Aave Built a Bank? 👻

Control over money is control over infrastructure is control over distribution. Aave finally figured out you need all three.

I know, I know… bear market whispers are getting louder. Bitcoin’s down 30% from its peak, which technically makes this a bear market by the textbook definition.

I choose to look at it differently. Easy to do when you don’t have your life savings in Bitcoin like you responsible adults. Mine already evaporated in the last memecoin supercycle, so I’m operating with house money at this point. Which means I can unironically believe the bear market takes: they clean out noise, let you focus on building, make you a better person, cure baldness, etc.

But if we’re accepting the premise that winter is tolerable, maybe even productive, then we should stop refreshing CoinGecko every fifteen minutes and pay attention to what is getting built in the cold.

So let me tell you about Aave’s new app.

Not a protocol upgrade. Not a governance proposal. Not another DeFi primitive for people who already spend their weekends reading Solidity documentation.

A retail savings app.

This matters because it’s arriving at a weird moment. Nobody asked for it. The hype cycle moved on months ago. We’re past the phase where every new DeFi product gets breathless Twitter threads and venture capital term sheets. We’re in the phase where most people have accepted that crypto exists, it’s not disappearing, but it’s also not replacing the dollar by Thursday.

Which makes this launch feel less like a moonshot and more like something that might stick.

Play. Earn. Own. That’s Klink Finance.

With Klink Finance you don’t just watch crypto, you act. Complete tasks, social quests, and partner offers to earn in crypto or cash. Build reputation, unlock rewards, and gain access to special drops.

Earn for gaming, app trials, surveys and more.

Flexible withdrawals: crypto or fiat, your choice.

Backed by a global user-base and trusted integration partners.

If you’re ready to turn your time into value, join the earning revolution with Klink.

I’ve written about neobanks before. I’ve written about the yield economy, about how fintech companies wire together banking APIs, crypto rails, and insurance wrappers to offer you 4% on your savings while taking their cut in the middle. This playbook is not new. Chime did it. Ally did it. A thousand startups with names that sound like rejected Pokémon have tried it.

So why should anyone care that Aave is doing it now?

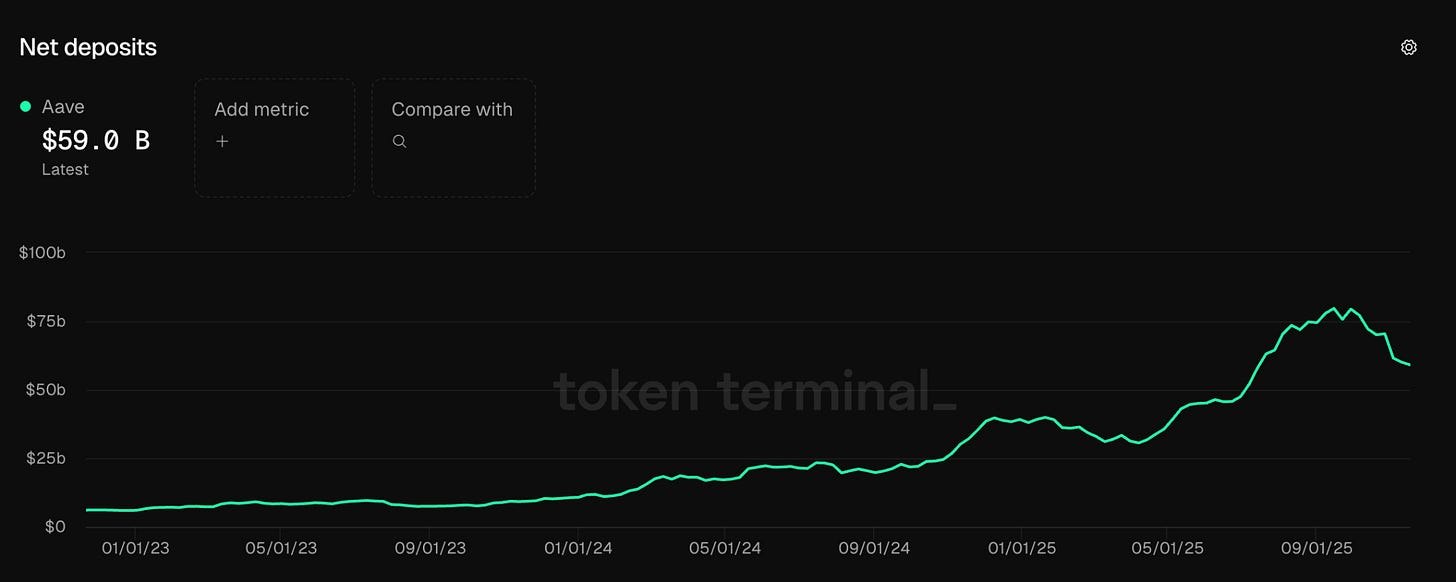

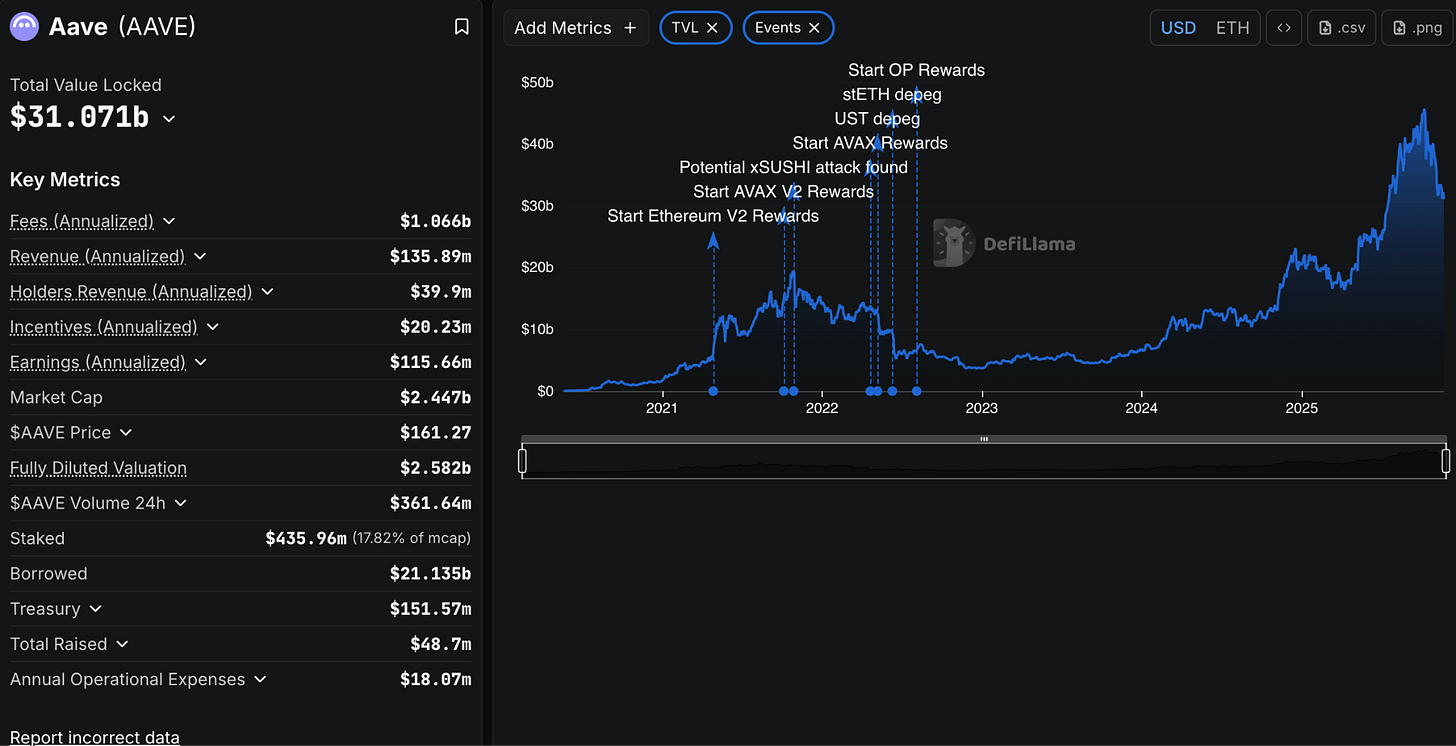

Aave is not a startup trying to figure out where to park your deposits (no offence to those who are). Aave is one of the foundational lending protocols in DeFi. It has been around since 2017, back when it was called ETHLend ( a substantially worse name, but that’s beside the point). The protocol has facilitated over $55 billion in deposits historically. Current TVL sits around $31 billion, depending on which chains you’re counting and what day you check.

To put that in perspective, if Aave were a traditional bank, it would rank somewhere between a mid-tier regional institution and a large credit union. Not JPMorgan. Not nothing either. Big enough that if it collapsed, you’d see congressional hearings, and some uncomfortable questions would be asked about financial stability.

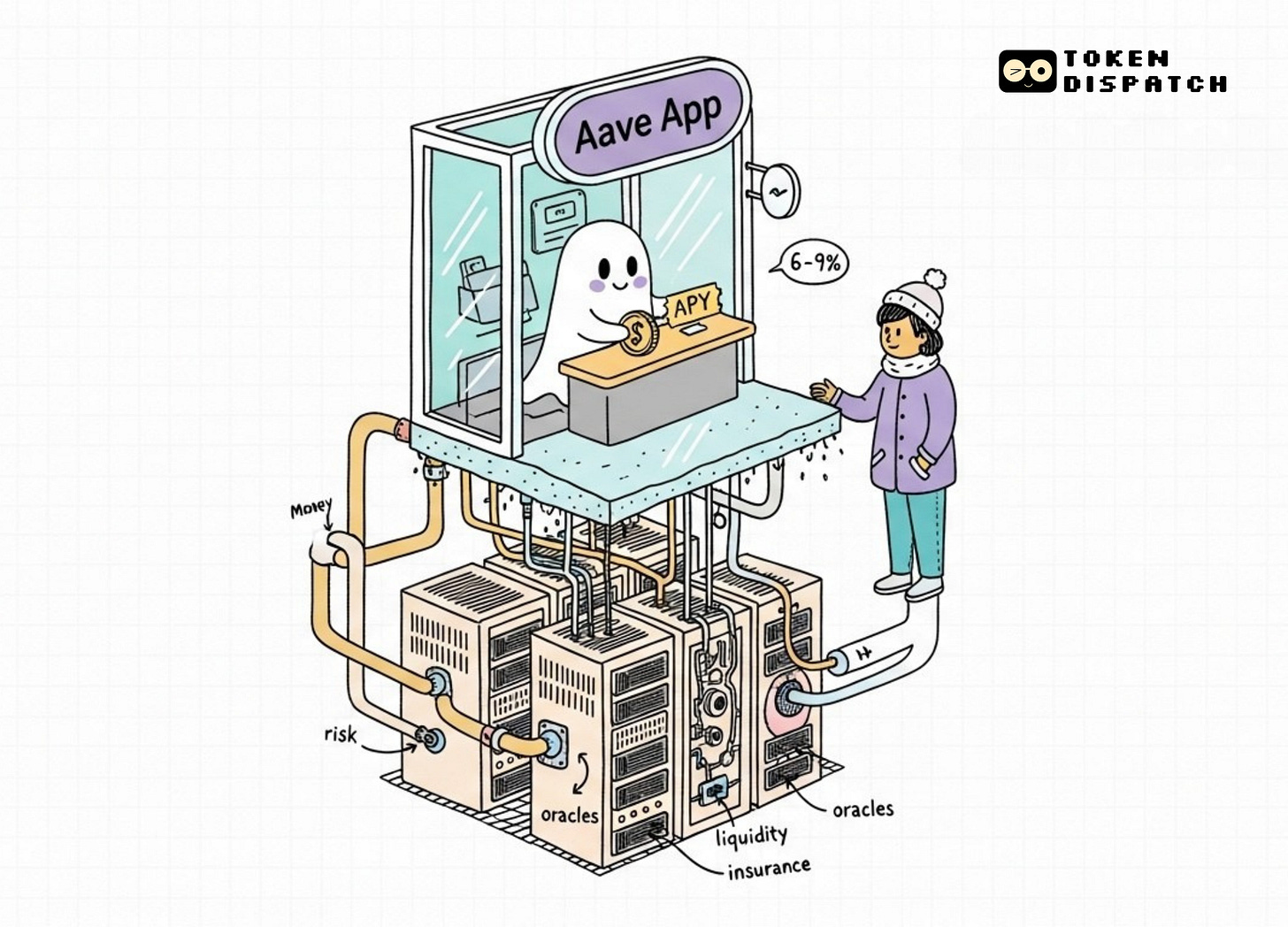

The point is, when Aave says it can offer you 6% to 9% on stablecoins, that number isn’t coming from some mysterious offshore entity or a VC fund’s balance sheet. It’s coming from the same lending markets that have been running on Ethereum (and Polygon, and Arbitrum, and a dozen other chains) for years. Markets that have been stress-tested through multiple crashes, billions in liquidations, and some significant adverse conditions.

In Q3 2025 alone, Aave generated $259 million in fees. During the volatility in October , when centralised exchanges were stuttering and retail investors were panic-selling, Aave automatically liquidated over $200 million in collateral, preserving protocol solvency without manual intervention. Founder Stani Kulechov told a London audience it was “scary because of the size of the protocol today,” but added that “DeFi really proved itself.”

That’s the difference. We are talking about a protocol that has already shown it can handle the bad days.

Three Ways to Think About This

Let me break this down depending on where you sit.

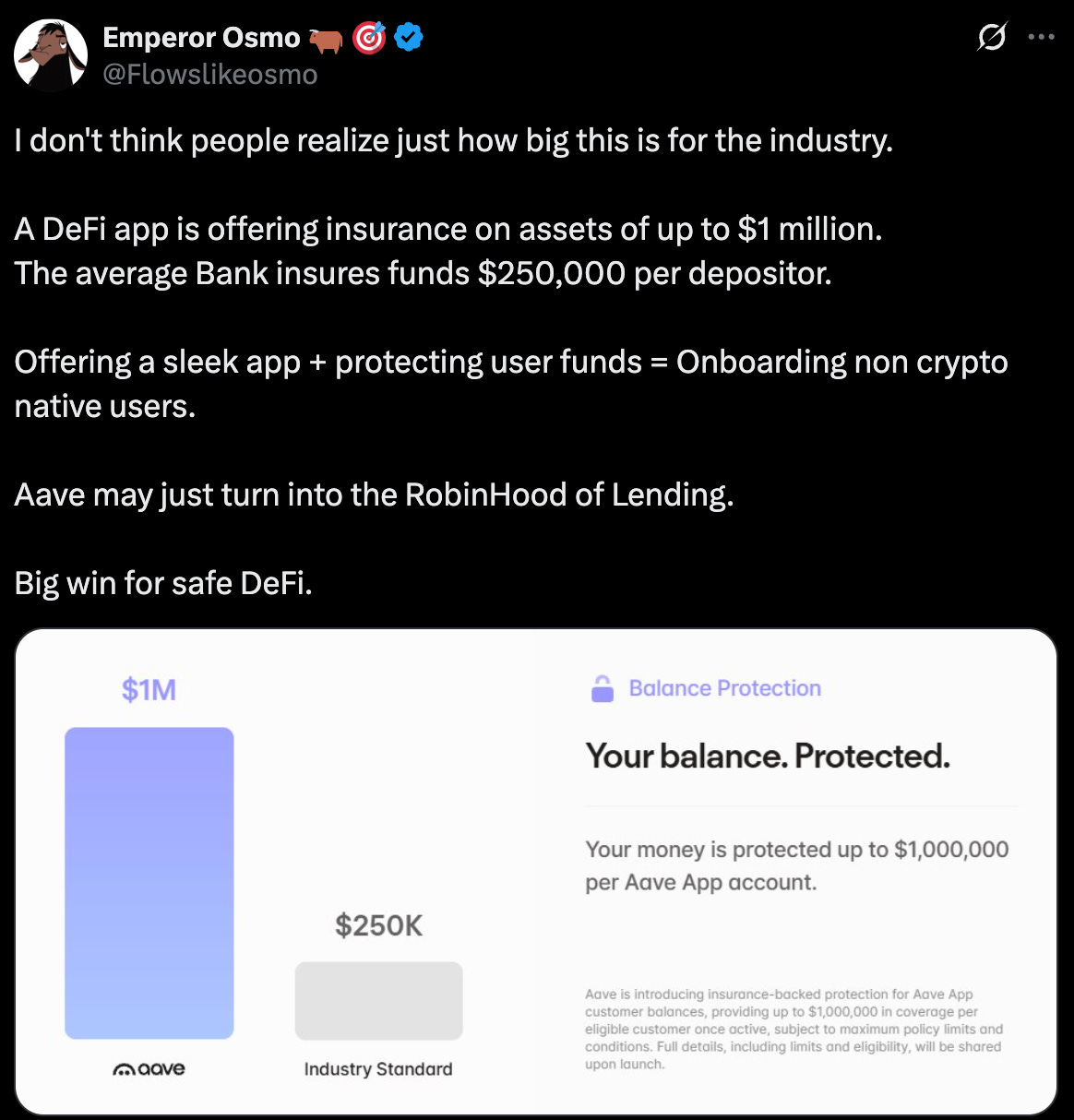

If you’re a regular saver, the value proposition is simple. You download the app. You connect your bank account (Aave claims onboarding from 12,000+ banks, using standard fintech rails). You deposit dollars. You earn between 6% and 9% APY on stablecoins, compounding in real time, with no lockups and fast withdrawals. You also get $1 million in deposit insurance, which is four times the FDIC’s $250,000 limit.

Why is the yield higher than your bank’s? Because banks make money by borrowing from you cheaply and lending expensively. They might pay you 0.5% on savings and charge 4.5% for a mortgage. The 4% difference covers their branches, their compliance teams, their executive compensation, and whatever’s left becomes profit. That net interest margin is how banking has worked for centuries.

Aave operates differently. It’s a peer-to-peer lending market. Borrowers over collateralise their loans (put up $150 in ETH to borrow $100 in stablecoins). Interest rates adjust algorithmically based on supply and demand. When borrowing demand is high, rates rise. When supply is abundant, rates fall. Right now, stablecoin lending rates sit in the 6% to 9% range because there’s consistent demand to borrow stablecoins without selling their crypto holdings.

You, as a depositor, capture most of that rate. Aave charges a small protocol fee (about 10% of the interest), with the rest flowing to you. No branches, no loan officers, no marble lobbies. Just code and collateral.

The trade-off is that you’re not depositing into a bank. You’re depositing into a smart contract. If the contract has a bug or if something catastrophic happens to the collateral, you could lose money. The insurance exists to cover this risk, and Aave has spent years auditing its code, but the risk is not zero. It’s different. You’re trading “what if the bank fails” for “what if the smart contract fails.” Most people won’t think about this distinction until something breaks.

If you’re crypto-native, this app is more interesting for what it means for Aave than for users. The DeFi mullet thing (fintech front, protocol back) is table stakes at this point. We’ve seen it attempted dozens of times. What matters is whether Aave can use this to change its user composition and, by extension, its economics.

Right now, Aave’s users are mostly crypto people depositing crypto to borrow more crypto. They’re yield farmers, leverage traders, and protocol treasuries managing working capital. These users are sophisticated but fickle. They’ll move $50 million from Aave to Morpho if rates shift by 20 basis points. They’re also concentrated: a relatively small number of large depositors make up most of the TVL.

Retail savers are different. They’re sticky. They don’t check rates daily. They won’t pull funds over a 0.3% rate difference. They also bring genuinely new capital into DeFi rather than recycling existing crypto across protocols. If Aave can onboard even a fraction of the retail savings market, it fundamentally changes the protocol’s liquidity profile: more stable deposits, less rate sensitivity, lower volatility in utilisation.

This also changes Aave’s competitive positioning. Right now, Aave competes with Compound, Morpho, and a dozen other lending protocols for the same pool of DeFi-native capital. That’s a zero-sum game. But if Aave is pulling deposits from Bank of America and Chase? That’s net new capital. Suddenly, Aave isn’t just the biggest fish in the DeFi pond. It’s building a bridge to an ocean.

There’s a protocol revenue angle too. Aave takes about 10% of interest as protocol fees. In Q3 2025, that translated to $259 million in fees on roughly $31 billion in TVL. If the app drives TVL to $50 billion, $70 billion, $100 billion, those fees scale proportionally. More importantly, retail deposits tend to be long-duration and less rate-sensitive, which means higher utilisation rates and better margins for the protocol.

The risk is that retail users bring retail problems. When the next black swan hits and Aave liquidates $500 million in collateral in three hours, those users won’t understand why their “savings account” dropped 2% intraday. They’ll complain on Twitter. They’ll file support tickets. Some will probably try to sue. Aave’s governance will have to decide how much hand-holding and customer service infrastructure is worth the capital inflows.

If this works, it’s the template every other DeFi protocol will copy. Not because the UX is revolutionary, but because Aave will have proven you can tap mainstream capital without compromising on the underlying DeFi primitives. That’s the bet.

If you work at a bank or fintech, this is a warning shot. Aave is now competing directly with traditional financial institutions on the metric retail savers care about: yield, and it’s doing so with a product that’s arguably easier to use than most bank apps.

By offering $1 million in deposit protection, Aave signals that it’s serious about retail safeguards, even if the mechanism differs from FDIC insurance. This matters because one of the main arguments against DeFi has always been “but what if something goes wrong?” The answer used to be “you should have done your research.” The new answer is “we have insurance for that.”

This puts pressure on traditional banks, obviously. It also puts pressure on neobanks and fintechs that have been offering yields of 4% to 5% by routing deposits through partner banks or, in some cases, quietly using crypto rails themselves. If Aave offers yields of 6% to 9% with comparable UX and better insurance, the competitive moat shrinks fast.

The regulatory implications are fascinating and, for incumbents, probably terrifying. This could push banks to integrate with DeFi protocols to compete on yield. Or it could make regulators extremely nervous that “shadow banking” is now available in the App Store.

The Nerd Section

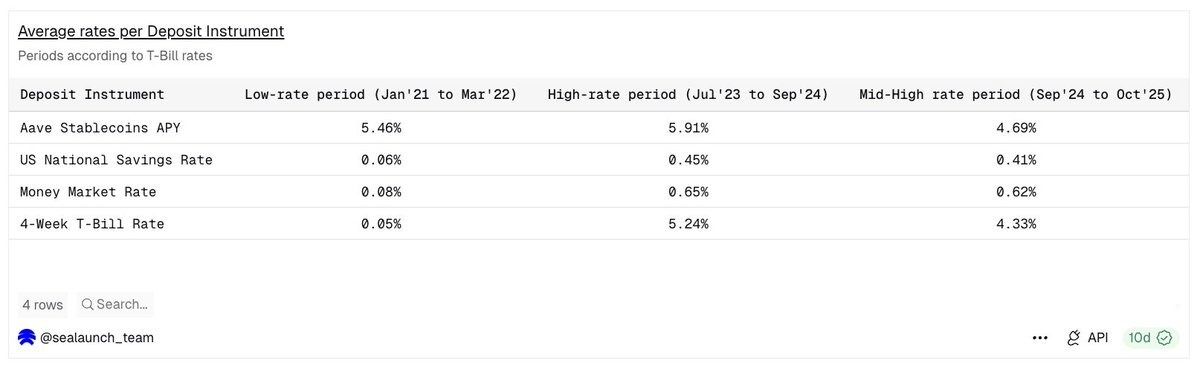

According to SeaLaunch Intelligence’s analysis, Aave stablecoin APYs have consistently outperformed US Treasury bills across three different monetary policy regimes: the low-rate period from January 2021 to March 2022, the high-rate period from July 2023 to September 2024, and the current mid-high period. The pattern holds across geographies too. EUR stablecoin yields on Aave run 1 to 2 percentage points above the Euro Short-Term Rate.

Why? Because the yield derives from on-chain borrowing demand, rather than central bank policy. This creates a structural premium. As traditional rates fall (which they’re projected to do through 2026), the spread between bank savings accounts and Aave widens. For global users, particularly in developing economies with unstable banking sectors, it’s a financial lifeline.

Compare this to alternatives. Morpho Protocol offers USDC lending at around 6.5% by matching lenders and borrowers directly, improving capital efficiency. Compound’s USDC rates hover around 2% to 4%. Coinbase’s retail USDC lending sits near 5%, often with withdrawal restrictions. Money market funds and T-bills yield about 5% to 5.3% in late 2025. Aave’s advertised APY sits at the high end of this range while maintaining full liquidity.

The metrics to watch post-launch are obvious. TVL (currently $31 billion, already spiking). User growth (waitlist conversions, geographic spread). And whether “app people” depositing retail savings change how Aave’s governance thinks about risk. When your depositors are MetaMask power users, you can be aggressive. However, when they think “smart contract” is a compliment for your lawyer, you probably need different guardrails.

One last thing worth mentioning is that during October’s volatility, Aave liquidated $200 million in collateral without breaking a sweat. Part of why it worked so smoothly was a small decision the risk team made months earlier. They hardcoded USDe’s price to match USDT in the system. When USDe crashed below $0.70 on Binance amid the chaos, this tweak protected billions in collateral from being liquidated. It was controversial when they did it (people worried about bad debt), but it turned out to be the right call. Risk management decisions like this are what separate protocols that survive tail events from protocols that don’t.

What This Actually Means

Prices are boring right now. Drama is low. In that quiet, Aave is trying to build something that looks like a retail bank on the front end and runs on DeFi infrastructure on the back end. Whether this is what crypto “was supposed to be” or whether we’re just reinventing banks on-chain with better interest rates and worse customer service phone numbers is, I suppose, a philosophical question.

What’s not philosophical is the economics. A protocol offering 6% to 9% yields with $1 million insurance and zero-friction onboarding puts real pressure on traditional finance. Not existential pressure, not yet, but enough that incumbents must respond. Either by integrating with DeFi themselves to capture those yields, or by lobbying for regulations that make it harder for protocols to compete.

My thesis is that bear markets are when real products get built. If that’s true, and this app works, maybe the winter was worth it. The lack of hype and the absence of moonboys were exactly what DeFi needed to mature into something normal people would use.

Or am I just talking myself into feeling better about my portfolio? Either way, Aave’s making the bet that when the market wakes up again, having real users who don’t care about decentralisation but do care about getting paid will matter more than having the loudest Twitter presence.

I guess we’ll see if they’re right.

Until next time, stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.