Who's Selling Bitcoin? 📉

Whales, miners and ETFs are profit booking. Did CertiK steal from Kraken? Germany moves Bitcoin to exchanges. Michael Saylor pumps BTC holdings to ~$15B. Stablecoins transfer volume up 16x in 4 years.

Hello, y'all. Finding words of wisdom … 🎹

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Yesterday was a big day for crypto.

Read: Ethereum Survives SEC 🏆

But why are we not getting rich yet?

Bitcoin is still down.

Whales are selling, but bulls are still here.

Whales are selling A LOT: Long-term holders have been cashing out. Dumped 14,000 BTC, compared to their previous record of 17,000 BTC.

“However, as this selling was related to long-term whales, it would only include a small fraction of ETFs Bitcoin holdings,” … “Additionally, there was no large selling from ETFs the day that long-term holder Whales sold (June 5).” - CryptoQuant Head of Research Julio Moreno.

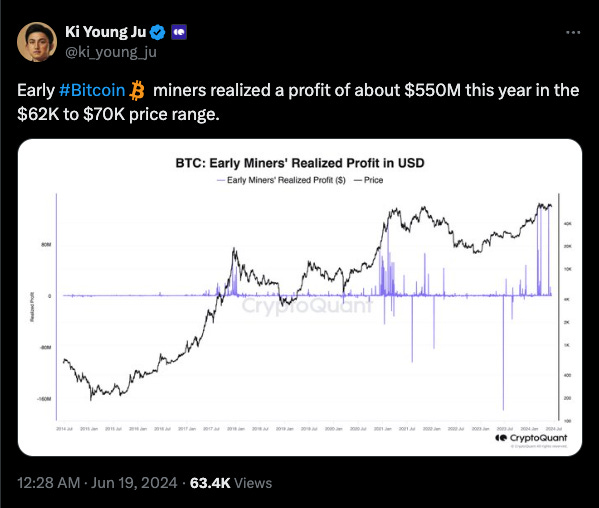

Miners Switching Gears: Bitcoin rewards shrink post-halving. Miners are shifting their focus to AI sector. Cashed out around $550 million after the recent price surge.

Read: $20T by 2023 👀

ETF outflows: Over $714 million has flowed out in June alone. Worst since April. $152.42 million flowed out on June 18, FBTC led the pack at $83 million.

Stablecoin Slump: The growth of stablecoins, often seen as a precursor to Bitcoin purchases, has slowed down.

Strong Dollar: The strengthening dollar makes riskier assets like Bitcoin less attractive. Investors might be moving away in favour of traditional stocks.

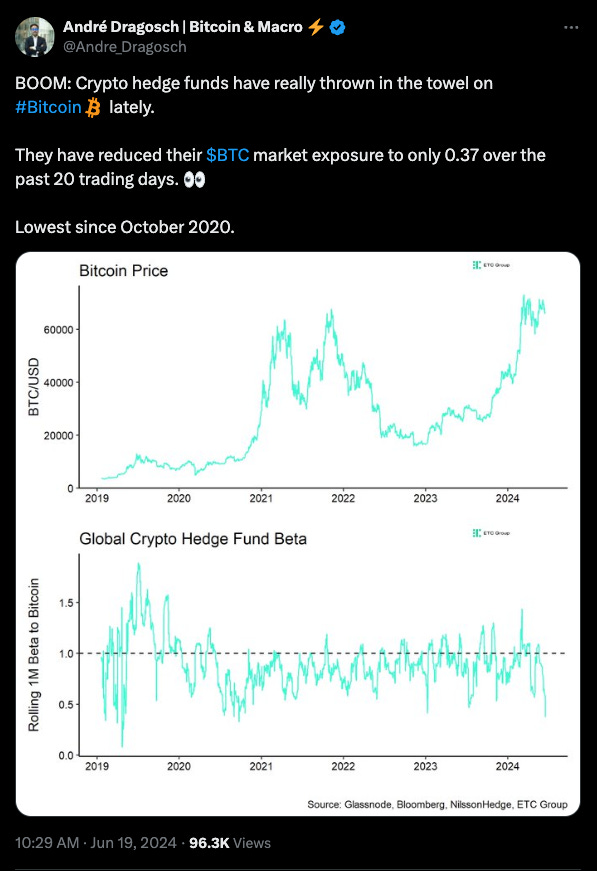

Crypto hedge funds are jumping ship: Slashed their Bitcoin holdings to 0.37 over the past month. Lowest level since October 2020 - ETC Group.

Where’s predictions at?

Biden, not so bad: Anthony Scaramucci, who previously predicted that Bitcoin will hit $170,000 over the next year, has another prediction: Bitcoin will hit record high under the second Biden term.

“He was very negative on Bitcoin and digital assets while president. He’s now done a 180 because he wants your vote … It’s anybody’s guess what he’ll do in the White House. He’s extremely transactional.”

More adoption? Bernstein analysts believe spot Bitcoin ETFs are on the verge of approval at major wire houses and private banks. And BTC could hit

$200,000 by the end of 2025.

$500,000 by the end of 2029.

$1 million by 2033.

They expect a wave of approvals in Q3 or Q4 this year.

Bitwise CIO Matt Hougan:

“There is also an element of game theory here. A major central bank adopting bitcoin as a reserve asset would be a game-changer for bitcoin and, I believe, would contribute to a dramatic increase in prices … At $250,000, bitcoin would be a $5 trillion asset. Could it go higher? Of course.”

Bullish metrics

Bitcoin's dominance has been hovering between 44% and 53% for almost a year. This weekend, it jumped to 52.92% - highest since early 2021's bull run.

Exchange reserve: Bitcoin just hit a 3-year low in terms of the amount available on exchanges.

Meaning? Less Bitcoin readily available + institutional demand rising = A price surge.

What about Altcoins?

Ethereum 2.0 is safe from SEC.

The result? Ethereum’s crossed $3,500 again.

Are other cryptocurrencies like Solana and Polygon safe?

SEC hasn't explained its reasoning for letting Ethereum off the hook, leaving the status of other coins uncertain.

Ethereum news strengthens the case for some PoS coins.

But, each coin is unique.

And therefore, the war doesn’t end yet.

Block That Quote 🎙️

Circle CEO, Jeremy Allaire.

“I’m more bullish than I have ever been about crypto.”

Why is Allaire bullish? He explains.

“My perspective here draws on closely watching internet technology adoption life cycles over the past ~35 years.”

Allaire credits Bitcoin with kicking off this whole crypto revolution.

Bitwise's Matt Hougan? He wants you to add ETH in your portfolio.

“Many investors will soon need to decide whether to add ETH exposure alongside their favourite Bitcoin ETP.”

Three reasons to buy Ethereum alongside Bitcoin.

Diversification is key - you're not putting all your eggs in one basket.

Different purposes - ETH gives a wider range of possibilities.

Studies show that including ETH in your crypto portfolio alongside Bitcoin has generally boosted returns.

One reason to just hold Bitcoin as well.

“If you are investing in crypto primarily because you are concerned with the degradation of fiat currencies (including the US dollar), or because you are worried about debt, deficits, and inflation, then you should stick with Bitcoin.“

Did CertiK Steal From Kraken?

On June 9, Crypto exchange Kraken fell victim to an exploit, losing nearly $3 million.

What happened? A researcher reported a critical bug that inflated account balances.

Kraken investigated and discovered a flaw allowing deposits without completion.

They patched the issue quickly.

While one researcher responsibly reported the bug (for a potential bounty), two others allegedly abused it, stealing millions from Kraken's own reserves.

When Kraken demanded the funds back - “Researchers” wanted to discuss a bounty … based on the potential damage they could have caused

Now, Blockchain security firm CertiK has revealed itself as the “security researcher, ” Kraken was talking about.

CertiK's Claim: It was "white-hat hacking."

Discovered a security flaw in Kraken's system.

Used the bug to assess its scope, but returned the funds.

Accuses Kraken of providing the wrong return address, threatening employees and asking to repay a MISMATCHED amount of crypto.

They even disclosed all testing deposit transactions.

Anyway, Kraken has reported the incident to law enforcement and is pursuing legal action.

Best of luck, researchers.

In The Numbers 🔢

$425 million

Bitcoin moved by Germany.

What happened? A German government wallet labelled by Arkham Intelligence moved 6,500 Bitcoin.

Exchange Bound? 1,000 Bitcoin were sent to major exchanges Kraken and Bitstamp.

Back and Forth: They then sent some Bitcoin back to the original wallet, but also...

Exchange Deposits: Significant amount. $32 million each – to Kraken and Bitstamp. This could signal plans to sell the Bitcoin.

Where'd it Come From? Experts at Arkham believe these funds might be seized assets from a shuttered piracy website.

While the government still holds a significant amount of Bitcoin, these transactions coincide with a broader market dip and outflows from Bitcoin ETFs. So, cashing in?

There’s someone who can’t stop buying 👇

Saylor’s MicroStrategy now holds 226,331 bitcoins worth around $15 billion.

Stablecoin Transfer Volume Up 16x In 4 Years

In October 2020, it was $100 billion.

In April 2024, the monthly volume reached a record high of $1.68 trillion.

Now? 2.8 Trillion.

There are over 31 million active users making transactions with stablecoins every month.

The total market cap of all stablecoins reached $161 billion.

What do Stablecoins have that other cryptocurrencies don't? Stability (if you forget the Terra crash).

This stability makes them a bridge between traditional finance and the crypto world.

Increasing use of stablecoins is a sign of growing investor confidence in the crypto market.

What’s up in UK? MiCA.

Tap Global, a UK-based crypto management company, is expanding into the US market, while other companies have fled the US due to regulatory concerns. Tap Global is focused on the rewards of the massive US crypto market (93 million crypto owners.)

Uphold, the crypto exchange is saying goodbye to Tether (USDT), Dai (DAI), Frax (FRAX), Gemini Dollar (GUSD), Pax Dollar (USDP), and TrueUSD (TUSD). A response to the European Union's Markets in Crypto-Assets Regulation (MiCA).

Signal, the privacy-focused messaging app, is up in arms again over the EU's latest attempt to peek into encrypted chats. This time, the EU calls it "upload moderation," but Signal boss Meredith Whittaker isn't buying it.

The Surfer 🏄

Crypto Super PAC, Fairshake, raised $169 million following a $10 million donation from Jump Crypto. Fairshake has been backing attack ads against US lawmakers and aims to impact races in 2024 and beyond.

Crypto community supports Tornado Cash devs facing legal charges. JusticeDAO, an advocacy group, raises $2.3 million for their legal defense. Fund has already spent $1.39 million in legal fees and expects to spend $2.8 million more.

Binance plans to appeal a $4.4 million fine imposed by Canadian regulator FINTRAC. The fine was issued in May for alleged noncompliance with Anti-Money Laundering and Countering the Financing of Terrorism regulations.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋