Today’s edition is brought to you by Infinity Hash. Transparent and reliable system to own part of a real mining farm.

Sign-up here and get 10% bonus shares on the first purchase 👇

Hello ya’ll. Grab your favourite Sunday beverage. Today's Rabbit Hole takes us into the shadowy world of "debanking" — when banks don't want your money.

Imagine being so successful that banks refuse to let you be their customer. That's the kind of backwards logic we're unpacking today.

The real reason banks are saying "no" (spoiler: it's not them, it's their regulators).

First up, show us some love on X 🤞

Consider signing up for pay-what-you-want subscription to support our work - which is possible thanks to support from readers like you.

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

About an hour into a Congressional hearing earlier this month, Representative French Hill had heard enough.

"No one has any patience on this on either side of the aisle," the Arkansas Republican declared. "Legal businesses in the United States, in this great country, should have the freedom to bank and have financial services."

The issue at hand? Debanking — crypto's latest existential crisis that's rapidly becoming Washington's newest political battleground.

The crypto world is buzzing with stories of founders and companies suddenly finding themselves bankless.

Not because they lost their private keys, but because banks showed them the door. And it's not just small players getting the boot.

Even Coinbase's Brian Armstrong and Frax's Sam Kazemian have stories to tell.

World's biggest crypto founders are getting "debanked."

Now that’s not so normal, is it?

A perfect storm

The crypto industry is no stranger to regulatory challenges, but what's happening now feels different.

We're witnessing what appears to be a coordinated effort to cut off crypto companies from the banking system, and it's happening with such surgical precision that even industry veterans are alarmed.

Just last month, Marc Andreessen dropped a bombshell on Joe Rogan's podcast: over 30 tech founders in his portfolio had been systematically denied banking services.

And he wasn't alone. A chorus of prominent crypto voices quickly joined in.

David Marcus, former Meta executive, shared his own debanking story

Jesse Powell, Kraken's founder, detailed multiple instances of banking relationships suddenly terminated

Sam Kazemian of Frax revealed JPMorgan closed his account citing "crypto associations"

Tyler Winklevoss called it "unlawful, evil behaviour"

What exactly is debanking?

Imagine waking up to find your bank account frozen. No warning. No explanation. no appeal process.

Just a simple message: "Please move your funds. Your account is being closed."

That's debanking - when banks suddenly cut ties with customers, leaving them without access to basic financial services.

Why?

Not because they've done anything wrong, but because they've been deemed "high risk" or politically unfavourable.

There's no formal process, no clear rules, and crucially, no avenue for appeal.

One day you're running your business, the next you're scrambling to find a new bank that will take you.

It sounds absurd, like trying to play baseball without a bat. Yet for crypto hedge funds, this isn't a hypothetical — it's reality.

A recent survey by the Alternative Investment Management Association reveals that 75% of crypto-focused hedge funds are struggling to access basic banking services.

120 out of 160 crypto funds surveyed face banking obstacles. Meanwhile, their peers in real estate and private credit report smooth sailing.

It's as if there are two separate banking systems — one for traditional finance, and another (much more restrictive) one for crypto.

What they say?

Marc Andreessen, co-founder of Andreessen Horowitz

"There's no due process. None of this is written down. There's no rules. There's no court. There's no decision process. There's no appeal."

Brian Armstrong, Coinbase CEO

"This is one of the most unethical and un-American things that happened in the Biden administration. My guess is we'll find Elizabeth Warren's fingerprints all over it."

Nic Carter, crypto investor

“If bank regulators continue their pressure campaign, they risk not only losing control of the crypto industry, but ironically increasing risk, by pushing activity to less sophisticated jurisdictions, less able to manage genuine risks that may emerge.”

Read: Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs

Matt Hougan, Bitwise CIO

"Everyone in crypto saw this happening in real-time but if you tried to talk about it people either shrugged or suggested you were making it up."

As the crypto industry matures and institutional adoption grows, you might expect banking relationships to become easier, not harder.

Instead, we're seeing what industry veterans call "Operation Chokepoint 2.0."

What is that?

If this playbook sounds familiar, that's because we've seen it before.

Back in 2013, the Obama administration launched "Operation Chokepoint" — a Department of Justice initiative that pressured banks to cut ties with "high-risk" industries like gun shops and payday lenders.

The programme was officially shuttered after Congressional backlash, but its spirit appears to have been resurrected.

What we're seeing now has been dubbed "Operation Chokepoint 2.0," and it's targeting crypto with unprecedented precision.

The evidence?

Recently, Coinbase's chief legal officer Paul Grewal revealed internal FDIC documents showing explicit instructions to banks to "pause all crypto asset-related activity."

Not through formal channels, mind you, but through quiet "guidance" that banks dare not ignore. FDIC Chair went on to reject the notion.

Remember Ryne Saxe's startup Eco?

Their story reads like a thriller.

First came new compliance requirements. Then their payroll service, Bill.com, cancelled their account.

After eight months of struggle, they had to shut down their app.

"It was like being in hell," Saxe said.

But it's not just startups feeling the heat.

Even established players are getting burned.

Frax's Sam Kazemian: JPMorgan closed his account after learning his income came from crypto.

Blockdaemon: Lost access to Bank of America with no explanation.

And there’s more ... read on.

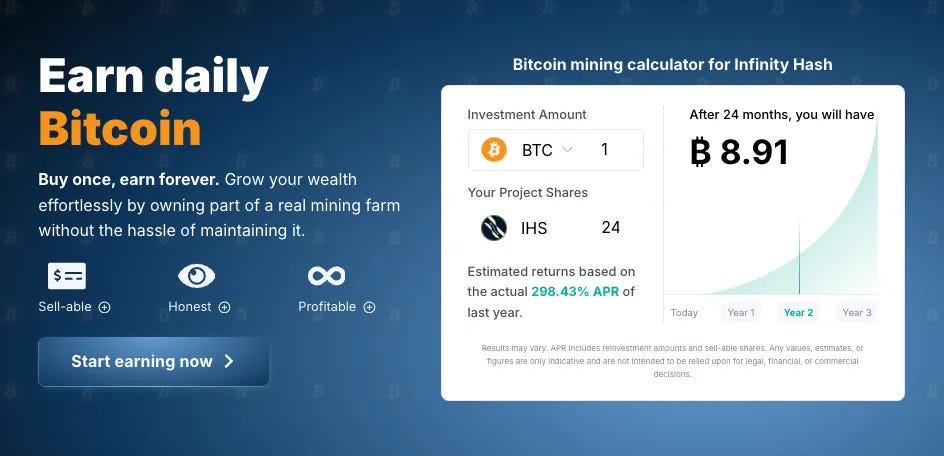

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Life-long contracts via Infinity Hash Shares

Daily payouts in Bitcoin and other coins

A fully transparent community project

A History of Financial Exclusion

Debanking isn't just a crypto problem. It's been happening for years.

The Government's Gambit

So why would regulators resort to such tactics? The official line is risk management.

After FTX's spectacular collapse and various crypto-related scandals, regulators argue they're protecting the banking system from potential contagion.

Critics see a darker motivation: using banking access as a political weapon to control or eliminate industries that have fallen out of favour.

As Professor Julie Hill of the University of Wyoming College of Law explains, regulators define "reputation risk" so broadly that it includes "any risk of negative publicity, whether true or not."

This creates a perfect pretext for targeting any industry they dislike.

More than 30: That's how many tech founders from just one VC firm (a16z) lost their bank accounts.

15%: The number that changed everything in 2022. Banks got a quiet message: keep crypto deposits under 15% of total deposits ... or else.

You know what happens.

96 banks: Remember when banks wanted in on crypto? Back in 2023, nearly a hundred financial institutions told the FDIC they were ready to dive into "crypto-related activities."

What happened next? Two major players down.

Silvergate Bank: Forced to wind down operations.

Signature Bank: Shuttered while still solvent.

The real cost? It's not just about numbers.

Startups moving offshore

Banking costs through the roof

Months of delays just to open accounts

Some companies simply giving up

Limited access to basic financial services

These numbers likely understate the problem. Many victims stay quiet, fearing further retaliation or lacking resources to fight back.

The Road to Capitol Hill

The issue is finally getting the attention it deserves in Washington.

Senator Tim Scott, the incoming chair of the Senate Banking Committee, has declared that "no legal business should ever be debanked."

Representative French Hill has promised investigations, and with Republicans set to control Congress, we might finally see some action on this front.

The gaslighting is perhaps the most fascinating part of debanking.

As Bitwise's Matt Hougan notes, for years the industry watched this happening in real-time, but speaking up about it was met with skepticism or outright denial.

It's the financial equivalent of seeing a ghost — everyone thinks you're crazy until they see it too.

Now the ghosts are becoming visible.

Even SEC Commissioner Hester Peirce, crypto's maternal figure in Washington, is asking questions about how regulatory bodies might be "dissuading regulated entities from serving the crypto industry."

What can you do?

If you've been affected by debanking, industry leaders has recommendations for you.

Document everything — keep all communications with your bank

Share your story publicly (if you can safely do so)

Report incidents to relevant Congressional committees

Consider joining or supporting ongoing legal challenges

Explore alternative banking options, including offshore solutions

The Token Dispatch View 🔍

The entire narrative suggests that banks have gone political, turning away customers whose views don't align with their values.

That's not quite right. In fact, it's backwards.

Banks are in the business of making money from money. They take your deposits, pay you a bit of interest, and then lend those funds out at a higher rate. It's Banking 101.

The idea that they'd voluntarily turn away deposits because they don't like someone's politics is about as logical as a bakery refusing to sell bread because they disagree with their customers' taste in music.

The story becomes clearer when we look back to 2008, during the financial crisis. That's when banks learned a crucial lesson about who really calls the shots in finance.

Remember TARP? The Troubled Asset Relief Program was supposed to be a lifeline for struggling banks.

Many banks that didn't need or want the money were "asked" to take it anyway.

Asked, in this case, being a polite way of saying "told."

Why would healthy banks accept money they didn't need?

Simple: Because the alternative was worse.

Government regulators can shut down a bank faster than you can say "deposit insurance."

When the people who can end your business make a suggestion, it tends to sound a lot like an order.

Fast forward to 2024, and that same dynamic is playing out in what we're calling "debanking."

Banks aren't turning away crypto companies or controversial businesses because they've suddenly developed political consciousness — they're doing it because they've learned that staying in business means staying in the good graces of regulators.

It's a bit like that scene in every mob movie where the local shop owner pays "protection money."

No. Not about protection — it's about being allowed to stay in business.

The irony is thick enough to cut with a knife: the very institutions designed to facilitate commerce are being forced to restrict it.

Banks want your business — all of it. But as long as politicians are picking winners and losers, banks will be forced to play along.

Week That Was 📆

Saturday: 2025: What’s in Store for Crypto ETFs 🎊

Friday: Inside 2024's RWA Revolution 📦

Thursday: Crypto’s $MIRA Christmas Magic 🪄

Wednesday: The Memecoin Takeover of 2024 💥

Tuesday: Does HYPE Need Help? 🚨

Monday: Crypto's Dream Regulator ✨

If you want to make a splash with us, book a demo call 🤟

You can check out partnership opportunities🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Thank you for spreading awareness ♥️☀️☮️🌈🏁