Vibecoding DeFi strategies with Almanak's AI agents 👾

AI agents that code, test, and execute DeFi strategies automatically

In the 1980s, Wall Street was complete chaos.

Traders in coloured jackets packed the New York Stock Exchange floor, screaming "Buy!" and "Sell!" while frantically waving hand signals across the trading pit. They had to invent gestures about buying and selling and effectively communicating numbers to the counterparty at a distance. Each trade was a human decision made in milliseconds. When to buy, what price to offer, whether that slight hesitation in a competitor's voice meant weakness or strength.

The best traders could read market sentiment from the crowd's energy, spot arbitrage opportunities across different trading pits, and execute complex strategies entirely in their heads. These human computers earned millions because their brains could process information and make decisions faster than anyone else.

But they were still just humans. They got tired. They made emotional decisions. They could only track a few positions at once. And they definitely couldn't monitor markets 24/7 across multiple exchanges simultaneously.

Then something shifted. Computer terminals appeared on trading floors in the late 1980s. By the 1990s, smart firms started building algorithms that could scan market data automatically. The computers didn't get emotional during crashes. They didn't need coffee breaks. They could monitor thousands of stocks simultaneously and execute trades in microseconds.

By the 2000s, the legendary human traders were being replaced by mathematicians and programmers. The shouting floor gave way to quiet server rooms. The expensive human expertise involved in gathering and processing information got commoditised with automated intelligence running on silicon substrates.

These algorithmic tools eventually escaped Wall Street's exclusive clubs. Retail trading platforms started offering basic automated features like simple order routing, stop-losses, and preset trading strategies. Suddenly, a day trader in Kansas could access the same order routing intelligence that Goldman Sachs built for their institutional clients.

Today, over 80% of stock market volume runs through algorithms. The humans aren't gone. They've evolved. Instead of manually executing trades, they focus on bigger questions: what strategies to deploy, how much risk to take, and which markets to target. The algorithms handle everything else.

Now the same change is underway in DeFi.

Almanak's AI agents are bringing that institutional-grade automation to decentralised finance, handling the technical complexity of strategy creation and execution while you focus on your financial goals.

👉🏼 Join the AI DeFi revolution at almanak.co

Crypto investing today is overwhelming. There are hundreds of different platforms where you can earn interest on your coins. New opportunities appear daily, but by the time you hear about them, they're often gone. Moving money between different platforms is complex and time-consuming.

Building a profitable DeFi strategy requires skills that rarely overlap: financial modeling, smart contract development, Python programming, risk management, and deep protocol knowledge. You might have a brilliant idea for cross-chain arbitrage or yield optimisation, but implementing it means months of coding, testing, and debugging before you can deploy a single dollar.

Hedge funds solve this by hiring teams of quantitative analysts, developers, and risk managers. Individual DeFi users either settle for basic strategies or spend countless hours trying to build sophisticated approaches manually. The profitable opportunities exist — arbitrage gaps, yield differentials, optimal LP ranges — but accessing them consistently demands institutional-level resources.

Enter Almanak: Your AI Trading Desk

Almanak spent three years building something different. A platform where AI agents handle the technical stuff while you focus on the big picture strategy.

Instead of automating fund management through black-box AI, they created a "vibecoding" platform that helps you build sophisticated financial strategies without writing code yourself. Think Cursor or GitHub Copilot, but for quantitative finance.

Through guided structured workflows and AI assistance, you can build institutional-grade DeFi strategies that would normally require months of development. The AI handles the technical implementation while you maintain full control over verification, testing, and deployment. You can keep strategies private, share them with the community, or deploy them as complete public vaults or whitelist-based public vaults that others can invest in.

The core principle is that code is law. Everything is fully verifiable and auditable. No black box LLMs managing your money based on trust.

The platform raised $8.45 million from Delphi Labs, HashKey Capital, NEAR Foundation, and other institutional investors. But what makes this interesting is the approach to solving DeFi's coordination problem through agent-based automation.

The Agent Team That Builds Your Strategy

Almanak operates on a simple premise: AI excels at coding and processing data (trillions of bytes per second vs thousands for humans). Instead of forcing natural language onto financial markets, they start with proven quant workflows and layer AI agents on top.

The platform deploys 18 specialised AI agents that work together like a quantitative research desk. When you describe a strategy like "Build a strategy that LPs on UniV3, rebalances based on volatility, and hedges on Hyperliquid," the agents activate:

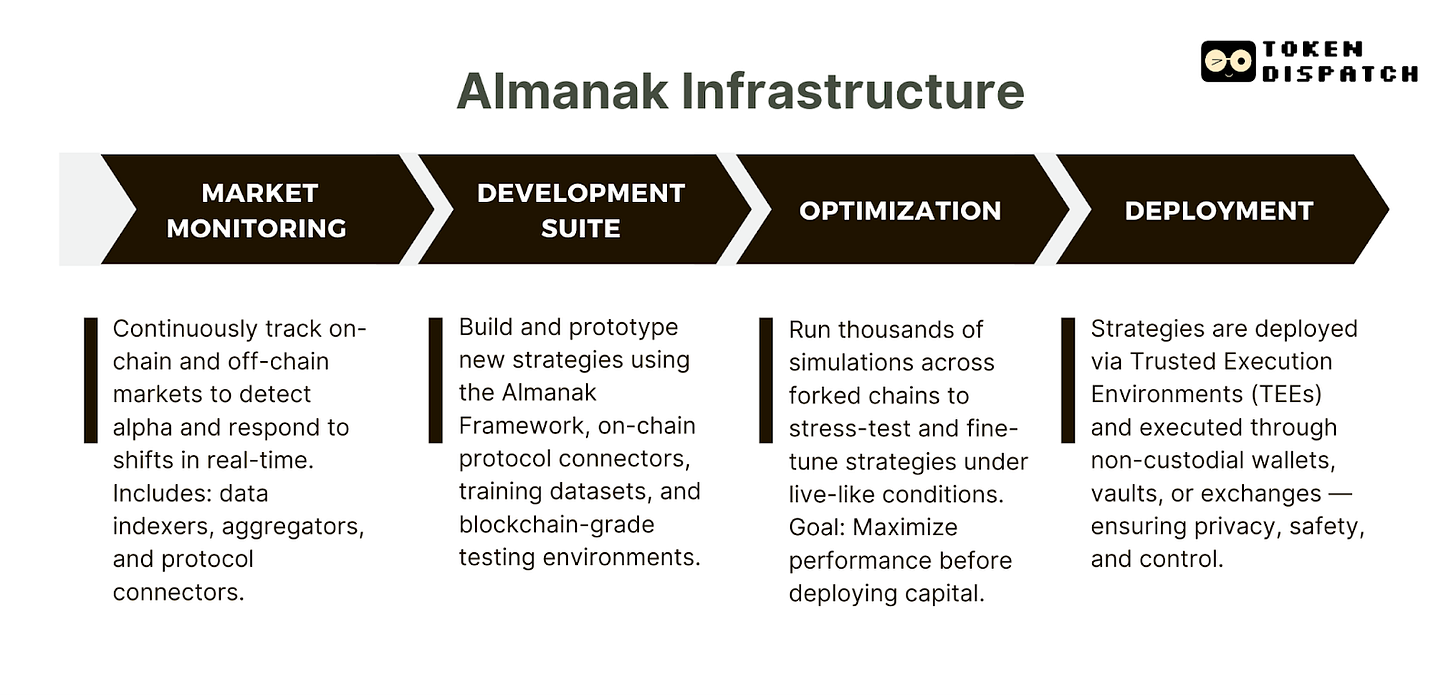

Strategy Team converts your high-level objectives into production-ready code. A Strategist designs the logic, a Coder converts it to smart contract code, a Reviewer audits for correctness, a Debugger resolves errors, and a QA Engineer runs simulations. You describe what you want —"optimise yield across stable assets with 5% max drawdown"— and agents build the executable strategy.

Alpha Seeking Team continuously scans DeFi markets for inefficiencies and opportunities. While you sleep, these agents identify new yield farms, spot arbitrage opportunities, analyse protocol changes, and propose strategic adjustments based on market conditions.

Optimisation Team stress-tests strategies through Monte Carlo simulations across 10,000+ scenarios. They backtest performance across different market cycles, optimise parameters for current conditions, and identify potential weaknesses before deployment.

Each agent's actions are logged and verifiable. No black-box decisions. Every strategy gets human approval before going live. The time from idea to deployment: 30 minutes instead of 2-4 weeks.

How It Actually Works

The structured workflow mirrors hedge fund operations but compressed from weeks to hours.

You start by describing your strategy objective through the platform interface. Instead of writing code, you specify parameters like risk tolerance, target returns, preferred protocols, and investment timeframe. The Strategy Team converts this into executable Python code.

Deployment happens through Safe-based smart accounts with granular permission systems. These permissions let you specify exactly what actions the strategy can take, like swapping specific tokens or providing liquidity to certain pools, while preventing unauthorised activities like withdrawals or risky protocol interactions. You maintain full custody. Almanak can only execute pre-approved actions within defined boundaries. The agent can swap tokens, provide liquidity, or rebalance positions, but cannot withdraw funds or perform unauthorised transactions.

Ongoing monitoring provides real-time analytics and automatic adjustments. If market conditions change or better opportunities emerge, agents can modify strategy parameters or reallocate capital while respecting your risk constraints.

The entire process runs on Trusted Execution Environments (TEEs) to protect strategy code from being copied or front-run by other market participants.

The 4 core building blocks powering Almanak’s AI strategy engine:

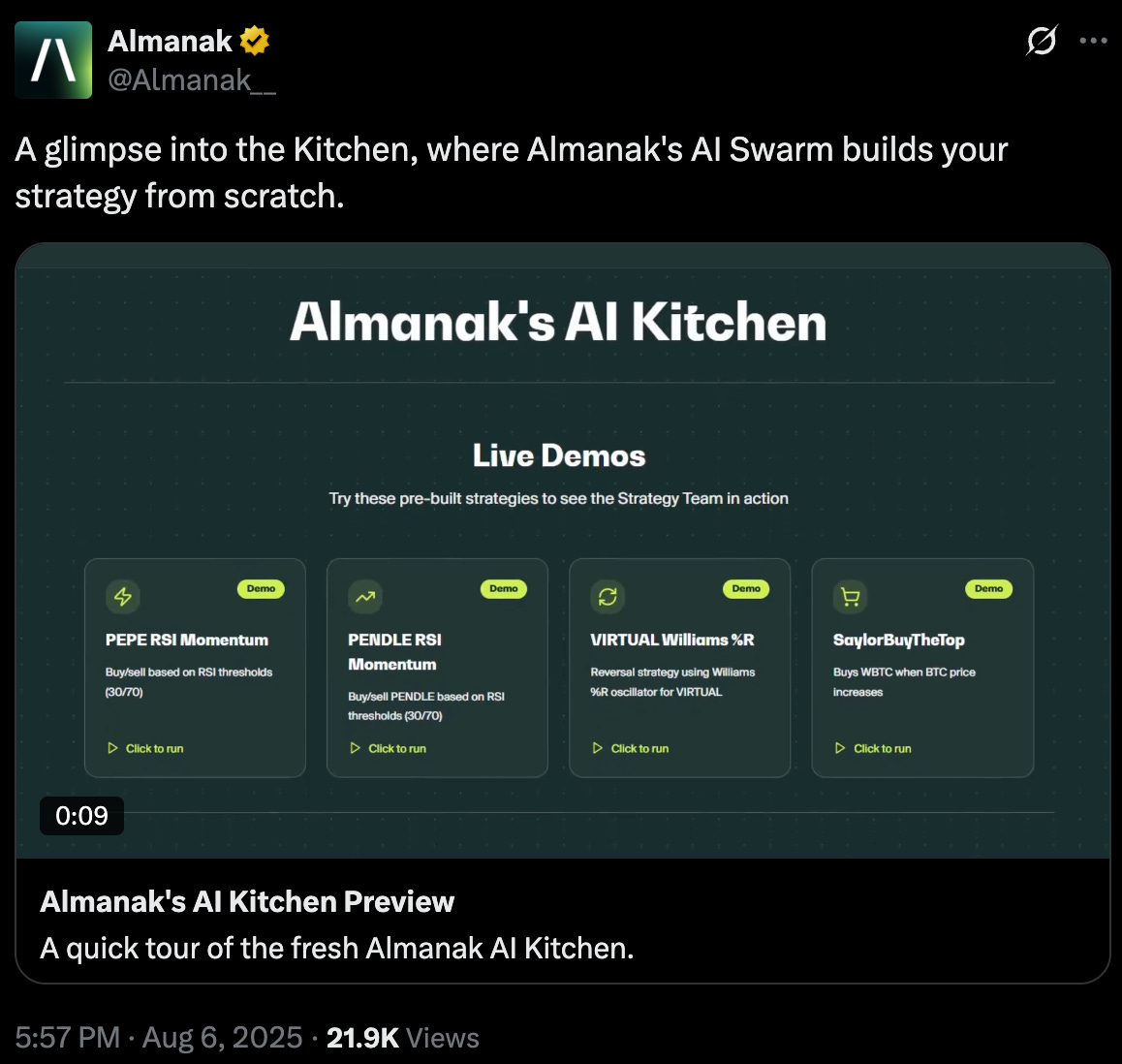

The Almanak Kitchen: Strategy Templates and Demos

Almanak offers a public showcase called "The Kitchen" where users can see AI agents in action and try pre-built strategy templates.

The Kitchen features ready-to-run demos across common DeFi use cases: technical analysis-based trading, Uniswap liquidity provisioning, automated lending protocol loops, arbitrage strategies, yield farming, and derivatives trading. Users can watch the AI Strategy Team build strategies from scratch in real-time.

The platform launched this as a "2-Click Demo" environment where you can explore live strategy flows from ideation to deployment. It's educational rather than a guarantee of returns, designed to show how the agent teams collaborate to build, test, and deploy strategies.

The Kitchen also serves as an entry point for users to understand how AI Swarm Agent-based strategy creation works before deploying real capital. Each demo shows the specialised agents (Strategist, Coder, Reviewer, QA Engineer) working together like a quantitative research team.

Weekly "AI Kitchen" updates roll out new features, strategy templates, and improvements based on user feedback. The Kitchen demonstrates that Almanak's agents can handle complex financial logic beyond simple automation.

Vaults are now Tokenised AI Strategies

Almanak vaults are programmable capital that slots into DeFi like any other building block.

When you deposit into an Almanak vault, you get ERC-20 tokens representing your slice of the AI strategy. Those tokens work everywhere. Use them as collateral on Compound, provide liquidity on Uniswap, or trade them on secondary markets. Your AI-generated strategy becomes a composable asset that plays nice with the rest of DeFi.

This works because of ERC-7540, which lets vaults think before they act. Traditional vaults execute everything immediately. Someone deposits and money gets deployed instantly.

Almanak vaults can batch deposits for better pricing, wait for optimal market conditions, and unwind positions gradually without getting rekt by forced liquidations.

With older standards like ERC- 4626, all logic needs to be on-chain and locked in stone. With ERC-7540, only permissions are on-chain while execution stays flexible. For strategies that need to adapt to market conditions, having the freedom to change execution logic within on-chain constraints can be the difference between profit and significant losses.

The result? Vault shares that aren't just static holdings but active, liquid positions that integrate seamlessly with other protocols while maintaining the sophistication of AI-generated strategies.

Protocols Are Bribing Robots Now — With Math

In DeFi’s next phase, protocols will compete for AI-managed capital.

Almanak calls this “agentic traffic” — trading volume and TVL that is sourced, optimised, and moved around by AI agents, not humans. And it believes this kind of capital will soon dominate DeFi.

But there’s a problem. Right now, protocols have no real way to attract that traffic. So Almanak built one.

Inspired by Curve Finance’s “bribes” model and battle-tested incentive designs, Almanak lets protocols stake ALMANAK tokens to receive veALMANAK, which gives them voting power. These votes are used to boost emissions for specific vaults, but only if those vaults interact with the protocol’s own smart contracts.

A protocol can identify vaults on Almanak that interact with its contracts and vote to increase their emissions using veALMANAK. These emissions can be boosted by up to 3x, making the vault more profitable for its creator and more attractive for liquidity providers.

Now vault curators are incentivised to build strategies that use your protocol. Liquidity providers follow. Capital flows.

This creates a feedback loop:

Protocols vote for vaults that benefit their ecosystem.

Vaults get more emissions and attract more capital.

Curators build more strategies around those high-emission vaults.

AI agents route more traffic to protocols offering the best incentives.

This model turns Almanak into more than a strategy platform. It becomes a capital coordination layer, where emissions, strategies, and protocol growth are all linked through a transparent, governance-driven system.

👉Read the full Almanak Token Paper for details on the model and mechanics.

Who Gets What and Why

The updated token model sharpens the roles and realigns the incentives.

There are two key players:

Strategy & Vault Curators: These are the builders. They design AI-powered strategies, package them into vaults, and earn emissions based on performance and demand. High-yielding, high-TVL vaults earn more and get bonus multipliers if protocols vote on them using veALMANAK.

Liquidity Providers: They supply the capital. By depositing into vaults, they get ERC-20 vault tokens and access to sophisticated strategies. They also earn emissions, plus any yield generated by the strategies themselves.

This setup eliminates speculation-based farming. Only vaults with actual usage and real performance earn emissions. No artificial pumps. No “just stake and wait” mechanics. If your strategy’s good and people use it, you get paid.

So instead of one-size-fits-all farming, Almanak’s system rewards what matters: effective strategy design, capital coordination, and on-chain results. And that coordination is driven not by hype, but by aligned incentives across builders, users, and protocols.

Behind the AI agent technology sits real performance with real money. The first community-created vault on Almanak, called alUSD (Autonomous Liquidity USD), currently manages over $27 million in user deposits.

This tokenised AI yield optimisation strategy maximises risk-adjusted returns on stablecoin investments across numerous DeFi protocols. The Stable Rotator Agent continuously scans the DeFi ecosystem, identifies opportunities, and repositions capital to capture the highest available yields while operating within customisable risk parameters.

AI DeFi Summer

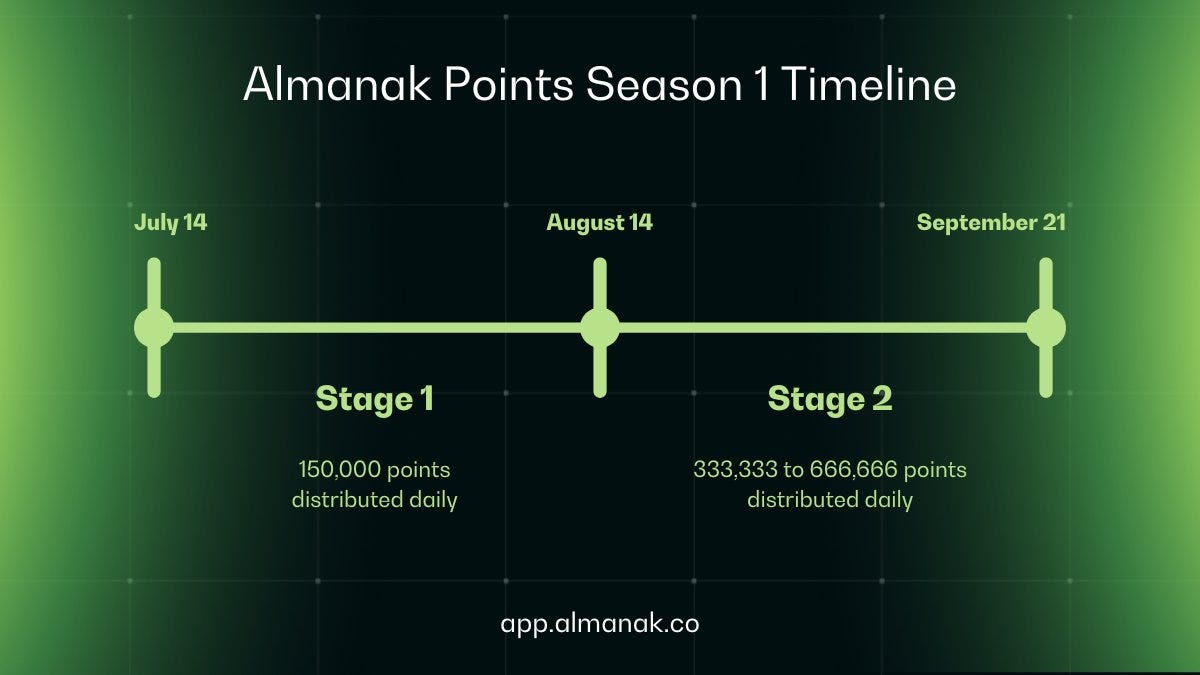

Almanak runs a points program called "AI DeFi Summer" that mimics the original DeFi Summer liquidity mining campaigns.

Season 1 started on July 14 and is structured into two distinct stages with different daily point distributions. Stage 1 ran with 150,000 points distributed daily, while Stage 2 launched August 14 with significantly higher rewards. Daily emissions increased to 333,333 points (up 122% from Stage 1) with time-weighted boosters that reward users who keep deposits in vaults longer. The program includes a referral system where you earn 20% of points generated by people you invite, and by early next week, referred users will automatically receive a 10% bonus as well.

Current APY estimates exceed 50% for vault depositors, driven by the 2x points multiplier for platform users. The program runs through September 21, with points expected to convert to tokens during the TGE in late September/early October.

You can track progress through the in-app points dashboard and leaderboard. The time-weighted mechanics favour early participants who deposit and hold, making timing relevant for maximising rewards.

The points program also integrates with Cookie's Attention Capital Market, where early participants can earn additional rewards. Cookie ACM allocates 0.55% of total token supply to program participants, potentially worth $2.1-3.7 million depending on final valuation multiples.

Additionally, Almanak is conducting a Legion Round (opening August 21 at 1pm UTC) as part of the ACM campaign. This represents the first-ever presale under the Attention Capital Markets framework, powered by Cookie DAO and hosted on Legion.

Technical Architecture and Security Model

Almanak addresses the unique security challenges of letting AI agents handle your money.

You Always Control Your Funds: Your money stays in a smart contract wallet that you own completely. Only the Almanak strategy code can execute pre-approved actions within specific limits you set. You can revoke these permissions anytime.

Strategy Privacy Protection: Your trading strategies remain private during execution. Other users can't copy your approach or front-run your trades.

Transparent Code: Every strategy can be tested and understood before you use it. No black-box systems where you don't know what the AI is actually doing.

Automated Operations: The platform handles technical details like gas fees, failed transactions, and moving money between different blockchains automatically.

The core principle: agents get enough access to execute strategies effectively, but never enough to steal or misuse your funds.

The Bigger Picture

Almanak represents a broader shift toward democratising sophisticated financial tools previously available only to institutions.

Traditional hedge funds employ teams of quantitative analysts, developers, and risk managers to build and execute strategies. This infrastructure costs millions and requires significant expertise barriers.

By packaging these capabilities into AI agents with intuitive interfaces, Almanak potentially levels the playing field. An individual with good ideas but limited capital can build strategies that compete with institutional approaches.

The permissionless nature of DeFi provides the foundation. Anyone can access the same protocols and data that institutions use. AI provides the intelligence layer to process that complexity effectively. Almanak provides the infrastructure to combine these elements safely and efficiently.

The platform reports rapid adoption in its early phases. In July, the first-ever community-run vault on Almanak reached $5 million capacity within 24 hours, then $10 million shortly after, and now surpassing $27 million in TVL

Almanak's total addressable market spans four segments: DeFi TVL and trading volume, centralised exchange activity, real-world assets on-chain, and eventually traditional markets.

Almanak's thesis is that 99% of assets will eventually be managed algorithmically through verifiable and deterministic strategies. Traditional finance already sees high algorithmic execution rates in many markets. Crypto is catching up, and Almanak positions itself to capture this transition.

Whether this actually democratises returns or simply creates new forms of alpha concentration remains to be seen. But the technical foundation for agent-based finance is clearly advancing rapidly.

The coordination problem gets solved. You focus on strategy. Agents handle implementation.

Ready to try agent-powered DeFi? Explore Almanak's Kitchen at almanak.co

I’ll see you next week with another cool product.

Until then … DYOR and make wise decisions.

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.