Hello,

Crypto token launches have mostly been one-way doors. Once you buy a token, the only “refund” option available to early backers is to find someone else to sell it to. Worse, if the team behind the project stops shipping or the product never launches, finding a buyer becomes nearly impossible. In the worst-case scenario, all you’re left with is a chart full of red candles crashing down.

We have projects that are addressing this, albeit in different ways.

The first is MetaDAO, which treats the core risk as custody risk. It aims to make fundraising unruggable by routing investor funds into a governed treasury and restricting how teams can spend them.

Another approach comes from Virtuals Protocol’s new “60 Days” framework. This framework proposes a trial-launch format in which a project can wind down in the event of failure, ensuring supporters are not left holding worthless tokens.

Both seek to reinvent fundraising by addressing the accountability gap that persists among early-stage investors.

In today’s deep dive, I will explain how Virtuals’ new approach could change the landscape and whether it outperforms MetaDAO in addressing the problem.

Virtuals’ “60 Days” framework is a contract among three parties: founders, early buyers, and the protocol. It differs from other token-launching protocols in how it funds founders, while ensuring investors a guaranteed refund if the project fails.

Virtuals isn’t the first one in crypto to build a refund button into fundraising. Vitalik’s DAICO idea was an early attempt to let tokenholders “turn down the tap” on treasury outflows, and Fabian Vogelsteller later proposed the “reversible ICO” to let contributors exit without needing a governance vote. But the market moved toward simpler primitives.

Virtuals’ framework allows buyers to purchase tokens and support the founder during a 60-day trial period. During this period, the founder must build in public. All funds raised are placed in a private pool and aren’t fully accessible to the founder until the 60-day period concludes.

It mimics the modus operandi of Special Purpose Acquisition Companies (SPACs), in which funds are held in trust and investors can typically redeem their pro rata share if they don’t like the deal.

Under Virtuals, the project will launch on Base and follow a standard bonding curve, with early liquidity starting in “private pools” and migrating to a Uniswap V2 pool once cumulative volume exceeds 42,000 VIRTUAL.

At the end of the trial, the founder must decide whether to Commit or Not Commit. If they choose to commit, the project “graduates” into a long-term token. If they don’t, Virtuals winds down the project, liquidity is withdrawn, and refunds are distributed from a pre-determined pool.

So, what’s in it for the founder?

Founders can access a small portion of the capital raised and, more importantly, learn the market demand and interest in their project. This gives them the confidence to proceed, knowing they will have sufficient liquidity once they ship a working product.

Meanwhile, Virtuals compensates founders during the trial period in three ways.

First is through a 1% fee on all token trades. This fee is split 30:70 between the protocol and the founder. Here, too, the founder’s share is locked during the trial period and released only upon commitment. This ensures that founders don’t burn capital on a substandard project and instead view it as an incentive to earn returns from successful product shipping. If they don’t commit, the funds are redirected to refunds.

The conditional fee income acts as a behavioural watchdog of founders. They can access a lion’s share of that revenue, but only if they keep building after the trial.

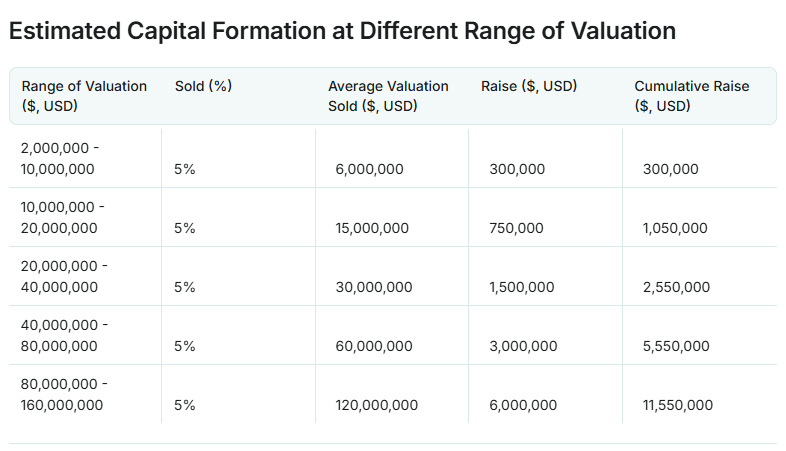

Second is the Automated Capital Formation (ACF) route. ACF is a funding mechanism that allocates capital based on the token’s market participation and trading activity during the trial period. Instead of raising a big lump sum upfront and hoping the team spends it wisely, the framework releases capital available as and when the market reprices the project higher.

Additionally, founders can receive stipends every 30 days (on Day 30 and Day 60), amounting to 10% of the collected funds (from trading tax revenue and released ACF), capped at $5,000 USDC.

Meanwhile, MetaDAO allows teams to optionally allocate up to 12.9 million tokens (50% of initial the supply) into a price-based performance package: five equal tranches unlocking at 2x, 4x, 8x, 16x, and 32x the ICO price, with a minimum unlock time of at least 18 months (and a 3-month Time-Weighted Average Price [TWAP] smoothing where large orders are executed by breaking them into smaller, equal-sized, and evenly timed chunks).

The third route to access capital in Virtuals is via Growth Allocation (GA). Founders may optionally open a GA pool by selling tokens from their team allocation (up to 5%) at a fixed, publicly announced FDV. This differs from the existing fundraising systems in that the GA tokens vest linearly over six months only if the founder commits. Until then, investors deposit USDC at a fixed FDV, and these funds are held in an escrow account until founders commit.

If the GA pool is oversubscribed, Virtuals resolves it using a pro-rata approach, scaling down allocations proportionally. Any unused USDC is automatically refunded.

MetaDAO resolves oversubscription using a slightly different approach. It gives the founder discretion to determine the final accepted capital, after which the pro rata share is calculated relative to that amount.

Although both approaches may appear similar to participants (who eventually receive tokens and a refund), their intents differ. Virtuals treats oversubscription as a mathematical problem, whereas MetaDAO treats it as a decision for founders to make.

Market participants will still complain about both approaches.

Some might argue that MetaDAO’s approach is risky, as it may render the token price a metric that teams optimise for, despite TWAP smoothing. Others may feel that Virtuals’ approach risks embedding predictable selling pressure into the market as a project succeeds, given that it triggers systematic selling. But that might still be healthier than the usual cliff-unlock dump that we witness on other launchpads.

I view both models as the market’s response to the risk of scams and rug pulls in the existing token-launching ecosystem.

Consider the memecoin-style bonding-curve launch model from the pump.fun ecosystem. I find it great for price discovery and creating instant liquidity. However, it’s also evident that the system is optimised for velocity rather than for fixing accountability. Fees are collected as people trade, yet few regard them as a form of capital formation.

On the other hand, systems such as Juicebox.Money treats “money in the treasury” as something users can partially reclaim, depending on a project’s configured redemption rules. Then there’s MetaDAO, which mimics crypto’s version of an IPO by making fundraising less manipulable. It offers investors four days to commit USDC, allocates funds pro rata, and allows the founder to apply a discretionary cap on the capital they can accept. This means that if investors commit $2 million, the founder can cap the fundraising at $1 million.

In this context, I find it difficult to compare what Virtuals and MetaDAO are doing because, while the latter has designed a better auction and treasury handoff, the former offers a better trial period for builders to test the waters before they take off.

But where Virtuals differs from the rest is how it can trigger a structured shutdown when a founder does not commit to launching, while also automating refunds.

There’s a catch here. Virtuals clearly states in its whitepaper that“full refunds are not guaranteed”.

The refunds will be given from an “accumulated funds” pool. This pool comprises released ACF funds, the founder’s share of trading revenue (70% of the 1% trading fee), and the remaining $VIRTUAL in the liquidity pool. However, this pool excludes tokens reserved for teams, unreleased ACF, and certain buyback-related tokens.

Even in the “no commit” outcome, some value may already have left the system through stipends to founders. It might seem unfair to investors, but I find it a fair deal. Consider it the risk any investor assumes when they seek to reap the rewards of betting on a builder or an asset.

In that sense, I like how Virtuals offers a conditional “money-back guarantee”, rather than hiding the fact. I find the framework superior to the incumbents in that it normalises shutting down.

Crypto, like any other industry, is susceptible to failures. If anything, more projects will likely fail than succeed. In a world where many teams keep zombie tokens alive to preserve their reputation, I expect an exit door to change how crypto looks at failed attempts to build something.

I also find it interesting that Virtuals aligns fee extraction with continued effort by making the founder’s trading-tax allocation explicitly contingent on the founder’s commitment to continue building the project.

While Virtuals offers a new way for founders to be early in public without incurring punitive penalties for failure, it also provides participants with a clearer set of rules regarding what happens if the founder walks away. It might still fall short in fully solving the investor protection problem. But I don’t think anyone can. The market will likely always remain unfair to the investor. No investor would ever be willing to part with any of their refund no matter how little.

But the “60 Days” framework, at least in theory, looks like a measured step toward normalising and standardising failure in the world of crypto without compromising on the rights of the investors.

That’s it for today. I will be back with another analysis.

Until then, stay curious!

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.