"Uptober" Unleashed 💰🔥

Crypto markets add $100 billion to the market cap, Bitcoin and Ethereum hit the accelerator. ETF buzz fuels crypto engine. AI's path to common sense. Sharjah NFTs for verified digital certificates.

Hello, y'all. What song are you FEELING right now?

Oh yes, you can know that. Check out 👉 ImFeeling

What we feelin?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

It's October, and crypto has got its skates on.

Bitcoin Surges by 12.6%

Bitcoin (BTC), the largest cryptocurrency, has seen a 12.6% increase in its value in a single day. It's currently trading around $34,000.

Bitcoin hits $35,000

Bitcoin briefly surpassed $35,000. the highest value for Bitcoin since May of the previous year.

Liquidation of short positions

The surge resulted in over $310 million in liquidated short positions within the past 24 hours.

BTC Fear and Greed Index indicates "Greed"

The BTC Fear and Greed Index, a sentiment metric, spiked to 66, indicating that market sentiment is in the "Greed" territory.

Ethereum experiences significant gain

Ethereum (ETH), the second-largest cryptocurrency, has seen a substantial increase. It is currently trading around $1,800, showing a 10% gain in a single day.

Total Market capitalisation surpasses $1.3 Trillion

The total market capitalisation of all digital assets has increased by over $100 billion, reaching 9.3% above the $1.3 trillion mark, the highest since April. More than half of this market capitalisation now belongs to Bitcoin.

The fuel

Bitcoin ETFs (Exchange-Traded Funds) are the talk of the town. Advocates are gung-ho, believing these ETFs could be a game-changer, opening up BTC to a larger investor pool.

Grayscale's current roadblock with the SEC might be turning in their favour, making their dreams of a grand ETF more tangible.

Today's headlines screamed as a DC judge gave the SEC a lil' nudge to reconsider Grayscale's application for a Bitcoin ETF.

Remember what happened to Gold?

Gold prices rampaged on an eight-year bull run following the ETF listing, analysts observed.

Gold was trading at around $430/oz in November 2004, and it had doubled in price by the end of 2007. By the end of 2011, gold prices had surged more than 300% to reach $1,800/oz.

And Blackrock?

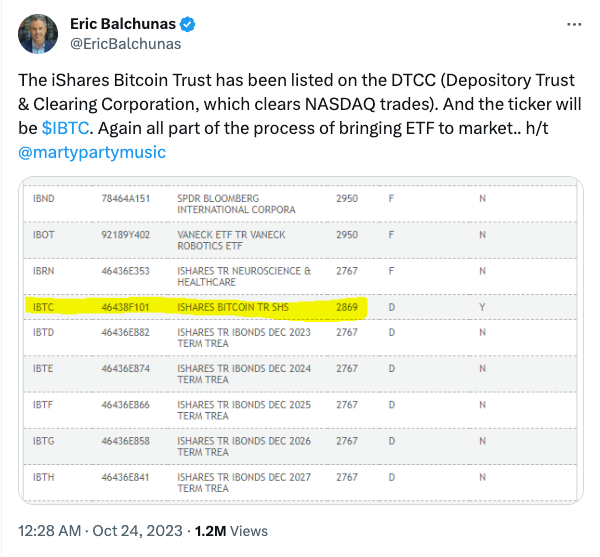

BlackRock's ETF has made a cameo on the Depository Trust & Clearing Corp's website.

The narrative surrounding this development suggests that BlackRock might either have a nod from the SEC or is diligently preparing, anticipating such approval.

The clock is ticking for the SEC – they have until Jan. 10, 2024, to declare their final verdict, either sanctioning or rejecting the ETF.

A potential watershed moment

If BlackRock's application garners approval, it could potentially usher in a cascade of approvals for several spot crypto ETF proposals that are under the SEC's scrutiny.

Some of the notable names in this queue include ARK Investment, Fidelity, and Valkyrie. As of now, the SEC hasn't given its nod to any spot Bitcoin or Ether ETFs for a US exchange listing.

However, it did commence the sanctioning of investment tools linked to Bitcoin futures in October 2021.

Post the BTCC listing, a US appellate court issued a directive enforcing an Aug. 29 decision.

This decision mandates the SEC to re-evaluate a spot BTC ETF proposal from Grayscale Investments. Subsequently, Grayscale submitted a proposal to the SEC, aiming to list its Bitcoin trust shares on the New York Stock Exchange Arca under the ticker symbol GBTC on Oct 19.

Crypto stocks has been outshining this year

While Bitcoin's been strumming a catchy 87% rise this year, some crypto companies have been hitting even higher notes:

GBTC has soared by 196%. The possible conversion of GBTC to a spot Bitcoin ETF has fans on their feet.

Up by 161%, they're not just humming along, they have a huge $4.8 billion Bitcoin stash.

A 135% gain! With a bold stance against a government lawsuit and BlackRock's backing, they're rocking the stage.

Block (formerly Square) and PayPal have seen drops of 31% and 27% respectively. Time for a remix?

Public Bitcoin mining firms have struck a chord with an average return of 148.59% in 2023.

TTD Numbers 🔢

158,245 Bitcoins

Is what MicroStrategy owns as of September 24, 2023.

The MicroStrategy announcement states the average purchase price as $29,582 per bitcoin with a total cost of $4.68 billion USD.

Check the full list of companies that own Bitcoin.

What's with ETF 🚨

The total market capitalisation of crypto went up more than $100 billion , soaring 9.3% above the $1.3 trillion mark—the peak value since April, according to CoinGecko.👇🏻

TTD Blockquote

EY’s global blockchain leader Paul Brody

“Bitcoin is facing a lot of pent-up demand from institutions amid spot Bitcoin ETF developments”

EY’s global blockchain leader Paul Brody asserts that Bitcoin has garnered significant attention from institutional investors, yet the absence of an SEC-approved spot BTC ETF has kept a significant influx of funds at bay.

Trillions on the sidelines 💵

During his appearance on CNBC's Crypto Decrypted on October 23, Brody dropped a startling revelation: trillions of dollars of institutional money are on standby, ready to pounce on Bitcoin the moment a BTC ETF gets the green light.

He elaborated that many of these institutional funds have their hands tied due to regulatory constraints.

For them to invest in Bitcoin, it either has to be through an ETF or another sanctioned financial instrument.

“But any of these other institutional funds, they can’t touch this stuff unless it’s an ETF or some other kind of regulatory blessed activity. If you look at people who are buying Bitcoin, they are buying it as an asset. They are not buying it as a payment tool. Those who are buying Ethereum, are buying it as a computing platform for business transactions and DeFi [decentralised finance] services.”

The regulatory body has yet to approve a spot Bitcoin ETF. This hasn't deterred industry giants, however. Big names such as Grayscale Investments, ARK Investment, BlackRock, and Fidelity have thrown their hats in the ring, submitting applications for multiple Bitcoin ETF products.

TTD AI 🟡

Qualcomm's AI Power Boost 📲

Qualcomm is set to release the third generation of its Snapdragon 8 chip, which is expected to have enhanced performance and groundbreaking AI capabilities. The new chip will have a 25% faster GPU and a 30% faster CPU, as well as a powerful AI engine capable of running local AI models with over 10 billion parameters. This trend of AI-capable chips in consumer devices opens up possibilities for personalised chatbot assistants, hyper-realistic gaming, real-time health monitoring, and adaptive user interfaces. These chips promise faster processing, better personalisation, and more privacy for users.

Artist's AI Shield🛡️

Researchers at the University of Chicago have developed a tool called Nightshade that allows artists to "poison" their digital art to prevent AI systems from using it without permission. The tool modifies images in a way that tricks AI systems into misinterpreting them, such as labelling a dog as a cat. This would potentially damage the AI's ability to generate accurate outputs. The tool is an expansion of the researchers' existing artist protection software called Glaze, which allows artists to obfuscate the style of their artwork. Experts suggest that even robust AI models like OpenAI's ChatGPT could be vulnerable to such attacks.

The Path to Common Sense? 🧠

OpenAI CEO Sam Altman believes that AI models like ChatGPT are on track to achieve Artificial General Intelligence (AGI), which would give them the adaptability and common sense of a human.

OpenAI has shifted its focus to developing AGI, and its Large Language Models, such as GPT-3 and GPT-4, are just the beginning.

ChatGPT's human-like abilities, such as intuitive understanding and opinion-forming, have raised philosophical questions about the nature of intelligence and consciousness.

Some scientists have even reported sparks of human intelligence in modern AI chatbots.

Read the thread

TTD NFT 🐝

Sharjah NFT

Sharjah City in the UAE has launched the "Sharjah NFT" initiative, which uses NFT technology to issue verified digital certificates.

The platform allows government and private entities to store and track documents on the blockchain using a QR code.

It aims to be user-friendly and can be used by various organisations, including government authorities, educational institutions, and businesses.

The platform ensures the authenticity and security of certificates through blockchain technology, making them tamper-proof.

This initiative is part of Sharjah's digital transformation campaign and aligns with the vision of Sheikh Dr Sultan bin Mohammed Al Qasimi, the Ruler of Sharjah.

Singaporean freezes Hacker's Assets

The Singapore High Court has allowed financial investigation firm iSanctuary to attach NFTs containing a legal document to cold wallets associated with a hack.

iSanctuary wrote on its website that they were hired by a businessman who tragically lost $3 million in crypto assets.

“The on chain and off chain evidence was presented by an iSanctuary senior investigator to the Singapore High Court and the worldwide injunction, a first issued by that court, was granted. iSanctuary financial and crypto investigators identified a series of cold wallets holding the proceeds of the crime and their method of service via NFT was accepted by the court.”

The NFTs serve as a warning to counterparties and exchanges that the wallets were involved in a hack and allow iSanctuary to track funds leaving the wallets. The NFTs were produced by Mintable, a Singaporean NFT studio. The case involves a stolen private key and spans multiple countries.

Async Art says bye

Async Art, a creator platform known for its unique approach to digital art, has announced its shutdown.

The platform allowed artists to create multi-layered, dynamic pieces that could change over time or be controlled by collectors.

However, the NFT space has shifted, and the platform's CEO, Conlan Rios, stated that the industry's motivations have changed.

Async NFTs will continue to exist on-chain, but the marketplace will no longer support purchases by the end of 2023.

Rios aims to preserve the works created on the platform and help the team members find new opportunities in the Web3 space.

TTD Surfer🏄🏻

Cathie Wood's Ark Invest sells $5.8 million in Coinbase, Grayscale Bitcoin Trust Shares as crypto market surges.

Andreessen Horowitz backs Nym's $300M privacy-centric 'Innovation Fund' - for growth and development of privacy-enhancing technologies.

dYdX Trading, the US firm developing the decentralised derivatives exchange dYdX, has released the open-source code for its independent blockchain to the public.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋