Your Spotify listening data is worth money. So are your Reddit posts, your health metrics, your driving patterns, and basically every digital breadcrumb you leave behind. But right now, you’re not seeing a penny of that value.

Google, Meta, and OpenAI are building trillion-dollar empires on your data while you get free email and targeted ads in return. It’s the most lopsided trade deal in human history, and most people don’t even realise they’re part of it.

Vana is trying to flip that script entirely. Instead of tech giants owning your data and profiting from AI models trained on it, Vana lets you own your data, pool it with others through DataDAOs, and actually get paid when AI companies want to use it for training.

The concept isn’t new, but Vana’s execution is.

With over 1.3 million users, 300+ DataDAOs, and a working Layer 1 blockchain processing 1.7 million daily transactions, they’ve moved beyond crypto promises into actual utility.

The current data economy is fundamentally broken. You generate massive amounts of valuable information every day through your digital activities, but you have zero ownership stake in what gets built from it. When ChatGPT trains on your writing or when recommendation algorithms learn from your behaviour, you’re providing the raw material for billion-dollar products without any compensation.

This creates several cascading problems. The best data remains locked in corporate silos because there’s no incentive structure for sharing it safely. AI development becomes centralised around whoever can hoard the most data, creating massive competitive moats.

Users have no say in how their data gets used, leading to privacy violations and applications they never consented to.

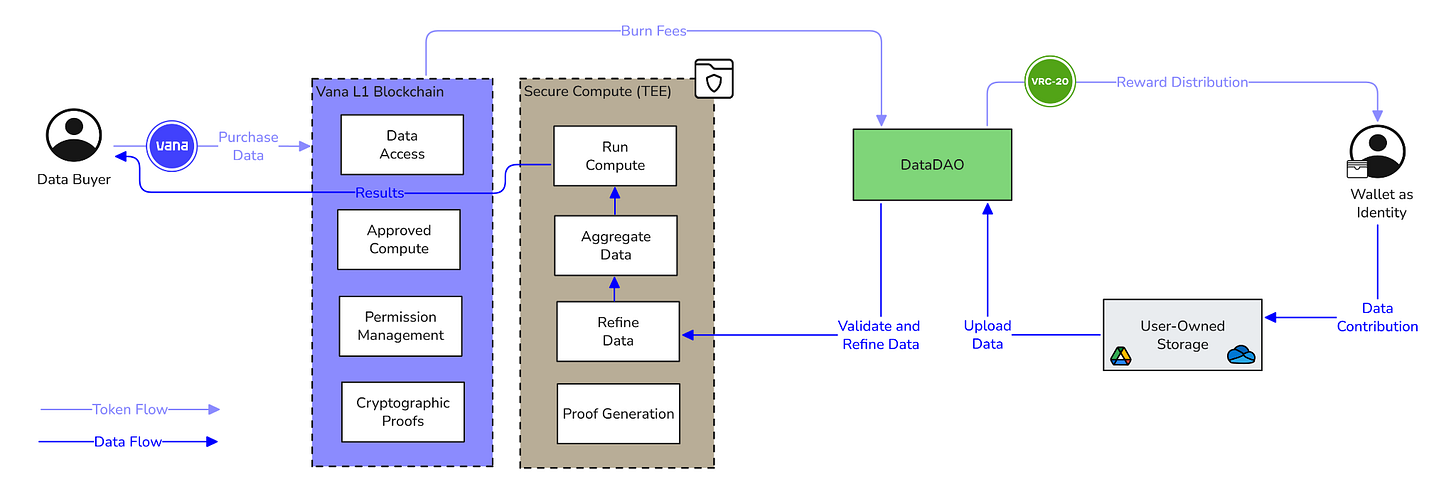

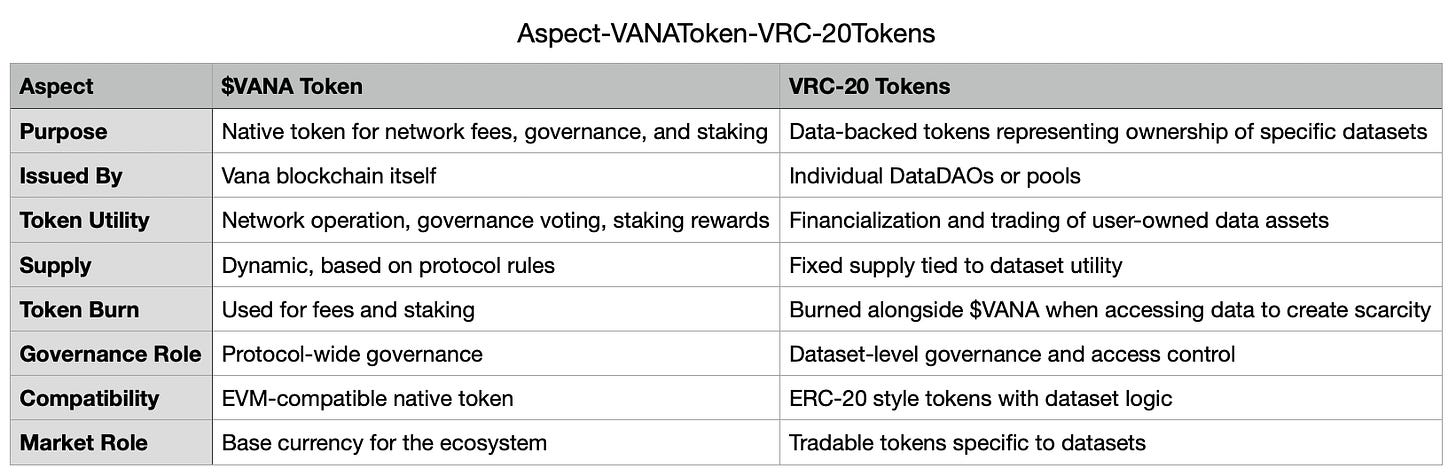

Vana’s approach revolves around two clever innovations that make data ownership practical instead of just a nice idea on paper. Their VRC-20 token standard creates programmable ownership rights over datasets (think NFTs but for useful data collections), while their secure compute layer enables AI training on private information without anyone actually seeing your personal details.

How does it work?

Think of Vana as infrastructure for turning your personal data into a financial asset.

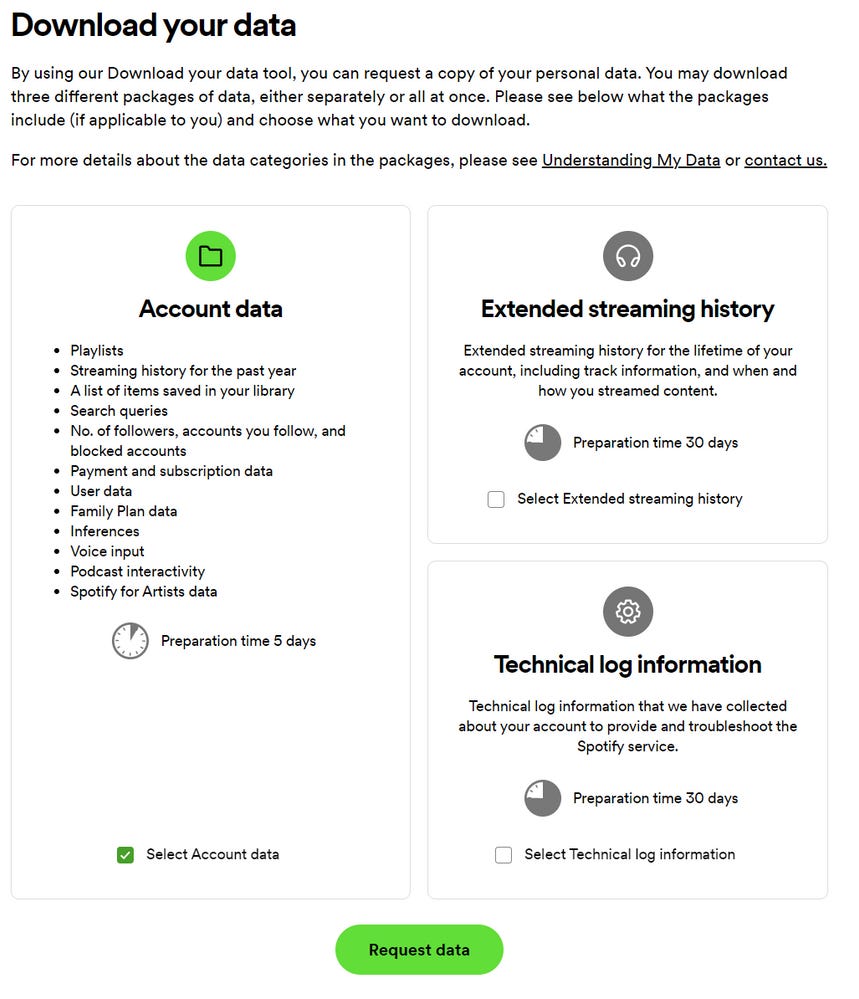

The process starts with something you probably didn’t know you could do: export your data from major platforms using existing privacy laws. Those GDPR regulations and similar laws actually force companies to let you download all the information they have about you.

You upload this data into encrypted wallets within the Vana network, maintaining complete control over access permissions. From there, you can contribute your data to DataDAOs, which are basically decentralised organisations that pool similar datasets for specific purposes.

The Reddit DataDAO is a perfect example of this in action.

Over 140,000 users contributed their Reddit data — posts, comments, message history — to collectively train an AI model capable of generating Reddit-style content. Each contributor received VRC-20 tokens representing their ownership stake in the dataset and the AI model trained on it.

When AI builders want access to this pooled data, they have to burn these tokens to get in. This creates a direct economic link between contributing your data and getting paid when it creates value. The technical implementation handles privacy through secure enclaves and cryptographic proofs. Your raw data never gets exposed during AI training. Instead, the training happens inside trusted execution environments where AI builders can process the information without seeing individual details.

This technology only works at scale when you can pool enough similar data to make AI training worthwhile. That’s where DataDAOs come in.

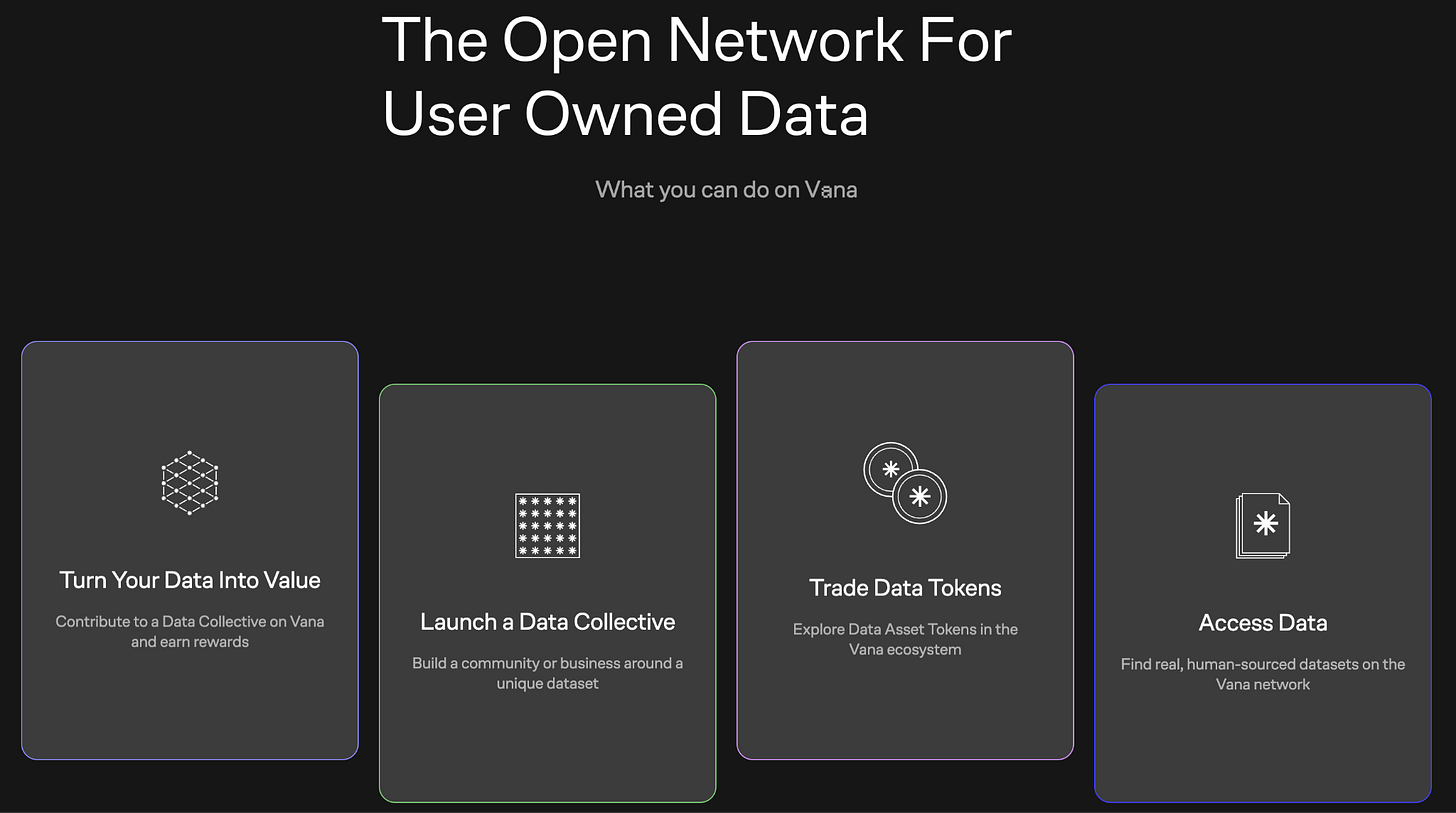

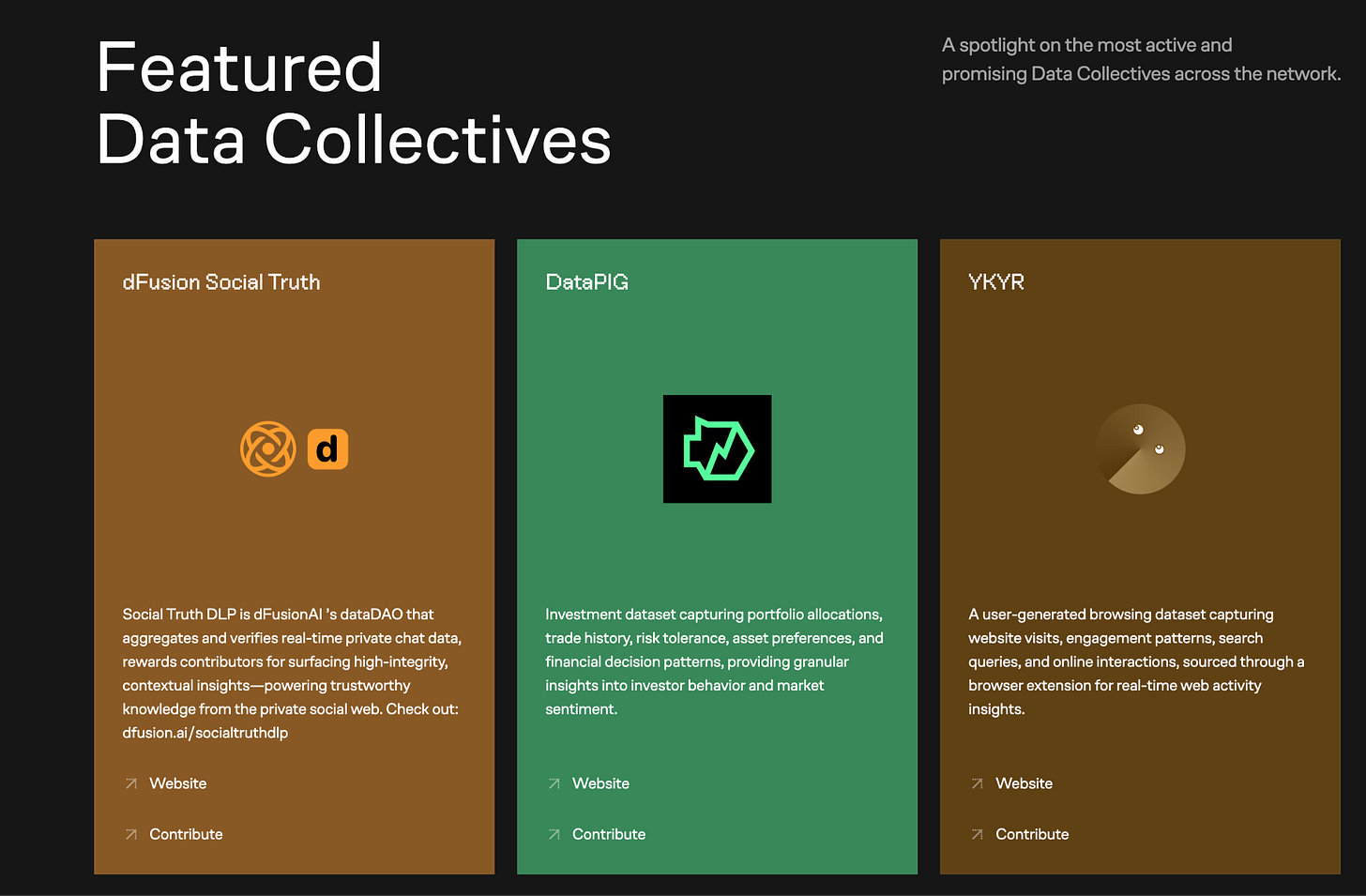

DataDAOs represent something genuinely new in how datasets get created and governed. Unlike traditional data collection where a company decides what to gather and how to use it, DataDAOs are community-driven from the ground up.

Each DataDAO focuses on a specific type of data and use case. There are DataDAOs for health and wellness information, driving behaviour, language learning, financial records, and social media content. The community of data contributors collectively decides on validation rules, access policies, and reward distribution.

What makes DataDAOs particularly interesting is their governance structure.

Token holders vote on dataset policies and access control. If a contributor disagrees with how their data is being used, they can withdraw it or participate in governance to change the rules. This level of control is impossible in traditional data relationships where platforms dictate terms unilaterally.

The economic model is designed to be sustainable long-term. Instead of one-time emissions of tokens, DataDAOs operate through continuous liquidity rewards. When AI builders pay to access data, 80% of fees flow back to the DataDAO community.

The Technical Stack

Vana operates as an EVM-compatible Layer 1 blockchain specifically designed for data coordination. Unlike general-purpose blockchains, every component is optimised for handling private, user-owned data relationships.

The VRC-20 token standard is the foundation of this system. These are cryptographically bound to specific datasets through proof-of-contribution mechanisms. When you contribute data to a Data Liquidity Pool, you receive VRC-20 tokens that trace back to your specific contributions.

The secure compute layer runs on Trusted Execution Environments that can decrypt data only when proper tokens are burned and permissions are granted. Raw data never leaves the encrypted environment during computation, and all compute jobs require blockchain approval with results written onchain.

This architecture enables something that was previously impossible: AI training on private datasets where users control access and benefit from the value created. The technical design choices reflect real-world constraints - the Layer 1 blockchain stores contribution proofs and access grants but never the raw data itself.

Understanding Vana conceptually is one thing, but actually participating in the data economy requires navigating several platforms and processes.

How to Actually Use Vana

Step 1: Set Up Your Vana Wallet

Vana runs on an EVM-compatible Layer 1, so any Ethereum wallet works. MetaMask, Rabby, or Trust Wallet will do fine. You’ll need to add the Vana network manually:

Network Name: Vana Mainnet

RPC URL: https://rpc.vana.org

Chain ID: 1480

Currency Symbol: VANA

Block Explorer: https://vanascan.io

Get some VANA tokens from exchanges like Binance or swap for them on decentralised exchanges. You’ll need VANA to pay gas fees and participate in DataDAO activities.

Step 2: Explore Active DataDAOs

Visit the Vana ecosystem to browse available DataDAOs. Popular options include Reddit DataDAO (contribute your Reddit history), Spotify DataDAO (share music listening data), Health & Wellness DataDAOs (fitness metrics), and Financial DataDAOs (transaction patterns). Each has its own requirements, reward structures, and governance policies.

Step 3: Export Your Data

Most DataDAOs require you to export data from major platforms using data portability rights.

Reddit: Go to User Settings - Privacy & Security - Data Export Request

Spotify: Visit Account Privacy Settings - Download Your Data

Google: Use Google Takeout for Drive, Gmail, or other services

Social Media: Check platform settings for data export options

Step 4: Join a DataDAO

Once you have your data export, navigate to your chosen DataDAO’s contribution interface. Connect your wallet, upload your exported data files, sign permissions to grant processing access, wait for proof-of-contribution validation, and receive VRC-20 tokens representing your ownership stake.

Step 5: Manage Your Data Tokens

Your VRC-20 tokens represent ownership in the DataDAO and its dataset.

You can hold for rewards when AI builders access the dataset, participate in governance votes on DataDAO policies, trade on DataDEX (Vana’s decentralised exchange for data tokens), or provide liquidity to earn trading fees.

Step 6: Monitor Your Contributions

Keep track through DataDAO dashboards, Vanascan explorer for blockchain transactions, and community Discord/Telegram channels for updates and governance discussions.

The process isn’t as simple as traditional apps, but it’s manageable for anyone comfortable with basic crypto operations. Your raw data gets encrypted client-side before leaving your browser, and DataDAOs can validate and use your data for AI training while individual details remain private through secure computation.

The user experience is getting more streamlined with Vana’s mobile app launch on iOS and Android. The app positions itself as ‘the first blockchain app that lets you reclaim your data, take it anywhere, and turn it into capital.’ With invite-only access currently, the mobile interface could significantly lower barriers to entry for users who find desktop crypto interfaces intimidating.

The numbers suggest Vana has achieved something most crypto projects struggle with: actual adoption beyond speculation. Since launching their developer testnet, they’ve onboarded over 12 million data points through multiple DataDAOs, with 16 DataDAOs currently incubating projects across health, social media, and prediction markets.

The April 2025 introduction of the VRC-20 token standard marked a crucial evolution in their approach. Instead of relying on VANA token emissions for DataDAO incentives, they shifted to a model where DataDAOs issue their own VRC-20-compliant tokens backed by actual data utility.

The $185 million Series B funding round led by Paradigm in June 2025 valued Vana at $2 billion, reflecting investor confidence in the data ownership model. Recent developments include Changpeng Zhao joining as an advisor through YZi Labs’ investment, bringing traditional crypto expertise to the data sovereignty space.

The Economics and Applications

Vana’s economic model creates multiple revenue streams that didn’t exist before. Data contributors earn VRC-20 tokens through proof-of-contribution validation. AI builders must burn both VANA and VRC-20 tokens to access datasets, with the 80/20 split ensuring most value flows to data owners.

The practical applications extend far beyond typical crypto use cases. Healthcare DataDAOs are enabling medical research on datasets that would otherwise be impossible to assemble due to privacy regulations. Financial DataDAOs are creating new possibilities for credit scoring and risk assessment. Social media and content DataDAOs are already proving valuable for AI training, while gaming applications could let players earn real value from their activity.

Privacy-preserving computation enables entirely new business models. Instead of selling raw data, DataDAOs can sell access to insights or model training opportunities while keeping individual information protected.

Looking Forward

Vana’s success will ultimately depend on whether they can maintain the balance between user control and practical utility. The technology works, the adoption is real, but the path to mainstream success requires navigating complex technical, regulatory, and user experience challenges.

The shift toward data ownership appears inevitable given increasing awareness of data value and privacy concerns. Whether Vana captures this trend or gets displaced by competitors will depend on execution and market development over the coming years.

For users interested in data ownership, Vana offers a practical entry point into what could become a much larger movement. For developers and AI researchers, it provides access to high-quality datasets that aren’t available elsewhere.

Data ownership might finally be ready for primetime.

That’s it for this week’s product deep dive. I’ll see you next week with another one.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.