Hello!

The companies that figure out how to grow while preserving their essential character will have sustainable advantages over those that optimise purely for scale.

Check out our Saturday edition to know more.

I used to get excited about every crypto funding announcement.

Every pre-seed round felt like breaking news. "Anonymous team raises $5M for revolutionary DeFi protocol!"

I'd frantically research the founders, dive into their Discord, try to understand what made this one special.

Flash forward to 2025. Another funding round crosses the desk. Series A. $36 million. Stablecoin payments infrastructure.

I move it under "enterprise blockchain solutions" and move on.

When did I become so... practical?

For the first time since 2020, later-stage deals captured more capital than early-stage deals in crypto VC.

65% vs. 35%.

Read that again.

This is the industry that was built on pre-seed rounds to anonymous pseudonymous teams building DeFi protocols in their garages.

Now? Series A and beyond are driving the money train.

What changed?

Everything. And nothing.

All the Web3 Funding Data You Need

Don’t raise funds in the dark — know who’s investing and who’s deploying in Web3. Get clarity with Decentralised.co’s all-in-one Funding Tracker.

Here’s a note on how to use the tracker.

If you are a founder, reach out to us at venture@decentralised.co

VCs in suits. Due diligence that takes months, not minutes.

Regulatory compliance. Institutional adoption.

Professional pitch decks instead of anonymous Discord messages.

KYC processes. Legal teams. Revenue models that actually make sense.

Companies like Conduit raising $36 million for "unified onchain payments." Beam securing $7 million for "stablecoin-based payment services."

These are infrastructure plays. B2B solutions. Enterprise-grade platforms.

Boring, profitable, scalable businesses.

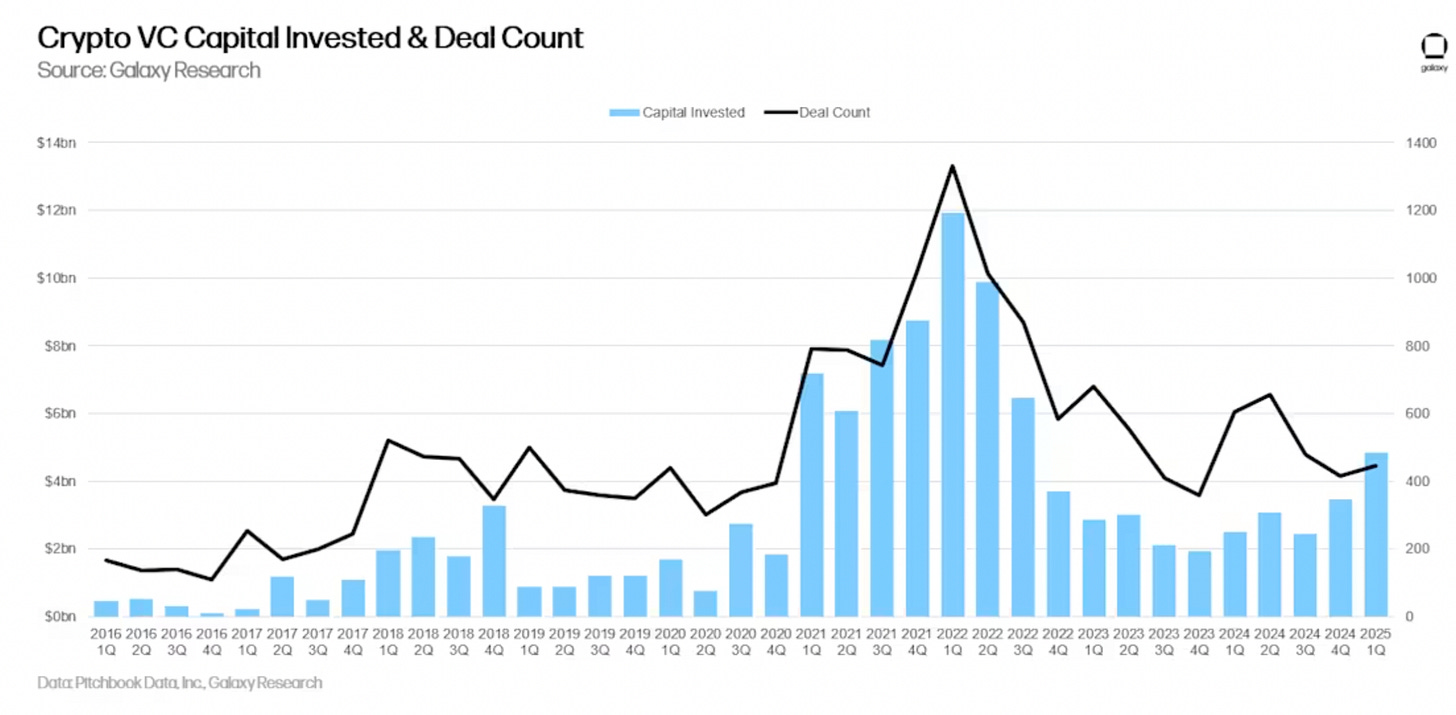

Crypto VC headlines love to throw around big numbers, so let's start with the facts:

Q1 2025: $4.9 billion invested across 446 deals (+40% quarter-over-quarter).

Year-to-date: $7.7 billion raised, putting 2025 on track for $18 billion total.

The catch: MGX (Abu Dhabi's sovereign fund) wrote a $2 billion check to Binance.

This perfectly captures the current VC environment: a few massive deals skewing the numbers while the broader ecosystem remains tepid.

According to Galaxy Research, the correlation between Bitcoin price and VC activity—reliable for years—broke down in 2023 and hasn't recovered.

Bitcoin hit new highs while VC activity stayed subdued. Turns out, when institutions can buy Bitcoin ETFs, they don't need to fund risky startups for crypto exposure.

The VC Reality Check

Venture funding in crypto has collapsed 70% from its 2022 peak of $23 billion to just $6 billion in 2024.

Deal count has plummeted from 941 in Q1 2022 to 182 in Q1 2025.

But here's the part that should terrify every founder pitching "the next big thing" — of the 7,650 companies that raised seed funding since 2017, only 17% ever made it to Series A.

Just 1% reached Series C.

This is crypto venture capital growing up, and it's going to be painful for anyone who thought the party would last forever.

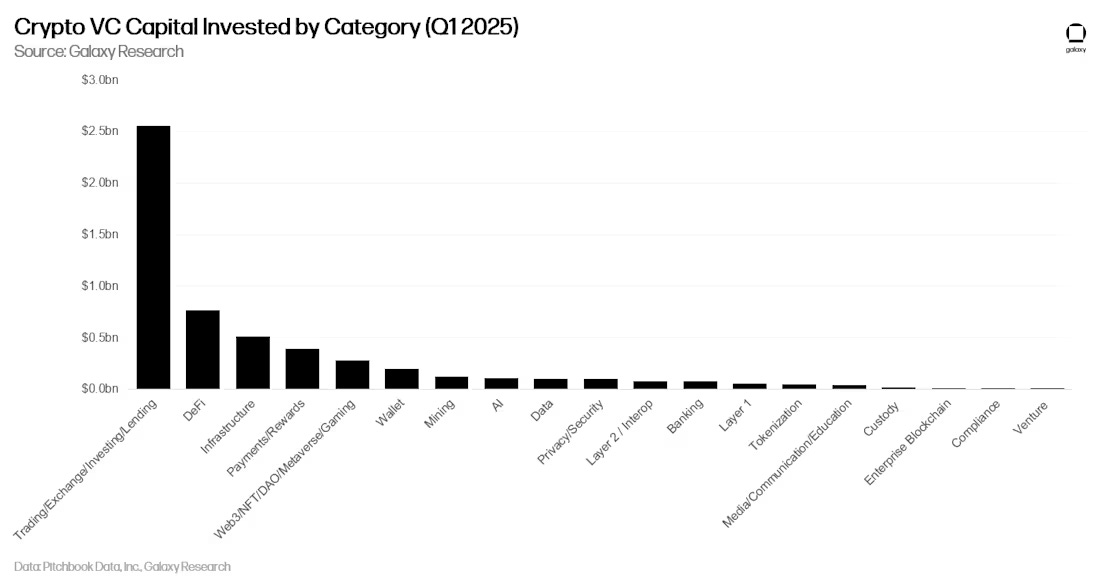

The Category Rotation

The hot narratives of 2021-2022 — gaming, NFTs, DAOs — have essentially vanished from VC interest.

In Q1 2025, companies building trading and infrastructure captured the majority of venture dollars. DeFi protocols raised $763 million. Meanwhile, the Web3/NFT/DAO/Gaming category, which once dominated deal count, has slipped to fourth place in capital allocation.

It's VCs finally prioritising revenue-generating businesses over narrative-driven speculation.

The infrastructure that actually powers crypto transactions gets funded.

The applications that people actually use get funded.

The protocols that generate real fees get funded.

Everything else is becoming increasingly starved for capital.

AI has also emerged as a major competitor for venture dollars.

Why bet on crypto gaming when you can bet on AI applications with clearer paths to revenue? The opportunity cost has shifted dramatically against crypto-native applications that can't demonstrate immediate utility.

The Graduation Crisis

Let's start with the most sobering statistic buried in the data: the graduation rate from seed to Series A in crypto is 17%.

That means for every six companies that raise a seed round, five will never see meaningful follow-on funding.

Compare that to traditional tech, where roughly 25-30% of seed companies reach Series A, and you start to understand the magnitude of the problem.

Crypto has been operating with fundamentally broken success metrics.

Why? Because for years, the crypto playbook was simple: raise venture money, build something that looked innovative, launch a token, and let retail investors provide the exit liquidity. VCs didn't need companies to actually graduate through funding rounds because the public markets would bail them out.

That safety net has evaporated. Most tokens launched in 2024 are trading at fractions of their initial valuations. EigenLayer's EIGEN launched with a $6.5 billion fully diluted valuation and is down 80%. The list of projects generating over $1 million in monthly revenue can be counted on one hand.

When the token listing route became a dead end, the true graduation rates became visible. And they're ugly. The result? VCs are now asking the same questions that traditional investors have been asking for decades: "How do you make money?" and "When do you become profitable?" Revolutionary concepts in crypto land, apparently.

The Concentration Takeover

While deal count has collapsed, something interesting has happened to deal sizes. The median seed round has grown significantly since 2022, even as fewer companies are raising altogether.

This tells the story of an industry consolidating around fewer, larger bets. The days of "spray and pray" seed investing are over.

Read: Venture Funding Tracker | Decentralised.co

Instead, a small number of well-capitalised funds are writing bigger cheques to fewer companies, betting that concentration beats diversification in a world where most startups fail.

The network effects here are striking. When you map crypto VC co-investments, clear patterns emerge.

Robot Ventures appeared in three of Paradigm's deals, while Dragonfly shared three rounds with Robot Ventures out of 13 total investments. Dragonfly shared three rounds with Robot Ventures in 13 total investments. These aren't coincidences — they're the early signs of an exclusive club forming.

Read: How crypto VCs choose who to invest with

The message to founders is clear: if you're not in the network, you're probably not getting funded. And if you're not getting funded by the top-tier funds, your chances of raising follow-on rounds drop dramatically.

This concentration extends beyond just funding.

The data shows that 44% of companies that raised follow-on rounds from A16z's portfolio saw A16z participate in that subsequent round.

For Blockchain Capital, it's 25%. The best funds aren't just picking winners; they're actively ensuring their portfolio companies continue to get funded.

Token Dispatch View 🔍

We have all been watching the shift from "revolutionary DeFi protocols" to "enterprise blockchain solutions."

And honestly? I'm conflicted.

Part of me misses the chaos. The wild swings. The anonymous teams with Discord handles raising millions for ideas that sounded like they came from a fever dream.

There was something pure about the madness. Just builders and believers betting on a future that traditional finance couldn't even imagine.

But the other part of me—the part that's watched too many promising projects die from poor fundamentals—knows this correction was inevitable.

For years, crypto VC operated under a fundamentally broken model. Ventures could raise money based on white papers, launch tokens to retail investors for liquidity, and call it success regardless of whether they built anything users actually wanted.

The result? An ecosystem optimised for hype cycles rather than value creation.

Now, it's the industry's long-overdue transition from speculation to substance.

The market is finally applying performance standards that should have existed from the beginning. When only 17% of seed companies reach Series A — that's market efficiency finally catching up to a sector that had been artificially propped up by narrative excess.

All of this creates both challenges and opportunities. For founders accustomed to raising money based on token potential rather than business fundamentals, the new reality is harsh. You need traction, revenue, and a clear path to profitability.

But for founders building real businesses that solve real problems, the environment has never been better. Less competition for funding, more focused investors, and clearer success metrics.

The tourist money has left, leaving behind serious capital for serious businesses. The institutional players that remain aren't looking for the next meme coin or speculative infrastructure play.

The founders and investors who survive this transition will build the infrastructure for crypto's next chapter. And unlike the last cycle, it will be built on business fundamentals rather than token mechanics.

The gold rush is over. The mining operation has just begun.

And despite everything I said about missing the chaos? That's exactly what crypto needed.

See ya, next Friday.

Until then … stay curious,

Thejaswini

Don't forget to whitelist thetokendispatch+rabbithole@substack.com to ensure you’ve got me each week in your primary inbox.

Week That Was 📆

Saturday: The Social Network Growth Theory 📈

Thursday: The Sovereign Bitcoin Rush 🏦

Wednesday: Pumping The Creator Economy 💰

Monday: BTC Retreats on Profit Booking 💰

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.