What Happens to Lost Bitcoin? 🥺

Estimated 4 million Bitcoin are permanently inaccessible. The phenomenon of lost Bitcoin underscores both the increasing scarcity of digital assets and the risks associated with self-custody.

Hello, y'all. The music quiz game that you want to play. Over 1.7 million plays and music fandom to flex. Who are you playing with then 👇

What is the biggest fear of a Bitcoiner apart from the electricity bill?

No, not the bears, not Gary Gensler (not at this point).

It’s losing their Bitcoin.

You have the Bitcoins, but you don’t have them. You are a millionaire, but you can’t live a millionaire life.

You've weathered the volatility, outsmarted the skeptics, and accumulated a fortune in digital gold.

But with great wealth comes great responsibility – and in the world of cryptocurrency, that responsibility can be overwhelming.

Imagine waking up one day to find your wallet emptied, your private keys compromised, or worse, realising you've forgotten the seed phrase to your cold storage.

In an instant, years of hodling could vanish into thin air.

What are you left with? Nothing but regret and a story of what could have been.

Bitcoin loss?

Yes, its digital. But Bitcoin can become inaccessible or lost through various mechanisms.

Understanding these is crucial.

Or, we all turn into Gollum.

We know someone who has

Our story begins in 2013, in the quaint city of Newport, UK.

James Howells, an IT engineer, was doing some routine house cleaning when he accidentally tossed out a hard drive.

Little did he know, this seemingly innocuous act would set off a chain of events.

The hard drive: Contains 8,000 Bitcoin

2013 value: Approximately £1 million ($1.3 million)

Current value: A £495 million ($647 million)

When Howells realised his mistake, the hunt was on. A quest to locate a small hard drive in a sea of 110,000 tonnes of garbage.

The obstacles?

Newport City Council: Repeatedly denied requests to excavate

Environmental concerns: Landfill flagged for asbestos, arsenic, and methane

Legal hurdles: Council questions the legality of Howells' claims

In 2022, Howells upped the ante. He proposed an $11 million recovery operation.

Robotic "spotters" to search through trash

AI-powered scanners to identify the drive

A team of experts and specialised equipment

Newport City Council still said no.

Fast forward to 2024, and Howells isn't giving up. He's taking the council to court, seeking £495 million in damages.

Court Date: Set for December

Howells' Offer: 10% of recovered Bitcoin value to the council

Council's Stance: Unmoved, citing environmental and legal concerns

Can we blame Howells? NO.

How do people lose their “precious”?

Lost private keys

Private keys are cryptographic codes that allow access to and control of Bitcoin holdings.

Bitcoin wallets are secured by private keys. If a user loses their private key, they lose access to their Bitcoin, as there is no way to recover it without this key.

There's no 'forgot password' option in the world of Bitcoin.

Once a private key is lost, the associated Bitcoin becomes permanently inaccessible.

Hardware failures

Bitcoin wallets are often stored on physical devices such as computers, external hard drives, or specialised hardware wallets. If these devices fail or become damaged without proper backups, the Bitcoin stored on them can be lost.

Fraud and scams

Phishing attacks: Users may fall victim to scams where they inadvertently give away their private keys or access to their wallets.

Ponzi schemes: Some may invest in fraudulent schemes promising high returns on Bitcoin investments, only to find out that the operation was a scam.

Accidental deletion or disposal

In some cases, Bitcoin loss occurs due to human error, such as accidentally deleting wallet files or disposing of storage devices containing Bitcoin.

The most infamous example is that of James Howells, who in 2013 discarded a hard drive containing 7,500 BTC. At current valuations, this amounts to approximately $450 million.

Despite years of lobbying his local council for permission to search the landfill, Howells has been unsuccessful in recovering his lost fortune.

Exchange failures

If users store their Bitcoin on exchanges that go bankrupt or are hacked, they may lose their funds entirely. High-profile cases like the collapse of Mt. Gox illustrate this risk.

Some exchanges impose limits on withdrawals, making it difficult for users to access their funds when needed.

Death of the owner

That’s quiet obvious. When a Bitcoin holder dies without sharing access information or including their digital assets in estate planning, their holdings can become permanently inaccessible.

Legal and regulatory issues

In some cases, authorities may seize Bitcoin holdings as part of legal actions against individuals or entities involved in illicit activities.

Sudden changes in regulations can lead to restrictions on accessing or trading Bitcoin, affecting users' ability to manage their assets.

Bitcoin supply: Separating myth from reality

While it's widely known that Bitcoin's protocol limits the total supply to 21 million coins, the reality of the accessible supply is quite different.

Total Bitcoin to ever exist: 21 million

Estimated lost forever: 3-4 million (15-20% of total supply)

Actually mined (as of October 2024): ~19.6 million

Realistically available: Potentially as low as 15-16 million

Analysts estimate that between 3 to 4 million Bitcoin might be lost forever. This represents a staggering 15-20% of the total supply that will ever exist.

The implications of this reduced effective supply are profound, potentially significantly impacting Bitcoin's future value and utility.

Notable cases of Bitcoin loss

Satoshi Nakamoto's holdings: The mysterious creator of Bitcoin is estimated to have mined about 1 million BTC in the cryptocurrency's early days. These coins have remained unmoved since then.

The Mt. Gox mystery: Following the infamous Mt. Gox hack, a wallet containing 80,000 BTC from the theft remains untouched.

James Howells' landfill saga: As mentioned earlier, Howells accidentally discarded a hard drive containing 7,500 BTC in 2013. His ongoing efforts to recover the drive from a landfill have been unsuccessful.

Parity wallet hack: In July 2017, a vulnerability in the Parity Wallet led to the accidental freezing of over 500,000 ETH, but it also involved Bitcoin transactions that resulted in significant losses.

Africrypt: In June 2021, the founders of Africrypt allegedly absconded with $3.6 billion worth of Bitcoin after claiming their platform had been hacked.

Stefan Thomas' password predicament: Thomas, a programmer, forgot the password to an IronKey hard drive containing 7,002 BTC. The device gives users 10 attempts before it seizes up and encrypts its contents forever. As of 2024, Thomas has used 8 of his 10 attempts.

QuadrigaCX controversy: The founder of Canadian exchange QuadrigaCX, Gerald Cotten, allegedly died in 2018 with sole access to $190 million worth of cryptocurrency.

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

The $45.3 Billion in British

Now, welcome to the curious case of Britain's lost Bitcoin billions.

Total unaccounted Bitcoin in the UK: Up to 720,000 BTC

Value in GBP: £25 billion to £34 billion

Value in USD: $45.32 billion

We're talking about a sum that could buy you a small country or, more fittingly, a fleet of Aston Martins for every pub in Britain.

With the cost of living on the rise, some Brits might be sitting on a potential goldmine without even knowing it. Analyst David Bartram suggests.

"It's certainly worth it for people to check through old hardware and try to remember passwords if they have ever owned Bitcoin."

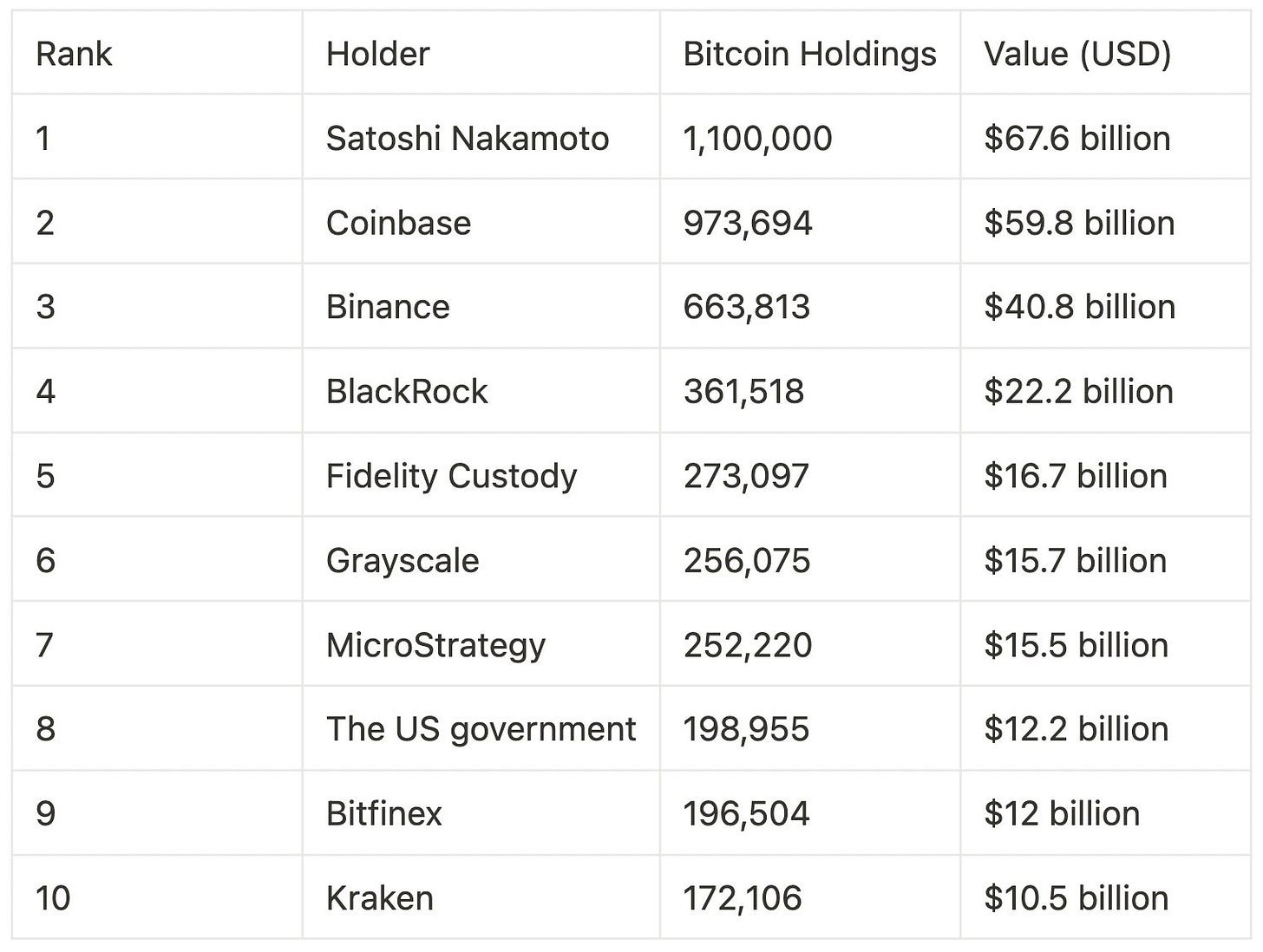

Largest Bitcoin Holders?

While tales of loss dominate many Bitcoin narratives, it's important to note that some entities have accumulated vast holdings.

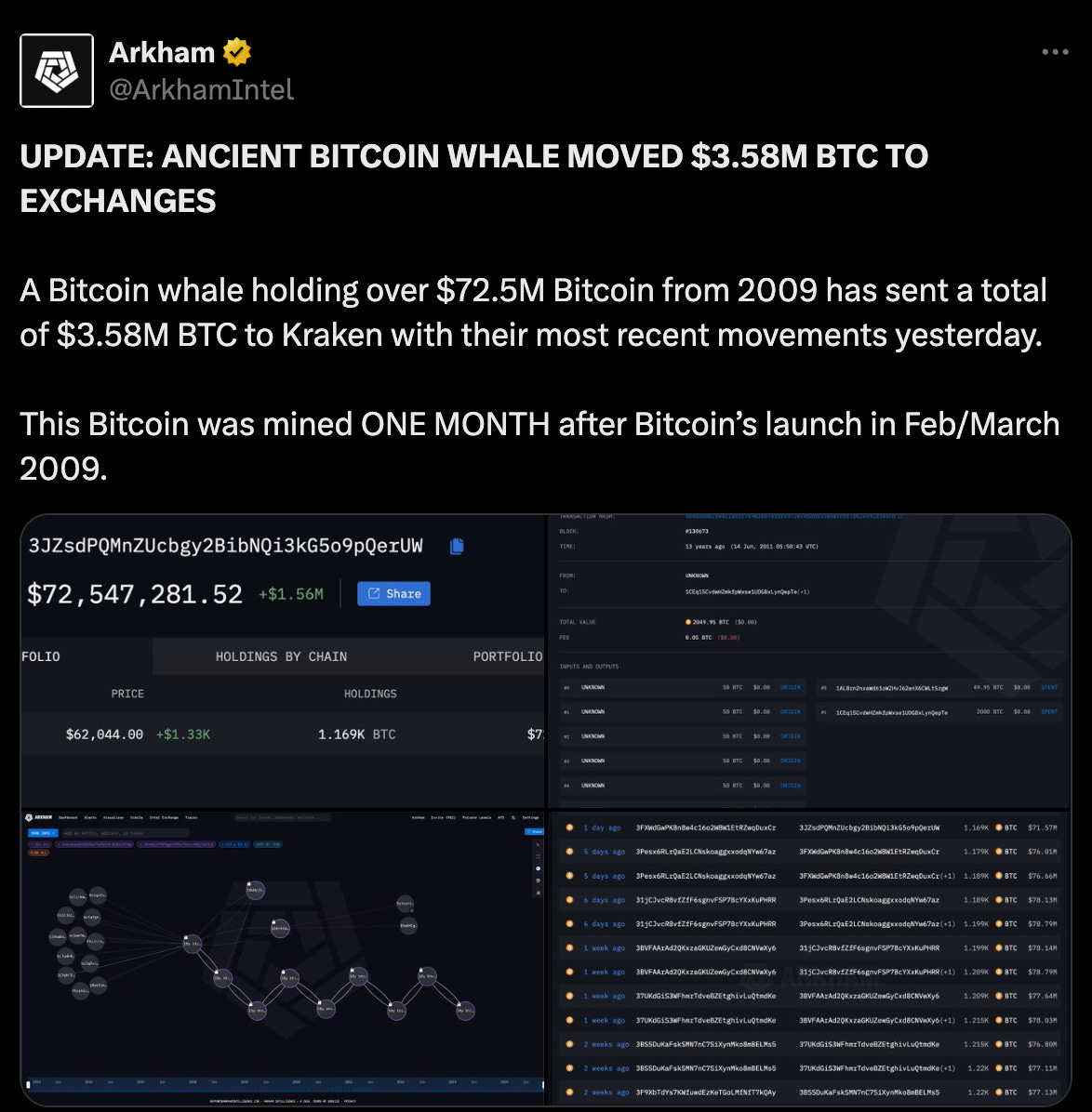

The Phenomenon of Reawakening Wallets

While many lost Bitcoins remain dormant indefinitely, there are instances where long-inactive wallets suddenly show new activity. These events often cause excitement and speculation in the crypto community:

In November 2023, a wallet containing 500 BTC from 2010 – the early days of Bitcoin – moved for the first time in 13 years. This event led to widespread discussion about whether the wallet might belong to Bitcoin's mysterious creator, Satoshi Nakamoto, or another early adopter who had rediscovered their long-lost coins.

In August 2024, a wallet containing 2,000 BTC, which had been inactive since 2012, suddenly became active. The movement of these coins, worth approximately $120 million at the time, sparked intense speculation about the identity of the wallet owner and their reasons for moving the funds after such a long period.

The $10.2 million transfer: In August 2024, another case involved a dormant wallet from 2014 that moved 174.88 BTC, worth over $10.2 million, after nearly ten years of inactivity. The original value of these coins was around $142,000 when they were last active.

The recents: With all the HBO Satoshi documentary drama, few satoshi era wallets have been moving.

Read: "I'm not Satoshi" 💔

This means long-lost coins to re-enter circulation at any time?

The quest for recovery?

Quantum computing: There's speculation that future quantum computers could potentially crack the encryption protecting lost Bitcoin. However, this remains firmly in the realm of theoretical possibility for now.

AI and Machine Learning: These technologies are being investigated for their potential to help reconstruct lost keys or crack forgotten passwords. While promising, practical applications remain limited.

Brute force attempts: Some companies offer services that use sheer computational power to attempt to crack wallets. Success stories are rare, but they do occur occasionally.

Legal and forensic approaches: In cases involving theft or exchange collapses, legal action combined with forensic blockchain analysis has sometimes led to partial recovery of lost funds.

Despite these efforts, the cryptographic principles underlying Bitcoin mean that full recovery of lost coins remains nearly impossible in most cases.

The Ripple effect?

When Bitcoin is lost, it doesn't disappear from the blockchain. Instead, it remains recorded but becomes permanently inaccessible.

This has several effects on the Bitcoin ecosystem.

Increased scarcity + value

Lost Bitcoin contributes to the deflationary nature of the cryptocurrency. With a maximum supply of 21 million BTC, any coins that are lost effectively reduce the circulating supply. This scarcity can lead to an increase in value over time, as demand for a limited resource tends to drive prices higher. Estimates suggest that between 17% and 23% of all Bitcoin may be lost, translating to approximately 2.78 million to 3.79 million BTC that are no longer in circulation.

Read: What's Bitcoin Inflation? 🔑

Market Impact

Large-scale losses can have significant short-term impacts on the crypto market. A prime example is the Mt. Gox exchange collapse in 2014, which resulted in the loss of approximately 850,000 BTC. This event sent shockwaves through the crypto market, causing a substantial price drop and shaking investor confidence.

Development of Recovery Solutions

The challenge of lost Bitcoin has spurred a cottage industry focused on asset recovery. Companies specialising in recovering lost cryptocurrencies have emerged, offering services to help users regain access to their funds. This has led to increased awareness about proper wallet management and security practices among investors.

Technological and Security Innovations

The issue of lost Bitcoin highlights the need for improved security measures within the ecosystem. Innovations such as multisignature wallets and better recovery solutions are being developed to mitigate the risk of loss due to forgotten keys or hardware failures. These advancements aim to foster broader adoption by making it easier for users to manage their assets securely.

Psychological Impact

High-profile cases of Bitcoin loss may affect public perception of cryptocurrencies, potentially influencing adoption rates and investment patterns. Addressing these concerns will be crucial for the continued growth of the crypto ecosystem.

So, not all bad? yes as long as what’s lost is not yours.

Token Dispatch view

The phenomenon of lost Bitcoin is a double-edged sword for the crypto ecosystem.

On one hand, it creates a narrative of "digital gold" becoming even scarcer, potentially driving up value.

On the other, it highlights the steep learning curve and risks associated with self-custody of digital assets.

In the quest for financial sovereignty, some Bitcoiners have become victims of their own security measures. It's a stark reminder that with great freedom comes great responsibility – and sometimes, great regret.

While the tales of lost fortunes make for captivating headlines, they also serve as crucial lessons for the entire crypto community. As we move towards a more decentralised financial future, striking the balance between security and accessibility will be key.

Remember: Not your keys, not your coins – but don't forget where you put those keys.

Week That Was 📆

Saturday: Will Crypto Cast its Vote in 2024? 🗳️

Friday: SEC vs SEC 🤼

Thursday: Memecoin Prophet 🤼♂️ Blockchain Sleuth

Wednesday: "I'm not Satoshi" 💔

Monday: This time for Africa? 💃

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Great article!! The team at Vultisig (backed by THORChain founder JPThor) figured out how to eliminate seed phrases by forces you to use a co-signing device on a different platform: https://t.me/vultirefbot/app?startapp=ref_83cf5f3d-7b64-459e-a621-aa624d245478

While lost Bitcoin makes headlines and sparks public interest, it also reveals the need for more accessible recovery solutions. Self-custody comes with massive responsibility, and while 'not your keys, not your coins' holds true, the industry needs to create a better balance between security and user-friendliness. Otherwise, we'll keep hearing more of these tragic stories of lost fortunes.