Happy Thursday, Dispatchers! Welcome to this week's News Rollups.

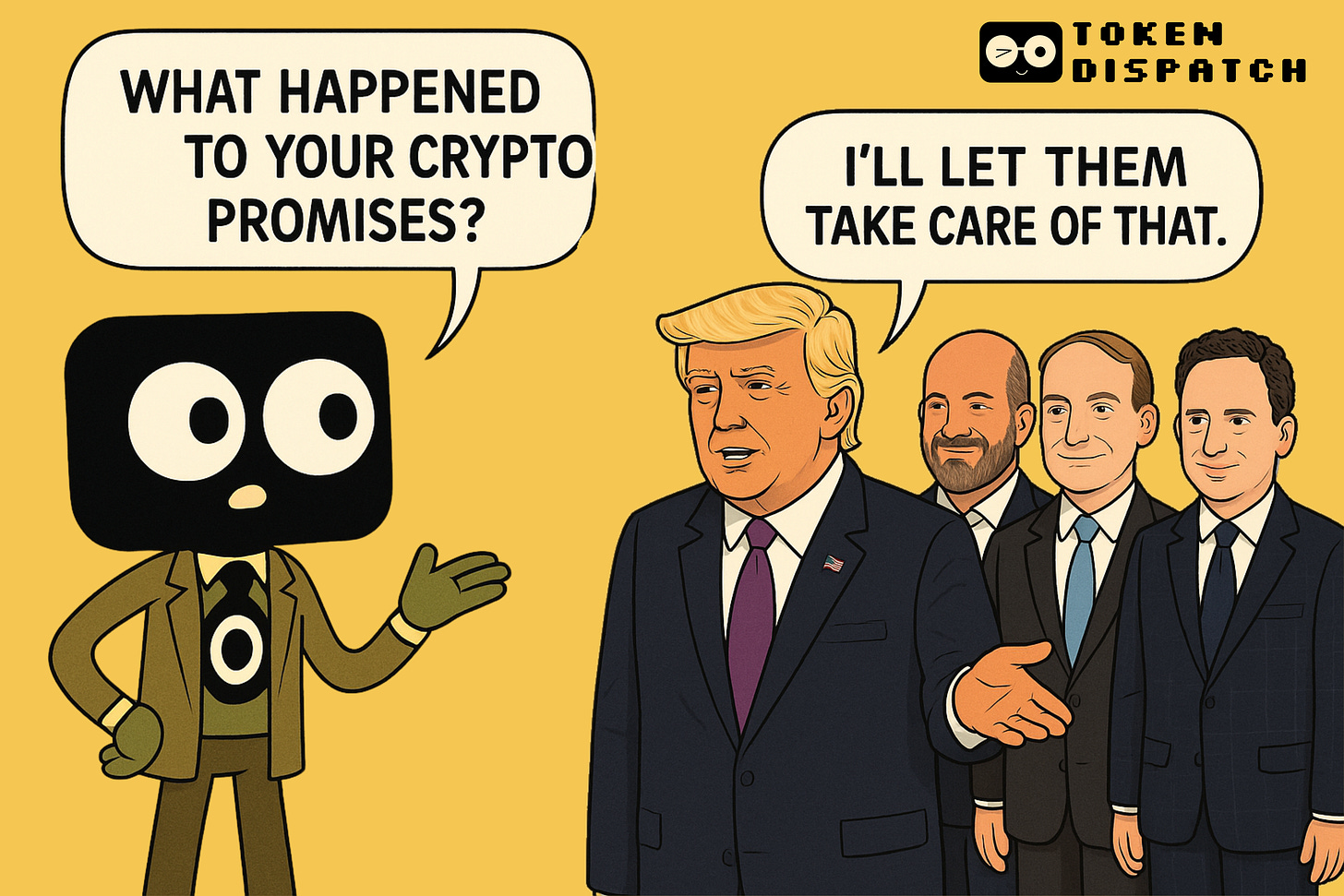

Despite fulfilling several crypto-friendly campaign promises and appointing industry advocates to key positions, the crypto market cap and Bitcoin are down since US President Donald Trump’s inauguration in January.

In today's News Rollups edition, we examine:

The gap between Trump's crypto promises and market reality 100 days into his term

How El Salvador manages to keep accumulating Bitcoin despite IMF restrictions

Current state of crypto staking and where to find the best yields in 2025

Why the DOJ is seeking a 20-year sentence for former Celsius CEO Alex Mashinsky

How NVIDIA is quietly shutting the door on crypto startups in favor of AI

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in our weekly News Rollups.

Secure your Bitcoin with Hardware Wallets

Trezor has transformed crypto security from a complex puzzle to a user-friendly playground, so you can be the boss of your financial future.

Securely store, manage, and protect your coins with Trezor hardware wallets, app & backup solutions.

Q: 100 days in, where’s Trump with his crypto promises?

Most crypto-friendly president in US history ✅

First president to sign a crypto bill ✅

Strategic Bitcoin Reserve executive order ✅

Digital Assets Stockpile ✅

This looks like a dream run for the crypto industry in the first 100 days of Trump’s second term at the White House.

Yet, the reality today stands in stark contrast.

Crypto market cap? Down 15%+ since his inauguration

Bitcoin down almost 10% from the all-time high after Trump’s inauguration

To his credit, Trump has fulfilled several campaign promises that signal a regulatory shift.

Silk Road founder Ross Ulbricht got the promised presidential pardon. Trump issued executive orders on the first day of his office banning central bank digital currencies (CBDCs) and protecting miners' rights. Became the first president to sign a crypto bill by overturning an IRS rule for DeFi platforms.

His appointments of crypto-friendly figures like Securities and Exchange Commission (SEC) Chair Paul Atkins and Commerce Secretary Howard Lutnick have already resulted in concrete changes, with the SEC ending nearly all active lawsuits against crypto firms and rescinding restrictive guidance like SAB121.

We have also seen the SEC shift away from the Gary Gensler-era ‘regulation-by-enforcement’ approach. The watchdog has been calling off pre-Trump 2.0 era cases that Gensler had filed against hoard of crypto firms.

However, the administration's more ambitious legislative agenda has stalled.

Despite public promises that both stablecoin and market structure bills would be signed within 100 days, neither has reached the president's desk.

There’s been progress on the stablecoin front, sure. But promises are either fulfilled or broken - no room for work-in-progress.

The Strategic Bitcoin Reserve appears largely symbolic, consisting mainly of assets already in government possession through criminal proceedings rather than new acquisitions.

Meanwhile, Trump's personal involvement in crypto ventures like World Liberty Financial and the $TRUMP memecoin has created concerning conflicts of interest.

Read: Crypto, Trump, and the Conflict💸

Just a week ago, the total assets under management in Bitcoin ETFs managed to climb back to $38 billion, the same level that was seen on the day of Trump’s inauguration.

Has the crypto landscape moved from where it was when Trump re-entered the White House? Sure. The direction of the move, though, is something that can be debated about.

Get 17% discount on our annual plans and access our weekly premium features (Game On, News Rollups, HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Q: What's the state of crypto staking in 2025? Is it thriving, and where are the best returns?

Numbers show that staking is booming in 2025, despite a few headwinds. Major chains see impressive participation rates.

About four years ago, JPMorgan predicted the global Ethereum staking market to be worth $40 billion. Today, Ethereum has over 34.3 million ETH locked up (worth more than $60 billion), with more than 28% of all ETH now staked – up from 23.8% in January 2024.

The yield landscape:

Ethereum: A modest 2-7% APY (averaging 3-4%), with Coinbase offering 2.01%, Kraken 2.5-7%, and Lido around 4-7%

Solana: Healthy returns of 5.57% on Coinbase

Polkadot: Up to 15% returns on DOT tokens for those willing to participate in governance

For the yield hunters, Binance offers even higher Annual Percentage Yield (APY) on select tokens, though these typically come with higher risks.

The staking game is evolving too.

Innovations like liquid staking (through Lido, Ether.fi) and restaking (via EigenLayer) let you double-dip, using staked assets in DeFi while still earning base rewards. EigenLayer can potentially boost ETH returns beyond 5% for the technically savvy.

Is it all sunshine? Not quite.

More validators mean shrinking individual rewards (Ethereum's APR dropped from 4.3% to 3.13% last year), and some argue staking has become "anti-growth" without sufficient compensation. Regulatory uncertainty and platform risks still loom large.

Bottom line: Staking remains a cornerstone of crypto passive income, but the days of effortless double-digit yields on major assets are mostly behind us. The smart play in 2025 is diversifying stakes across multiple coins and platforms while keeping a close eye on innovations like restaking that can juice those returns.

Shoutout to our frequent reader, Buck, for sending across this question on staking.

Got questions about this week's crypto world? Fill out this form for a chance to have your question featured in our next edition with an exclusive shoutout.

Q: Who is Alex Mashinsky and why is DOJ seeking a 20-year sentence for him?

Alex Mashinsky, 59, pleaded guilty in December 2024 to two counts of fraud after Celsius, the crypto lending platform he had founded.

Chares: Lying about Celsius’s financial condition to convince investors to deposit their Bitcoin and defrauding buyers of company’s native token, CEL, by manipulating its price and lying about selling his own personal holdings.

Prosecutors argued his "years-long campaign of lies" caused $550 million in losses while he personally profited $48 million.

Mashinsky's lawyers have tried to distance him from FTX founder Sam Bankman-Fried, arguing for a sentence of just one year and one day. Their key argument: "There are no allegations that Alex misappropriated, embezzled or stole any customer assets" and Celsius failed due to market conditions, not fraud.

Prosecutors strongly disagree.

Called his crimes "deliberate, calculated decisions to lie, deceive, and steal." They point out that while SBF was in his 20s, Mashinsky, at nearly 60, was "old enough and experienced enough to better appreciate the crimes he was committing."

The case has drawn over 200 victim impact statements, with one investor writing Mashinsky "devastated numerous lives, and there are those who have taken their own lives because of him." Many victims are demanding a life sentence similar to Bernie Madoff's 150 years.

Prosecutors said Mashinsky has shown a "lack of remorse" and "abandoned all pretense of acknowledging his sustained wrongdoing." They also claim he's shielded his assets in an "elaborate system of trusts" managed by his sister while his wife challenges government seizures meant for victim restitution.

The sentence hearing is scheduled for May 8.

The Crypto Comic 🎭

El Salvador President Nayib Bukele continues adding to the country's Bitcoin stash (now 6,163 BTC worth more than $585 million) despite IMF loan deal that restricted the nation from giving the cryptocurrency legal tender status.

The clever workaround? Using entities "outside the fiscal sector" while technically complying with the $1.4 billion agreement.

“’This all stops in April.’ ‘This all stops in June.’ ‘This all stops in December.’ No, it’s not stopping. If it didn’t stop when the world ostracised us and most “bitcoiners” abandoned us, it won’t stop now, and it won’t stop in the future. Proof of work > proof of whining,” Bukele tweeted.

Dispatch Decoder 👨🏽🏫

What are Liquid Staking and Restaking?

Liquid staking gives you flexibility with staked assets. Stake ETH, get stETH in return – a token you can trade or use in DeFi while still earning your base rewards. No more waiting through lock-up periods! This lets your crypto work double duty.

Restaking is crypto's way of squeezing extra juice from already-staked assets. Protocols like EigenLayer let you use your staked ETH (or its liquid version) to secure additional networks and earn extra rewards on top. It's essentially putting the same capital to work multiple times, potentially boosting yields while supporting the broader ecosystem.

Under the Radar 🔎

Chip giant NVIDIA has kicked crypto firms out of its Inception Accelerator Program as of April 24, formally adding "companies associated with cryptocurrency" to its no-fly list.

NVIDIA's CTO Michael Kagan didn't mince words back in 2023. "Crypto doesn't bring anything useful for society." Then the company went on to ride the mining boom to massive profits, only to now firmly pick Team AI over Team Crypto.

The biggest casualty? Arbitrum, a layer-2 platform which was about to be announced as NVIDIA's exclusive Ethereum partner until the chip giant got cold feet. Arbitrum promptly walked away, calling it a "sound business decision." Meanwhile, Aptos Foundation still has a seat at NVIDIA's table.

Well, some blockchains are more equal than others, perhaps?

That's it for this week's News Rollups. Until next Thursday, stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.