What is Bitcoin Halving?🌛🌜

Looking ahead to Bitcoin halving this year, we explore what it actually means and the impact it will have on the Bitcoin price and the mining industry performance.

Hello, y'all. If you think you know your music, then this is for you frens👇

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Every four years, Bitcoin performs a little trick – it vanishes half into thin air.

No, it's not disappearing, it's undergoing a halving, an event that has shaped the entire digital currency's history and promises to do so again in May 2024.

What is a Bitcoin Halving?

A Bitcoin halving is a pre-programmed event that occurs roughly every four years, where the reward for mining a block is cut in half.

This mechanism is designed to gradually slow down the rate at which new Bitcoins are created and ultimately reach a finite supply of 21 million coins.

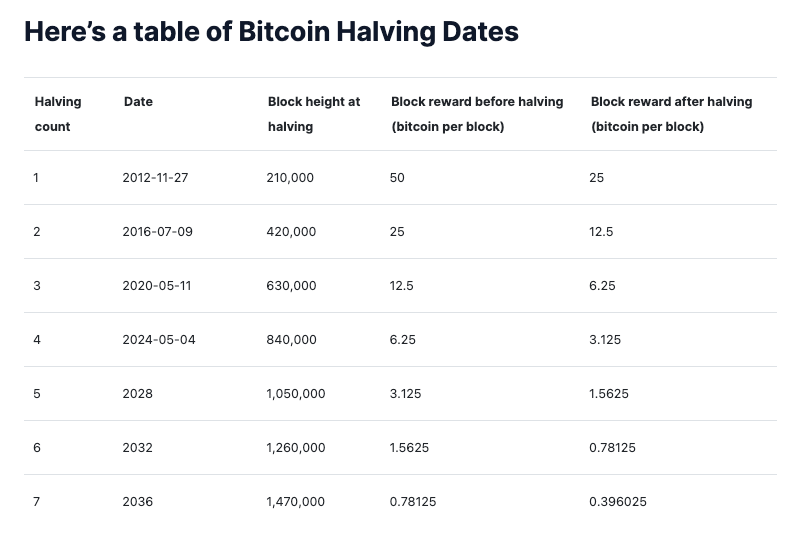

How did the past halvings go?

Act I: The Genesis Split (2012)

Miner loot? Slashed from 50 to 25 Bitcoins per block.

Price impact? Slow burn, but seeds of scarcity sown.

Act II: The Doubling Act (2016)

Reward? Dipped to 12.5 Bitcoins per block.

Price? Pumped from $650 to nearly $20,000!

Scarcity + demand = Bitcoin takes flight.

Act III: The Pandemic Pump (2020)

Miners get? 6.25 Bitcoins per block, half the bounty.

Price? Soars from $9,000 to a record-breaking $69,000!

Halving + global chaos = Bitcoin becomes a haven.

The Curtain Rises Again (May 2024)

Will scarcity spark another price surge?

Or will external factors steal the show?

Beyond the Symphony: A Look at the Score

The halving saga isn't just about price charts and dollar signs.

It's a testament to the ingenuity of Bitcoin's creator, Satoshi Nakamoto, who understood the fundamental principle of economics – scarcity breeds value.

By pre-programming this mechanism, Nakamoto ensured Bitcoin wouldn't suffer from hyperinflation, a common pitfall of digital currencies.

The halving also fosters a sense of community and shared purpose.

Miners become guardians of the network, their efforts rewarded with increasingly rare and valuable tokens.

CoinShares Report Highlights

Predicts increased mining competition post-halving, potentially leading to a 'miner exodus.'

Efficiency in bitcoin mining has risen, but so have hashrate and operational costs.

Post-halving production cost per bitcoin could stabilise around $38,000.

Read: CoinShares Mining Report: The Halving Impact

Price predictions?

So, CoinShares predicts Bitcoin to stabilise post-halving.

But, despite recent price drops, Michaël van de Poppe predicts a bull run for Bitcoin before the halving event, suggesting a potential rise to $300,000.

Anthony Scaramucci, founder of Skybridge Capital, predicts Bitcoin (BTC) could soar to at least $170,000 following its halving in April.

BitQuant predicts a post-halving price of up to $250,000, more than nine times its current value.

Bloomberg expects Bitcoin to hit $50,000.

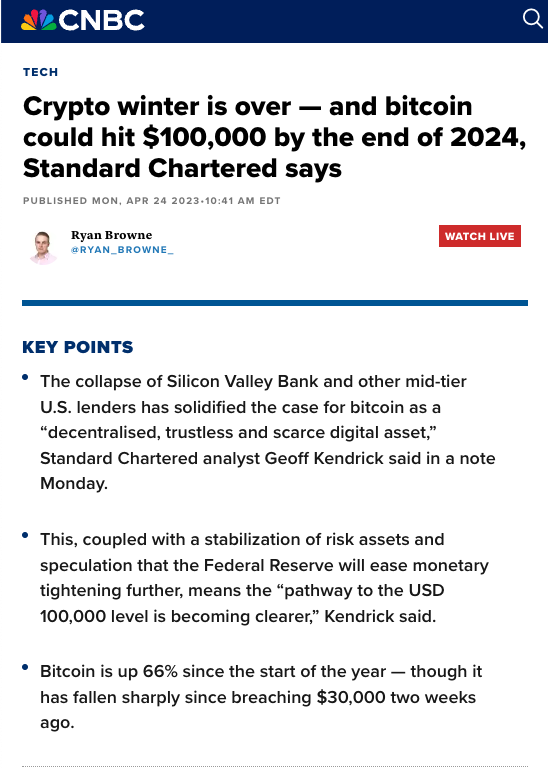

Standard Chartered predicts Bitcoin's value could reach $100,000 by the end of 2024.

Crypto trader Rekt Capital suggests a two-week window for buying Bitcoin at "bargain" prices before an expected pre-halving rally in February.

Rising Costs of Mining

Post-halving, the cost of mining a single Bitcoin is anticipated to double for publicly listed miners, potentially reaching a breakeven point of $20,000-$30,000 per Bitcoin.

JPMorgan predicts this cost could soar as high as $40,000.

Survival of the Fittest

The halving poses challenges for Bitcoin miners, as it will cut their revenue from block rewards in half. This has implications for miner profitability, especially amid fluctuating Bitcoin prices and operational costs.

This is prompting larger mining firms to bolster their operations with newer, more efficient mining equipment and consider acquisitions of smaller miners to sustain and capitalise on the halving.

Notable miners like Marathon Digital (MARA) and Hut 8 (HUT) are preparing for the halving by securing substantial financial reserves and pursuing mergers and acquisitions.

This industry consolidation is driven by the need to adapt to the reduced mining reward and maintain competitiveness.

Companies are investing in advanced mining hardware to stay ahead in the highly competitive mining landscape. For instance, Riot Platforms (RIOT) recently ordered 66,560 new mining machines worth $290.5 million.

Performance of the Bitcoin Miners Stocks

Bitcoin mining stocks have demonstrated significant performance, with some stocks experiencing substantial gains.

Riot Blockchain (NASDAQ: RIOT) and Marathon Digital Holdings (NASDAQ: MARA) have seen their stock prices increase by over 180%.

The Valkyrie Bitcoin Miners ETF (WGMI), which provides exposure to the bitcoin mining industry, has gained about 235.6%, making it the top-performing ETF of 2023.

The performance of Bitcoin mining stocks can be volatile, as they are influenced by factors such as the price of Bitcoin and the upcoming halving event.

While some analysts recommend buying the dip in Bitcoin mining stocks, others caution that the halving could lead to increased downside risk for these stocks.

TTD Week That Was 📆

Saturday: Better Days Ahead For Bitcoin? 🌞

Friday: Jupiter boosts Solana 🚀✨

Thursday: Happy Birthday Buterin 🥳

Wednesday: Heat on: Grayscale vs Others 🌋

Tuesday: Who's with crypto?👀🛡️

TTD Week in Funding 💰

Pixelmon. $8 million. An NFT gaming company.

Cube. $12 million. Hybrid crypto exchange.

Portal. $34 million. A decentralised exchange for P2P Bitcoin swapping.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋