Will Bitcoin Act as a Safe Haven? 🤔

As geopolitical tensions escalate, can Bitcoin be the digital gold hedge? Whoever wins, crypto laws are coming. DeFi leaders' political plans. Crypto's 272 years in jail. Mining profitability falls.

Hello, y'all. The music quiz game that you want to play. Over 1.7 million plays and music fandom to flex. Who are you playing with then 👇

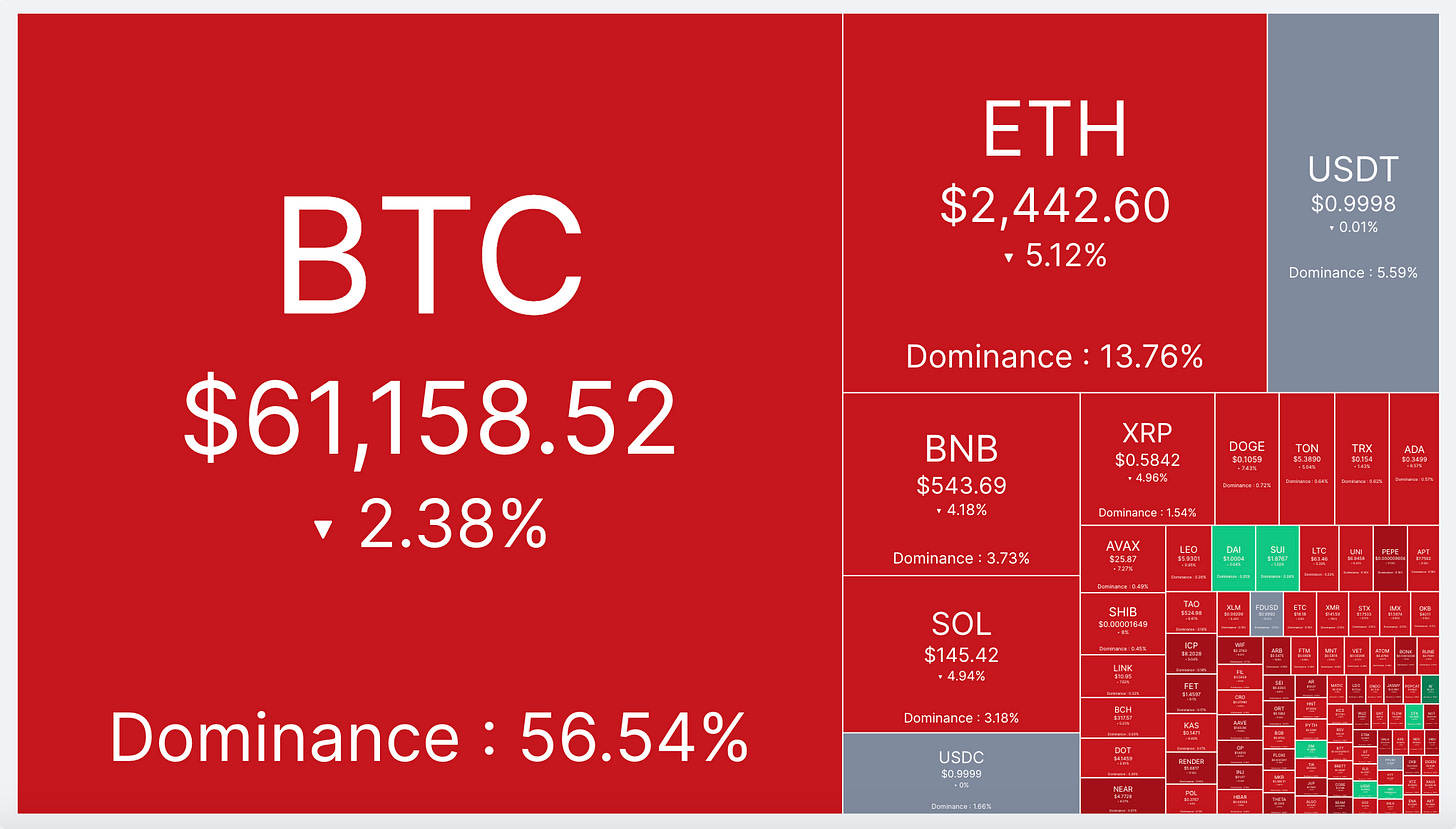

After all the “Uptober” did not start well.

We were all excited for the best month of the year.

The geopolitical tensions in the middle-east sent shockwaves across the markets.

Crypto was no different.

Here’s what happened on October 1?

Read: Bitcoin Liquidations Top $500 Million After Sharp Market Correction

Israeli Prime Minister Benjamin Netanyahu promised retaliation.

“Iran made a big mistake tonight — and it will pay for it.”

Bitcoin - not so safe-haven?

Is it really the digital gold that works in the tough times?

Bitcoin has shown varying degrees of correlation with gold and other traditional safe-haven assets.

You would think that in times of crisis, people would flock to Bitcoin for safety, but instead, it mirrored the traditional markets and fell alongside them.

This has left a lot of folks wondering if Bitcoin is really the safe bet it was once thought to be.

Let’s rewind a bit.

In previous conflicts—like the Palestine-Israel conflict and the Ukraine-Russia war—Bitcoin had some ups and downs too.

In February 2022, following Russia’s invasion of Ukraine, Bitcoin’s price dropped by about 9% to around $35,000, wiping out approximately $200 million from the global crypto market cap.

While Bitcoin's price remained steady during the Palestine conflict in October 2023, it plunged from over $63,000 to below $60,000 in less than two hours during the April 2024 conflict with Iran.

During the Gaza conflict, it was used by groups like Hamas for fundraising, which raised eyebrows about its use for shady purposes.

Meanwhile, Chainalysis reports that Russia is the most prominent country using cryptocurrency to evade sanctions and engage in illicit activities.

“Russia has become an international force using cryptocurrency for everything from sanctions evasion to ransomware attacks, and most recently, interference and disinformation campaigns targeting the US elections,” said Chainalysis chief marketing officer Ian Andrews

Bitcoin’s reputation is on shaky ground right now.

Token Dispatch View

Despite recent volatility due to geopolitical tensions, several tailwinds suggest a potentially bullish end to 2024 for Bitcoin and the broader crypto market.

What’s boosting the positive sentiment? Historical performance trends, anticipated FTX bankruptcy payouts, global stimulus through interest rate cuts, institutional interest in spot Bitcoin ETFs, rising global money supply, and potential political shifts in the US government that is supportive of digital assets industry.

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Harris vs Trump Won’t Bother Crypto Laws

Says who? Republican Tom Emmer told Decrypt.

Won’t matter who’s in charge. Measures to regulate crypto will be introduced regardless.

“I think it is ‘when,’ not ‘if’.”

So much optimism? Wait, there’s more.

Emmer has identified three legislative priorities if Republicans gain full control of the federal government.

A market structure framework similar to FIT21.

Legislation to prohibit the establishment of a US central bank digital currency (CBDC).

A bill facilitating the creation of dollar-backed stablecoins under US Treasury oversight.

Well, the other side is optimistic too.

Senate Majority Leader Chuck Schumer and 71 other Democrats recently voted to support the FIT21 bill, which aims to create a structured market for cryptocurrencies.

But how did the tide change towards crypto?

Emmer credits the younger voters. They prioritise crypto-related issues when casting their ballots.

So, the Congressman in all up for regulating crypto.

Oh, but wait.

He doesn’t want to create a new regulatory wing specifically to regulate crypto.

Why? That could complicate oversight rather than simplify it.

Crypto founders are geofencing to comply.

Meaning?

Crypto compliance in the US is not that simple.

So, what do you do to comply?

Skip the market. Simple.

Eh? Who does that? US crypto companies.

Crypto founders are choosing to geofence and block users in specific jurisdictions, particularly the US to tide over strict compliance requirement.

Said who? Jake Chervinsky, chief legal officer at Variant Fund, an early-stage crypto venture capital firm.

“It’s a pretty extreme solution to the problem of regulatory uncertainty — completely abandoning the US market — but sometimes there’s just no other way.”

In 2023, 17 jurisdictions tightened crypto regulations.

Result? Major players like Binance and protocols such as Eigenlayer and Orca have implemented geofencing to restrict US access.

Block That Quote🎙️

National Policy Network WOC (Women of Colour) Blockchain Founder Cleve Mesidor and et al

"We want a seat at the policy table and a say in the regulatory debate.”

Calling Kamala … Who?

Group of DeFi industry leaders wrote a letter to Vice President Kamala Harris and running mate Tim Walz's campaign policy team.

Why? Asking to meet and discuss policy recommendations to push forward innovation and inclusion in the digital assets landscape.

But why Kamala and her admin?

The letter comes days after Harris said her administration would “encourage innovative technologies like AI and digital assets while protecting consumers and investors," in her 80-page economic plan.

The 20-something leaders who signed the letter want Harris to bring a level playing field.

They said the recent policies made it easier for the wealthy to get access to digital assets while excluding marginalised.

"Black, Latino, AAPI, indigenous communities were the earliest, and continue to be the largest adopters of crypto. Since the inception of this sector in 2008 and 2009, diverse innovators have been a significant part of this emerging industry. We want a seat at the policy table and a say in the regulatory debate."

That’s all?

Well, a few more things.

More access to capital for diverse web3 startups and entrepreneurs.

And more financial education for digital assets.

In The Numbers 🔢

272 years

Total combined prison sentences for crypto-related convicts in the past decade.

And the convictions are increasing.

Between 2019 and 2023, conviction rate jumped 267%.

Longest sentence so far? Silk Road founder Ross Ulbricht - double life imprisonment plus 40 years.

For the top ten crypto cases, average sentence exceeds 20 years.

Money laundering and fraud account for nearly 60% of the longest sentences.

But the regulators have just got stricter. Over 63% of convictions occurred in the last three years.

Crypto Miners’ Profits Slump, Again

It’s tough to be consistent.

But, Bitcoin miners are doing it right.

Consistently.

Their profitability declined for the third consecutive month in September, a JPMorgan report.

Gross profit drop: Daily block reward gross profit fell by 6% month-over-month, reaching the lowest level on record at $16,100 per exahash per second (EH/s).

What’s an exahash? A unit to measure hashrate, which is the speed at which a crypto mining device processes.

Even the miners revenue fell.

Earned an average of $42,100 per EH/s in daily block reward revenue, 6% less than August.

Why is it dropping? Some of it is because after the halving event in April.

That halved block rewards and significantly impacted miners' revenues. Fell 2% this month and is now over 50% lower than pre-halving levels.

So, the miners are looking elsewhere.

Some of the biggest miners such as Marathon Digital and Cathedra Bitcoin are changing their business models.

Setting up develop data centres to use profits from that business to buy Bitcoin instead of mining it.

The Surfer 🏄

Bitwise has filed for a spot XRP ETF, marking a significant move in the crypto investment space. The U.S. SEC has never approved a spot XRP ETF, and potential challenges loom due to ongoing legal issues with Ripple.

Metaplanet, the Japanese firm purchased an additional 107 Bitcoin, bringing its total to over 500 BTC. The latest acquisition cost $6.9 million at an average price of $64,168 per Bitcoin, funded by a loan from MMXX Ventures.

DeFi hacks have decreased by 25% in the first nine months of 2024 compared to all of 2023, indicating improved security measures. Total crypto thefts in 2024 have reached $2.1 billion, surpassing the total losses of 2023 by 5%.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋