In 1961, General Motors installed Unimate, the first industrial robot, on an assembly line in New Jersey. The 4,000-pound mechanical arm moved die castings from one point to another. It did one task, repeatedly, without complaint. Workers hated it. Management loved it. The pattern was set.

Six decades later, over 4.3 million industrial robots operate in factories worldwide. They weld car frames, assemble smartphones, sort packages, and paint aircraft fuselages. Agricultural drones monitor millions of acres. Delivery robots navigate city sidewalks. Surgical robots assist in operating rooms. The machines arrived, quietly, while everyone argued about whether AI would take their jobs.

The robotics industry now represents over $100 billion in annual spending. Large companies build robots, deploy them in controlled environments, capture the data, and repeat. Vertical integration works. It’s proven. It’s also expensive and closed.

A parallel development is emerging. Projects are experimenting with cryptocurrency and decentralised networks to fund robot deployments, coordinate operations, and distribute value across participants. The entire robotics-crypto market sits at $524 million. That’s a rounding error compared to traditional robotics capital.

The gap between $524 million and $100 billion suggests either enormous opportunity or enormous delusion.

This piece examines which one it is.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

AI models consumed the internet. GPT-4 trained on 13 trillion text tokens. Stable Diffusion ate 5 billion images. Digital data got strip-mined.

Robotics faces a parallel problem. Just as OpenAI and Anthropic train on public internet data but keep their improvements proprietary, robotics companies hoard their operational data. Over 4.3 million industrial robots operate globally, generating sensor readings, movement patterns, environmental interactions. Tesla doesn’t share Optimus training runs. Boston Dynamics doesn’t open-source Atlas algorithms. Factory data stays locked in corporate silos.

Robotics data carries extra baggage like privacy concerns, safety regulations, real-time processing needs, massive infrastructure costs. You can’t just upload it somewhere and call it solved.

Figure AI raised $675 million. Tesla spent billions. Boston Dynamics represents decades of DARPA funding. Building physical AI requires fortress-style vertical integration: robots ($500 to $50,000 each), deployment locations, human teleoperators, GPU compute, researchers. Every piece costs money. Coordinating these stakeholders without shared incentives is nearly impossible.

This creates a coordination nightmare. The robot manufacturer wants to sell hardware. The building owner wants cleaning services. The teleoperator wants fair pay. The researcher wants access to data. The GPU provider wants reliable customers. None of them trust the others to fairly distribute the value being created.

Traditional corporate structures solve this through ownership. Tesla owns the robots, the data, the training infrastructure, and the researchers. If Optimus succeeds, Tesla could control the largest corpus of humanoid robot training data on Earth - a strategic advantage that could last decades.

The alternative is what crypto does best: aligning misaligned incentives through tokens.

The global robotics market is projected to reach $518 billion by 2035, according to Research Nester. Within that, specific segments highlight where physical AI is headed. Drone networks will hit $57 billion. Humanoid robots will grow to $38 billion. Robotic exoskeletons will become a $41 billion market.

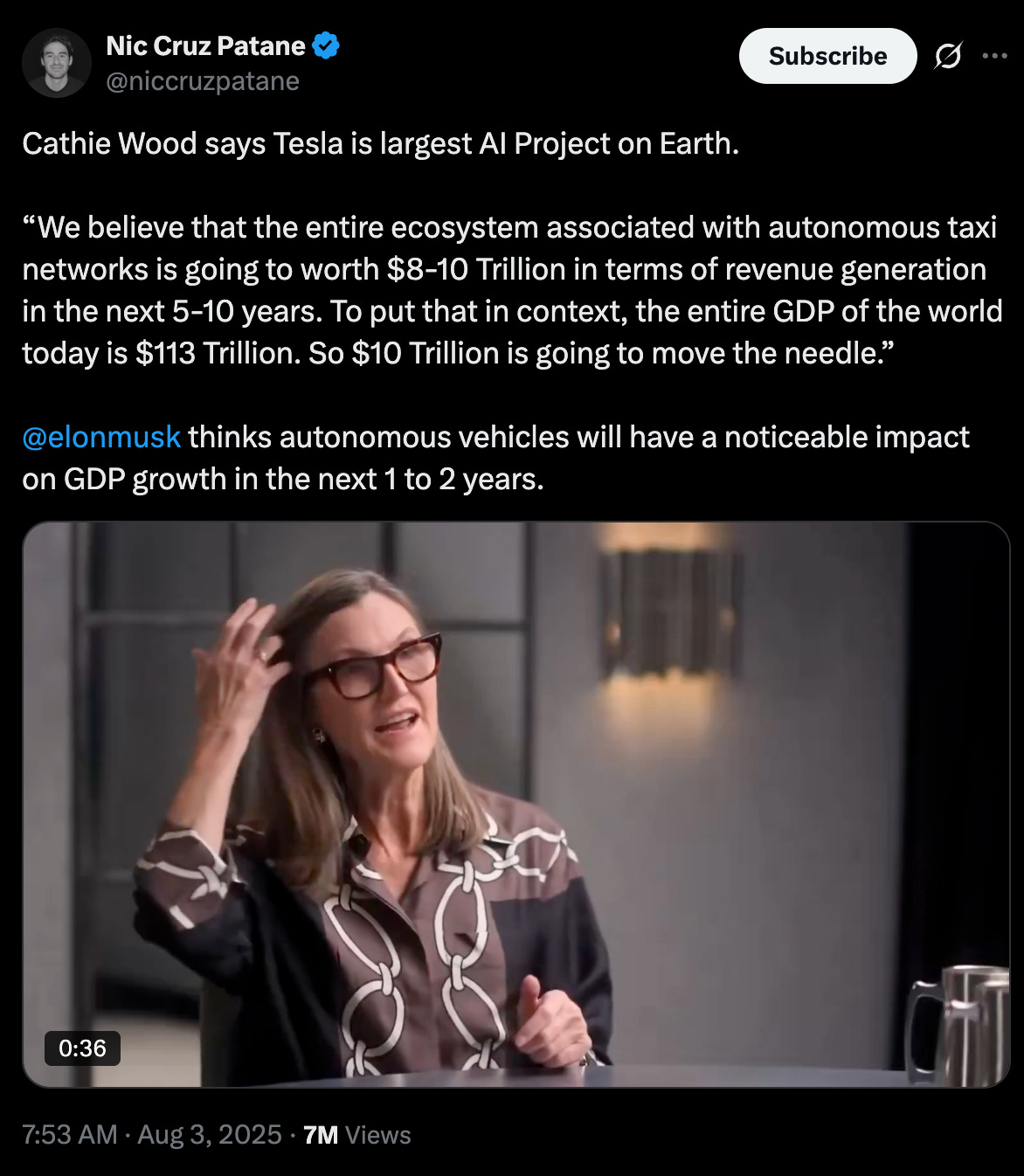

Cathie Wood has made bold predictions about autonomous vehicles:

Companies are reinvesting capital. The robotics industry collectively spends over $100 billion annually on R&D and deployment.

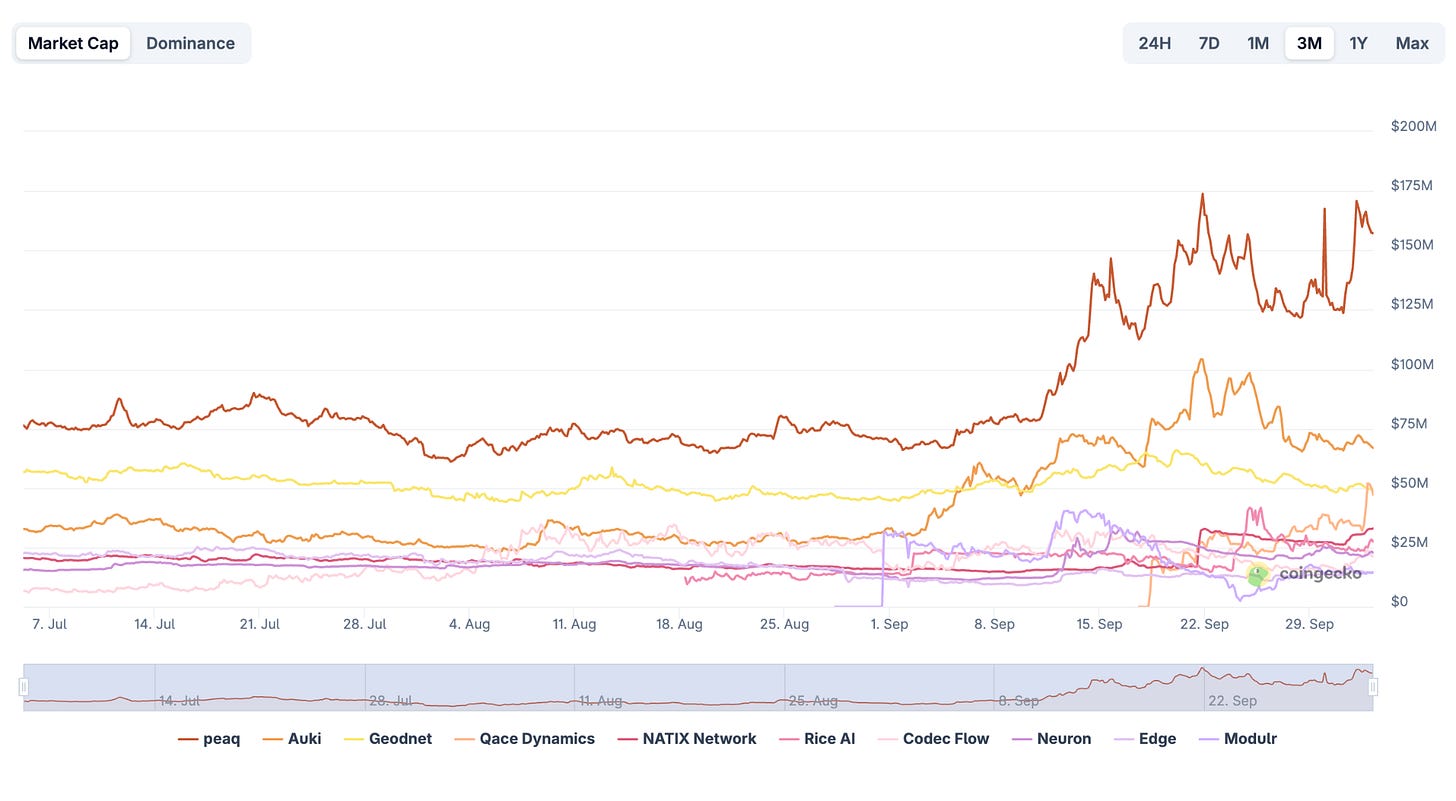

Now compare that to crypto-robotics: the total market cap of all projects stands at $524 million. PEAQ, the largest, has a market cap of $173 million. AUKI comes in at $72 million. The entire sector wouldn’t even rank in the top 50 crypto projects by market cap.

Blockchain integration into robotics is projected to grow at a 38.2% CAGR, reaching $7.28 billion by 2033. That’s still a rounding error compared to the broader robotics market, but the gap represents opportunity.

DePIN projects more broadly are gaining traction. The sector grew from 100 projects in 2022 to 1,500 by 2025. Market value has jumped from $5 billion to $18 billion. Physical infrastructure networks are proving they can bootstrap capital and coordination at scale.

Robotics is next.

The Projects Building Robot Economies

1/ RICE AI operates robots at SoftBank offices, 7-Eleven Japan stores, and Mitsui Fudosan properties. These are real deployments handling everyday tasks. The company raised $750,000 through a token presale, reaching a $7.5 million valuation. They are creating a decentralised marketplace where robotics data gets collected, tokenised, and sold to companies training AI models.

Robots collect data through daily operations. That data gets tokenised and sold through a decentralised marketplace. Companies training their own robotic models can buy specialised datasets without having to build their own robot fleet. Token holders can stake RICE for governance rights and receive platform fee burns.

RICE implements deflationary tokenomics through platform fee burns. Every time someone purchases data through the marketplace, a portion of RICE tokens is burned. Reduced supply with constant or growing demand supports price appreciation. Token holders also receive governance rights over which types of data the network prioritises collecting.

2/ NATIX Network has 250,000 drivers who have collected 160+ million kilometers of street data. They’re building the data infrastructure needed for autonomous vehicles. Every Tesla has cameras, and NATIX pays drivers to monetise those camera feeds through a DePIN network.

Their StreetVision subnet on Bittensor processes real-world imagery for autonomous driving training. Miners compete to improve AI models, earning tokens for better performance. The network has already processed billions of frames of street-level data, creating one of the largest geospatial datasets in existence.

Traditional mapping companies like Google and Apple spend billions building their own data collection infrastructure. NATIX crowdsources it for a fraction of the cost by properly aligning incentives.

NATIX implements staking requirements for data validators. You need to stake tokens to validate street-level imagery. Poor validation gets you slashed. Good validation earns you fees. This creates skin in the game, ensuring data quality without centralised oversight.

4/ Peaq launched the world’s first tokenised robo-farm in Hong Kong. Built by KanayaAI and tokenised by DualMint, the semi-autonomous vertical farm automates 80% of farming tasks. Token holders receive yields based on cash flows from selling fresh greens to local subscribers.

The farm produces lettuce, kale, and spinach. It sells them. Token holders get paid. The entire operation runs mostly autonomously, with blockchain handling payments and record-keeping.

The estimated 20% APY comes from actual economic activity, not from token inflation or speculation. This model could extend to other forms of physical infrastructure, such as, robot-operated warehouses, autonomous delivery networks, and drone services.

If crypto-robotics networks can coordinate physical infrastructure more efficiently than corporate hierarchies, the $524 million will look quaint in five years. If they can’t, most of these tokens go to zero.

The DePIN Solution

Decentralised Physical Infrastructure Networks (DePIN) solve the two main challenges robotics faces. Capital formation and stakeholder coordination.

Traditional VC requires companies to give up equity, submit to governance, and align with investor timelines. Token sales, on the other hand, allow projects to raise capital directly from communities who understand the technology and want to participate in the upside.

RICE AI raised $750,000 without traditional VC. FrodoBots bootstrapped through hardware sales and gaming fees. Peaq’s robo-farm was funded through token sales. None of these required approval from Sand Hill Road.

Physical infrastructure takes time to compound. Token sales allow robotics companies to find patient capital from communities who ‘get it.’

The more difficult challenge is coordination. How do you align robot operators, teleoperators, data contributors, GPU providers, and researchers around shared resources?

Token economics creates natural alignment. Teleoperation labor providers earn tokens for their work. Data contributors are paid for valuable datasets. GPU providers receive tokens for compute. Researchers access subsidised training data. Everyone holds the same token, so everyone benefits from network growth.

BitRobot implements this through a subnet model inspired by Bittensor. Each subnet focuses on specific robotic tasks, such as manipulation, navigation, and classification. Miners compete to produce better models for each task. Validators assess performance and distribute rewards.

This creates a decentralised research lab. Instead of one company trying to solve humanoid manipulation, you have dozens of research teams competing and collaborating. The best approaches get rewarded. Failed experiments fail fast and cheap. The entire network learns faster than any single corporate lab could.

Training a manipulation model requires thousands of hours of gripper interactions with different objects. Traditional companies collect this data internally at huge cost. DePIN networks let anyone contribute data and anyone purchase access.

NATIX demonstrates how this scales. Each driver contributes marginal amounts of data, but with 250,000 drivers, creating a dataset at a scale and diversity that’s extremely challenging for any single company to build alone, especially in a decentralised, token-incentivised way.,. More drivers mean better coverage, which attracts more customers, which increases token value, which attracts more drivers.

Can decentralised coordination compete with vertical integration at scale? Tesla can mandate that every Optimus robot feeds data into their training pipeline. DePIN networks have to incentivise it. Which approach wins matters enormously for how the robotics industry develops.

Token sales democratise access to capital. If your project makes sense and you can articulate the value proposition, you can raise money directly from people who want to participate. No VC firm has to believe in your vision. You just need enough believers to reach your funding target.

This accelerates experimentation. More teams can try more approaches faster. Failed ideas fail quickly. Successful ideas get copycat competition, driving further innovation. The evolutionary pressure is higher in open networks than in corporate labs.

The next few years will tell us whether decentralised robot networks can scale from 30 cities to 3,000, from thousands of robots to millions. The early experiments are working. The capital is starting to flow. The coordination mechanisms are being battle-tested.

Physical AI is the next frontier after digital AI. Whoever solves the data problem wins. The crypto-robotics sector is betting on decentralised coordination. Both approaches have merit, but both also face challenges.

The robots don’t care who wins. They just need money, data, and a reason to exist. Crypto is providing all three.

That’s it about them robots. See you next week with another deep dive.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.