US Bitcoin ETFs vs Satoshi Nakamoto? 💪

ETFs are poised to overtake pseudonymous Bitcoin founder's stash. US treasury $1T liquidity injection will send BTC to $100k? MetaMask & Mastercard launch debit card. TON’s $40M crypto ecosystem fund.

Hello, y'all. The coolest dope on Web3 is on Decentralised.co ✅

Insights and information by the founders and developers covering all things Web3. Don’t believe us, check it out yourself on you favourite podcast app👇

Money is a funny thing. It goes where the the tide is. Where the wind is blowing. It is blowing in favour of Bitcoin. So it goes.

Money is no one’s friend. Remember Omar Little from The Wire?

The digital gold that has caught the attention of the world.

Attracted the fund houses.

Satoshi Nakamoto didn’t think of this reality. If anything, it was completely opposite.

Bitcoin as a form of currency in a way that would challenge the traditional finance.

Not the one that would boost it.

Money is always and will always be in bed the multiplier.

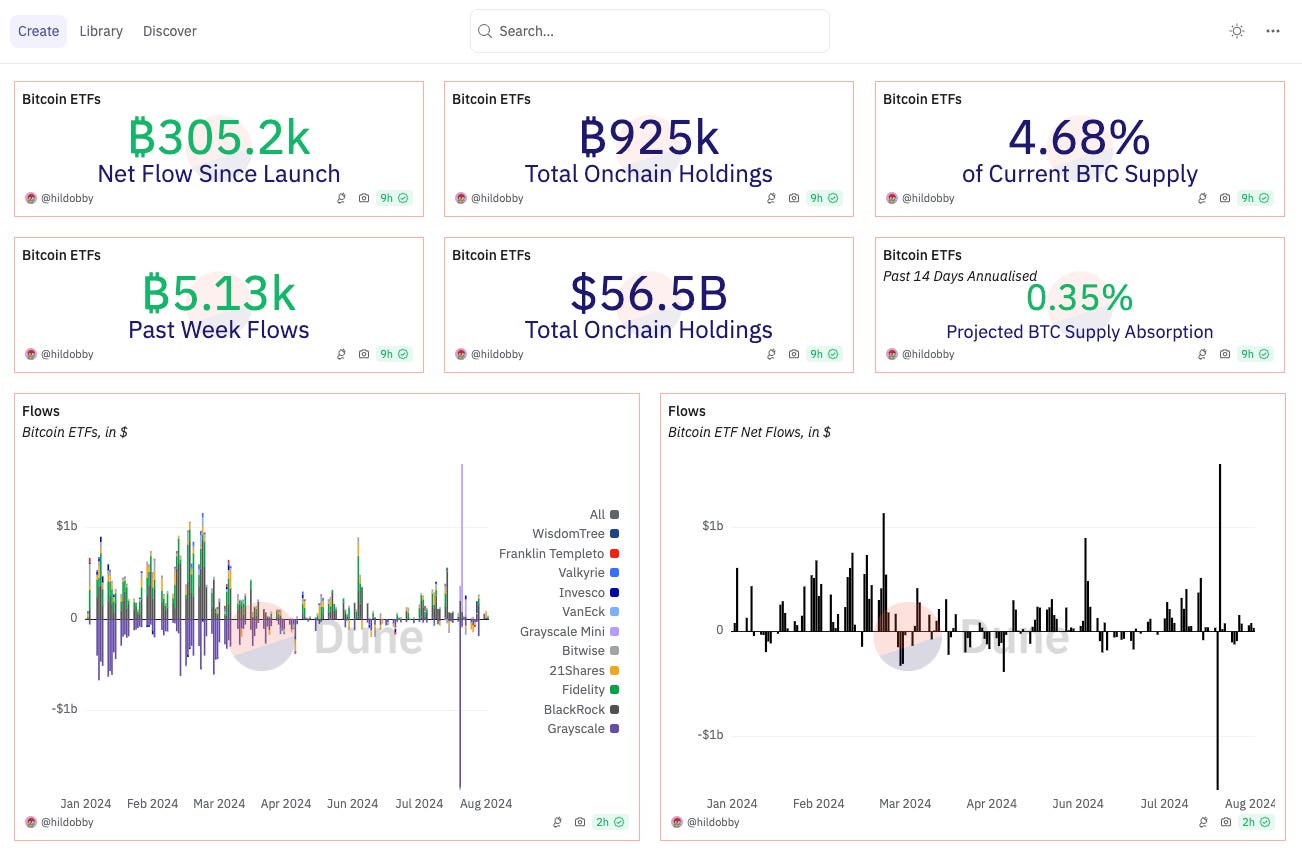

What are we on about? The cumulative holdings of US spot Bitcoin exchange-traded funds (ETFs) are set to exceed the estimated 1.1 million BTC stash of Bitcoin's pseudonymous creator, Satoshi Nakamoto, as early as October 2024.

According to Bloomberg ETF analyst Eric Balchunas, the 10 spot Bitcoin ETFs currently trading in the US hold close to 1 million BTC collectively.

BlackRock's iShares Bitcoin Trust (IBIT) leading the pack with 347,994 BTC.

Grayscale holds the second-largest amount at 232,542 BTC.

Theories on Satoshi Nakamoto's stash: Estimates suggest that Bitcoin's anonymous creator mined around 1.1 million BTC in the early days.

Approximately $67 billion at current prices.

Successful ETFs: Launched in January 2024, they are one of the most successful ETF launches in history, attracting billions of dollars from investors seeking a regulated way to gain exposure to Bitcoin.

FBI will ‘neither confirm nor deny’ Satoshi’s existence

The FBI has responded to a Freedom of Information Act (FOIA) request from journalist Dave Troy regarding the identity of Bitcoin creator Satoshi Nakamoto, stating it can neither confirm nor deny having records on the individual, implying Satoshi may be a "third-party individual."

Troy plans to appeal the response, with intent to gather information rather than directly identify Nakamoto.

Are investors accumulating?

Signs of renewed Bitcoin accumulation are emerging as investors begin to rebuild their holdings after a recent drop to $49,000, according to Glassnode.

Despite ongoing market challenges, including geopolitical tensions and recession fears, Bitcoin's Accumulation Trend Score has reached its highest level.

Indicating significant buying activity, particularly among long-term holders who have shifted back to accumulating Bitcoin.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth

Block That Quote 🎙️

Co-founder of BitMEX and crypto’s macroeconomics analysts, Arthur Hayes.

“The next stop for Bitcoin is $100,000.”

Really? How’s that? He has an essay on it

Enjoy: Water, Water, Everywhere.

TL;Dr if you can’t wade through the essay.

Liquidity injection: Hayes suggests that the US Treasury will inject between $301 billion and $1 trillion into the economy before the end of the year, which historically boosts Bitcoin's price.

Altcoin season: Predicts that an "altcoin season" will follow, only after Bitcoin and Ether surpass $70,000 and $4,000, respectively, with Solana expected to rise to $250.

Market dynamics: Bitcoin performs well during periods of increased liquidity and expects the market to recover from recent downturns, starting in September.

Long-term Outlook: Bullish long-term outlook, projecting Bitcoin could eventually reach $1 million by 2025, contingent on continued liquidity support from the Treasury.

MetaMask to Rollout Blockchain-Based Debit Card

MetaMask has begun rolling out its blockchain-based debit card, developed in partnership with Mastercard and Baanx.

Initially available in a limited pilot phase, offering a few thousand digital-only cards to users in the EU and UK, with plans for broader distribution later this year.

Functionality: The MetaMask Card operates like a traditional debit card, enabling purchases using digital assets such as USDC, USDT, and wETH, which are held on the Linea blockchain. Users retain custody of their funds until the point of payment.

Integration of financial services: Growing convergence of traditional finance and blockchain technology, as major payment companies explore ways to incorporate digital assets into their systems.

User benefits: Simplify the spending process for self-custody wallet users, enhancing financial accessibility, especially in regions with unbanked populations.

Future expansion: The full rollout of the MetaMask Card is expected later this year, with additional pilot programs planned for other regions in the coming months.

In The Numbers 🔢

$418.5 million

That’s Goldman Sachs' Bitcoin ETF Holdings.

The investment bank disclosed it holds approximately $418.65 million in US spot Bitcoin exchange-traded funds (ETFs) as of June 30, according to its quarterly 13F filing.

Goldman Sachs joins other major financial institutions increasing their exposure to cryptocurrencies, reflecting growing client demand for digital assets.

Major holdings: 6.9 million shares of BlackRock’s iShares Bitcoin Trust, valued at $238.6 million, making Goldman Sachs the third-largest holder of this fund.

Additional investments: The bank also reported 1.51 million shares of Fidelity’s FBTC worth $79.5 million, 660,183 shares of Grayscale’s bitcoin fund valued at $35.1 million, and $56.1 million in the Invesco Galaxy bitcoin ETF, among other holdings.

TON $40M Fund For Telegram’s Crypto Ecosystem

Former TON Foundation members Ian Wittkopp and Inal Kardan have launched a new $40M VC fund as part of TON Ventures to support early-stage TON ecosystem projects.

TON Ventures to provide funding, marketing, partnerships to selected projects to drive growth.

Initial focus on sub-$500K investments in consumer-focused Telegram mini apps, with plans to later back larger "strategic" protocol integrations.

Ecosystem has seen rapid growth, especially in crypto games, as Telegram user base surpassed 950M.

Already backed over a dozen startups and expects to deploy fund within a year given high developer interest.

The Surfer 🏄

Defunct Canadian cryptocurrency platform ezBtc and its founder David Smillie have been found guilty of diverting $9.5 million (CAD $13 million) of customer assets to gambling sites while falsely assuring clients their funds were securely held in cold storage.

Jatinder Singh, 39, has been sentenced to 3 years in prison after pleading guilty to stealing AU$4.4 million ($6.8 million) from an accidental refund by Crypto.com, which mistakenly sent the funds to his partner's account instead of a $65 deposit. Singh and his partner, Thevamanogari Manivel, spent the money on luxury items and properties before the error was discovered seven months later.

Liquidators of Three Arrows Capital (3AC) are pursuing a $1.3 billion claim against TerraForm Labs, alleging that the company manipulated the market for its LUNA and TerraUSD tokens, leading to massive losses for 3AC following their collapse in 2022.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋