Wang spills the beans 🙊

Ex-lovers, billions, and courtroom drama? Netflix, take notes. Microsoft backls AI in health. Crypto frog leaps to millionaire club in a single jump. Crypto comes to together for Israel and Gaza.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

Who are the rebels? 👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Let's look at the updates on the FTX court drama?

First, the basics:

Trial Date: Started on October 3rd.

Charges: Seven counts of fraud and conspiracy to commit fraud.

Location: Federal court in New York.

FTX co-founder Gary Wang spilled the beans about the crypto exchange's insurance fund.

It wasn't as it seemed. It wasn’t even true.

In his courtroom confession, Wang unveiled that the showcased insurance fund's balance wasn't genuine.

The Fake Figures

Gary Wang's revelation: The fund wasn't flush with FTT, FTX's native token.

That grand figure that caught eyeballs … didn't match the real digits in the database.

The FTX insurance fund, which is designed to protect users against significant financial pitfalls and market upheavals, was a focal point of Wang's disclosure. Contrary to public belief, Wang clarified that the actual insurance fund balance held by FTX diverged from the advertised numbers.

"For one, there is no FTT in the insurance fund. It's just the USD number. And, two, the number listed here does not match what was in the database."

How'd they did it?

To show the insurance fund's balance on FTX's website, they took a seemingly arbitrary number, approximately 7,500, and multiplied it by their daily trade volume.

Divide the result by a billion, and voilà.

That was the "insurance fund" for all to see.

Wang further disclosed code specifics, which seemingly provided a visual representation of how the insurance fund's size was publicly fabricated.

Alameda's unlimited access

Another stunning aspect of Wang's testimony centred around Alameda Research's seemingly unbounded access to FTX.

By incorporating an "allow_negative" balance feature within FTX's code, Alameda Research gained the capability to trade on the exchange with virtually limitless liquidity.

Wang's cooperation

Wang pleaded guilty and is collaborating with investigators.

He alleged that Sam Bankman-Fried, his long-time friend from high school and the face of FTX, was involved in wire fraud.

While Sam Bankman-Fried was the public face of FTX, the lesser-known Wang played a pivotal role behind the scenes in setting up the crypto exchange.

The Defense: A tough nut to crack?

Bankman-Fried's defense team comprises two seasoned attorneys, Mark Cohen and Christian Everdell.

Both former federal prosecutors, they've represented high-stakes clients, most notably Ghislaine Maxwell.

Yet, despite their impressive track record, their defense in this case has been less than stellar.

Strategy (so far)

Portraying SBF as a young entrepreneur who made mistakes amidst the company's rapid growth.

Emphasised FTX's nature as a startup that may not have had the right infrastructure.

Denied allegations of theft.

Defense's challenges

Lack of narrative: Despite the gravity of the charges, the defense hasn't presented a compelling counter-narrative to the prosecution's claims.

Witness credibility: Defense mainly tried to undermine the credibility of key witnesses like Adam Yedidia and Gary Wang, both of whom have pled guilty and are cooperating with the DOJ.

Alleged witness tampering: Bankman-Fried's arrest for supposedly tampering with witnesses has put the defense at a disadvantage.

Tarnishing witnesses: Cohen's primary strategy seems to be to undermine the credibility of key witnesses, notably Bankman-Fried's ex-associates like Adam Yedidia and Gary Wang. Both have already pleaded guilty to related charges and are assisting the DOJ.

Defense's arguments: Cohen vehemently denies that Bankman-Fried was solely responsible for FTX's downfall. He argues that Bankman-Fried acted in good faith and depended on his close confidants to navigate challenges. There's also a nod to Binance CEO Changpeng Zhao's potential involvement.

Ellison's Pivotal Testimony

Crypto magnate Sam Bankman-Fried's trial intensifies as ex-Alameda Research CEO, Caroline Ellison, prepares to testify.

A former romantic partner to Bankman-Fried, Ellison allegedly oversaw $8 billion in misappropriated FTX user funds.

Prosecutors claim she was used as a front, with Bankman-Fried secretly orchestrating behind her.

In contrast, the defense paints her as the real culprit, suggesting her managerial errors led to Alameda's financial troubles.

Their strategy might also attempt to discredit her, emphasising her cooperation with prosecutors for a lighter sentence and pointing to her past recreational drug use.

Ellison's testimony, given her intimate involvement in the case and her relationship with the defendant, is poised to be a turning point in this high-stakes trial.

TTD Blockquote 🎙️

Peter Lee, Microsoft VP.

AI in medical research will be "net positive benefit for us."

At the Healthy Longevity Global Innovator Summit, the spotlight was on the merging worlds of AI and healthcare.

Peter Lee, Microsoft's VP in the research department, took the stage for the keynote and shared a heartfelt story that hits close to home.

Peter's family faced the challenging task of managing his elderly father's health remotely.

With so many medical jargons and time-crunched doctor visits, the Lee siblings were getting overwhelmed.

But ChatGPT-4 came to the rescue, helping the family decipher medical tests and reports, and keeping family ties intact.

“The ability for GPT to give us guidance just brought the temperature down and really kept family harmony,” Lee said.

Peter sees a bright path ahead, with GPT-4 potentially paving the way for medical breakthroughs. He's particularly excited about how AI can empower individuals and caregivers in the golden years.

Lee is all for harnessing AI's power, but he's quick to remind everyone that GPT-4, despite its advances, isn't human. It's a powerful tool, yes, but without human consciousness.

ChatGPT’s knack for spotting biases in medical studies is impressive, even outpacing humans.

But here's the catch - if asked to write those same studies, GPT-4 might unknowingly slip in those biases. So while AI's got a keen eye, it’s not perfect.

The tech titans - Microsoft, Google, Amazon, and Meta, are all in the AI game, betting big bucks. Microsoft's partnership with OpenAI is noteworthy, especially after their massive $10 billion investment.

TTD NFTs 🐝

Frog leaps into the millionaire pond 🐸

A CrypToadz NFT which usually lingers around the 0.53 ETH price range (roughly $835), was sold for 1,055 Wrapped Ethereum (WETH).

Do the math, and that’s over $1.6 million.

If that wasn’t enough, the buyer graciously tossed an extra $42,000 ETH to OpenSea as a fee.

Crypto Twitter’s detectives initially thought it was a classic case of a “fat finger”. But, further investigation revealed that the wallet that welcomed the CrypToadz NFT was just pampered with about 1,116 ETH ($1.76 million) from another wallet.

This generous wallet had itself been gifted almost 1,200 ETH ($1.9 million) via Tornado Cash in September.

While the use of Tornado Cash suggests potential illicit activity, it does not necessarily imply illegal intent.

$1M black hole? 🌠

They say stars can guide your path. However, it seems the Lucky Star Currency (LSC), an astrology-themed NFT project, might have led its followers straight into a cosmic pit.

On Oct. 9, CertiK, a blockchain security firm, released a report claiming that LSC performed an astronomical exit scam, sending over $1 million into a black hole of sorts.

The project's deployer account withdrew tokens from its contracts and swapped them for BUSD stablecoin before sending them to another account.

Lucky Star Currency, which claimed to be founded by astrologists, heavily promoted itself in the Chinese crypto investment market.

China Daily says Hi 🌐 🇨🇳

China Daily, a government-owned newspaper, is planning to launch its own NFT platform and metaverse. The newspaper is offering a contract worth $390,000 to a third-party contractor to design the platform.

The platform must be capable of handling 10,000 transactions per second and support features such as uploading, displaying, and managing digital collections.

It will also integrate pricing, bidding, and limited-time functions, as well as support multi-currency settlement.

In addition to its own platform, China Daily plans to collaborate with mainstream NFT platforms like OpenSea and Rarible to issue digital collections.

China has banned cryptocurrency transactions, but blockchain entities still operate under scrutiny.

The FTX Saga🚨

The crypto industry should not get distracted by the trial and instead focus on passing enabling legislation and serving their customers👇🏻

TTD Aid ⛑️

In the midst of an escalating humanitarian crisis between Israel and Gaza, with death tolls rising and violence spreading, an unexpected beacon of hope shines: crypto.

From Israel

On Monday, a union of Israeli crypto mavens inaugurated 'Crypto Aid Israel', aiming to gather donations in a medley of 12 cryptocurrencies from global benefactors.

This initiative's objective? To provide support for Israelis affected or rendered homeless by the recent turbulence.

A surprise onslaught on Saturday saw Palestinian fighters, primarily associated with the Hamas faction that governs Gaza, storm through barriers dividing the territory and southern Israel.

This resulted in nearly 800 Israeli casualties and over 150 hostages, as reported by the Israeli authorities.

Crypto Aid Israel intends to channel its crypto-raised donations to Israeli nonprofits. These organisations will subsequently assist families who, in their haste to escape from southern Israel to Tel Aviv, left behind basic necessities.

Eminent entities in the Israeli crypto space, like 42Studio, MarketAcross, Collider Ventures, and CryptoJungle, are pivotal parts of this endeavor.

Additionally, the initiative has engaged with multiple Israeli government sectors keen on supervising the allocation of these digital donations.

From Gaza

Gaza has also adopted cryptocurrency as an essential means of rallying support.

This shift was particularly noticeable post-Sunday, following Israel's intense airstrike campaign against the region.

On Monday, an alarming declaration from Israel's defense minister called for an exhaustive blockade of Gaza, impacting necessities like electricity, sustenance, and water.

Several Arab charity organisations have advertised crypto wallet details on social platforms to muster donations for Gazans.

These endeavours have already accumulated thousands of dollars in cryptocurrencies. Gaza's Ministry of Health reports that these airstrikes have tragically resulted in at least 687 Palestinian casualties and more than 3,726 injuries.

TTD Numbers 🔢

370%

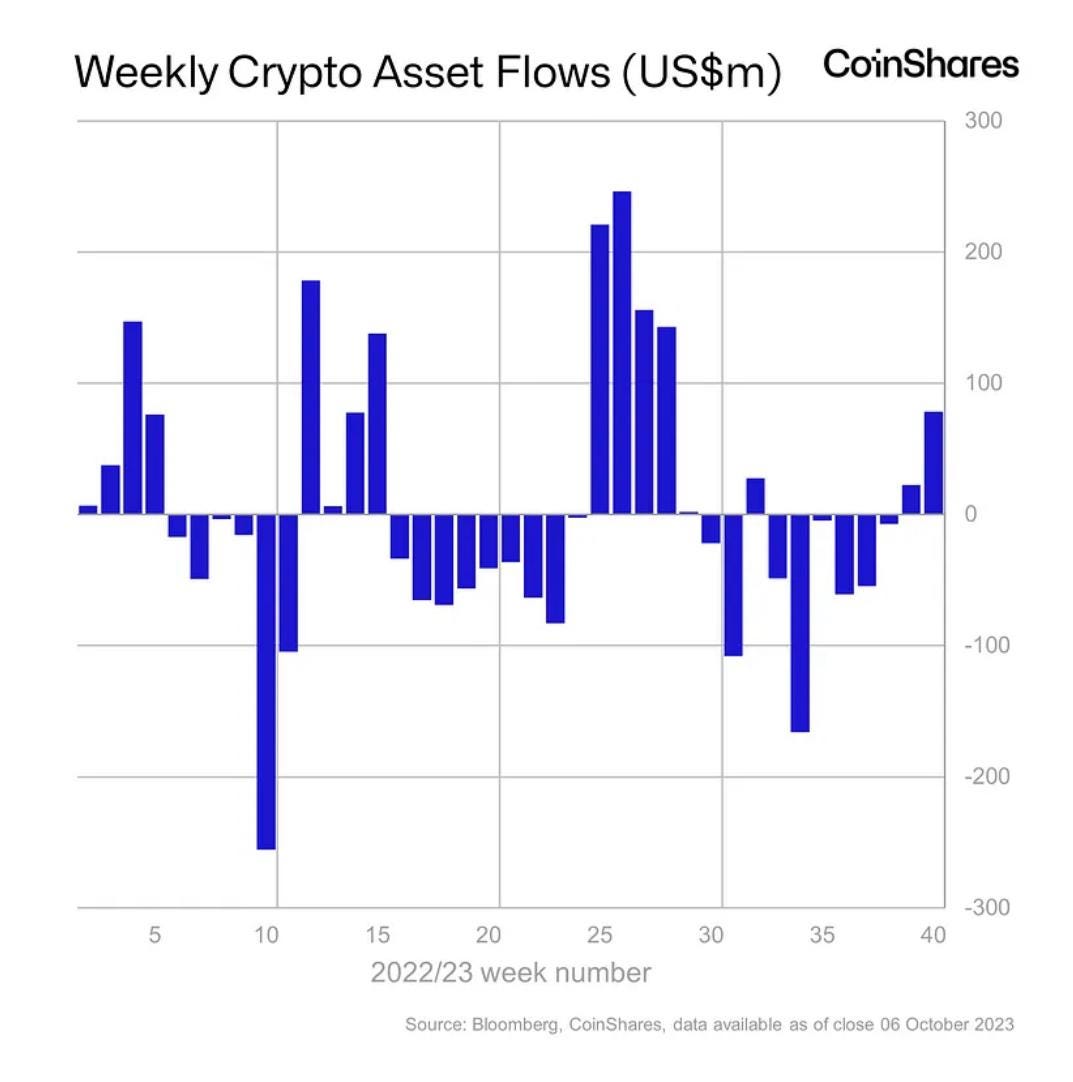

Crypto investments saw a remarkable upswing in the past week, according to CoinShares, with inflows reaching $78 million. This represents a significant 370% increase from the preceding week, which registered inflows of just $21 million.

ETP Trading & Digital Asset Investments

Digital asset investment inflows for two consecutive weeks: $78 million.

ETP trading volume increase: 37%.

ETP trading volume total: $1.13 billion.

Ethereum ETF Launch

US Ethereum Futures-based ETFs launched last week.

First-week inflow from these ETFs: just under $10 million.

Inflows have been correlated with anticipated Bitcoin ETF applications this year.

Solana Highlights

Solana's weekly inflows: $24 million.

Highest weekly inflows since March 2022.

Solana’s 2023 Total Value Locked (TVL) high: $338.82 million.

Speculation due to approval for the FTX estate to liquidate its holdings, which includes $1.2 billion worth of Solana (SOL).

63%

Venture capital funding for crypto firms has dropped 63% in Q3 2023 compared to the previous year, putting many crypto companies at risk of shutdown.

The decline in funding is attributed to the bear market in crypto and the increasing interest in artificial intelligence (AI).

VCs invested only $1.9 billion in crypto firms in Q3 2023, with smaller deals becoming more common.

The AI hype has also diverted investment focus away from crypto, with companies like SoftBank and Disney investing in AI startups. However, some investment firms, like Blockchain Capital, continue to have a long-term vision for the crypto ecosystem.

TTD Surfer 🏄

A $20 million tokenised loan on decentralised lending platform Goldfinch has gone sour, bringing scrutiny to real-world asset (RWA) lending.

South Korean crypto exchange Upbit has experienced over 159,000 hacking attempts in the first half of 2023.

OpenSea claims to be unaware of any involvement of its former executive, Kevin Pawlak, in the AnubisDAO rug pull, a scam that resulted in a loss of $60 million.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋