War of NFT marketplaces. All eyes are on Blur. Everyone is watching

NFT marketplace Blur comes in sharp focus. SEC trains its gun on Do Kwon. Dubai likes Crypto. Singapore likes Crypto, Kansas, not as much. GQ gets a NFT redpill. eBay gets creator smart contracts

Hello y'all. This is The Token Dispatch. Who likes Stable Do Kwon? Not stable. Not us. SEC? Anyone? No chance. There ain't no day without SEC love #sad. Dispatched dreaming about the weekend, it is almost here and we are still smashing them computer keys. Need some love #JustLikeThis

If you dig what we do, show us some love on Twitter, Instagram and Telegram #prettyplease

🕵️♀️ It all started with …

A little loophole, which was discovered in January, allowed Blur to skirt past OpenSea's policy of blocking trading on secondary marketplaces that don't honour creator royalties. This discovery intensified the competition between OpenSea and Blur.

⚔️The War

OpenSea wants creators to use on-chain tools that prevent the sale of NFTs on marketplaces that don't enforce creator royalties. And Blur is a royalty-optional platform. So, users must block their NFTs from being sold on Blur to earn full royalties on OpenSea. If they don't, OpenSea automatically sets royalties to "optional" on these collections.

That didn't sit well with Blur, who now advises creators to block NFT listings on OpenSea in order to collect full royalties on Blur's zero-fee marketplace. Blur objects to OpenSea's stance, claiming that creators, should decide where and how their items are sold.

💰About Blur's new token

Blur wasn't content with just skirting past OpenSea's policies. They released their native token, BLUR on Tuesday.

Reached $500 million in trading volume hours after its airdrop.

The total supply will be capped at three billion.

15 million BLUR tokens were already distributed to Wintermute.

Launch distributed 12% of BLUR tokens, or 360 million.

So far, users have claimed almost 90% of BLUR tokens.

More than $780 million in tokens have changed hands since the airdrop, with most users selling their assets.

About 24.3% are still in the same wallets they were airdropped to.

Airdrop wallet holders sold 28.6% of BLUR tokens on decentralised exchanges and transferred 45.6% to exchange wallets.

12% of all Blur tokens were part of the airdrop, with 88.6% claimed by Blur users.

86% of BLUR tokens are in three wallets associated with the founders.

🔥 The rise of Blur

Blur recently achieved unicorn status with a valuation over $1 billion. 🦄 This is no small feat, and it's a testament to the growth that Blur has experienced in recent months.

According to data from Dune Analytics, Blur has surpassed OpenSea's trading volume for the past week by over $13 million. The trading volume on Blur's marketplace stood at 6,602 ether (ETH) Wednesday, while OpenSea's trading volume stood at 5,649 ETH. 😎

👑But but but..

Despite many declaring that Blur is the leader in NFT marketplace volume, OpenSea remained the leader in NFT sales and unique daily users - still has a higher weekly trading volume than Blur. And, the number of sales and wallets on OpenSea is greater than on Blur.

🤔 Deja Vu?

There are concerns that some users might be engaging in "wash trading" on the platform, where they play hot potato with NFTs, buying and selling them back and forth between their own wallets at inflated prices to boost their rewards. 😬 This isn't the first time this has happened, either! A similar thing went down with LooksRare.

While Blur hasn't been caught up in any billion-dollar shenanigans like that (yet), the data shows that it has far fewer active traders and transactions than OpenSea, despite having higher overall trading volume.

💭 The response

The response to Blur's blog post was swift, with many members of the Web3 community discussing a new era in the royalty wars. Some are really pissed becasues Creators are currently caught in the middle. And some still believe in Opensea supremacy!

Notable crypto exchanges like Coinbase and Huobi have already announced plans to support the BLUR token once it starts trading.

Hello Do Kwon. It's the SEC. We want to Do You

The SEC is bringing the heat on Terraform Labs and its founder, Do Kwon, for pulling off a sneaky multi-billion dollar crypto scam! Kwon and Terraform are getting hit with a laundry list of charges for fibbing and not registering their securities properly. Kwon's passport has even been snatched away, making it harder for him to make a run for it.

The SEC has charged Kwon and Terraform with violations of the registration and anti-fraud provisions of the Securities Act and the Exchange Act, as well as fraud for repeating false and misleading statements. The SEC is on a mission to recover the losses of the poor investors who got taken for a ride by Kwon and Terraform.

Dubai likes Crypto. Singapore Likes Crypto. Crypto likes both

Dubai's crypto scene is on fire! The city has opened its arms wide to the world of digital currencies, making it super easy for peeps to use 'em. Even the day-to-day grocery chain is in on the action, accepting crypto payments like it's no big deal. And if that's not cool enough for you, there's a fancy-pants car club in Dubai that's using NFTs and all sorts of futuristic tech to keep their business running smoothly. Some other businesses tried to join in on the fun, but they couldn't quite hack it. But no worries, The crypto industry in Dubai is alive and kicking, with plenty of top talent from all over the world flocking to the UAE to be a part of the action.

But hold on to your hats, because Singapore's got some love for crypto, too! According to KPMG's fancy-sounding "Pulse of Fintech" report, crypto was the biggest winner in the city-state's fintech game in 2022. Sure, global investment in crypto dropped a bit, but Singapore didn't get the memo, apparently. They threw a whopping $1.2 billion into the crypto pot - that's no small change, my friends! And if that wasn't enough, the regtech scene saw some major bucks, too. But let's get back to the good stuff - Singapore-based crypto company Amber made bank with a $300 million raise, which was the second largest wealth-tech deal of the year.

Kansas wants to check Politician crypto fuel

There's a new rule proposed by some lawmakers in Kansas that limits the amount of cryptocurrency you can donate to political campaigns to $100. This is because they want to make sure that donations from people outside the country are controlled, and they want to know who is donating. This $100 limit is based on how much the cryptocurrency is worth at the time of the donation.

This isn't the first time people have been worried about cryptocurrency donations to political campaigns. In 2017, the government in Kansas said they were too secretive, and California banned them in 2018, but then changed their mind and also set a $100 limit. In Ireland, they banned cryptocurrency donations in April because they were worried about foreign interference in their elections.

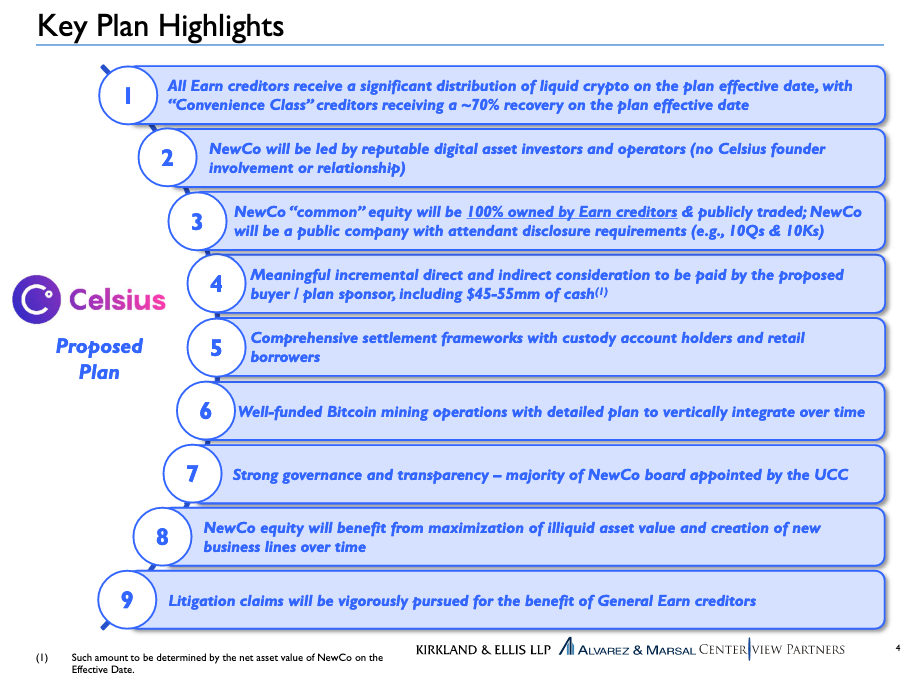

Exit approved. Celsius chooses NovaWulf

Celsius Network has picked NovaWulf Digital Management to be the sponsor of its new plan for restructuring called Chapter 11. This will make a new public platform, owned by Earn creditors and called NewCo.

NovaWulf will give money directly to the new firm, between $45 million and $55 million. People with claims worth $5,000 or less on the day of the request will be put into a "Convenience Class".

They will get Crypto as a one-time payment. Those who have a claim above $5,000 will get a payment of Crypto after the smaller accounts are paid, and they will also own a part of NewCo through equity and management share tokens. If you have Celsius tokens, they will be bought at the initial coin offering (ICO) price of $0.20, but any "insider CEL token claims" won't get any money back.

NFT #DailyBuzz 🎨

#WelcomeAboard GQ, the media house released its first collection of NFTs called "GQ3 Issue 001: Change Is Good" featuring art from Chuck Anderson, Serwah Atafuah, Kelsey Niziolek, and REO.

eBay lures creators with their NFT marketplace, KnownOrigin is launching a Creator Contract that lets artists share their earnings and earn royalties as co-creators.

Rarible gives a thumps up for Tezos and Polygon, the NFT marketplace, is going to start featuring Tezos NFTs! They'll even grab listings from other cool Tezos NFT spots like Versum, Objkt, fxhash, and Teia.

Crypto #FundingFriday💰

Salsa a Web3 messaging platform, has raised $2 million in pre-seed funding to expand its mobile app for brands looking to engage audiences in a crypto-native way.

Sending Labs raises $12.5 million in seed funding and launches two products, including its flagship product, the SendingNetwork.

Orb Labs raised $4.5 million in a seed round led by Bain Capital's crypto arm to develop interoperable blockchains and launch their first products.

Taurus, the Digital Asset infra provider raises $65M from Credit Suisse and Deutsche Bank to expand across Europe and the UAE.

Caldera a provider of infrastructure for Web3 applications, has raised $9 million in two funding rounds led by Sequoia Capital and Dragonfly - for hiring, partnerships, and integrations.

TTD Surfer🏄

Bank of Japan will start a pilot program in April to test the use of a digital Yen, joining a growing number of countries testing CBDC.

Sony Network Communications teamed up with multi-chain smart contract network Astar Network to launch a Web3 incubation program.

Crypto web domain provider Unstoppable Domains is expanding its reach through new domain offerings on Web3 browser Opera.

Collab.Land is launching its own governance token, COLLAB, and will distribute it via airdrops to over 2 million eligible users.

A report from the Financial Stability Board states that the DeFi world is rapidly evolving and does not differ substantially from traditional finance.

If you like us, do tell us. If you don't like us, still tell us. ✌️

Finally, after you done reading and telling, don't forget to share with everyone you love. Each one in your little, big world can sign up here. 🤟

So long. OKAY? ✋