Hello,

Credit is the economy’s time machine. It allows businesses to bring tomorrow’s cash flows into today’s decision-making.

I consider it one of the most underrated aspects of the financial world.

Seldom do people notice credit when it works. But it appears in how businesses function. An effective credit system enables businesses to replenish inventory before shelves are completely empty. A factory can upgrade its obsolete equipment before it breaks down. A founder can hire an extra person before human resource redundancies become a crisis.

The gap between a good idea and its execution is often due to limited access to credit. This gap is what banks promise to fill.

Banks accept deposits from customers through bank accounts and extend credit to those seeking loans. They pay their customers lower interest rates than they charge borrowers, pocketing the difference as profit. However, bank credit comes with challenges. The credit demand-supply mismatch is one of the most significant ones.

Private credit pitches in where banks can’t reach, but the gap persists. This gap reflects investors’ reluctance to lend in the current credit markets.

In March 2025, a report by IFC–World Bank MSME Finance Gap estimated a financing gap of approximately $5.7 trillion across 119 emerging markets and developing economies (EMDEs). That’s about 19% of their collective GDP.

In this context, I find last week’s developments in the on-chain credit space promising. On-chain lending isn’t new. We saw a crazy cycle in 2022 that is still debated today for various reasons. But this current cycle feels different.

In this week’s analysis, I dive into all that has changed in the on-chain credit market and tell you why it makes me feel it could change credit for good.

Let’s get started, shall we?

We’ve had money markets on Ethereum for years. Over-collateralised borrowing, liquidation bots, rate curves, and occasional liquidation cascades are not new at all. So, when credit-related announcements came out last week, it was the players who joined the game and how they are repackaging credit that grabbed my attention, not the primitive itself.

What excites me is that these isolated partnership announcements collectively signal a broader convergence. What began in siloed DeFi during the summer of 2022 is now coming together. Vault infrastructure, non-custodial wrappers, professional risk managers, and automated yield optimisation are all being integrated and distributed.

Kraken rolled out DeFi Earn, a retail-friendly wrapper that routes lender deposits into vaults (Veda, in this case). The vaults will then direct funds to lending protocols such as Aave. Chaos Labs will serve as the risk manager, monitoring the engine. Kraken promises to offer its lenders an annual percentage yield (APY) of up to 8%.

What changes with vaults? They offer lenders self-custody and visibility. Instead of handing their money to a fund manager, as in traditional credit markets, and waiting for monthly disclosures, vaults are integrated with smart contracts that mint claims on the funds and display real-time deployment on the blockchain.

Around the same time, Bitwise, the world’s largest crypto fund manager, launched non-custodial vault strategies on Morpho, an on-chain lending platform.

That’s not the first time on-chain lending has received institutional validation. In 2025, Coinbase launched USDC lending, enabling a smart contract wallet to connect and route deposits into Morpho via on-chain vaults. Steakhouse Financial curated this to allocate funds across markets and optimise returns.

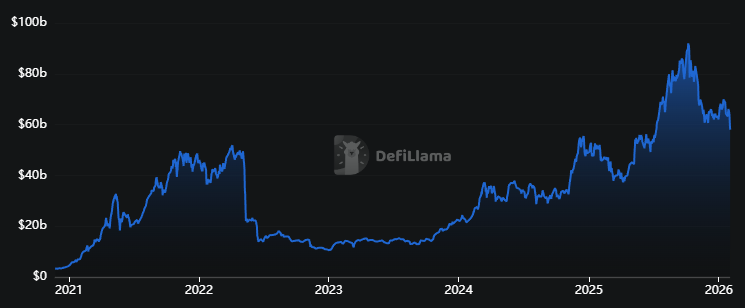

It comes at a time when the on-chain lending market is looking set to explode. The data establishes this.

The total value locked (TVL) in lending protocols stands at $58 billion, up 150% over two years. Yet, this figure is only 10% above the 2022 highs.

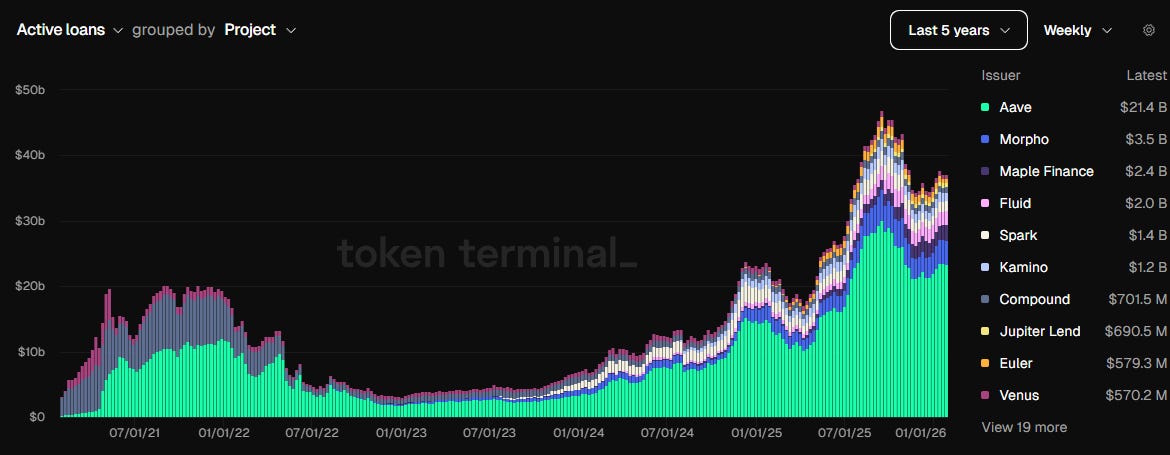

This is where the active loans outstanding dashboard reflects a more accurate picture.

The dashboard shows a solid foundation laid by incumbents, including Aave and Morpho, with active loans exceeding $40 billion over the last few months, more than double the 2022 highs.

Both Aave and Morpho today make six times the fees they did two years ago.

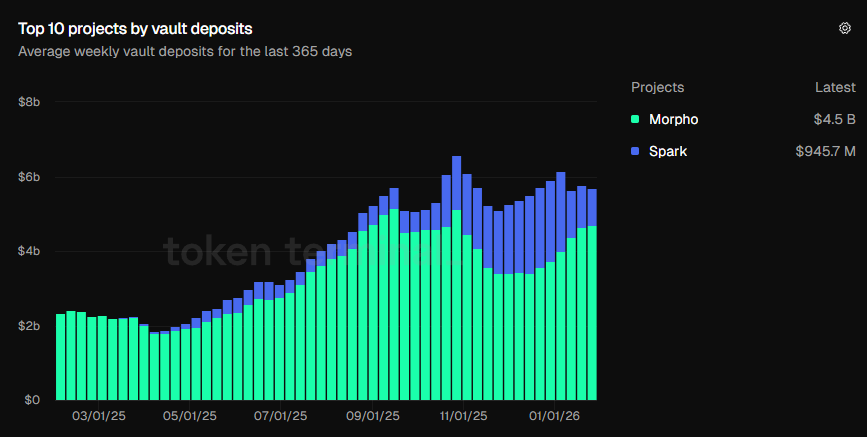

While these visuals demonstrate investors’ confidence in lending protocols, I find the growth in vault deposits over time even more compelling.

In October 2025, total vault deposits exceeded the $6-billion mark for the first time ever. Today, those deposits stand at $5.7 billion, more than double last year’s amount ($2.34 billion).

These charts show that users are choosing products that offer a comprehensive ecosystem, including vaults, yield-optimisation strategies, risk profiles, and professional managers.

This is the evolution I am optimistic about, in contrast to what we observed during DeFi Summer. At that time, the lending market appeared to be a closed loop. Users leveraged the loop by depositing collateral, borrowing against it, using the proceeds to purchase additional collateral, and redepositing it to earn higher yields. Even if the price of collateral fell, these users at least received incentives from the platform for using the platform's lending protocols. But when the incentives themselves fade? The loop snapped.

Even the current cycle is built on the same primitive - over-collateralised borrowing, but is based on a different and robust foundation. Vaults today have become wrappers that convert protocols into automated asset managers. Risk managers have taken centre stage to set guardrails.

This shift changes how on-chain lending appeals to investors and lenders.

During DeFi Summer, lending protocols were merely another avenue to make quick money. It worked until the incentives dried out. Users opened Aave, added funds, borrowed against collateral, and repeated the process until the incentives dried out. We saw this with Aave’s Avalanche deployment, where incentives attracted deposits and initially financed the loop. But when the subsidy weakened, the loop unwound. As a result, outstanding debt on Avalanche dropped 73% quarter-on-quarter in Q3 2022.

Today, lending has evolved into a well-supported ecosystem with specialised actors, each responsible for risk, yield optimisation, and liquidity.

Here’s how I’d put the entire stack together.

At the bottom is the settlement money in stablecoins. They can be moved instantly, parked anywhere, deployed at any time, and, crucially, measured easily.

Above this sit familiar money markets, like Aave, where lending and borrowing are enforced by software code and collateral.

Then comes the world of wrappers and routers, which pool and route funds from lenders to borrowers. Vaults act as wrappers that package the entire lending product in a way that makes sense to retail investors. It could appear as “deposit $X, and earn up to Y%,” as Veda wallets do on Kraken’s Earn platform.

Curators sit above these protocols, deciding what collateral to allow, liquidation thresholds, exposure concentration, and when to unwind a position when collateral value declines. Think of what Steakhouse Financial does on Morpho or how asset managers like Bitwise feed their judgment directly into vault rules.

In the background, AI systems operate 24/7 to manage on-chain credit risk and serve as the nervous system for the lending ecosystem when humans are away. Manual risk management is difficult to scale. Constrained risk management increases credit risk during periods of volatility. It could result in substandard yield at best, or liquidation at worst.

The AI optimisation engine tracks borrowing demand, oracle deviations and liquidity depth to trigger timely withdrawals. It triggers alerts when vault exposure drifts beyond pre-established thresholds. It advises on de-risking actions and supports the risk team in decision-making.

It is this round-the-clock optimisation, de-risking, audited vaults, curated strategies, institutional validation, and professional risk managers that make the current market feel safer and carry fewer risks.

But none of these completely eliminates risk. One of the most overlooked risks is liquidity risk.

While a vault offers “better liquidity” than siloed protocols, it still operates in the same market as those protocols. Vaults can make it difficult to exit funds by increasing unwinding costs in thin markets.

Then there is the risk of the curator’s discretion.

When users deposit in a vault, they are trusting someone’s discretion on what markets to allocate to, which collateral to trust, and what unwinding thresholds to set. This is how credit works everywhere, but lenders should understand that non-custodial does not necessarily mean risk-free.

Despite these challenges, on-chain lending is changing the crypto landscape and, by extension, economies.

Credit markets run on the cost of time and operations.

Enormous spending on verifying, monitoring, reporting, settling, and enforcing transactions makes traditional credit costly. A large portion of the interest they charge borrowers is avoidable and not necessarily tied to the “time value of money”.

On-chain credit compresses both time and operating costs.

Stablecoins minimise settlement time, smart contracts cut enforcement time, transparent ledgers reduce audit and reporting time, and vaults eliminate user complexity. These cost savings become even more significant when addressing the credit gap in small and medium enterprises.

On-chain credit won’t fill the credit gap overnight, but a lower cost of credit will make verification easier and make access more inclusive. And that could reshape economies.

That’s it for this week’s quantitative analysis. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Brilliant breakdown of how the lending stack has matured. The vault wrapper concept is particualrly clever since it abstracts away protocol complexity while maintaining transparency. I've seen similar patterns in TradFi where automated risk engines help scale credit decisions, but the real-time visibility here changes the game completely. One thing worth watching tho is whether curators actually maintain their discipline during the next downturn or if they'll chase yield like everyone else.