$2.7 Billion Electricity Bill 👀

Worth electricity spent on US Bitcoin mining in 2024, report. Riot Platforms's hostile takeover plans. BlackRock’s IBIT overtakes GBTC ETF. What does US voter want? Meet Malcom, crypto's folk hero.

Hello, y'all. Flying like a bird, like electricity … electricity 🎹

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

US Bitcoin miners are racking up a hefty electricity bill.

Paul Hoffman, analyst at BestBrokers estimates they've spent $2.7 billion on electricity in the first few months of 2024.

"Since the start of 2024, Bitcoin mining in the US has consumed an enormous 20,822.62 GWh of electric power.

At the average commercial electricity rate of $0.1281 per kWh as of February, this amounts to an expenditure of $2,667,378,196.47."

That's enough to

Charge every electric vehicle in the US ... 87 times.

Power nearly 2 million households for a year.

Globally, 116,550 Bitcoin, worth $8.2 billion, has been mined year to date.

US miners accounting for 44,102 BTC or 37.84% of global production.

Roughly 19.5 million Bitcoin has been mined supply of 21 million.

Read: What's Bitcoin Inflation? 🔑

The halving impact

The recent Bitcoin halving event (reward cut in half) has impacted efficiency. It now takes double the electricity to mine a single Bitcoin.

Before the halving event in April, the electricity needed to mine 1 BTC was 407,059.01 kilowatt-hour (kWh), costing around $52,144.26.

Since then, 862,635.55 kWh of power are now needed to mine 1 BTC, costing around $110,503.61 at average commercial rates.

Read: Crypto and AI are Electricity Hungry 🔌

The green side

Despite their high energy usage, Bitcoin mining is currently the only primary global industry powered mainly through sustainable energy.

Bitcoin mining is a leader in sustainable energy use among major industries, reaching a record high of 54.5% in 2023 - the Bitcoin ESG Forecast.

Increase is due in part to miners moving to greener grids in North America or sustainable off-grid sites, following restrictions on mining in China and Kazakhstan.

Read: Is Bitcoin thirsty? 💦

Riot plans hostile takeover of Bitfarms

Riot Platforms, a major miner, just offered a hefty $950 million to acquire its smaller rival, Bitfarms.

Colorado-based Riot is already Bitfarms’ largest shareholder, with a 9.25% stake.

Offer is combined cash and common stock to shareholders that would represent about $950 million in equity value.

Bitfarms shareholders would own about 17% of the combined company.

Here's the drama: Riot originally made a private offer in April, but Bitfarms wasn't interested. Now, Riot's taking its bid public, hoping to pressure Bitfarms' shareholders.

Riot has proposed to buy all the outstanding BITF shares for $2.30 apiece, representing a 24% premium over Bitfarms' one-month volume-weighted average share price as of May 24, 2024.

A tempting deal for shareholders. If successful, the combined company would be the biggest publicly listed Bitcoin miner in the world.

More to the story: Bitfarms is searching for a new CEO after a recent lawsuit from the old one. Riot suggests Bitfarms' leadership might not be acting in shareholders' best interests. Also, Bitfarms' earnings haven't been stellar, while Riot's are booming.

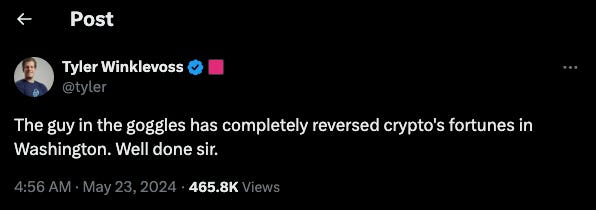

Block That Quote 🎙️

Donald Trump, US Presidential Candidate.

"You, with the goggles on.”

Meet Malcolm, a shades-wearing NFT builder from DeLabs, who's turned into a crypto folk hero.

His question to Donald Trump at a Mar-a-Lago event for Trump NFT holders has everyone talking about US crypto policy.

At a small, exclusive gathering, Malcolm tossed out a question about regulatory clarity to Trump.

Malcolm: “A lot of the smartest people in crypto are moving their businesses out of the U.S. because they’re scared of the regulations.”

Trump: “Because of the hostility … They’re moving out of the U.S. because of the hostility toward crypto … Well, we’ll stop it because I don’t want that. If we’re going to embrace it, we have to let them be here.”

Malcolm's moment in the spotlight has stirred up significant conversations about crypto regulation among the 2024 presidential candidates

Shortly after Malcolm’s viral question, the SEC approved multiple applications for Ethereum ETFs—a dramatic shift from their previous stance.

This move has left many wondering if Malcolm's question played a role in changing the SEC's heart.

What Does America Want?

Crypto has got politicised.

Crypto has gone mainstream.

Grayscale survey shows that geopolitical tensions and inflation have led more and more American voters to turn to Bitcoin.

47% of voters expecting part of their portfolio to include cryptocurrencies, up from 40% at the end of last year.

Cryptocurrency has become an issue that neither party can ignore

The survey conducted by Harris Poll on behalf of Grayscale Grayscale rounded up 1,759 politically savvy voters to dish on crypto.

Trump explores: Donald Trump asks Bitcoin Magazine's CEO about Bitcoin's potential to address the $35 trillion US national debt.

Read: 'Give Me Liberty, or Give Me Death!' 🤌

In The Numbers 🔢

$1 billion

InflowsDigital asset investment products last week, year-to-date total: $14.6 billion, according to CoinShares.

BlackRock's IBIT fund has officially surpassed Grayscale's GBTC as the world's largest Bitcoin ETF.

BlackRock is putting its money where its mouth is, adding its own Bitcoin ETF to some of its income and bond funds.

BlackRock's Strategic Income Opportunities Fund ($37.4 billion) and Strategic Global Bond Fund ($776.4 million).

The income fund bought $3.56 million in IBIT shares, while the bond fund bought $485,000. These are relatively small investments compared to the overall fund sizes.

Semler Scientific. Another Microstrategy?

The medical device company, is making waves by following in the footsteps of tech giant MicroStrategy.

On Tuesday, they announced a major investment in Bitcoin, allocating it as their primary treasury reserve asset.

Bitcoin Bet: Semler purchased 581 BTC (around $40 million).

Stock Soars: The announcement triggered a 33% surge in Semler's stock price (SMLR), reversing a downward trend since February.

MicroStrategy Effect: This move echoes MicroStrategy's strategy, which saw their stock value skyrocket over 1,000% after their initial Bitcoin investment in 2020.

Institutional Interest: Semler cites the recent launch of successful Bitcoin ETFs as a factor in their decision, reflecting growing institutional adoption of the cryptocurrency.

Long-Term Play: Semler plans to hold Bitcoin as their primary treasury reserve, indicating a long-term commitment to the digital asset.

The Surfer 🏄

A federal judge dismissed the SEC’s case against Debt Box and ordered the SEC to pay $1.8 million in attorney and receivership fees, ending the civil lawsuit filed by the commission in 2023.

Former FTX executive Ryan Salame got 7.5 years in prison for campaign finance violations and unlicensed money transmitting. This is the first sentence for FTX execs, exceeding the government's recommendation.

Solana has partnered with PayPal to allow the integration of PayPal's stablecoin, PYUSD, onto the Solana blockchain network. Aims to leverage Solana's faster transaction speeds and lower fees to improve the payments experience for PayPal's over 420 million users.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋