Where Are Prediction Markets Headed? 🔮

Hello y’all! Welcome to Wednesday's dispatch.

There’s a lot of action happening in the crypto world - Bitcoin’s see-saw game, Ethereum’s persistent lack of performance, AI agents and a lot more.

Something else also happened beyond cryptocurrencies in the crypto space. Polymarket got banned in yet another country.

Last week, Singapore joined France and Taiwan in banning the top prediction platform and called it an "illegal gambling site". Meanwhile, Donald Trump Jr - the President-elect’s son - joined Kalshi, another betting platform.

That’s not all, there’s more.

Well, hang in there, in today’s crypto dose we unwrap for you how far the prediction markets have come and where are they headed amid the regulatory troubles.

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

State of Prediction Markets

The industry finds itself at a fascinating crossroads.

In fact, as we write this, Thailand’s Technology Crime Suppression Division (TCSD) also announced that it plans to propose closing Polymarket.

Reason given? Same as Singapore - “illegal gambling”.

A ban in both the Asian nations is not the only setback the platform is tackling.

On January 8, the US Commodity Futures Trading Commission (CFTC) served Coinbase with a subpoena seeking general customer information of its users in relation with the Polymarket case.

These events make predicting the future of Polymarket more interesting. Why does it matter, though?

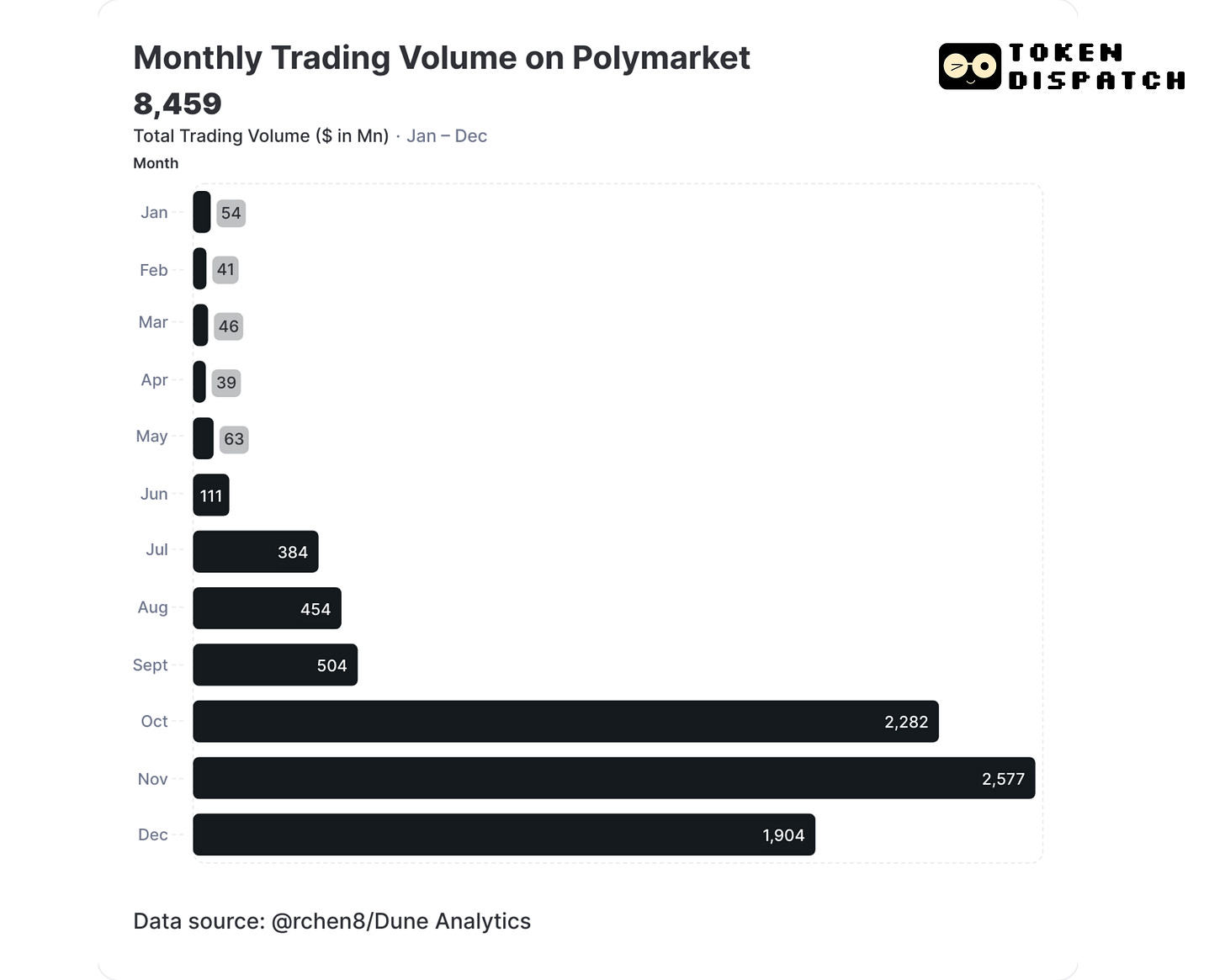

Polymarket started 2024 with insignificant numbers. It stayed low under the radar until June, when it sprang into action.

In October and November, Polymarket witnessed a total trade volume worth almost $5 billion, that’s 3x the total volume seen in January through September that year.

Read: Elections Pumping Polymarket? ⛽

On November 6, these prediction platforms had just proven their worth by accurately forecasting Trump's return to the White House.

Read: Can Polymarket Whales Sway US Voter Sentiment? 🐋

The Number Game

$8.5 billion: Polymarket’s total trading volume in 2024

314,500: Active traders in December 2024

$2.6 billion: Highest monthly volume (November 2024)

$510 million: Peak open interest during US elections

66.5%: Average monthly growth rate in 2024

Yet they're facing their biggest regulatory challenge yet.

Singapore and Thailand labelling the platform as "illegal gambling"

CFTC subpoenaing Coinbase for Polymarket user data

FBI raid on Polymarket CEO's home

France and Taiwan restricting access

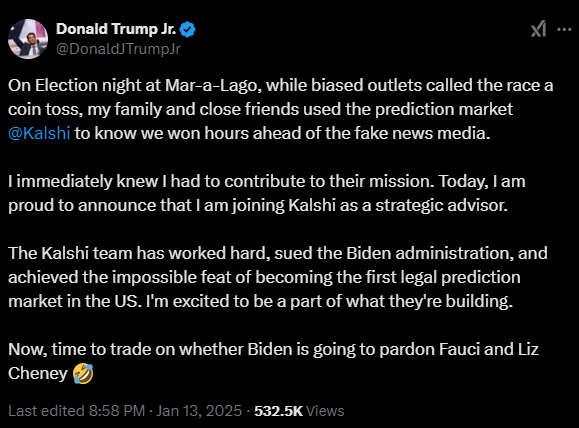

Meanwhile, US-based Kalshi, which sees much smaller volumes being traded on its platform when compared with Polymarket, just got a shot in the arm. Donald Trump Jr joined them earlier this week to advise the trading platform on partnerships and go-to-market strategy.

“Don Jr.’s bold vision and deep expertise perfectly align with our mission to reshape how America engages with information,” Kalshi said in a post on X.

Where does this leave the future of prediction markets?

Beyond Elections: The Future

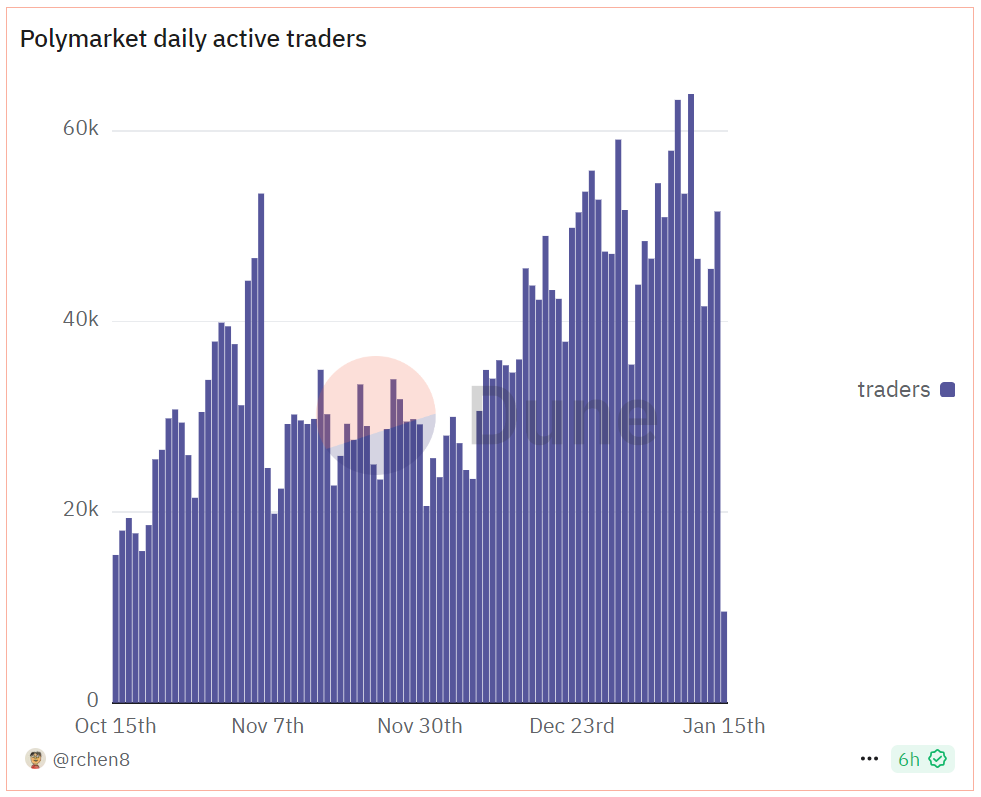

Prediction markets have managed to keep their platforms active post the elections.

The open interest on Polymarket, which peaked to north of $500 million during the elections, is down to averaging $100 million in December and January. That’s still level with the open interest the platform saw in the run up to the elections in August and September.

Even the daily active traders on the platform have been gradually on the rise after the post-election drop.

The average has shot up to more than 40K daily active traders in December and January from less than 30K in November post election.

While people are fixated on prediction markets’ election success, Ethereum co-founder Vitalik Buterin sees something bigger emerging out of prediction markets - “Info finance”.

"Predicting the election is just the first app. The broader concept is that you can use finance as a way to align incentives in order to provide viewers with valuable information."

Meaning? He thinks of this concept as a “three-sided” market, where bettors make predictions, readers consume these forecasts, and the system generates public predictions.

That’s not all. Read on…

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

What Lies Ahead

Three shifts could shape prediction markets moving forward.

The Micro-Markets Revolution

"The most interesting applications of info finance are on 'micro' questions," says Buterin.

Imagine millions of tiny markets, each seemingly inconsequential on its own, but powerful when combined.

Still don’t understand?

Streamers running real-time prediction games

Gamers betting on in-game events

Fans wagering on their favourite artist's next move

Netflix using crowd wisdom for content decisions

AI-Enhanced Predictions

AI could make these micro-markets viable even with just $10 in volume.

For some perspective, 1 in every 5 bets made on Polymarket average less than $10.

Buterin predicts AI will "turbocharge" prediction markets in the next decade, enabling millions of "micro-markets" for smaller decisions that individually have low consequence but collectively matter greatly.

The DeFi Integration

Think bigger than simple bets.

Your prediction market positions could become collateral in DeFi protocols.

If you're confident enough to lock your position for three months, you could earn additional yields. This creates an entirely new financial layer built on information accuracy.

Read: Do Crypto Prediction Markets Matter? 🤔

Block That Quote 🎙️

Nimrod Cohen, head of product at eOracle

“When you have substantial market volume, you get two crucial benefits: extensive coverage and instant reaction times.”

The game-changer isn't just about predictions - it's about creating a new way to value and trade information itself.

TV shows where viewers influence plot developments in real-time (think Black Mirror: Bandersnatch)

Cities using prediction markets to optimise resource allocation

Brands testing product ideas through market sentiment

DAOs making decisions through prediction market voting

We're moving from an era where information was just shared to one where it's priced, traded, and valued in real-time. And that might be the biggest prediction market bet of all.

So, all good?

Houston, We Have a Problem

The Gambling Question

From FBI raids on CEOs' homes to CFTC subpoenas, the industry that revolutionised electoral forecasting is now wrestling with an existential question: are they gambling platforms or legitimate information markets?

The regulatory landscape is complex:

US views them as event contracts, similar to weather derivatives

Singapore, Thailand, France, and Taiwan label them as "illegal gambling"

Kalshi and Polymarket took different paths: Kalshi got CFTC approval, while Polymarket settled and blocked US users

The Sports Dilemma

Post-election, prediction markets have shifted heavily toward sports.

$1.1 billion volume on NFL Super Bowl

$740 million on Champion's League

$700 million on NBA Finals

Unlike elections or corporate decisions, sports outcomes have limited macro-economic impact. There are no broader financial or societal consequences to the outcome of the NFL Super Bowl. This shift might inadvertently strengthen regulators' gambling argument.

Three Core Challenges

Regulatory definition: The industry needs to convince authorities that predicting outcomes based on probabilities differs fundamentally from games of chance. The house doesn't set odds or win - it's all about market participants.

Market legitimacy: While sports betting dominates volume, platforms need to demonstrate their value beyond entertainment. For instance, NFL ratings predictions could help media companies evaluate billion-dollar broadcasting rights investments.

Jurisdictional complexity: With each country taking a different stance, platforms face a fragmented global landscape. The US treats them as derivatives, while Singapore sees gambling. This regulatory patchwork makes scaling difficult.

Token Dispatch View 🔍

Prediction markets stand at a fascinating inflection point. While the regulatory heat might seem like a setback, we see it as a necessary growing pain for an industry transitioning from niche crypto experiment to mainstream information tool.

Collective wisdom of crowds is powerful, not infallible. Markets don't always tell us what will happen; sometimes they just tell us what people think will happen.

Remember, that 40,000 odd people betting on outcomes is still a tiny sample representing a disproportionately large population and their views.

Three factors have an overarching impact on the future of the prediction markets.

Evolution Beyond Betting

The shift to sports betting isn't a weakness - it's a bridge. Just as crypto needed NFTs to gain mainstream attention, prediction markets need familiar use cases to drive adoption. The innovation lies in what comes next: micro-markets, AI integration, and info finance infrastructure.

Market Validation

Between Kalshi's regulatory win, Donald Trump Jr's advisory role, and Polymarket's sustained post-election activity (40K+ daily active traders), we're seeing legitimacy build from multiple angles. The industry is growing up.

Info Finance Revolution

While regulators debate gambling definitions, they're missing Buterin's larger vision: prediction markets aren't just about betting - they're about creating a new financial layer for information itself. Think of it as Bloomberg for everything, where any verifiable outcome becomes a tradeable asset.

Remember, these platforms aren't crystal balls - they're mirrors reflecting collective belief, weighted by conviction (AKA money). Sometimes that belief is spot-on; sometimes it's spectacularly wrong. Their value isn't in perfect prediction but in aggregating and pricing diverse perspectives in real-time.

The future lies in understanding these markets not as oracles of absolute truth, but as sophisticated tools for measuring and pricing collective intelligence.

The smart money is betting on the evolution of prediction markets. One that acknowledges its own limitations while pushing the boundaries of how we measure and value collective wisdom.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.