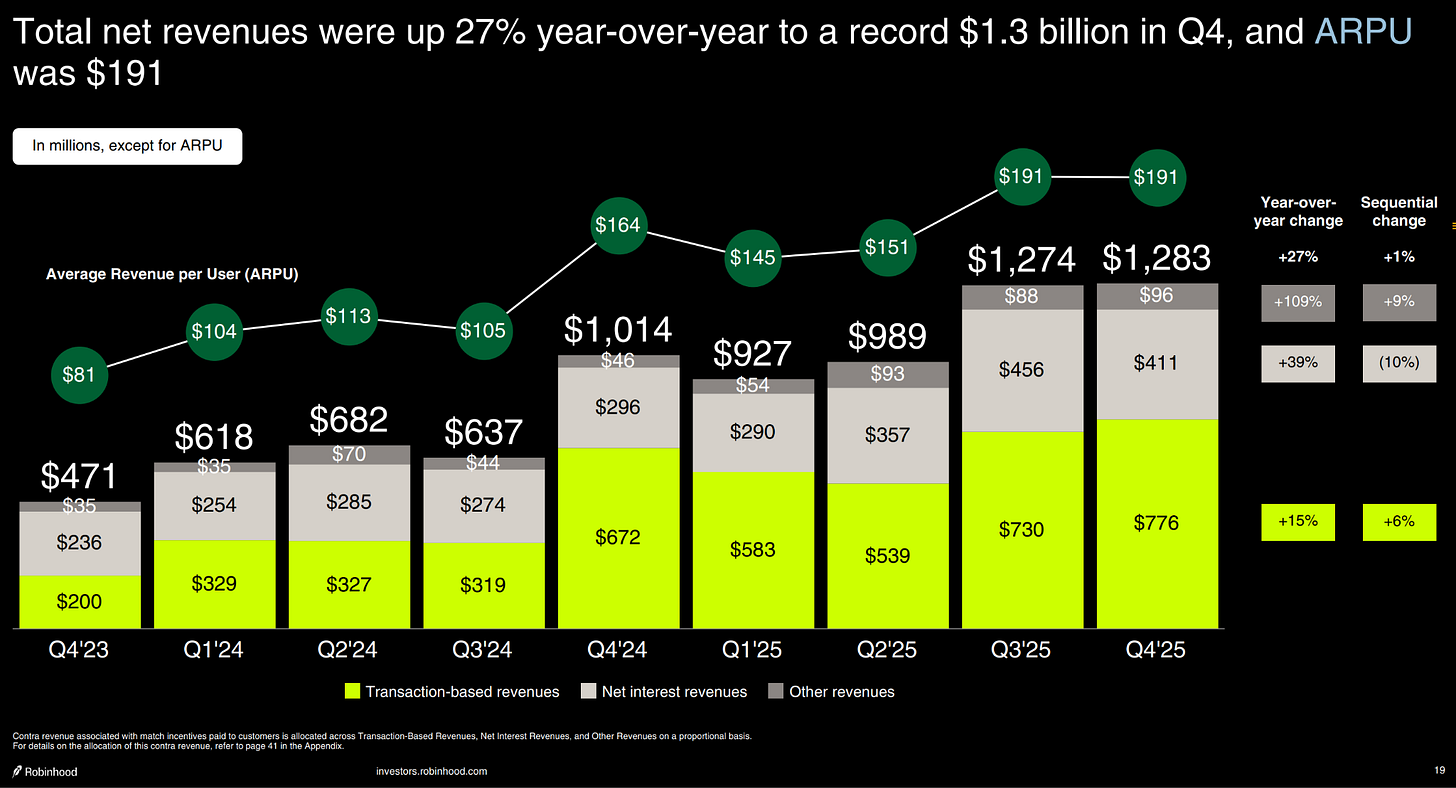

What stands out is its average revenue per user (ARPU) that grew 27% YoY to $191, even as funded customers grew only 7%. It shows that Robinhood is making more money per customer without needing to grow its user base as quickly. This is a much more diverse business model than the one that went public in 2021.

Where is the ARPU growth coming from? Partly from the fastest-growing ‘Other Transaction Revenue’ line that shot up 300% YoY to $147 million, whose primary driver was the prediction markets. Partly also from Options, which grew 41% to $314 million. Some of that is also coming from the growth in net interest income and Gold subscriptions.

While transaction-based crypto revenue grew by over 40% YoY in 2025, Robinhood still derives $8 of every $10 in revenue from non-crypto businesses. This ensures the company is less dependent on crypto cycles.

The $300M Business

The biggest signal for Robinhood’s future trajectory is in the performance of its prediction markets. The fact that CEO Vladimir Tenev called a product line that was less than a year old the fastest-growing business in Robinhood’s history tells us its importance. At a $300 million annualised revenue rate and $12 billion in contract volume in its first year, the acceleration rate is a clear signal of what to expect.

Robinhood has also doubled down on the prediction market play by establishing a joint venture with Susquehanna, Rothera LLC, which acquired MIAXdx in January 2026. The deal gives Robinhood its own CFTC-licensed exchange and clearing house. This layer helps Robinhood build the infrastructure underlying the prediction markets, enabling it to control pricing, contract selection, and the economics of those markets.

Although the NFL season is over, several near-term catalysts make Robinhood’s prediction markets bet more resilient. The NBA contracts outpaced the NFL contracts on the platform in January. A government shutdown drove significant volume in the same week the NFL ended. Then there is the FIFA World Cup this summer, following the Winter Olympics that are now underway. Besides all these, there is an entire non-sports universe that Robinhood has just begun building.

The Diversification Dilemma

There’s something beyond the prediction markets and Robinhood’s current monetisation engine, including options, margin, and Gold subscriptions, that will give its investors more confidence. $HOOD is also building the next layer of distribution via private markets, family investing and banking.

Robinhood Banking launched to its first customers a few months ago. By late January, it had 25,000 funded customers and $400 million in deposits. Over half had enrolled in direct deposit, which is the signal Tenev found most encouraging. It means those customers are moving their financial lives to the Robinhood ecosystem and are no longer experimenting. But $400 million is still a small figure relative to the $324 billion platform. Banking is a long-term build, and Robinhood will have to brace for a rough journey on that front.

While the world is busy building prediction markets, I believe private markets could become the wild card for Robinhood. Something that few would compete in. Tenev also believes private markets could become “bigger than prediction markets”. Robinhood Ventures, the vehicle for giving retail investors access to private companies through registered funds, is yet to launch. But European customers got a taste of it through OpenAI and SpaceX stock token giveaways last year, albeit not without controversy. The U.S. launch is coming in 2026, and the total addressable market is enormous. Tenev repeatedly referenced the $100-trillion generational wealth transfer now underway. If Robinhood can capture even a sliver of that as private assets move from institutional-only to retail-accessible, it will dramatically change the revenue mix.

The bigger challenge for it will be managing the customer expectations by clarifying the thin line between tokenised equity and traditional equity.

Private markets as a revenue line could kick off in 2026, but will likely play out over a longer period.

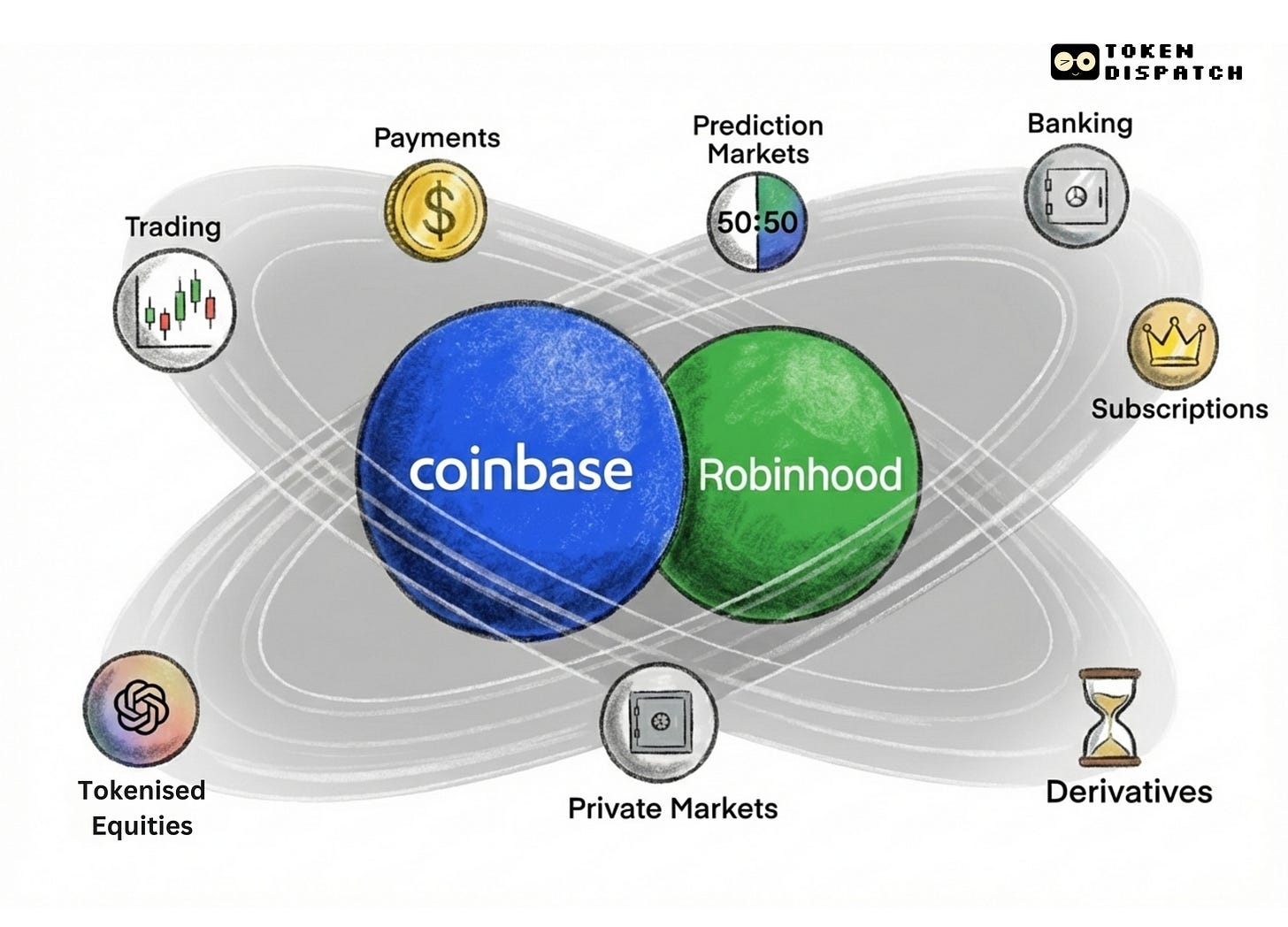

Same Destination, Different Clocks

When you look at Coinbase and Robinhood, they may appear to be taking different paths. Indeed, they are building from opposite ends of the financial spectrum. Yet, today, they are moving towards the common vision of becoming a financial super app. Their recent timelines prove this.

Robinhood entered finance through the traditional door: commission-free stock trading, built for a generation that found legacy brokers too expensive and too complicated. Over five years, it has been layering crypto-native infrastructure on top of that TradFi foundation. It now offers a margin book, a Gold subscription, a card, a banking product, a derivatives exchange, prediction markets, and a tokenisation strategy.

Coinbase was born in crypto, offering the most trusted way to buy, store and trade digital assets at a time when most of Wall Street wouldn’t touch the space. Over the same five years, it has been building outward from that crypto-native core into the consumer products that traditional finance already offers — equities, a subscription product, a credit card, and now prediction markets.

Both are converging rapidly from opposite directions toward the middle ground where the next decade of retail finance will be fought.

Prediction markets are the clearest playground where you can see them go head-to-head today. Robinhood leads on that front, with a head start over Coinbase, which rolled out just two weeks ago. $HOOD also owns its exchange and clearing house, while $COIN is proceeding with a Kalshi partnership without exclusivity.

Tokenisation will be another battlefield where the picture is more nuanced. Coinbase is approaching it as an infrastructure problem by issuing tokenised equities in-house and building regulatory relationships to enable on-chain trading of bonds and securities. Meanwhile, Robinhood is approaching it as a consumer-access problem by making private-company stock tokens accessible. Both are opting for different paths to solve different parts of the same problem.

Private markets could become the third area where the two players converge. While Coinbase enables on-chain capital formation through its Echo acquisition, $HOOD is just taking its initial steps through Robinhood Ventures to bring private company investing to retail customers.

Both companies know that the broader market will trust whoever establishes the deepest financial relationship to meet investors’ growing needs. Financial services are often one of the stickiest categories. People don’t switch their banks, brokers and custodians easily. If a platform can offer a user the ability to hold their retirement account, card details, prediction market positions, and, eventually, their private equity portfolio, then it could become difficult for the other platform to flip their competitor and win over the customer.

That’s it for this week’s analysis. I’ll see you with the next one.

Until then, stay curious!

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.