Yat Siu: The Man Who Wants to Own the Metaverse 🌌

Yat Siu built a $5 billion empire betting that digital ownership will reshape capitalism itself.

In classical music, there’s a concept known as Urtext. The original, unedited manuscript of a composition. When a pianist plays Beethoven, they’re not actually playing Beethoven’s true work. Instead, they’re playing an editor’s interpretation of what Beethoven might have intended. The Urtext is different. It’s the composer’s original hand, the notes as they were first written, untouched by anyone else.

The value isn’t in the performance. It’s in the provenance. In knowing, with certainty, that this came from the source.

Yat Siu spent his childhood in Vienna learning this principle. His mother conducted orchestras. His father played instruments. Surrounded by the world of European classical music, SIU learned early on that a Stradivarius violin from 1700 isn’t valued because it sounds better than modern instruments, but because you can trace every hand that has held it.

Decades later, Siu applied this same principle to the internet. Not with music, but with code. He sought to build a world where digital objects could have provenance, where ownership could be verified, and where the original could be distinguished from the copy.

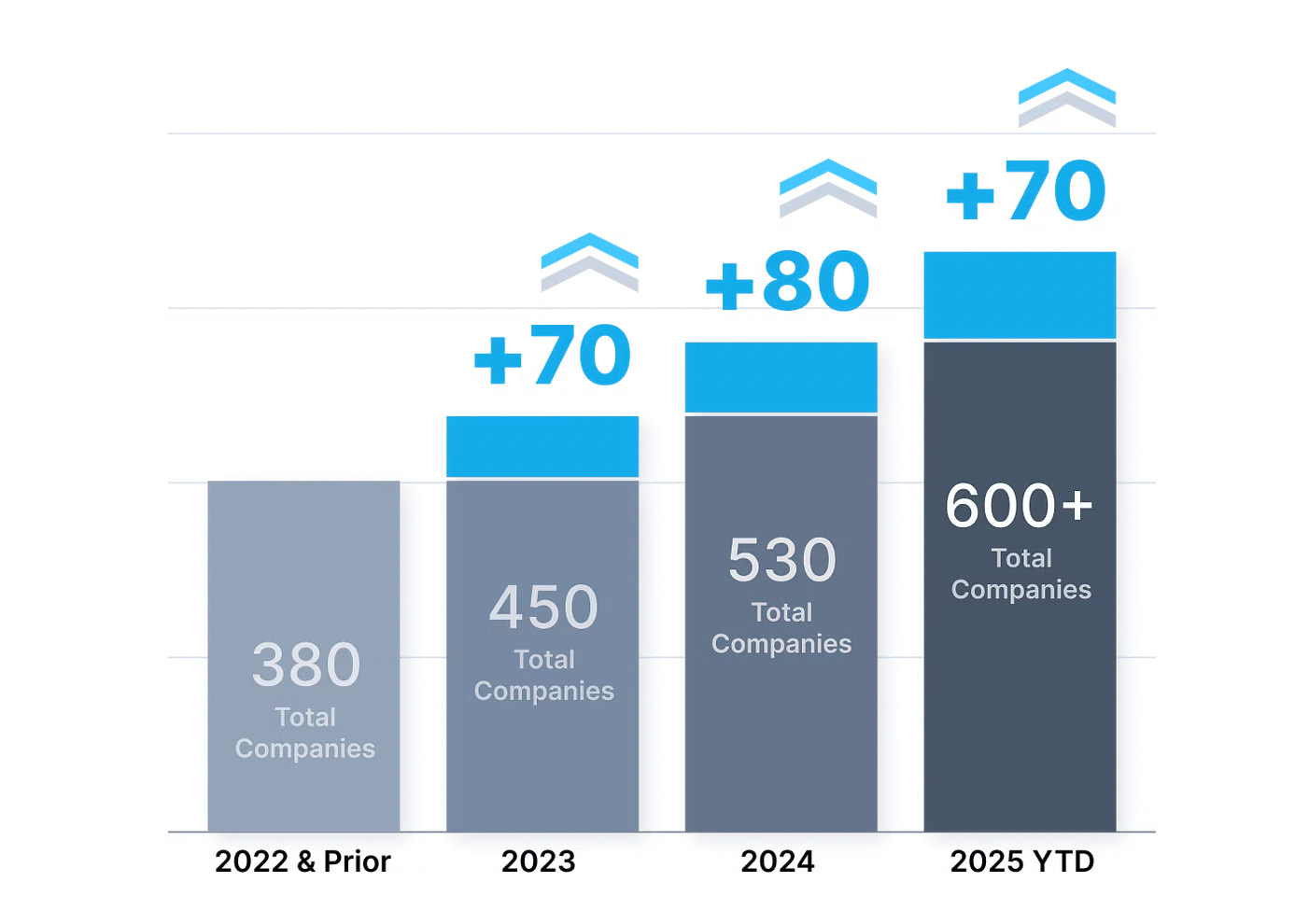

Siu is the co-founder and executive chairman of Animoca Brands, a Hong Kong-based company valued at $5 billion with stakes in over 600 Web3 projects. His portfolio includes OpenSea, Axie Infinity, Yuga Labs, and The Sandbox. When he talks about the future of digital ownership, institutions listen.

But his conviction didn’t come from watching charts or tracking money flows. It came from understanding what happens when you can prove something is truly yours.

Your Shortcut To Crypto’s Inner Circle.

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

Apply Today

Born in Vienna in 1973 to those immigrant musicians, Siu studied at the Music and Arts University of the City of Vienna, training in cello, flute, and piano.

But his music training left a lasting mark. Classical music operates on a principle that the tech world had forgotten: the importance of the original. You can have a thousand recordings of a Beethoven symphony, but there’s only one original manuscript.

When Siu discovered blockchain decades later, he recognised something others missed. Digital ownership wasn’t about speculation. It was about bringing that same principle of provenance, verifiability, and authenticity to a world where copies were infinite and originals didn’t exist.

Siu’s first encounter with computers came through music. He wrote MIDI software on Atari machines in the 1980s. In 1990, Atari Germany hired him through CompuServe without knowing how old he was. He was 13.

“When I showed up at the office in Vienna, which was just a one-man operation, they were surprised,” Siu told the Australian Financial Review. “I was this Asian kid, but I still got the opportunity. The only thing that mattered was who I was virtually and online.”

By 1996, Siu had relocated to Hong Kong. He founded Hong Kong Cybercity, later renamed Freenation, which was Asia’s first free web page and email provider. Millions signed up.

In 1998, Siu co-founded Outblaze with Antony Yip, creating a white-label communication platform. Outblaze survived the dot-com crash. By 2009, it had scaled to 75 million users. That year, Siu sold the messaging division to IBM’s Lotus Software, funding Asia’s first IBM cloud lab.

In 2014, Siu co-founded Animoca Brands as a mobile gaming studio. The company made games like Crazy Kings and Crazy Defense Heroes. In January 2015, Animoca went public on the Australian Securities Exchange, raising A$2.4 million.

Then in 2017, everything changed.

Dapper Labs, a Vancouver-based company Siu had invested in, released CryptoKitties, which is a game where players bred and collected digital cats on the Ethereum blockchain. Each cat was an NFT, (non-fungible token), meaning it was unique and verifiably owned.

The game exploded and people spent thousands of dollars on cartoon cats.

Siu saw past the absurdity. In 2018, Siu pivoted Animoca entirely into blockchain. The company acquired The Sandbox and began accumulating a portfolio of Web3 investments. By 2019, Animoca held stakes in Axie Infinity, OpenSea, Dapper Labs, and dozens of other blockchain projects.

The Australian Securities Exchange raised concerns about how Animoca valued its virtual assets. They didn’t understand NFTs.

Siu made a choice. On March 9, 2020, Animoca voluntarily delisted from the ASX. The company explained the move was necessary “to focus on building the business in an environment that is more welcoming to activities that involve virtual asset ownership through blockchain and non-fungible tokens.”

Operating as an unlisted entity gave Siu regulatory freedom. By January 2022, Animoca Brands was valued at $5 billion.

Siu frequently draws a parallel between countries and virtual worlds. Nations with strong property rights — the United States, Canada — have high GDPs and entrepreneurial activity. “Freedom and property rights are inseparable,” he says, referencing George Washington.

In Web2, platforms own everything. Facebook owns your photos. Spotify owns your playlists. Fortnite owns your skins. If the company shuts down or changes the rules, your assets vanish.

But with NFTs, ownership is verifiable and portable. You can prove something is yours, sell it, or move it to another platform.

Siu uses numbers to make his case. In a single year, NFTs generated over $24 billion in sales, with most of that value flowing directly to creators. In the same period, Spotify paid creators about one-third of that amount.

When asked if NFTs are dead, Siu reframed the question. “Currently, monthly NFT trading is at 300 to 400 million dollars,” he told Trending Topics. “So it is a market. I see it more as digital skins or objects, where in the future people won’t say ‘That’s an NFT’ anymore. Just like people don’t say ‘MP3’ anymore, but simply ‘music.’ Good technology disappears into the background.”

To Siu, the crash of NFTs only proves his point: NFTs are infrastructure, not speculation. The technology becomes invisible when it works.

But Bitcoin maximalists argue that altcoins are distractions. To them, only Bitcoin matters.

Siu disagrees. “Bitcoin is like digital gold,” he says. “Innovation comes from altcoins, all new products emerge there. Nobody builds on Bitcoin.”

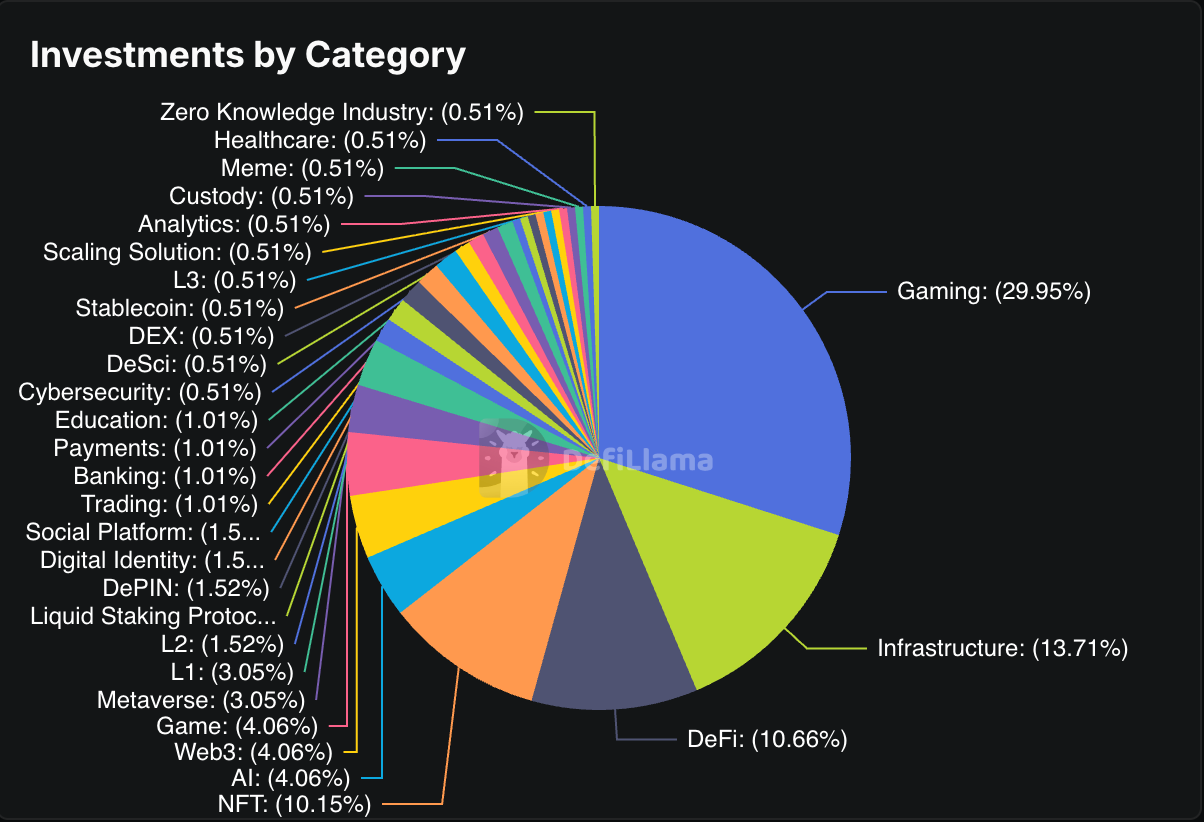

Animoca now holds stakes in over 600 blockchain projects — 230 of them in gaming and entertainment alone. “We’re probably the best altcoin index as a private company,” Siu said. “Our thesis: Altcoins will collectively become larger than Bitcoin.”

The crypto winter of 2022 tested that thesis. When FTX collapsed and Bitcoin plunged, many Web3 companies retreated.

Siu stayed in. While competitors pulled back from blockchain investments, Animoca doubled down on its Web3 portfolio and continued launching token advisory services for struggling projects.

The conviction paid off. While many developers struggled in 2022, Animoca recorded bookings of $573 million. After a dip in 2023 following the FTX collapse, the company’s annual bookings grew by over 12 percent in 2024. Total assets increased by 43 percent.

By the end of 2024, Animoca’s balance sheet held approximately $300 million in cash and stablecoins, over $500 million in digital assets, and more than $560 million in minority investments, bringing its total assets to: $4.3 billion.

Much of the growth came from a new business model. Rather than just writing checks during funding rounds, Animoca offered consulting and token launch services to Web3 projects. In exchange, the company received tokens at early valuations, often between $10 million and $20 million before they hit public markets. By 2024, this digital asset advisory division generated $165 million, more than double the previous year.

In 2025, Siu began preparing Animoca for a return to public markets through a Nasdaq listing in 2026, executed via a reverse merger with Currenc Group. Under the deal, Animoca shareholders would hold approximately 95 percent of the combined entity.

“We’re going public now following the motto ‘The early bird catches the worm,’” Siu says. “Next year, at least a dozen companies from our portfolio will go public.”

The timing is deliberate. Institutional investors want exposure to Web3 but they can’t easily buy altcoins. A publicly traded company holding those assets solves the problem.

Beyond going public, Siu is expanding Animoca’s influence. In August 2025, the company formed a joint venture with Standard Chartered bank and Hong Kong Telecom to issue licensed stablecoins. That same month, Animoca partnered with Provenance Blockchain Labs to develop NUVA, a vault marketplace for real-world assets.

In July 2023, the Hong Kong government appointed him to the Task Force on Promoting Web3 Development, giving him direct influence over how one of Asia’s major financial hubs regulates blockchain technology.

The market could crash again. Regulations could tighten. But Siu’s still trying to change the conversation about what ownership means online.

There’s a reason Siu talks about classical music when explaining blockchain. Both are about authenticity. About provenance. About proving that something came from a specific source at a specific moment.

In classical music, the Urtext matters because it preserves the composer’s original intent. Every note has weight. You don’t own the performance. You own the manuscript.

The internet Siu is building works the same way. You don’t just consume content. You own pieces of it. The tokens in your wallet are proof that you were there, that you participated, that something belongs to you in a way that can’t be erased.

It’s a different kind of internet. Not one where you rent access from platforms that can take it away. But one where ownership is verifiable, portable, permanent.

Just like an original manuscript. Just like an Urtext.

The technology will disappear into the background. But the principle remains.

You can prove it’s yours.

This is the final profile in our series exploring the architects of Web3. Starting next week, we’ll shift our focus to book reads, examining the ideas and narratives that shape how we understand technology, ownership, and the future of the internet.

Thank you for reading.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.