Washington’s Crypto Moves Face Political Roadblocks 🚧

Hello dispatchers!

Months of careful bipartisan negotiation on crypto regulation collapsed over the weekend as nine Senate Democrats abruptly withdrew their support for landmark stablecoin legislation.

Their concerns? Both policy-related and US President Donald Trump's growing crypto empire.

The GENIUS Act initially was passed through committee with Democratic support less than two months ago. The legislation now faces serious headwinds as the Republicans reportedly plan to force a floor vote on Thursday.

Today we examine:

Why key Democrats suddenly reversed their support for crypto legislation

How Trump's crypto adventures are coming to bite back Republicans

What's next for crypto bills in both chambers of Congress

Whether bipartisan crypto regulation is still possible in 2025

Editorial Note: In our previous article titled "El Salvador's Bitcoin Tightrope Act🌋" published on May 4, 2025, we incorrectly stated that El Salvador added 32 BTC worth more than $650,000 last month. The correct information is that El Salvador purchased 7 BTC for $650,000 during a period of 7 days. We apologise for the error and appreciate your understanding as we strive to provide accurate reporting.

A shoutout to our reader Denis Byrne for helping us spot the error.

Grayscale Makes Crypto Investing Super Simple

You know how getting into crypto usually means setting up wallets, writing down seed phrases, and hoping you don’t lose everything in a browser tab? Grayscale skips all that mess.

They let you invest in Bitcoin, Ethereum, and other digital assets just like you’d buy stocks through regulated, SEC-reporting products. No keys, no stress, no DIY crypto rabbit holes.

It’s crypto exposure, the Wall Street way.

What does this actually mean?

Want to invest in Bitcoin? Buy GBTC like a stock

Curious about Ethereum or Solana? There’s a product for that

Don’t want to touch an exchange or wallet? You don’t have to

Want crypto in your retirement account? You can do that too

Grayscale brings crypto to the table without making you sit through a Metamask tutorial. It’s the easiest on-ramp for anyone who wants it, especially institutions.

This isn’t just crypto made accessible. It’s crypto made investable - Check it out.

The Eleventh-Hour Reversal

A coalition of nine Democrats, including Banking Committee members who originally supported the GENIUS bill to regulate stablecoins, on Saturday released a statement withdrawing their backing and shocking fellow Republicans.

Read: Stablecoin Debate: 2 Bills, 1 Mission 🤺

"We recognise that the absence of regulation leaves consumers unprotected and vulnerable to predatory practices. However, the bill as it currently stands still has numerous issues that must be addressed," the statement read.

The dissenting senators including Senator Ruben Gallego, ranking member of the Digital Assets Subcommittee, and four others, called for inclusion of stronger provisions on anti-money laundering, foreign issuers, national security, preserving the safety and soundness of our financial system.

A Politico report claims that the reversal was orchestrated.

Senate Minority Leader Chuck Schumer reportedly urged fellow Democrats during a Thursday caucus meeting to withhold support from the bill to extract more concessions from Republicans - particularly around foreign issuers like Tether and national security provisions.

Senator Gallego, however, denied Politico’s claim.

With Republicans holding a slim 53-47 Senate majority and most legislation requiring 60 votes to advance, the bill's path forward has narrowed significantly.

Result? A rare prospective bipartisan win is now another legislative impasse.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Trump's Crypto Ventures

Democrats weren’t dissenting only due to policy-related shortfalls.

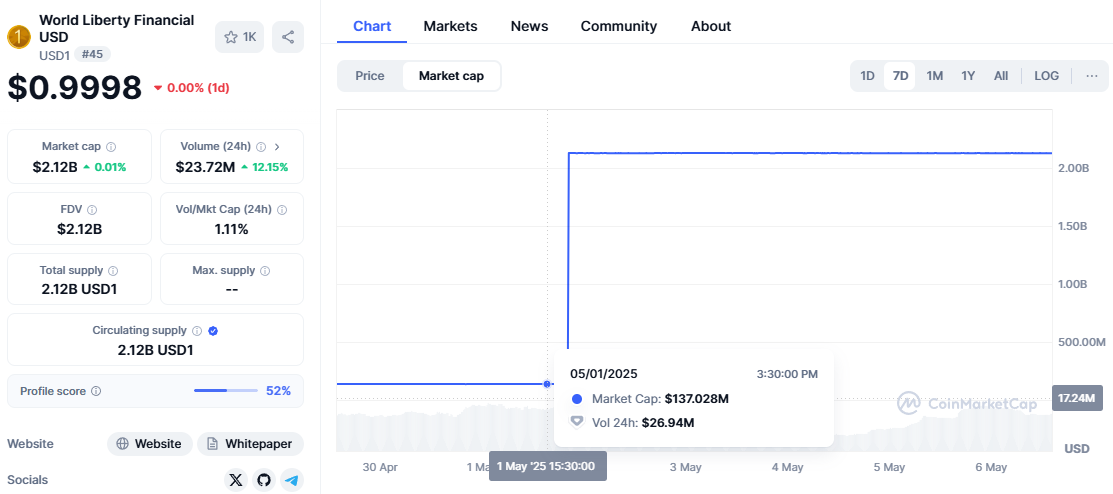

The opposition comes days after World Liberty Financial, a firm in which president Trump and his family hold a direct stake, used its USD1 stablecoin to settle a $2-billion deal with Abu Dhabi-based MGX Group to invest in Binance.

Read: Crypto, Trump, and the Conflict💸

This deal catapulted USD1 from obscurity to become the seventh-largest stablecoin globally in just 48 hours, with its market cap exploding from $137 million to $2.12 billion between May 1-2.

The transaction's success has raised concerns about the Trump family's expanding crypto influence while related legislation advances.

"The Trump family stablecoin surged because of a shady crypto deal with the United Arab Emirates, a foreign government that will give them a crazy amount of money," said Senator Elizabeth Warren.

Trump added fuel to the fire by announcing two crypto-themed events this month.

First, Trump spoke at a $1.5 million-per-plate "Crypto & AI Innovators Dinner" hosted by super PAC MAGA Inc, at the Trump National Golf Club in Virginia on Monday.

The second event scheduled for May 22, was announced two weeks back, will give exclusive dinner opportunity with Trump to the holders of his $TRUMP memecoin.

The memecoin dinner has become particularly contentious, with access determined by a leaderboard tracking the largest token holders. The top 220 will attend the dinner, while the highest-ranking 25 are promised a VIP reception and White House tour.

This invited trouble even from his party members.

“This is my president that we’re talking about, but I am willing to say that this gives me pause,” Sen Cynthia Lummis, a close Trump ally, told NBC News on Thursday.

Sen Lisa Murkowski, R-Alaska, wasn’t pleased either.

“I don’t think it would be appropriate for me to charge people to come into the Capitol and take a tour,” said Murkowski.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

The Parallel House Showdown

The stalemate in crypto legislations isn’t limited to the Senate.

House Democrats, led by Financial Services Committee Ranking Member Maxine Waters, reportedly plans to walk out of Tuesday's joint committee hearing titled "American Innovation and the Future of Digital Assets."

This planned protest came as House Republicans unveiled their draft market structure bill on Monday.

"Instead of stopping this grift, you are enabling it," Waters accused Republican lawmakers of enabling Trump to profit from the planned legislations.

"This Committee voted to make Trump the King of Crypto by passing legislation that lets him corner the market on stablecoins, kick George Washington off the dollar, and make his own stablecoin US legal tender," Waters said last month.

House Financial Services Committee Chair French Hill acknowledged the complications in March, admitting that the Trump family's involvement in memecoin activity and stablecoin development "have made our work more complicated."

Call for Common Ground

Industry representatives have urged lawmakers to find common ground.

The CEOs of Blockchain Association, Crypto Council for Innovation, and the Digital Chamber released a joint statement urging the Senate to bring the bill to the floor for debate this week.

The breakdown isn't limited to Washington.

Arizona Governor Katie Hobbs, a Democrat, vetoed a bill that would have allowed the state treasurer and retirement system to invest up to 10% of public funds in cryptocurrencies, calling them "untested investments."

This decision came despite the Arizona State Retirement System already owning about 67,000 shares of Strategy (formerly MicroStrategy) worth about $19 million at the end of Q1.

Token Dispatch View 🔍

The current crypto legislative standoff exposes a governance challenge: when a president becomes directly involved in an industry he's simultaneously regulating, the political and ethical boundaries blur. Beyond a partisan obstruction, the ongoing logjam throws legitimate questions about separating private profit from public policy.

Trump's dual role as both industry participant and a crypto entrepreneur creates an untenable regulatory environment. When sitting senators from his own party like Cynthia Lummis express discomfort with White House access being provided to his memecoin holders, it’s no longer a partisan issue.

For the crypto industry, this entanglement presents a dilemma.

While Trump's crypto-friendly stance seemed initially beneficial, his direct market participation has paradoxically jeopardised the regulatory clarity the industry desperately needs. By transforming stablecoin legislation from a technical policy matter into a constitutional ethics issue, the path to bipartisan crypto regulation has narrowed significantly.

The way forward requires decoupling presidential business interests from regulatory progress. Industry leaders should advocate for stronger ethics provisions that would address Democrats' concerns while acknowledging the legitimate governance questions at stake. Without this separation, crypto regulation risks becoming permanently entangled in constitutional conflicts rather than focusing on technological innovation and consumer protection where bipartisan agreement remains possible.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.