Wall Street's Stealth Chain

Canton chose efficiency over freedom. Institutions chose Canton. Now what?

Technology becomes infrastructure when the people with the most to lose start betting their balance sheets on it.

Canton Network crossed that line sometime in 2023, and almost nobody in crypto noticed.

By the time the $CC token showed up on CoinGecko in late 2025, the network was already processing $6 trillion in tokenised assets. The DTCC had picked it to tokenise US Treasuries. Goldman Sachs was running a super validator. Broadridge was settling $380 billion in repo transactions every month on Canton rails. To give you a sense of scale, the US repo market averaged about $12.6 trillion in daily exposures in Q3 2025, so Canton’s share is tiny. But it’s real volume, moving real collateral, every single day.

The entire infrastructure of institutional finance was being rewritten on blockchain rails, and the only people paying attention were the ones writing the checks.

Then, the token started climbing the rankings. And suddenly, crypto Twitter had opinions.

“Centralised corporate chain.” “Wall Street’s vampire attack on crypto.” “The Empire Strikes Back.” Some of it was bag bias. Emmet calls it Canton Derangement Syndrome (CDS).

But some of it was genuine ideological alarm. Most of it, I think, was confusion. Because Canton doesn’t fit neatly into the boxes we’ve spent a decade building.

Not trying to replace Ethereum. Not trying to be Bitcoin. But solving a completely different problem, and the fact that it showed up on the same CoinGecko page as every other blockchain doesn’t mean it’s playing the same game.

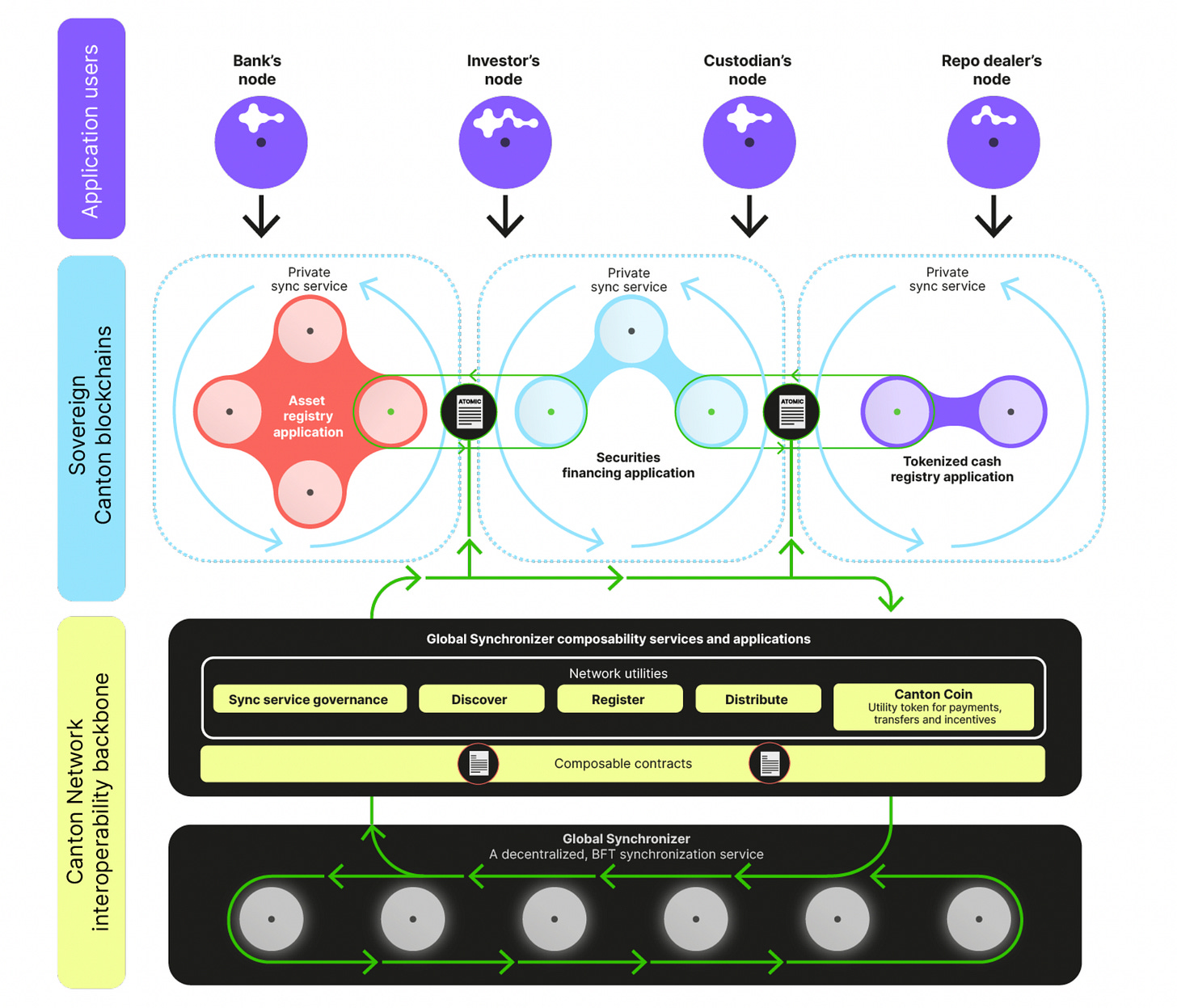

Canton is a network of networks. Think of it less like Ethereum (one big global ledger everyone can see) and more like the internet (a bunch of independent networks that can talk to each other when needed). Canton is trying to solve a problem that crypto has mostly hand-waved away.

Finance needs to coordinate.

Finance also needs to be kept secret.

Public blockchains are excellent at the first part and terrible at the second. Private blockchains are good at secrecy and terrible at coordination. For a decade, institutions were told to pick one and live with the trade-offs.

Canton refuses that choice.

Instead of one global ledger where everyone sees everything, Canton is a network of many ledgers. Each participant runs their own environment, keeps their sensitive data private, and only reveals what is strictly necessary to the parties involved in a transaction.

Each application on Canton runs in its own “canton,” a sovereign environment with its own rules, its own validators, and most importantly, its own data. If you’re JPMorgan running a payments app, your transaction data stays in your canton. If you’re the DTCC tokenising Treasuries, your data stays in your canton. Nobody else sees it unless you explicitly give them permission.

But these cantons can still transact with each other atomically. This means if JPMorgan’s payment needs to settle against the DTCC’s tokenised bond, that happens in one indivisible step. Either the whole trade goes through, or none of it does.

This is made possible by something called the Global Synchroniser, which is run by a set of “super validators.” These validators don’t see your transaction data. They can’t read it. They simply provide the ordering and timestamping service to ensure everyone’s private ledgers stay in sync.

The whole thing is built on the Daml programming language, designed specifically for financial contracts. Unlike Solidity (which lets you write any arbitrary code), Daml forces you to think in terms of rights and obligations. Who can do what? Who needs to approve? Who gets to see which parts of the transaction?

For a bank, this is perfect. For a cypherpunk, it’s a nightmare.

Why do institutions care?

Traditional finance has two big problems that blockchains were supposed to solve. The first is settlement risk. When you trade a bond for cash, there’s a gap between agreeing to the trade and when the assets actually move. That gap creates risk. Someone might fail to deliver. The market might move. Collateral might get stuck. This costs banks billions in capital charges and operational overhead.

The second problem is data leakage. If you’re a bank moving $500 million in collateral, you don’t want your competitors to see it. You don’t want them to be front-running your transaction. You don’t want information about your liquidity position broadcast to the entire world. But public blockchains make everything visible by default.

Canton solves both problems, but through different mechanisms. Atomic settlement means trades either complete entirely or fail entirely. Privacy comes from the fact that your transaction never hits a public mempool. It goes straight to your counterparty, gets validated privately, and syncs through the Global Synchroniser only after it’s finalised. No one can front-run what they can’t see.

This is why Broadridge’s repo platform is doing $380 billion in monthly volume. Repo is the market where banks lend to each other overnight, using government bonds as collateral. It’s enormous, and incredibly inefficient. Collateral sits locked when it should be moving. Settlement windows stretch too long. Fails happen more often than anyone wants to admit.

Canton fixes this by letting banks move tokenised Treasuries in real time, 24/7, with instant finality. Trades settle instantly. Reconciliation happens automatically. Fails are mostly eliminated. Let me zoom in on the technical pieces, because this is where Canton diverges most sharply from Ethereum.

Daml and the “need-to-know” principle

In a normal smart contract on Ethereum, everyone sees everything. The whole point is radical transparency. But Daml contracts can specify exactly who gets to see what. You define “signatories” (parties who must approve the contract) and “observers” (parties who are allowed to view it). A regulator might be an observer. Your trading counterparty might be a signatory. But your competitor doesn’t even know the contract exists.

This is how a single transaction can be “sliced” so that different participants see different parts. In a delivery-versus-payment trade, the bank moving cash sees the cash leg. The custodian sees the bond leg. The regulator sees everything. But the rest of the market sees nothing.

This enables GDPR compliance. It protects trade secrets. And it means you can run sensitive financial workflows on a shared ledger without leaking your strategy to the world.

Super validators and the governance question

Canton’s “super validators” are not chosen by staking capital. They’re approved by governance. The current list includes Goldman Sachs, BNY Mellon, Broadridge, DTCC, Coin Metrics, Figment, and a handful of others. Some are banks. Some are infrastructure providers. Some are crypto-native firms. But they’re all known entities with reputations to protect.

Critics call this a cartel. Defenders call it accountable infrastructure.

The difference between Canton and Ethereum is that Ethereum optimises for permissionlessness. Anyone can run a validator. Anyone can deploy a contract. Anyone can fork the chain. The tradeoff is that Ethereum can’t make promises about who controls the ledger or what happens to your data.

Canton makes the opposite tradeoff. It’s permissioned by design. You can’t just spin up a super validator in your basement. But in exchange, institutions get the governance certainty they need to move real balance sheets on-chain.

Is this decentralised? Not by Bitcoin standards. But it’s also not a single company running a database. The super validators use Byzantine Fault Tolerant consensus, meaning no single entity can control the network. And because governance is handled by the Canton Foundation (a nonprofit under the Linux Foundation), there’s at least some structural separation between the validators and the code.

Whether that’s “decentralised enough” depends entirely on what problem you think blockchains are supposed to solve.

Why is this blowing up now?

Canton has been building since 2015. The network launched in 2023. But the token didn’t list until November 2025, which is when crypto Twitter finally noticed.

Canton’s thesis has always been that moving finance on-chain is a decade-long project, not a hype cycle. So they built first. Signed partnerships. Got assets moving. Proved the architecture worked. And only then did they launch the token and start talking publicly. Usually, you ICO first, build later, and hope you don’t run out of money before you ship something real.

The result is a network that claims $6 trillion in assets, though there’s no public breakdown of what that actually includes or how it’s measured. Transaction volume is easier to verify: Broadridge’s repo platform alone does roughly $10 billion daily (separate from the $380 billion monthly repo figure), but full network-wide metrics remain opaque. Still, DTCC, NASDAQ, JPMorgan, Circle, all signed before most people in crypto had even heard the name Canton.

And now the token is worth $5 billion.

The tokenomics are unusual. Canton Coin ($CC) is a utility token. You burn it to pay for transactions on the Global Synchroniser. Fees are denominated in USD, but settled in $CC, which means the amount of $CC you burn adjusts based on the token price. If the price goes up, you burn less. If it drops, you burn more.

There’s a “burn-and-mint equilibrium” built into the system. Every transaction burns $CC. But the network also mints new $CC to reward validators, super validators, and application developers. The idea is that over time, the burn rate should converge with the mint rate, creating a stable supply tied to actual network usage.

The reward split heavily favors applications and users. Super validators get about 20% of emissions. Regular validators get another 12%. But 66% goes to the applications actually generating transactions. This is the “network before net worth” philosophy. Reward the people building things, not just the people running servers.

Whether this works depends entirely on whether Canton can sustain real transaction volume. If institutions keep using it for repo, bond issuance, and treasury settlement, the burn rate stays high, and the tokenomics hold. If usage drops, the network becomes inflationary, and the token probably goes to zero.

So far, usage is growing. Fast.

If you’re reading this from the Ethereum side of crypto, Canton probably feels like a betrayal.

We spent a decade building permissionless infrastructure. We valorised censorship resistance. We said blockchains were supposed to disintermediate the old guard, not give them better tools. And now here comes Canton, running validators chosen by committee, processing trillions in Wall Street transactions, and getting celebrated for it.

The criticism breaks down into a few buckets:

It’s not really decentralised. Super validators are approved by governance, not chosen by the market. If you’re not Goldman Sachs or Coin Metrics, you probably can’t run one. That’s permissioned infrastructure, not a public blockchain.

It’s not really private. The architecture uses selective disclosure, not zero-knowledge proofs. Regulators can see everything if they’re granted observer status.

It’s not really forkable. If you don’t like the rules, you can’t just copy the code and start your own Canton. The governance model, the validator set, and the institutional relationships are all part of the value. You’d be forking an empty network.

It’s just TradFi with extra steps. Real-world assets already have issuers. Those issuers can freeze, censor, or revoke your holdings at any time. So what’s the point of putting them on a blockchain if you haven’t actually gained sovereignty?

These critiques are just aiming at a different target, not wrong.

Canton is trying to maximise efficiency within the constraints that regulated institutions actually face. And those constraints are real. You can’t issue a permissionless equity token in the US. It’s illegal. You can’t run a DTCC-scale settlement system on a chain where anyone can be a validator. The regulators won’t allow it.

So Canton made a choice. Build the infrastructure that institutions can actually use, even if it means compromising on decentralisation. Prove that blockchains can improve settlement, reduce risk, and unlock liquidity. And maybe, over time, the overtone window shifts.

Is that a cop-out? Or is it pragmatism?

I think the answer depends on whether you believe incremental progress matters. If the only blockchain worth building is one that completely bypasses the existing system, then Canton is a failure. But if you think there’s value in moving trillions of dollars onto transparent, programmable rails (even if those rails are permissioned), then Canton starts to look like the most important infrastructure project in crypto.

It’s not trying to replace Ethereum. It’s not trying to be Bitcoin. It’s solving a different problem for a different audience. And the fact that it’s succeeding doesn’t make Ethereum less valuable. If anything, it proves that the design space for blockchains is bigger than we thought. Ethereum maximises freedom. Canton maximises institutional usability. Both can be true. Both can matter.

But I’ll say this. If you’re still dismissing Canton as “just a corporate chain,” you’re missing the point. This is $6 trillion in assets. This is the DTCC. This is the infrastructure that moves real money in the real world.

And whether you like it or not, that infrastructure is moving on-chain.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Great framing on the efficiency vs freedom tradeoff. The most overlooked part here is that Canton isn't trying to replace permissionless rails, it's buildng infrastructure regulators will allow at scale. The Daml "need-to-know" model genuinely solves the visibility problem institutions face on public chains. Still, the real test is whether transaction burn keeps pace with emissions once the novelty fades. If volume plateaus, the tokenomics unravel fast.